Welcome to our FP&A salary and career path guide, where we map out the exciting journey from entry-level roles to the executive suite. 🎓

Let’s be honest – everyone’s FP&A career path looks a bit different. But no matter which road you choose, there are certain milestones and pit stops that most FP&A professionals will encounter along the way.

This guide is all about giving you a roadmap of what to expect, from entry-level gigs to the big c-suite roles.

We'll break down the typical responsibilities, skills, and salary ranges for each stage of the FP&A career path. 🪜

Table of contents:

- FP&A salary and career path

- Does FP&A lead to CFO?

- What are the qualifications for FP&A?

- FP&A skills

- How to get a job in FP&A without experience

- Is FP&A a good career?

- Does FP&A have good exit opportunities?

- How to get into FP&A

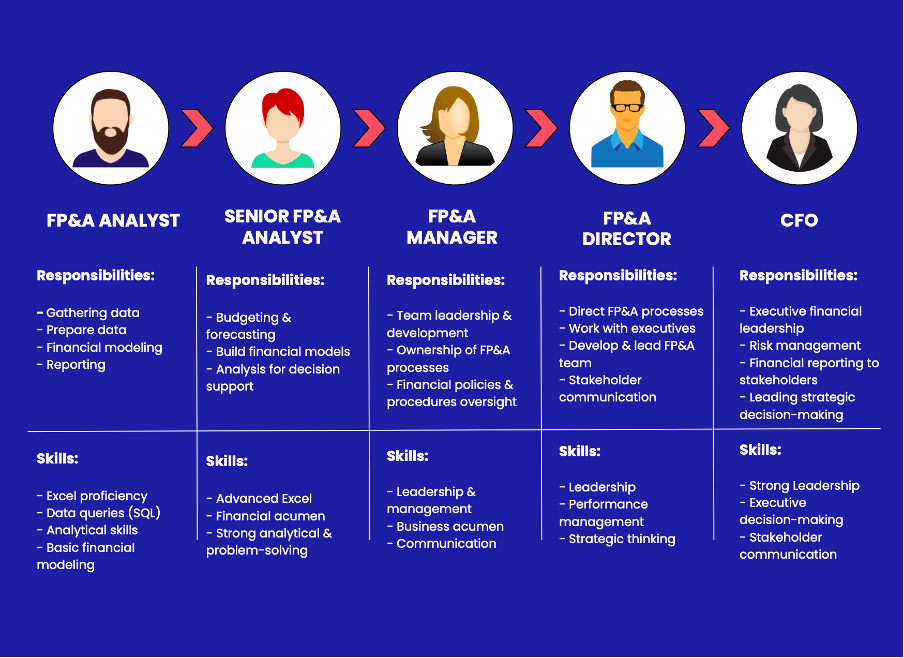

FP&A career path (progression)

As we mentioned, not every FP&A career progression looks the same. However, it can typically look something like this:

Let’s explore each role (and FP&A salary insights) in more detail:

FP&A Analyst

An FP&A Analyst specializes in gathering, analyzing, and interpreting financial data to support an organization's planning, budgeting, forecasting, and strategic decision-making processes.

Responsibilities: Some common responsibilities include:

- Monitoring and analyzing financial activities

- Preparing reports that summarize the company’s financial performance

- Assessing profitability and investment returns

- Financial health assessment

- Risk evaluation

- Support senior management and stakeholders in decision-making

Desired skills: Proficiency in Excel, data queries, basic financial modeling, a solid understanding of accounting principles and financial reporting standards, keen attention to detail and excellent problem-solving abilities are just some of the desired skills of the role.

FP&A Analyst salary range

Glassdoor reports the average base FP&A Analyst salary range to fall between $67,000 and $93,000 with an average annual salary of $79,204. Other sources report a slightly higher annual salary of $80,604. Our own salary survey reported similar numbers with a reported annual salary of $76,757.

Senior FP&A Analyst

A Senior FP&A Analyst stands as a more experienced and advanced position within the financial planning and analysis (FP&A) sector, typically following the role of an FP&A Analyst. This progression is a crucial step in the FP&A career path, indicating a move towards more strategic, high-impact responsibilities within the finance function.

Responsibilities: Senior FP&A Analysts are usually responsible for:

- Leading financial forecasting

- Managing budgeting activities

- Conducting scenario analysis

- Providing financial recommendations

- Collaborating across departments

- Ensuring report accuracy

- Developing financial strategy

Desired skills: Some key skills to succeed in this role include advanced financial modeling and Excel capabilities, strong analytical and strategic thinking, effective communication with stakeholders, and leadership qualities to guide teams and influence decisions.

Proficiency in corporate finance and financial reporting standards is also essential, alongside the ability to efficiently collaborate with cross-functional teams for data analysis and strategic planning.

Senior FP&A Analyst salary range

The average FP&A salary for a Senior FP&A Analyst ranges between $90,237 and $108,840. However, other sources report slightly slower ranges with highs of $85,000. We advise carrying out research to discover the typical salary range for this role within your local area or state.

FP&A Manager

The next role in the typical FP&A career path is the role of a FP&A Manager. This is a key finance role within organizations, responsible for overseeing financial planning, analysis, and reporting activities. This managerial position involves leading the FP&A department in budgeting, forecasting, and providing analytical support to inform business decisions and strategy.

Responsibilities: Primary responsibilities include:

- Managing the financial planning process

- Developing and refining financial models

- Conducting variance analysis between actual results and forecasts

- Leading financial performance reviews

- Driving the development of financial reports

Desired skills: Beyond technical skills, this role demands excellent leadership, communication, and strategic thinking abilities, as it involves collaboration across various departments and levels of management. This role requires a combination of analytical expertise, strategic vision, and the ability to manage both projects and teams effectively.

FP&A Manager salary range

Wall Street Prep reports the average FP&A Manager salary to range from $85,000 to $115,000 including bonuses. However, Glassdoor reports that the estimated total pay is $159,488 per year in the United States with an average FP&A Manager salary of $128,758 per year.

FP&A Director (or VP of FP&A)

An FP&A Director or Vice President (VP) of Financial Planning & Analysis is a senior executive role within an organization, tasked with leading the FP&A department and setting the strategic direction for financial planning, analysis, and reporting.

The FP&A Director/VP oversees long-term financial planning, budget management, and performance analysis, ensuring that financial goals align with the company's strategic objectives.

Responsibilities: As the most senior role in FP&A, the Director or VP of FP&A can expect responsibilities such as:

- Strategic and long-term financial planning

- Budget management

- Financial reporting and analysis

- Performance analysis

- Risk management

- Team leadership and development

- Stakeholder communication

- Financial systems and process improvement

Desired skills: The most desired skills for an FP&A Director blends advanced financial expertise with strategic oversight and leadership capabilities. You’ll be expected to have a deep understanding of financial modeling, excellent leadership skills, communication skills, problem-solving, and experience in managing change.

FP&A Director salary range

According to ZipRecruiter, the average FP&A salary for someone in a director or VP position in the United States is $149,983 a year. The range, though, typically falls between $166,377 and $218,763.

Does FP&A lead to CFO?

The FP&A career path can definitely be your ticket to bagging a role as Chief Financial Officer (CFO). FP&A is all about budgeting, forecasting, and providing those killer financial insights that guide a company's major decisions – all of which are key components of the broader financial leadership responsibilities of a CFO.

Here's a simplified overview of how the FP&A career path can potentially lead to the role of CFO:

Let’s break down how FP&A experience can prepare you for the c-suite:

Strategic insight: In FP&A, you develop a deep understanding of a company's financial health and market position. This allows you to strategize effectively for growth and stability, which is crucial when you're sitting in that CFO chair.

Decision-making: You become a pro at making data-driven decisions in FP&A roles, a crucial part of a CFO’s role.

Cross-departmental collaboration: FP&A requires you to work closely with different departments. This helps you build those communication and leadership skills that are essential for the cross-functional oversight a CFO needs.

Financial reporting and compliance: You get first-hand experience with financial reporting, compliance, and risk management in FP&A positions. This lays the foundation for the comprehensive financial oversight responsibilities that come with being a CFO.

While moving from FP&A to CFO isn't the only path, many CFOs have backgrounds in FP&A, accounting, or finance. The journey often involves advancing through senior roles within FP&A, like FP&A Manager, Director, or VP, before stepping into that coveted CFO role.

To learn more about how to become a CFO, check out our playbook: Journey to CFO.

What are the qualifications for FP&A?

To thrive in Financial Planning & Analysis (FP&A), professionals must cultivate a robust foundation of education, certifications, and continuous skill development.

Here's a detailed look at the qualifications necessary for a career in FP&A, emphasizing the importance of understanding FP&A salary expectations and growth potential:

Certifications 🎓

Certified Public Accountant (CPA): Recognized globally, a CPA credential signifies expertise in accounting and finance. While it's more accounting-focused, it provides a strong foundation for financial analysis and fiscal management.

Chartered Financial Analyst (CFA): The CFA certification is prestigious in the fields of investment and financial analysis. It covers portfolio management, financial modeling, and investment analysis, which are valuable in moving along the FP&A career path.

Certified Corporate FP&A Professional (FPAC): Offered by the Association for Financial Professionals (AFP), the FPAC certification is specifically designed for FP&A practitioners. It focuses on data analysis, budgeting, forecasting, and strategic planning.

Advanced certifications and degrees 🎓

Master of Business Administration (MBA): An MBA with a focus on finance or accounting provides comprehensive business and financial training, leadership skills, and networking opportunities, making it highly beneficial for advancing in FP&A.

Master's in Finance: More specialized than an MBA, a Master's in Finance focuses intensely on financial theory, markets, and financial analysis techniques. It's ideal for those seeking deep expertise in finance.

Master's in Accounting or Economics: These degrees offer specialized knowledge that can be directly applied to FP&A roles, particularly in areas related to fiscal policy, economic analysis, and accounting principles.

FP&A skills

When it comes to FP&A roles, there are several key FP&A skills that are highly sought after and essential for success:

Strong analytical mindset and an ability to make sense of complex financial data

- Gather information from various sources.

- Crunch numbers and identify patterns and trends.

- Inform strategic business decisions with data-driven insights.

Effective communication skills

- Translate insights into clear, concise reports and presentations.

- Resonate with both finance and non-finance stakeholders.

- Tell a compelling story through data and make actionable recommendations.

Solid understanding of financial modeling and forecasting techniques

- Build robust models to accurately predict future performance.

- Develop scenarios, stress-test assumptions.

- Provide insights to support strategic planning and decision-making.

Strong business acumen

- Deep understanding of the organization's operations, industry trends, and competitive landscape.

- Provide context and perspective to analysis and recommendations.

- Ensure work is aligned with the company's overall objectives.

Collaboration and interpersonal skills

- Work closely with cross-functional teams (operations, marketing, sales).

- Build strong working relationships and influence stakeholders.

- Drive consensus around financial decisions.

Adaptability and willingness to learn

- Finance landscape is constantly evolving (new technologies, regulations, best practices).

- Open to continuously developing skills and embracing change.

- Stay ahead of the curve to remain relevant and valuable.

By possessing these key skills, FP&A professionals can excel in their roles and make a significant impact on the success of their organizations. Mastering these competencies is important for advancing along the FP&A career path, allowing you to take on increasingly complex and influential roles within the finance domain.

How to get a job in FP&A without experience

Getting a job in FP&A without experience can be a challenge, but it's definitely not impossible! Here are some tips to help you break into FP&A:

1. Learn about FP&A

If you want to get a job in FP&A without experience, it’ll help if you knew the ins and outs of the role.

“Start by gaining a solid understanding of the fundamentals of financial statements. Take the time to learn about the specific roles and responsibilities of an FP&A professional.

“This includes understanding management reporting, profitability and variance analysis, financial modeling, budgeting, and forecasting, as well as the tools and technologies commonly used in FP&A.” – Asif Masani, FP&A expert and Chief Learning Officer at FP&A Professionals

2. Highlight your transferable skills

Even if you don't have direct FP&A experience, focus on showcasing skills that are relevant to the role, such as strong analytical abilities, proficiency with Excel or data analysis software, and an aptitude for financial reporting and modeling.

3. Consider internships or entry-level roles

Look for internship opportunities in the finance or accounting departments of companies, which will provide hands-on experience and exposure to the FP&A process. While these early roles might offer a lower FP&A salary initially, they're crucial for building the experience necessary to advance in the field.

You can also consider entry-level roles like Financial Analyst or Accountant, which can serve as a stepping stone to an FP&A position.

4. Pursue relevant certifications

Earning certifications like the Certified Management Accountant (CMA) or the Financial Modeling and Valuation Analyst (FMVA) can demonstrate your commitment to the field and enhance your credibility, even without direct experience.

5. Network, network, network

Attend industry events, join professional organizations, and connect with people working in FP&A roles. This can help you gain insights, identify potential job opportunities, and even secure referrals or recommendations.

Want more networking in finance tips? Check out this blog post:

6. Be proactive in your job search

Asif Masani shares his advice:

“While you may not have direct FP&A experience, you can still highlight your relevant skills and knowledge in your job search.

“Look for entry-level positions or internships in finance or FP&A and tailor your resume and cover letter to highlight your relevant skills and experiences.” - Asif Masani, FP&A expert and Chief Learning Officer at FP&A Professionals

Is FP&A a good career?

The FP&A career path is an excellent choice for finance and analytics enthusiasts. It offers:

- High demand across industries, ensuring job security and opportunities for growth.

- An analytical and strategic role, analyzing data and providing insights to support key decisions.

- Cross-functional exposure, collaborating with various teams to understand their financial needs.

- Competitive compensation, with your FP&A salary increasing as you gain experience and responsibilities.

- Clear career advancement, progressing from entry-level roles to senior management positions.

- Transferable skills that open up diverse exit options, from corporate finance to investment banking and beyond.

While demanding strong analytical and communication abilities, FP&A's dynamic nature, continuous learning, and potential for career growth make it a highly rewarding choice. If you're passionate about finance, strategy, and driving business impact, FP&A is definitely worth considering.

Is it hard to break into FP&A?

Breaking into the field of FP&A can be challenging, especially for those without prior experience. FP&A roles are highly analytical and require a solid understanding of finance, accounting, and business operations. However, with the right approach and determination, it’s certainly possible to break into this field.

Does FP&A have good exit opportunities?

Yes, FP&A can provide excellent exit opportunities for professionals looking to transition to other roles or industries.

The skills and experience gained in FP&A are highly transferable and valuable across various domains, making it a versatile career path with many potential exit options.

Some options include consulting, moving into corporate finance, teaching, mentoring, entrepreneurship and more.

To find out more about FP&A exit opportunities, read our blog post on this topic here:

How to get into FP&A (FP&A salary & career path progression tips)

Advancing in the FP&A world is all about leveling up your skills and making yourself indispensable. Here's the scoop on how to climb that career ladder:

1. Get familiar with accounting best practices

This one's a no-brainer. You need a solid foundation in accounting principles, financial statements, and reporting standards. This knowledge will be the backbone of everything you do, so make sure you've got it covered.

2. Understand the ins and outs of budgeting

If you want to increase your FP&A salary and progress, you need to know how to manage the budget process from gathering data to monitoring performance against targets. Show off your skills in streamlining the process and providing insights that will help guide those big, strategic decisions.

3. Become an expert in financial analysis methods

You’ll need to be really good at techniques like variance analysis, ratio analysis, and trend analysis. Develop proficiency in building robust financial models and forecasting techniques to provide accurate and insightful projections.

4. Financial storytelling

Numbers alone won't cut it. You have to weave those financial data points into compelling narratives that will resonate with stakeholders. Use visualizations, dashboards, and killer presentations to bring your analyses to life and make complex information digestible and impactful.

Here’s our handy guide on how to present financial data using different charts and graphs:

5. Finance business partnering

Cultivate those relationships with cross-functional teams and business units. Position yourself as a trusted advisor who can translate financial data into actionable insights that support their goals. Effective communication and collaboration is so important in order to progress in FP&A.

6. Embrace continuous learning

Never stop expanding your knowledge and skillset. Pursue certifications like the CMA or CFA to show your commitment to professional development. Attend industry events, join professional organizations, and network with other FP&A pros to stay informed about emerging trends and best practices.

Conclusion

As you can see, the path to success in FP&A is all about continuous growth, adaptability, and making yourself invaluable. By mastering the fundamentals, developing your analytical skills, and cultivating those all-important soft skills, you'll be well on your way to climbing the career ladder and reaching new heights.

And let's not forget about that FP&A salary. With each step up the ladder, you can expect your paycheck to reflect your increasing expertise and value. From entry-level analyst to senior manager and beyond, the FP&A field offers competitive compensation packages that reward your hard work and dedication.

So, if you're passionate about finance, analytical problem-solving, and being at the forefront of strategic decision-making, the FP&A path might be the ideal career path for you!

FAQs

How do I start a career in FP&A?

Start by gaining a solid foundation in finance or accounting through education, then develop key skills in financial modeling, analysis, and forecasting. Internships or entry-level positions in finance can also provide practical experience.

What are the qualifications for FP&A?

Typically, a bachelor's degree in finance, accounting, or a related field is required. Professional certifications like CFA or CPA, and skills in financial modeling, Excel, and data analysis are also valuable.

Is FP&A a stressful job?

FP&A can be demanding, especially during budgeting and forecasting cycles or fiscal year-end. The stress levels can vary based on the company's environment, deadlines, and individual workload management.

Can you go from accounting to FP&A?

Absolutely. Many professionals transition from accounting to FP&A, leveraging their understanding of financial statements and analytical skills to move into more strategic financial roles.

Do you need to be an accountant for FP&A?

No, it's not mandatory to be an accountant to work in FP&A, but a solid understanding of accounting principles is crucial due to the financial analysis involved.

Can you move from FP&A to investment banking?

Yes, it's possible to transition from FP&A to investment banking, especially with strong financial modeling skills, industry knowledge, and a network within the banking sector.

Can FP&A become CFO?

Yes, many CFOs start their careers in FP&A, as it provides a comprehensive understanding of financial planning and business strategy, which are key components of the CFO role.

What is the career progression of FP&A?

Career progression in FP&A typically starts with roles like FP&A Analyst, advancing to Senior Analyst, then FP&A Manager, Director or VP of FP&A, and potentially to CFO. Each role involves increasing responsibility in financial strategy, analysis, and leadership.

FP&A Certified Core course: Take your career to the next level

Are you ready to advance to the next level in your FP&A career?

Our FP&A Certified Core course is your gateway to becoming a leader in the finance industry. This course is specifically tailored to provide you with the insights and techniques used by top FP&A professionals.

Through a series of comprehensive modules, you'll learn how to harness sophisticated financial tools, perform impactful analysis, and deliver results that propel your company forward.

With our expert guidance, you’ll not only achieve certifications but also gain a competitive edge in your career.

Follow us on LinkedIn

Follow us on LinkedIn