Not sure where to start with cost-benefit analysis?

We hear you.

With so many complex factors to identify and monetize, it can be hard to know which costs and benefits to focus on first – or how to accurately quantify them.

If you want to learn more about what cost-benefit analysis is and how to do it, keep reading as we dive into five key steps to streamline your financial evaluations and drive smarter decisions. 🧠

What is meant by cost-benefit analysis?

Cost benefit analysis attempts to lay out an objective framework for any major spending or investment choice by asking two vital questions:

1. Do the expected benefits outweigh the expected costs over time?

2. And if so, by how much relative to other alternatives?

It provides the needed structure for breaking down decisions into defined costs and benefits that can be systematically assessed.

What is the main goal of using a cost-benefit analysis? 🎯

The main goal of doing a cost-benefit analysis is to determine whether the benefits of a potential project or decision outweigh the costs.

Put simply, it answers the question – is this project or task worth it?

To get that answer, you've got to weigh all the possible outcomes, which involves lining up the good, the bad, and everything in between.

And yes, that means you need to sift through the options and choose the one that brings the most value without weighing you down with excessive costs.

How do you calculate cost and benefit analysis?

A cost-benefit analysis balances the cost of an action against its potential benefits, providing a clear financial comparison to guide decision-making.

To calculate cost and benefit analysis, there are several steps you must follow (see below). However, in terms of metrics, the most critical aspect is accurately quantifying and then comparing the total costs against the total benefits.

Here’s how you can do it (we'll get into the steps of the cost-benefit analysis process in more detail in the next section):

- Quantify costs: First, list all the costs associated with the project or decision and assign a monetary value to each one.

- Quantify benefits: Similarly, identify all potential benefits (both tangible and intangible). Again, assign a monetary value to each benefit.

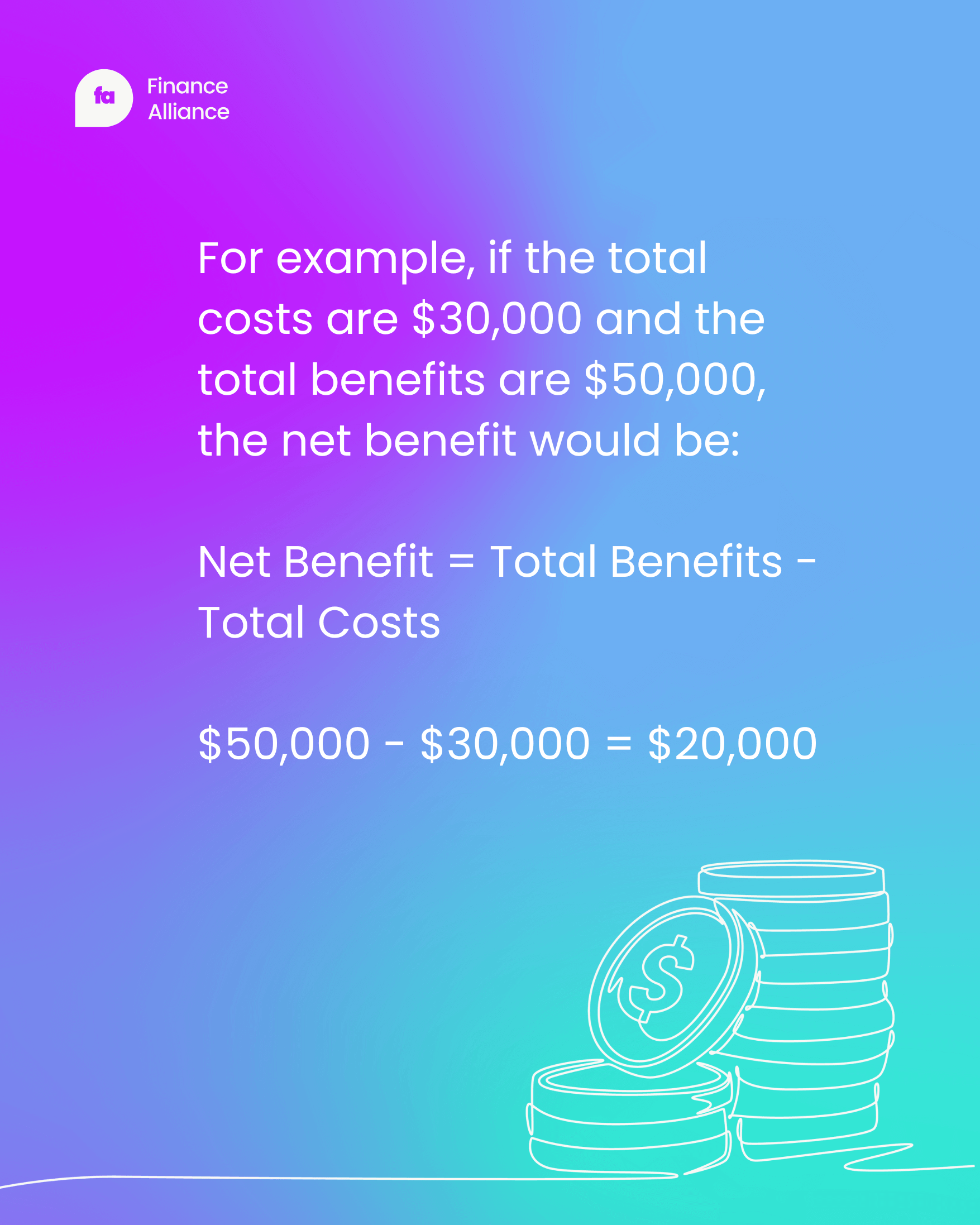

- Total the costs and benefits: Add up all the quantified costs to get a total cost figure. Do the same for the benefits to get a total benefits figure.

- Calculate net benefits: Subtract the total costs from the total benefits. This calculation will give you the net benefit (or net cost, if the costs exceed the benefits) of the project or decision.

- Additional analysis: To deepen the analysis, you might consider metrics like the benefit-cost ratio (BCR). To calculate this, you must divide the total benefits of a project by its total costs.

The formula looks something like this:

BCR = Total Benefits / Total Costs

What is a good cost-benefit ratio?

A BCR greater than 1.0 indicates that the project's benefits exceed its costs, suggesting it's a financially viable option. On the other hand, a BCR less than 1.0 means the costs outweigh the benefits, signaling a potential reconsideration of the project.

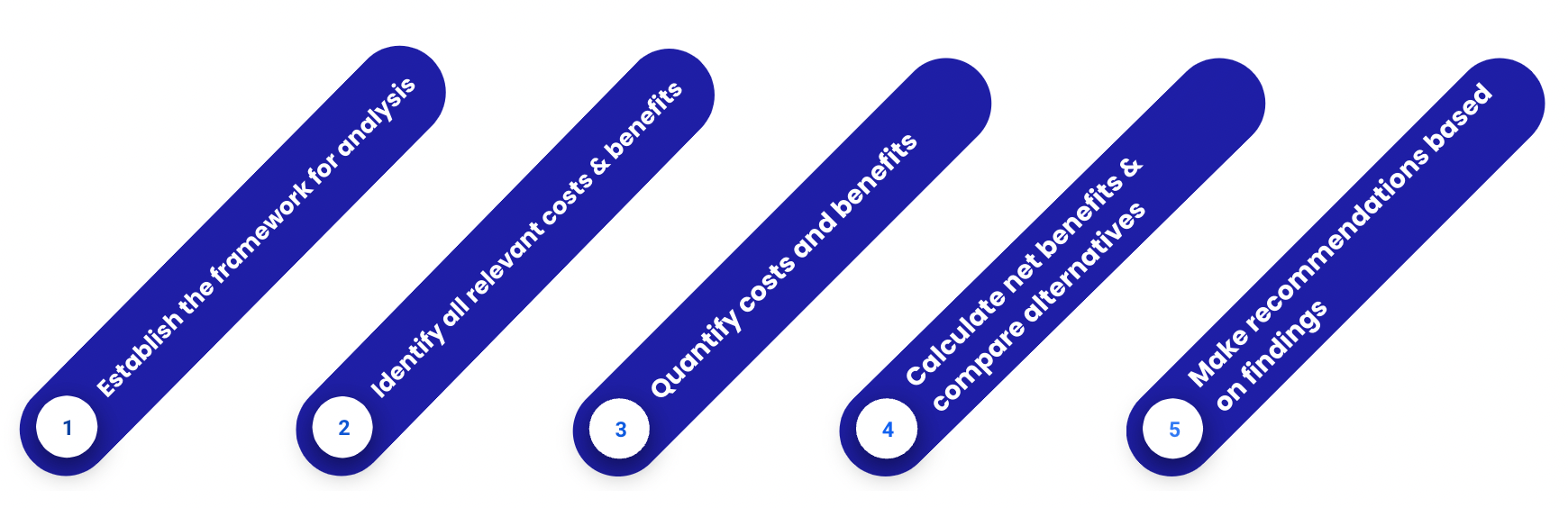

5 steps of the cost-benefit analysis process

Not every approach to cost-benefit analysis will be the same. But there tends to be five vital steps (or variations of these steps) that most will follow when carrying out the analysis.

These steps are:

Now, let’s explore each step in more detail:

1. Establish the framework for analysis

Kick things off by setting clear objectives and defining the scope of your analysis. This sets the stage for everything that follows, ensuring you're working within a structured and focused context.

Most of the planning takes place during this stage and there’s some questions you need answers to, such as:

What’s the purpose of the cost-benefit analysis?

For example, is it to help determine whether your company should move forward with a new software development project?

Or perhaps you want to assess the feasibility of the company's expansion into a new market, weighing the potential increase in customer base and revenue against the marketing and operational setup costs.

Whatever the case - zone in on the main purpose of the cost-benefit analysis to help maintain focus throughout the process.

What's the timeline?

Your timeline is important. A short-term cost-benefit analysis could involve assessing the financial impact of running a promotional campaign over the course of three months, while a long-term analysis might look at the benefits and costs of a major infrastructure project planned to unfold over the next 10 years. Decide on your timeline as early in the process as possible.

It's important to set both your goals and objectives at this stage too. Having a clear goal in mind will help during the next step. You’ll also need to choose how you’ll measure and compare costs and benefits and what metric you’ll use.

2. Identify all relevant costs and benefits

Now, list out all the potential costs – think materials, labor, time, and benefits, like increased revenue, efficiency gains, or intangible perks. This step is crucial; missing something here can skew your entire analysis.

And while you’re busy listing out all of those potential costs, don’t forget to consider the benefits too! These could be tangible, like increased revenue and efficiency gains, or intangible, like enhanced brand reputation or employee satisfaction.

Costs (and benefits) typically include:

Direct costs:

- Materials and supplies needed for a project.

- Labor costs, including salaries, wages, and benefits for employees directly involved.

- Equipment costs, whether it's purchasing or leasing necessary machinery.

Possible benefits:

- Increased revenue from sales growth, new customers, or market expansion.

- Enhanced productivity, leading to more output with the same or fewer inputs.

Indirect costs:

- Overhead expenses like utilities, rent for facilities, and administrative staff salaries.

- Maintenance and operational costs that keep the project running.

- Depreciation of equipment and technology used in the project.

Possible benefits:

- Long-term savings from improved processes or technology upgrades.

- Boosted brand value and stronger market positioning that can lead to indirect revenue growth.

Intangible costs:

- Negative impact on brand reputation or employee morale.

- Potential loss of customer loyalty or market share.

Possible benefits:

- Customer satisfaction that could translate into loyalty and word-of-mouth marketing.

- Improved employee well-being and job satisfaction, potentially leading to higher retention rates.

Opportunity costs:

- Potential revenue lost by choosing one project over another.

- The value of alternative uses of time and resources that are diverted from other activities.

Possible benefits:

- The project selected may offer a strategic advantage.

- Allocating time and resources to the chosen initiative could streamline operations or improve product quality.

- The decision might open up avenues for partnerships, collaborations, or even acquisitions.

3. Quantify costs and benefits

Assign a monetary value to each cost and benefit you've listed. This might require some digging into market rates, historical data, or expert forecasts, but it's worth the effort to get the most accurate picture possible.

By quantifying the financial elements of your cost-benefit analysis, you'll lay the groundwork for making decisions that are both financially sound and strategically smart.

Remember, consistency is key when you're crunching the numbers—make sure you're using the same currency and time frame across all elements for a coherent analysis.

4. Calculate net benefits and compare alternatives

It's time to do the math.

Subtract the total costs from the total benefits to find the net benefit of each option. This comparison is the heart of your analysis—it shows you which choices give you the most financial upside.

But remember, it's not just about the final figure. Take the time to understand the story behind the numbers.

Which option has the highest net benefit?

Does it align with your strategic goals?

Are there any non-financial factors that might influence your choice?

Here's a tip: When comparing alternatives, consider using a sensitivity analysis. This will help you see how changes in key assumptions affect your net benefit.

For example, what if material costs rise by 10% or the projected revenue falls short?

By testing these scenarios, you'll get a sense of how robust your findings are and whether one option might be safer than another in the face of uncertainty.

5. Make recommendations based on findings

Armed with your calculations, you can now recommend the most financially sound option. Your findings should support a clear path forward, providing a compelling case for why your chosen alternative stands out among the rest.

Keep in mind that a cost-benefit analysis balances the cost of an action against its potential benefits. This balance is crucial in guiding your recommendations.

As you make your recommendations, be transparent about your assumptions and the potential risks involved. Highlight how the benefits of your chosen option outweigh the costs, not just in monetary ways but also in terms of meeting strategic objectives or other non-financial benefits.

Tailor your recommendations to your audience. Whether it's a board of directors, a team of executives, or another decision-making body, make sure your presentation of findings resonates with their priorities and concerns.

This will help ensure that your cost-benefit analysis is not just a set of numbers, but a persuasive tool for making informed and strategic decisions.

What are the pros and cons of cost-benefit analysis?

Doing cost-benefit analysis has some clear upsides when done right.

First, it lifts decision making above gut reactions by forcing an objective, data-driven approach. In other words, it takes the guesswork out of decisions. Instead of making important choices based on feelings, you make them based on facts because you’re relying on hard data.

Cost-benefit analysis is known for breaking down big, complicated decisions into manageable chunks. Vague what-if scenarios turn concrete through tallying costs and benefits for direct comparisons.

Sometimes, the most crucial factors are the ones you don't see right away. This process shines a light on those hidden elements, ensuring nothing is overlooked.

Of course, cost-benefit analysis has limitations that deserve transparency too. Precisely projecting all variables years out can prove difficult, raising risk that hypotheticals skew off base.

Results can also depend heavily on the quality of baseline data and formulas used and as you know, faulty inputs lead to faulty outputs. If your input data is off, your conclusions will be too. So, it’s vital to double-check your numbers.

Finance Alliance Pro Membership

Tired of feeling stagnant in your FP&A career? Take control and unlock your true potential with the Finance Alliance Pro Membership and:

- Engage in high-level discussions with peers, sparking innovative ideas and expanding your perspective.

- Sharpen your skills with access to advanced financial analysis tools and expert-curated resources. ️

- Unlock exclusive career opportunities within a network of industry leaders.

Don't just survive your career, thrive in it.

Join Finance Alliance Pro Membership today! 🎓

Follow us on LinkedIn

Follow us on LinkedIn