In the past, environmental, social, and governance (ESG) factors tended to feel like a bit of a sideline concern for many finance teams and their companies. Sure, they were important, but did they really move the needle on portfolio performance?

The answer, as most of us have come to realize, is a resounding yes! ESG is rapidly becoming a core competency in our field and used to manage risk and facilitate sustainable, long-term returns.

The rise of ESG investing shows no signs of slowing down with Bloomberg reporting global ESG assets to top $53 trillion by 2025. 🤯

But why the sudden rise? And what, exactly, are the benefits of ESG investing?

Read on as we uncover seven key benefits of ESG investing.

Topics covered:

- What ESG means

- Why ESG is so important

- The benefits of ESG investing

- 6 challenges associated with ESG investing

What is ESG?

Before we get into the benefits of ESG, let’s make sure we’re clear on what ESG stands for.

So, ESG means environmental, social, and governance. It’s basically a framework used by companies to evaluate their level of sustainability and corporate responsibility.

ESG funds saw a surge in popularity in 2021, attracting a staggering $649 billion in inflows by November 30th, according to data providers Refinitiv Lipper. This represents a significant jump from $542 billion in 2020 and $285 billion in 2019 for the same period.

Each pillar of ESG focuses on specific areas:

- Environmental: carbon emissions, pollution, waste management, water usage, deforestation, biodiversity, green energy initiatives.

- Social: diversity and inclusivity, human rights, fair labor practices, workplace safety, employee welfare, data security.

- Governance: board diversity, executive pay, political contributions and lobbying, bribery and corruption, business ethics.

It involves considering a company's impact on the planet (environment), its treatment of employees and society (social), and its leadership and transparency (governance) alongside traditional financial metrics.

Rather than simply focusing on profit potential, ESG investors are looking for companies through a unique lens.

For example, they’re considering how they treat he environment (pollution, resources), their employees (fairness, safety), and how they're run (honest, transparent).

For investors, it is about investing in values alongside money.

Why is ESG investing important?

The recent focus on ESG directly responds to the climate crisis and legal requirements surrounding equality, diversity, and inclusion.

A healthy environment is instrumental to the continuation of economic growth. We need a healthy planet to be able to continue producing and evolving, and businesses need a high-quality environment to “contribute to the efficient utilization of resources” (Carolina M. Veira, VP, Community and Corporate Partnerships, CareMax).

As such, investors are now looking to back companies that are taking climate change seriously and undergoing the necessary steps to reduce their carbon footprint.

ESG reporting fosters accountability, driving companies to be positive forces for change. It also strengthens their resilience against emerging issues, making them more likely to thrive in the long run.

7 benefits of ESG investing

1. Improved risk management

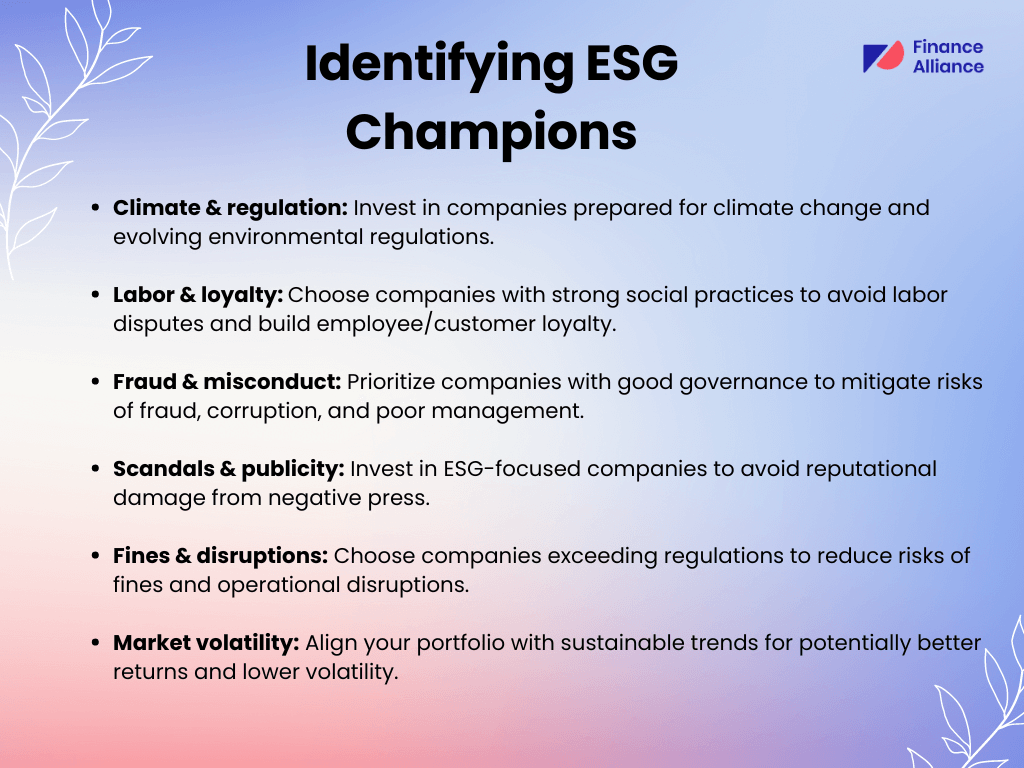

54% of companies include ESG in risk inventory reporting, and for good reason. From environmental regulations to shifting consumer demands, companies that prioritize ESG are better equipped to manage whatever comes their way.

ESG investing means being pickier about who you choose to work with. By integrating ESG criteria into your investment strategy, you might choose to work with companies that champion clean energy and responsible resource use, not those harming the environment through things like deforestation or relying heavily on fossil fuels.

That's the power of ESG investing. It lets you align your money with your values while also avoiding risks.

By focusing on ESG factors, you can invest with confidence by mitigating hidden risks associated with environmental regulations, social unrest, and poor corporate governance.

Here are some ‘green flags’ to help you identify companies that focus on ESG (and some key points that potential investors might be looking for when choosing whether to invest in your company).

2. Enhanced portfolio performance

Among the many ESG benefits for companies, ESG investments have proven to outperform non-ESG investments in the long term.

Morningstar analyzed the performance of sustainable funds versus traditional funds over a 10-year period, and found that ‘58.8% of sustainable funds outperformed their traditional peers.’

This suggests by prioritizing environmental, social, and governance factors, you’re not just doing your part for the planet and society, but you also demonstrate strong financial management and resilience.

These findings are further supported by McKinsey, who claim that a strong ESG proposition correlates with higher equity returns as well as a reduction in downside risk.

Additionally, research by the NYI Stern Center for Sustainable Business and Rockefeller Asset Management found a positive relationship between ESG and financial performance in 58% of corporations.

It’s also been noted that companies with sustainability strategies usually achieve:

- Enhanced operational efficiency

- Increased cost savings

- Lower employee turnover

- Retained talent

- Reduced compliance costs

3. Making a positive impact on the environment

ESG investing can be a powerful tool in combatting climate change. Plus, growing media and public pressure are pushing businesses to become more sustainable.

So, how are companies making a positive impact on the environment through ESG practices?

Well, many ways, actually.

For example, more companies are investing in green bonds. Green bonds aim to fund projects which deliver positive environmental goals such as reducing carbon emissions, improving air quality, and promoting sustainable resources and clean transportation.

Another example is sourcing materials from suppliers who reflect a similar commitment to environmental responsibility. For example, choosing a supplier who uses recycled materials in their packaging vs a supplier who uses a ton of plastic.

Prioritizing ESG can also majorly influence businesses to undertake initiatives to reduce their carbon footprint by increasing energy efficiency and sourcing renewable energy. This can lead to significant emissions reductions at the corporate level.

4. Greater innovation and adaptability

The rise of ESG investing fuels demand for sustainable products. Companies, eager to stay profitable and project a positive image, respond by innovating and launching eco-friendly options. This creates a win-win: it benefits the environment and keeps businesses competitive.

ESG investing also promotes more efficient use of resources. This can lead to innovations that help companies reduce waste, save energy, lower costs, and remain competitive in the market.

Businesses that are conscious of ESG criteria are also more adaptable. They’re able to anticipate and mitigate risks associated with climate change and adapt their strategies to stay ahead of new regulatory changes.

There are a few companies that have successfully adapted to ESG principles and achieved business success in recent years:

- Cisco met its goal to source 85% of electricity needs through renewable energy sources in 2021.

- In 2019, Verizon became the first US telecom company to issue a green bond, which raised $1 billion in net proceeds.

- Apple aims to become carbon neutral by 2030, and in 2021, they announced that 175 of their suppliers have committed to shift to renewable energy completely. They’ve also implemented environmentally friendly designs; by switching to the Apple M1 chip in the 13-inch MacBook Pro, they’ve reduced the product’s carbon footprint by 8%.

ESG investing pushes companies beyond short-term gains. It plays a huge role in creating a future-focused mindset, where innovation and adaptability become essential for navigating changing regulations, resource scarcity, and evolving consumer demands.

5. Attracting and retaining talent

ESG investing also provides social benefits and fosters a positive working environment. When businesses place emphasis on policies that protect employee welfare, promote a healthy work-life balance, and ensure a safe working environment, they’re more likely to attract and retain top talent.

Companies that perform well on ESG metrics often have more engaged employees as they see their jobs as more meaningful, which results in a culture of respect.

Carolina M. Veira believes that most employees prefer to work for companies that are socially and environmentally responsible:

“Employees are going to be looking for organizations that are going to help them become better citizens and that align with their values. The new generations are especially very concerned about the environment.”

Companies that adhere to high ethical standards and business practices often have a better reputation than most, and therefore are able to attract top-performing employees.

6. Strengthened regulatory compliance

ESG investing helps businesses prepare for regulatory changes and avoid potential penalties. By focusing on environmental practices, treating employees well, and having solid leadership, companies can avoid getting caught off guard by new regulations or slapped with fines.

In fact, McKinsey has observed that ESG enables companies to ‘achieve greater strategic freedom, ease regulatory pressure, reduce risk of adverse government action, and provide government support.’

For example, ESG-focused companies can stay ahead of the curve and transition to greener technologies ahead of stricter environmental regulations, and therefore avoid future compliance costs.

Implementing ESG principles can also reassure investors that a business is stable, responsible, and prepared for any future regulatory changes.

7. Contribution to global sustainability goals

ESG investments can be a game-changer in achieving the ambitious goals set out by the United Nations in 2015: the 17 Sustainable Development Goals (SDGs).

These goals aim to tackle some of humanity's biggest challenges by 2030, from eradicating poverty and hunger to achieving gender equality and protecting our planet.

Here's how ESG investing directly fuels progress towards these SDGs:

- Investing in renewable energy companies: This directly supports SDG 7, "affordable and clean energy." By putting your money behind these businesses, you're helping to create a cleaner, more sustainable future.

- Backing companies with strong diversity and inclusion practices: This contributes to achieving SDG 5, "gender equality," and SDG 10, "reduced inequalities."

When you invest in companies that champion equal opportunities and fair treatment for all, you're sending a powerful message and promoting a more just and equitable world.

These are just a few examples.

By prioritizing ESG factors, investors can support companies across various sectors that are actively working towards these critical goals.

This creates a powerful ripple effect, driving positive change throughout the business world and propelling us closer to a more sustainable and equitable future.

6 challenges associated with ESG investing

The many benefits of ESG don’t come without their challenges. Here are the main obstacles that companies should be mindful of when implementing ESG initiatives:

1. Standardization

As ESG metrics are not yet fully standardized, investors have to rely on company-defined figures. Therefore, the information provided might not be completely reliable, and poor business practices may be overlooked.

2. Transparency

ESG reporting can be a challenge as companies don’t always have the required software, data, or a sound understanding of these types of metrics. And because many companies have different interpretations of what actually constitutes strong ESG performance, it becomes tricky for investors to make accurate comparisons.

3. Greenwashing

A lack of standardized data can sometimes lead to greenwashing. Greenwashing occurs when companies claim that their products are more environmentally friendly than they actually are. This can make customers lose trust in a company, ultimately damaging their reputation.

4. Regulations

As global awareness of ESG issues increases, governments may decide to impose new regulations which can affect the value of existing ESG investments. Therefore, understanding and keeping up with regulatory shifts is crucial to mitigate potential risks.

5. High costs

Integrating ESG factors into financial analysis and investment isn’t a straightforward process. It requires a deep understanding of how ESG can affect financial performance. As such, companies may need to spend a significant amount of money on additional research, due diligence, and trained professionals in ESG investing.

6. Investment time

The benefits of ESG investing are often reaped over a long period of time. However, many investors are looking for shorter-term returns, which could lead to disappointment or misinterpretation of an ESG strategy's effectiveness.

ESG investing: A game-changer in modern finance

As we've seen, there are plenty of ESG benefits to consider. From enhanced portfolio performance and improved risk management to fostering innovation and making a positive impact on global challenges, ESG is the key to long-term profitability and a positive reputation for your brand.

While there are hurdles to overcome, such as the lack of standardized ESG metrics and risks involved with greenwashing, the potential for making positive changes in the financial landscape is enormous. By leveraging ESG principles, businesses not only stand to reap massive economic returns but can contribute to a better world for all.

ESG investing is no longer just a trend, it’s a key component of responsible and forward-thinking financial strategy.

FAQs

What is ESG and why is it important?

ESG stands for environmental, social, and governance, and is a set of criteria used to assess a company’s sustainability and societal impact. ESG helps investors to identify companies that are more sustainable and better positioned for long-term success. ESG also helps investors to steer clear of potential financial risks linked to poor environmental or societal practices.

How can ESG benefit business?

ESG can help businesses to manage potential operational, regulatory, and reputational risks to ensure long-term resilience and success. Companies can also enhance their brand reputation, and find innovative ways to increase efficiency and reduce costs through energy-saving measures and waste reduction, improving their overall financial performance.

How does ESG help sustainability?

By adopting ESG principles, companies are encouraged to consider the wider impact of their operations and strive for positive change. They’re motivated to reduce their carbon footprint, manage waste responsibly, and protect biodiversity to help mitigate the effects of climate change and preserve natural resources.

Is ESG Investing good?

There's growing evidence that strong ESG practices can lead to long-term financial benefits for companies. On top of that, ESG investing also helps you to align your portfolio with your values and contribute to a more sustainable future.

What is ESG factor investing?

ESG factor investing considers environmental, social, and governance factors alongside traditional financial metrics when making investment decisions. This helps identify companies with strong long-term potential.

Why do investors like ESG?

Investors are increasingly interested in ESG for various reasons, including potential for positive financial returns, alignment with personal values, and the chance to support companies making a positive impact on the world.

What are the disadvantages of ESG Investing?

Some ESG funds may have limited investment options, and data measuring ESG performance can vary. It's important to do your research before investing.

Is ESG investing ethical?

ESG investing allows you to focus on companies demonstrating ethical behavior in environmental and social practices, alongside good governance.

How does ESG impact investors?

ESG considerations can help investors identify companies with strong risk management and long-term growth potential, potentially leading to positive financial returns.

Why should investors care about ESG risks?

ESG factors can pose financial risks to companies, such as climate change regulations or labor disputes. Considering ESG helps investors identify and potentially avoid these risks.

Why do investors like sustainability?

Sustainable companies are often well-positioned for the future, considering resource scarcity, changing regulations, and consumer preferences. Investing in sustainability can be a way to support companies prepared for long-term success.

Continue the conversation inside our Slack community

If you’d like to talk to other finance professionals about ESG and sustainable finance, why not join our free Slack community?

It's the perfect place for finance pros to connect, network, share job opportunities, ask questions, and share ideas.

You can sign-up to our Slack Finance Alliance community right here.