In the world of finance, where precision and performance go hand in hand, what you earn often depends on much more than your skill set. It’s about timing, geography, experience and, increasingly, job title.

The Finance Alliance Salary Survey 2025 sheds light on just how dramatically compensation can vary between roles and regions, revealing a global pay landscape defined by opportunity for some and inequality for others.

A global benchmark with stark contrasts

The survey found that the average total compensation for finance professionals worldwide sits at $139,771, which includes both salary and bonuses. On paper, this figure looks healthy, but averages can be deceiving.

The underlying regional data exposes a sharp divide between markets, one that underscores the shifting dynamics of global finance talent.

North America leads the way, with finance professionals earning an average total of $204,729, far surpassing the global average. Europe follows at $115,488, and Asia trails significantly at $43,472.

These gaps reflect not only differing costs of living but also the relative maturity of financial roles within each region.

In countries where finance functions are deeply embedded into corporate structures (like the United States and the UK) salaries tend to be far higher than in developing economies, where financial management may still be seen as an operational rather than strategic function.

When bonuses are isolated from base pay, the imbalance becomes even clearer. European finance professionals enjoy the highest average bonuses at around $25,000, compared with just under $4,000 in North America.

The numbers suggest that while European firms may not always lead on base salary, they reward performance and profit-sharing more generously, an interesting reflection of differing compensation philosophies between regions.

The power of title: Who earns the most

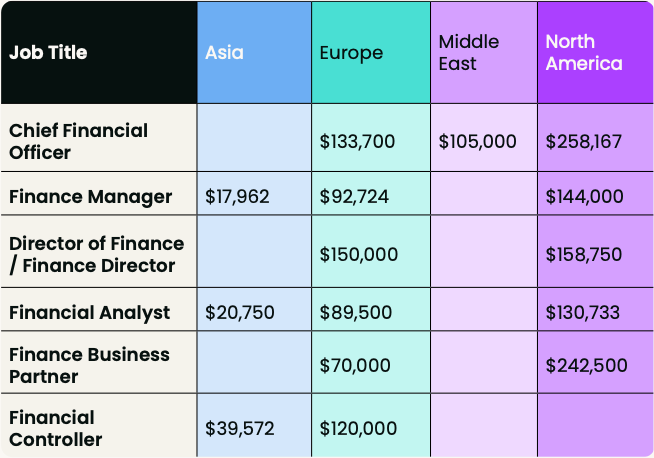

Beyond geography, job title remains one of the most significant determinants of pay. At the top of the ladder sits the CFO, commanding the highest average base salaries across the board.

But even among CFOs, geography matters. According to the report, CFOs in North America earn an average base of $258,167, while their counterparts in Europe average $133,700.

In the Middle East, CFOs take home around $105,000, less than half the North American figure.

The story is similar across other senior roles. Finance Directors in Europe make an average of $158,750, whereas those in Asia report $150,000.

The gap widens dramatically at the mid-management level. Finance Managers, for example, earn $144,000 in North America but just $17,962 in Asia, a staggering fourteenfold difference for the same title.

The data tells a clear story: title alone doesn’t dictate worth, context does. A Finance Manager in Toronto or London may oversee sophisticated systems, complex forecasting models, and large teams, whereas the same title in a smaller Asian firm might encompass a much narrower remit.

Job scope, company size, and industry maturity all play defining roles in setting compensation levels.

Geography matters

If there’s one takeaway from the 2025 data, it’s that location continues to wield enormous influence over pay. This is not just about cost of living, it’s about the economic structure surrounding finance itself.

In North America, finance roles have become increasingly specialized, strategic, and integrated into decision-making. CFOs are no longer just number crunchers; they are business partners and growth architects.

The same is true, to a slightly lesser extent, in Western Europe, where financial leadership has evolved to include performance management and investor relations.

By contrast, in Asia and parts of Latin America, finance departments in smaller firms often remain focused on reporting and compliance rather than strategic planning.

As a result, even senior finance professionals in these markets tend to earn less, despite having similar qualifications or experience levels.

However, this gap may narrow in coming years. Our report hints at a growing appetite for strategic finance capabilities in emerging markets, a sign that salaries could climb as these regions begin to prioritize finance as a driver of long-term growth rather than a back-office function.

The rise of the finance business partner

One of the most intriguing findings in this year’s report is the emergence of the Finance Business Partner as one of the highest-paid roles in the field.

In North America, these professionals are earning an average of $242,500, rivalling even CFO salaries in other parts of the world.

This shift marks a turning point for the finance profession. Traditional titles like Financial Controller or Accounting Manager, while still critical, are giving way to roles that emphasize commercial acumen and cross-functional collaboration.

Finance Business Partners are now at the center of decision-making, translating data into strategy and ensuring that every business decision is underpinned by sound financial logic.

The premium on these roles underscores a broader transformation in how companies perceive finance.

It’s no longer enough to report on what has happened; organizations increasingly need people who can explain why it happened and what should happen next.

The human side of the numbers

While the data paints a clear picture of pay disparities, it also raises deeper questions about fairness and satisfaction.

Our report’s later sections reveal that nearly half of finance professionals don’t believe their compensation reflects their true value.

That disconnect is even more striking when you consider the size of the paychecks being discussed. High earnings don’t always equate to happiness or perceived fairness, a tension that continues to shape career decisions across the industry.

This perception gap may stem from a lack of transparency. Many respondents noted that their companies don’t clearly define the criteria for pay increases or promotions. In a profession built on clarity and accountability, this ambiguity can be particularly frustrating.

For employers, this should serve as a warning. As the war for finance talent intensifies (especially for roles requiring hybrid technical and strategic skills) unclear pay structures risk driving high performers elsewhere.

Knowing your worth

For finance professionals navigating their next career move, the 2025 data offers both a benchmark and a roadmap. It confirms that leadership, specialization, and location remain the strongest predictors of compensation.

Those willing to invest in advanced skills (particularly in analytics, financial modeling, and business strategy) stand to earn significantly more, especially if they’re open to relocation.

For organizations, the findings underscore the need to think globally when benchmarking salaries. In an increasingly borderless talent market, professionals in Mumbai or Madrid can now compete for roles once confined to New York or London.

Offering competitive, transparent, and fair pay packages is both good ethics and a competitive necessity.

The bottom line

Our Finance Alliance Salary Survey 2025 makes one thing abundantly clear: the value of a finance role depends as much on where you are as on what you do.

Geography and job title intersect to create enormous variations in compensation, sometimes by hundreds of thousands of dollars a year.

Yet beneath those figures lies a deeper truth: that finance, as a profession, is evolving faster than ever.

Titles that once carried prestige are being redefined by technology, globalization, and a growing emphasis on strategic insight.

We're currently building the new edition of the Finance Alliance Salary Survey and need your input.

Join the decision-makers and finance leaders already submitting their insights and contribute to one of the largest reports in the industry.

Follow us on LinkedIn

Follow us on LinkedIn