Being a CFO is no easy feat. You’re always on the lookout for ways to save money, make smart investments, and build accurate forecasts - the list goes on.

It's a demanding job, that’s for sure. And 2024 is throwing even more curveballs your way. From staying on top of new tech to dealing with a tough economy, there's no shortage of CFO challenges to prepare for.

In this blog post, we cover 21 of the biggest CFO pain points in 2024, why they’re tricky, and how to overcome them.

1. Leading transformation

Leading a company through a major transformation can be unpredictable, chaotic, and frankly, stressful. As a CFO, spearheading this kind of change can be especially daunting.

The truth is that if you want to keep up with competitors, transformation isn’t optional. New technologies, changing customer demands, and economic shifts all push companies to adapt and evolve. This means it might be time to step outside your comfort zone a bit.

Yes, your main focus is to keep the company financially healthy, and diving headfirst into a huge change can feel risky. However, according to Gartner’s report, leading transformation efforts is the number one priority for CFOs in 2024.

Here are some tips to help you lead your team through transformation:

🔎 Shift your perspective

Think of transformation as an investment in the company's future, not just a risky expense. Look for ways to quantify the potential benefits – increased efficiency, cost savings, or new market opportunities.

🤝🏽 Embrace collaboration

Leading change isn't a solo act. Partner with other departments to understand their needs and concerns. This collaborative approach fosters buy-in and helps ensure the transformation aligns with the overall business goals.

🤖 Become tech-savvy

Technology is often at the core of many finance transformations. Don’t worry, you don’t have to suddenly become a tech expert overnight. But it’ll help if you take some time to understand new technologies and their financial implications. Doing so will help you to make informed decisions about their implementation.

2. Cutting costs

Our Pro members constantly tell us that finding ways to trim the budget (without causing an office riot) is a major headache for them.

Striking the right balance between efficiency and growth is important, but it's also one of the biggest CFO pain points of 2024. Cutting too much can stifle innovation, while not cutting enough can put the company's financial health at risk.

So, how can you approach this with the least possible amount of fallout?

Well, it’s all about strategic cost-cutting. Rather than slashing budgets across the board, focus on identifying areas where spending can be optimized without impacting core operations.

This could involve:

Remember, successful cost-cutting isn't just about saving money, it's about investing in the future. When it comes to CFO challenges, overcoming issues associated with cutting costs should be one of your top priorities.

3. Identifying investments with growth potential

As a CFO, you know the importance of making smart investments that fuel your company's growth. However, with so many choices available, how do you distinguish the best from the rest?

Identifying investments with growth potential can be a real challenge. There's always the risk of picking something that turns out to be a dud, which can put your company's financial future at stake. Plus, who has the time to research every single investment opportunity out there?

Here are some tips to help you identify investments with the most potential to drive growth:

- Evaluate market trends: Keep your eyes peeled for the latest buzz – new technologies, changing customer habits, and even government regulations. Investments that align with these trends are more likely to see significant growth.

- Scope out the competition: Look for areas where your competitors haven't yet claimed their territory. If you can stake your claim first, you'll have a head start capturing market share.

- Tap into the team: Chat with the folks on the front lines – your sales team, business unit leaders, etc. They often have their ear to the ground and can point you toward promising investment opportunities.

- Analyze growth rates: Look for areas, segments, and products where your business is already seeing the highest expansion. Focusing more resources on departments already experiencing strong growth can be a smart way to do just that. It leverages what's already working and can ease some of those CFO pain points by building on a foundation of success.

- Listen to your customers: Pay attention to customer feedback and identify unmet needs or desires. If there's a demand for something you don't currently offer, that's a potential goldmine.

- Do the math: Don't just rely on gut feeling (although that can be valuable too!). Build financial models that consider market size, potential costs, profit margins, and breakeven points.

4. Supply chain disruptions

Ever seen a perfectly good budget thrown off by a supply chain snag? This is a common issue these days, and it can be a real pain.

Welcome to the world of supply chain disruptions, a major pain point for CFOs everywhere.

These disruptions, caused by factors like worker shortages, lack of materials, and slow shipping can mess with everything. Costs go up, you have less stock to sell, and predicting sales becomes a guessing game. Not good for the company's bottom line!

So, what can you do to navigate these financial roadblocks?

First, diversify your sourcing to minimize the impact of single disruptions, just like you diversify investments to reduce risk. This strategy can be crucial in managing CFO pain points related to supply chain vulnerabilities.

Next, work on improving supplier relationships. Having a strong relationship with your suppliers can keep you informed of potential issues and help you work together to find solutions that minimize financial strain.

Remember to factor in potential supply chain disruptions when forecasting costs, revenue, and cash flow. This helps you anticipate financial challenges and prepare contingency plans to mitigate their impact.

5. More accurate forecasting

Industry research shines a spotlight on the importance of preparing for the unexpected. 90% of senior finance leaders agree that their key task in 2024 is to prepare their businesses for unforeseen events. And what better way to equip yourself for the unexpected than with accurate forecasting?

However, achieving pinpoint accuracy in an environment riddled with uncertainties can feel like chasing a moving target. From fluctuating economic conditions to evolving consumer preferences, the factors influencing a company's financial performance are constantly in flux.

This presents a significant challenge for CFOs. They need reliable predictions to make important choices, plan spending wisely, and keep the company running smoothly in the long run. When everything gets thrown off, it makes their job way harder.

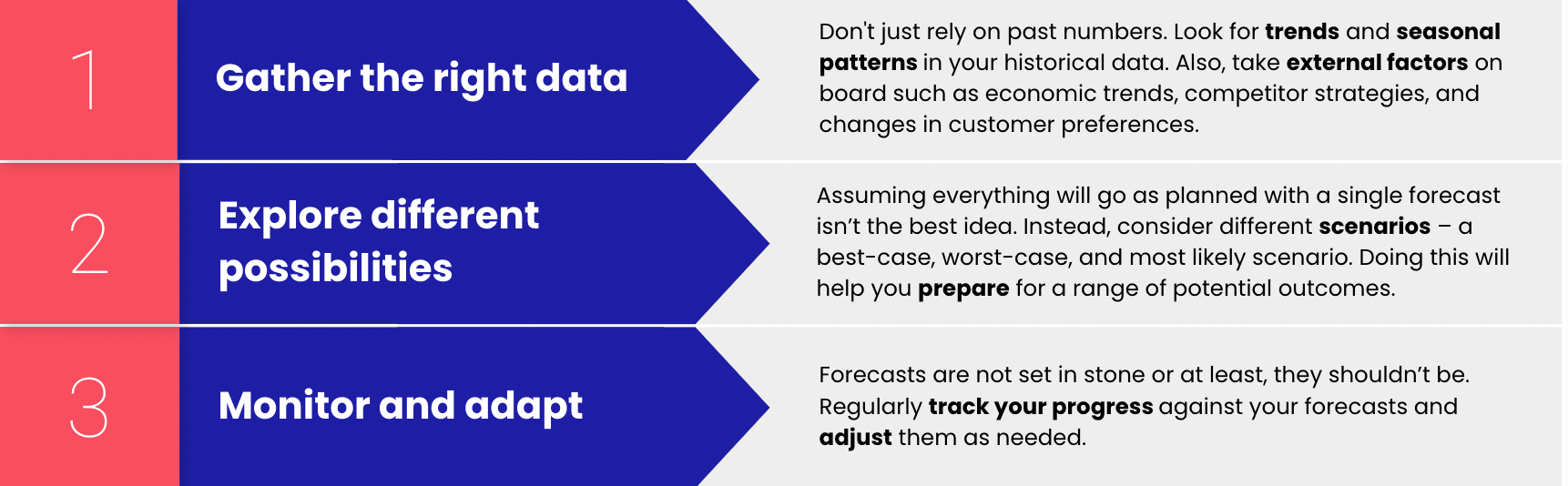

For more accurate forecasts, make sure to:

6. Capital costs

Capital costs usually rank high on the list of CFO pain points and it’s not much of a surprise when you think about it. For CFOs, managing capital costs feels like a constant game of chess - strategically balancing investments for growth against the need for financial stability.

Not to mention those rising interest rates can significantly increase borrowing costs for essential equipment, expansion projects, or even routine operations. This can squeeze profit margins and limit your ability to invest in strategic initiatives.

To overcome some common CFO challenges around capital costs, it’s a good idea to:

✔️ Scrutinize capital expenditures.

✔️ Explore alternative financing options.

✔️ Negotiate for better terms on loans, interest rates, and payment schedules.

✔️ Optimize cash flow management.

7. Profitability

One of the biggest CFO challenges is an obvious one and that’s profitability. The profitability of a company stands as the ultimate measure of success. It incorporates a blend of countless decisions, strategic maneuvers, and a constant battle against shifting market dynamics.

No matter the industry, everyone's dealing with two big problems:

- Costs are going up, making it harder to make money.

- Customers are changing their minds all the time, which means companies need to constantly adapt and fight hard to stay ahead of the competition.

To address these challenges, you need to be financial stewards and strategic partners, working across departments to identify cost savings, drive efficiency, and develop innovative strategies that capture market share and solidify your company's leadership position.

8. Cash and liquidity planning

Keeping operations running, paying the bills, and seizing opportunities as they come up are all top priorities for finance leaders. However, balancing incoming funds with outgoing payments isn’t always easy, so cash and liquidity planning is so important.

Despite its importance, this area remains one of the most persistent CFO pain points due to things like sales fluctuations, unexpected expenses, and unpredictable market shifts.

Planning cash and liquidity right helps you anticipate future cash inflows and outflows, preventing unexpected shortfalls that can derail strategic plans. It allows them to make informed decisions and manage financial stability more effectively.

9. Make the most of technology and automation

According to the PwC Pulse Survey, a whopping 88% of CFOs say they struggle to capture value from their technology investments. So, why the disconnect?

Firstly, choosing the right technology can be daunting. With a never-ending stream of options, it's easy to get overwhelmed and make costly mistakes.

Secondly, integrating new technologies with existing systems can be time-consuming and disruptive, requiring a lot of resources and expertise.

Finally, changing mindsets and fostering a culture of adoption can require patience. Not everyone is ready to embrace change, and navigating resistance within the organization can be an uphill battle.

Here are some quick-fire tips to help you get to grips with technology investments:

🗂️ Clearly define your needs

Before diving into the tech pool, understand your specific problems and desired outcomes. What are you hoping to achieve with technology? This helps you choose the right tools for the job, not just the shiniest ones.

⚖️ Start small and scale

Begin with implementing a single, well-defined solution and gradually expand as you gain confidence and expertise. It's like learning to ride a bike – start with training wheels and work your way up.

🗣️ Seek expert guidance

Don't be afraid to consult with technology experts and consultants. They can help navigate the options, ensure smooth integration, and provide valuable training and support. This step is especially important in addressing CFO pain points related to technological advancements and ensuring your financial team stays ahead in a digital age.

🎓 Embrace a culture of learning

Encourage continuous learning and skill development within your team. The more comfortable everyone is with the new technology, the quicker it will be adopted and utilized effectively.

10. Strategic risk management

While managing everyday operations is crucial, CFOs also have their eyes peeled for strategic risks. These are big-picture concerns that can significantly impact the company's long-term health, like disruptive technologies, changing regulations, or economic downturns.

Here’s your escape plan:

- Embrace "what-ifs" - Explore different scenarios, not just sunny days, to prepare for potential disruptions.

- Eyes on the lookout - Encourage everyone to identify and report potential risks.

- Stay adaptable - Be prepared to adjust your strategies and risk management practices as things change.

11. Data accuracy

For modern CFOs, the problem isn't a lack of information, it's a flood of it. Sales figures, operational metrics, market trends – the constant flood of data can be overwhelming.

But the real challenge lies not in the quantity, but the quality of that data. Inaccurate or incomplete data can lead to flawed decisions, missed opportunities, and ultimately, hinder a company's financial performance.

So, how can CFOs conquer this data challenge? Here are two tips:

- Implement data governance: Set clear guidelines for data collection, storage, and access. This ensures data integrity and minimizes the risk of errors or inconsistencies.

- Invest in data quality tools: Technology can be a powerful ally in identifying and correcting data discrepancies. Utilize data cleaning and validation tools to ensure the accuracy and completeness of your financial information.

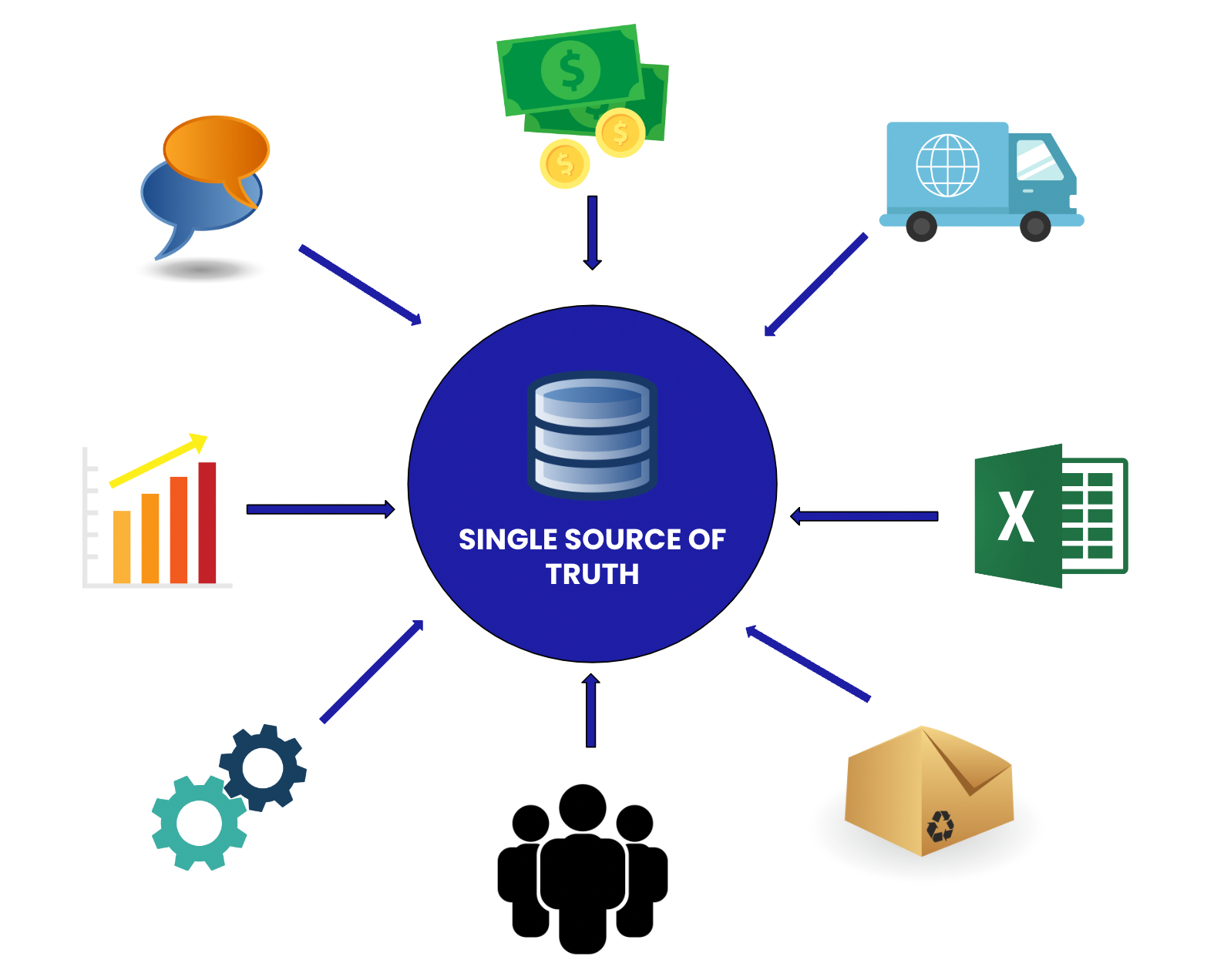

12. Unify disparate data

As we mentioned above, unifying disparate data is another major CFO pain point. The unique challenge here lies in integrating data from various sources fragmented sources - different accounting systems, spreadsheets, reports and more.

As you can imagine, trying to get a cohesive, holistic view of finance is extremely difficult when the data is so disparate and disconnected. This lack of unified data hinders their ability to conduct comprehensive analyses, generate accurate forecasts, and make informed decisions.

CFOs need to find ways to consolidate and integrate the financial data into a single, unified view to truly understand the state of the business.

By addressing this challenge and creating a single source of truth, CFOs can unlock the full potential of their data and gain a clearer picture of their financial position.

13. Attracting and keeping talent

Building a dream finance team is a mission on its own. The finance function demands a unique blend of technical expertise, analytical prowess, and strategic thinking. Finding people who possess these qualities, alongside a strong work ethic and cultural fit, is no easy feat.

This is why attracting and keeping top finance talent remains one of the most significant CFO pain points. Thankfully, we’ve got some tips to help you out in this blog post:

14. Preventing fraud and prioritizing cybersecurity

CFOs are often responsible for risk management, which can include fraud prevention and cybersecurity.

Here's why this matters:

Financial losses

Fraud can inflict a significant financial blow. Internal embezzlement or external hacking can siphon off funds, impacting everything from profitability to cash flow.

Reputational damage

A data breach or exposed fraud scheme can severely damage a company's reputation. Customers lose trust, investor confidence plummets, and attracting future talent becomes harder. Think of a once-trusted brand becoming synonymous with a security lapse – not a good look.

Regulatory fines

Depending on the nature of the fraud or cyberattack, companies can face hefty fines from regulatory bodies. These penalties can add insult to injury, further straining the company's financial resources.

CFOs are on the front lines of fighting fraud and cyberattacks. By investing in security measures, tightening internal controls, and making everyone security-conscious, they can significantly lower the chances and damage caused by these threats.

Want more tips and insights into the CFO’s role when it comes to cybersecurity? If so, read our blog post on this topic:

And, as a bonus, here’s a handy CFO cybersecurity checklist.👇

15. Improving cash flow

Keeping finances afloat is one of the biggest CFO challenges of 2024. Things can change quickly. Sales dip, customers pay late, or costs rise, disrupting even the best plans.

Cash flow is important because it gives a company financial stability. Having enough cash allows you to take calculated risks and pursue growth opportunities. It also helps to build investor confidence because strong flow shows financial health and makes supporting your growth more appealing to investors.

There are some things you can do to help improve cash flow such as encouraging timely payments from customers. This will help reduce delays. Another strategy is to manage inventory carefully and avoid stockpiling, which ties up cash.

16. Support a remote workforce

Remote work has become the ‘norm’ for many of us following the impact of COVID-19 on the workforce. But for CFOs, managing a remote workforce presents a unique set of challenges:

Communication and collaboration: Effective communication is vital for any team, but with geographical distance, fostering collaboration and maintaining a strong company culture can be more difficult.

Technology and security: Equipping employees with the necessary technology and ensuring robust cybersecurity measures are crucial for remote work success but can also add unexpected costs.

Supporting a remote workforce requires a shift in mindset for CFOs. This involves prioritizing investments in collaboration tools and virtual meeting platforms. Cybersecurity protocols should also be regularly reviewed and updated to safeguard against threats.

You can also help promote a positive remote culture by encouraging virtual social events, providing mental health resources, and offering flexible scheduling options to boost employee engagement and productivity.

17. Manage taxes and regulation

Managing taxes and regulatory compliance is one of the major CFO pain points that keeps popping up. As businesses expand across different states and countries, the tax and regulatory landscape becomes even more difficult to manage.

Staying on top of constantly evolving tax laws, filing requirements, and reporting obligations across multiple jurisdictions is a daunting task.

Failure to comply can result in hefty fines, penalties, and damage to the company's reputation. CFOs must ensure that their teams are well-versed in the intricate details of tax codes and regulations, which often require specialized expertise.

To alleviate this burden, CFOs can invest in tax management software and outsource to reputable tax advisory firms. These solutions can automate tax calculations, filings, and reporting, reducing the risk of errors and freeing up internal resources to focus on strategic initiatives.

18. Move toward ESG reporting

Almost a third of CFOs are analyzing how climate change scenarios could impact financial performance. They're analyzing how different climate scenarios, from rising sea levels to extreme weather events, could impact their company's bottom line.

While this might seem like an unexpected challenge for financial leaders, it highlights a growing area of concern – Environmental, Social, and Governance (ESG) reporting.

So, what is ESG reporting?

ESG is the process of disclosing a company's impact on the environment (environmental), its social responsibility practices (social), and its governance practices (governance). This includes metrics like carbon emissions, employee diversity, and board composition.

While ESG reporting offers benefits like attracting responsible investors and enhancing brand reputation, it also presents several difficulties:

Evolving standards

ESG reporting standards are still under development and can vary by industry and region, making it challenging to maintain consistency and transparency.

Data collection and analysis

Gathering and analyzing the necessary data from various sources across the organization can be time-consuming and resource-intensive.

Integration with existing reporting

Integrating ESG reporting with existing financial reports can be complex, requiring adjustments to existing systems and processes.

But there’s hope! CFOs can tackle these ESG reporting challenges by:

💻 Getting techy: Data software can help gather and analyze information, saving them tons of time and headaches.

🌿 Finding ESG experts: Partnering with specialists can provide valuable guidance and keep them on top of the latest standards.

💬 Talking it out: Open communication with investors, employees, and communities helps them understand what matters most to these groups.

👣 Taking it one step at a time: Starting small with a few key metrics allows them to build their expertise and resources before diving headfirst.

19. Lacking insight into customer behavior

CFOs who lack insight into customer behavior can't see:

- What products resonate

- How pricing impacts buying decisions

- Which marketing channels are most effective

This gap in understanding is a critical CFO pain point as it makes it difficult to predict future demand, optimize pricing strategies, and allocate budget and marketing resources properly.

Without insights into these areas, CFOs are navigating in the dark, potentially missing out on opportunities to enhance revenue and profitability.

20. Ensure compliance

PwC’s advice to CFOs is to:

“Think beyond compliance and focus on long-term value. CFOs can help lead the company in building greater resilience and stakeholder trust.”

PwC's advice to "think beyond compliance" hits the nail on the head for today's CFOs. While ensuring compliance is crucial, it shouldn't be the sole focus. Instead, CFOs can leverage a compliance-focused mindset as a springboard for creating long-term value.

Here’s how you can do it:

- Make ethical behavior natural with clear policies, training, and safeguards. Imagine a safety net catching everyone, not just a few.

- Foster a sense of shared responsibility where employees own ethical conduct. This builds a stronger foundation than just top-down rules.

- Collaborate with regulators openly and transparently. Think about building bridges, not walls, to foster trust and address issues proactively.

- Regularly update the board and CEO on compliance risks and strategies. It's like keeping a compass calibrated on a journey – everyone needs the same map.

- Stay up-to-date on changing regulations – compliance is a lifelong journey, not a destination. Think of it like learning a new language – it's an ongoing effort that opens doors.

21. Being innovative

Embracing innovation is so important because it can help CFOs unlock new opportunities. Innovation can lead to better ways to manage finances, identify new revenue streams, and gain a competitive edge.

A good tip is to encourage your team to "think outside the box" when tackling financial challenges.

This can involve:

- Brainstorming sessions: Dedicate time for your team to explore unconventional solutions, even seemingly outlandish ideas.

- Learning from other industries: Encourage your team to research and learn from innovative practices in other sectors, not just finance.

- Piloting new ideas: Allocate resources for small-scale experiments to test innovative solutions and learn from both successes and failures.

FAQs: CFO pain points & challenges

What is the biggest challenge for a CFO?

The biggest challenge for a CFO is navigating the complex and often unpredictable financial landscape, which requires balancing short-term financial health with long-term strategic goals. This involves making informed decisions amidst economic volatility, regulatory changes, and technological advancements while also managing stakeholder expectations and ensuring the company's financial integrity and growth.

What are the most difficult decisions for a CFO to make?

The most difficult decisions for a CFO often involve balancing risk and reward in financial investments, determining the right time for expansion or cost-cutting, and allocating capital between competing projects or departments. Deciding on strategic acquisitions or divestitures and navigating through financial crises or downturns also present significant challenges.

Is being a CFO stressful?

Yes, being a CFO can be highly stressful due to the high stakes involved in managing a company's finances. The role demands constant vigilance over the financial health of the organization, making critical decisions under pressure, and staying ahead of economic, regulatory, and technological changes, all while managing a team and communicating with stakeholders.

What are the challenges of CFO in the retail industry?

CFOs in the retail industry face unique challenges such as managing inventory levels efficiently, adapting to rapidly changing consumer behaviors, coping with thin margins, and navigating the competitive landscape. Additionally, the shift towards e-commerce requires them to invest in digital transformation while managing physical store costs.

What are the pros and cons of being a CFO?

The pros of being a CFO include having a significant impact on the strategic direction and success of a company, opportunities for professional growth, high compensation, and a broad, holistic understanding of the business. The cons include high stress, long hours, the burden of making tough decisions that affect the company's future, and accountability for the financial health of the organization.

What are CFOs most concerned about?

CFOs are most concerned about ensuring financial stability and growth, managing risks, complying with regulatory changes, attracting and retaining talent, and embracing digital transformation. They also worry about global economic uncertainties, market volatility, and the challenge of making data-driven decisions in a fast-paced environment.

What are some common challenges that finance leaders face today?

Common challenges for finance leaders today include digital transformation and leveraging technology to streamline operations, managing geopolitical and economic uncertainties, navigating complex regulatory environments, cybersecurity threats, and fostering a culture of innovation and agility within their teams.

What are CFOs most worried about?

CFOs are most worried about economic volatility, geopolitical tensions, cybersecurity risks, and the ability to adapt to rapid technological changes. They also concern themselves with maintaining compliance with evolving regulations, managing cost pressures, and ensuring their teams have the skills needed to meet future challenges.

Finance Alliance Pro Membership

Tired of feeling stagnant in your FP&A career? Take control and unlock your true potential with the Finance Alliance Pro Membership.

This exclusive community is your secret weapon, connecting you with elite finance professionals and equipping you with the cutting-edge tools and resources you need to dominate the field.

Fuel your growth:

- Engage in high-level discussions with peers, sparking innovative ideas and expanding your perspective.

- Sharpen your skills with access to advanced financial analysis tools and expert-curated resources. ️

- Unlock exclusive career opportunities within a network of industry leaders.

Don't just survive your career, thrive in it. Join Finance Alliance Pro Membership today! 🎓