Back in the day, a Chief Financial Officer's (CFO) job was pretty straightforward - crunch some numbers, keep the accounts in check, and make sure the balance sheets were all squared away. But fast forward to today, and modern CFOs are doing so much more than just focusing on financial statements.

The role of the CFO has really evolved alongside technology. They've become true partners in the business, stepping into more of a leadership role within their organizations. And they're collaborating with other departments besides just finance more than ever before.

CFOs aren't just dipping their toes into these new roles and responsibilities. They're diving in headfirst, embracing their roles as leaders, coaches, mentors, and motivators.

The modern CFO wears many hats and must master a variety of CFO skills. But what skills does the CFO of the future need to stay on top of their game?

Keep reading as we uncover some of the most important Chief Financial Officer skills, including:

- Financial expertise

- Strategic planning

- Risk management

- Investment savvy

- Influence & persuasion

- Communication skills

- Decision-making CFO skills

- Emotional intelligence

- Reliable & trustworthy

- Critical thinking & problem solving

- Global compliance

- Ethical standards

- Business acumen

- Innovative & adaptive

- Negotiation skills

Psst! Why not download this article in eBook format, so you'll always have these insights at your fingertips?

Driving IMPACT | Essential skills every CFO needs to have

For a more in-depth look at the top CFO skills, keep reading...

Core CFO skills

Financial expertise

The core foundation for any CFO is a deep understanding of financial principles like accounting, financial reporting, tax planning, budgeting, and forecasting.

A CFO must be able to interpret all that complex financial information and communicate it clearly to stakeholders, making sure decisions are grounded in solid financial data.

This core competency is what allows the CFO to effectively manage the company's overall financial health. They have to be able to identify risks and opportunities that could impact the bottom line, both good and bad.

Financial expertise is one of the most important CFO skills because it’s vital for keeping the business on solid financial footing. It's the bedrock that all their other skills are built upon.

Strategic planning

These days, CFOs can't just focus on the numbers. They need to use their financial expertise and insight to help drive the overall strategic decisions for the business. This means really understanding the BIG picture - the market landscape, who the competition is, and what the long-term goals are for the organization.

By aligning the financial planning with the broader business strategy, CFOs play a pivotal role in shaping the direction the company will take. They help steer the company through new growth opportunities, while also navigating any challenges or potential roadblocks that might come up.

Put simply, CFOs have to think strategically and use their financial know-how to help chart the course for where the business is headed. They're navigators and strategic partners, working hand-in-hand with the executive team to drive success.

Risk management

CFOs are risk management pros. They take the lead when it comes to limiting and mitigating the impact of a crisis. Better yet, they’re often the reason a crisis doesn’t happen at all because they spot the risks early and put the right plans in place.

But managing risk isn’t just about reacting. It’s a process - one that CFOs lead with a mix of experience, foresight, and strategy. At the heart of it are four key pillars:

1. Risk identification

First things first - you've got to spot the potential issues before they become problems. This means looking across the business and asking, “What could go wrong here?” Whether it's financial risk, compliance issues, or supply chain disruptions, a good CFO is constantly scanning for weak spots.

2. Risk assessment

Once you've identified the risks, it's time to figure out how serious they are. What’s the likelihood of them happening? What kind of impact could they have on the business? CFOs assess risks across the board (from liquidity and debt to personnel and IT) to prioritize what needs tackling first.

3. Risk mitigation

Now for the action part. Risk mitigation is all about putting safeguards in place such as reducing the chances of problems arising, or softening the blow if they do. This could be anything from building financial buffers, to introducing new internal controls, to diversifying suppliers. Smart planning makes all the difference.

4. Risk monitoring

Finally, you’ve got to keep watch. Risks change, new ones emerge, and mitigation strategies need updating. CFOs stay on top of the numbers and the narrative—regularly reviewing the risk landscape, updating the board, and making sure the business stays protected over time.

Risk management is a crucial CFO skill. Keeping the business out of hot water is a CFOs bread and butter.

Investment savvy

Successful CFOs have a keen eye for the right investments that align with the company's strategic goals. It's about knowing where to park the company's funds so they don't just sit idle but actually work to bring in more value.

This could mean anything from investing in new technologies that could give the company a competitive edge, to expanding into new markets, or even acquiring another business that could open up new revenue streams.

Now, here's the thing: markets are unpredictable. They go up, they go down, and sometimes they take turns nobody saw coming.

A CFO with good investment skills isn't just reactive; they're proactive. They have their finger on the pulse of market trends, understand the broader economic landscape, and can forecast potential shifts that could affect the company's investments.

This foresight is crucial because it means the CFO can pivot strategies as needed, protecting the company from financial pitfalls while capitalizing on opportunities.

Leadership, communication, & CFO soft skills

Leading teams (influence & persuasion)

Today’s CFOs are leaders through and through. They’re heavily involved in not only managing and leading a team but also assisting with team building and recruitment. Therefore, successful CFOs must have good leadership skills.

Bringing the team together and making sure everyone is supported and empowered within their roles is so important. The CFO needs to be a great leader who can strategically manage the team. They also must take leadership in the C-Suite. This involves showcasing leadership skills when assisting the CEO and other board members with key decision-making.

By articulating the why behind decisions and painting a clear picture of the end goal, a CFO can rally their team to push through challenges and achieve great results.

So leadership - getting people aligned, motivated and moving in the right direction – is one of the most vital CFO skills every CFO must try to master.

Communication skills

If you want to be a successful CFO, it’s time to brush up on your people skills. Communication is a big part of the CFO's role because they talk to a variety of people. This includes board members, shareholders, investors, suppliers, customers, and employees.

The CFO of tomorrow must be a superb communicator. They must be able to share company messages with people outside of the organization as clearly as possible.

And… they’ve got to have a knack for communicating complex information (such as data insights) to people who lack the same level of understanding.

So whether it's explaining the financial rationale behind a tough decision that had to be made, or sharing updates on the company's overall financial health and vision for the future, the way a CFO communicates can have a huge impact. It shapes team morale, instills confidence in stakeholders, and helps align everyone around the company's strategic direction.

Decision making

CFO skills like decisive leadership and analytical prowess are absolutely crucial. These financial leaders face tough choices every day that could significantly impact the company's future.

It’s not just about having a keen analytical mind to crunch the numbers. Top CFOs also need the courage and confidence to make the hard calls when necessary. They can’t afford to sit on the fence.

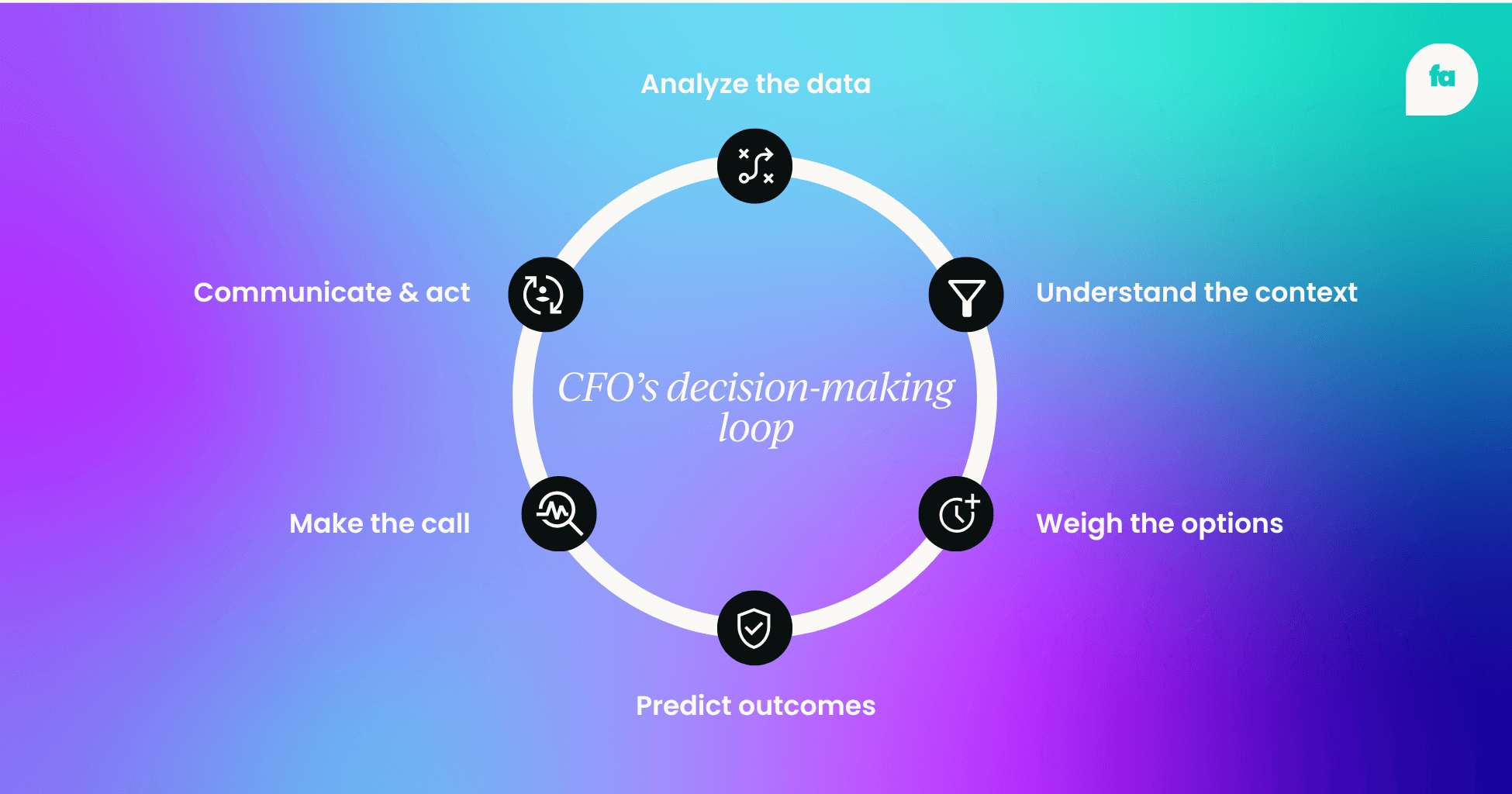

Great decision-making isn’t guesswork — it’s a repeatable process. That’s where the CFO Decision-Making Loop comes in:

This cycle plays out across all areas of the business, from managing cash flow to planning investments or navigating risk.

It's about carefully weighing all the options, considering the potential implications, and then decisively acting with the company's best interests as the top priority. Balancing data-driven insights with bold leadership is what separates the best CFOs from the rest.

Emotional intelligence

One of the most important CFO skills that often gets overlooked is emotional intelligence. A CFO with high emotional intelligence (EQ) is gold. They understand their own emotions and can read the room like a book.

So, what exactly is emotional intelligence?

Emotional intelligence (EI or EQ) is the ability to recognize, understand, manage, and use your own emotions in positive ways to:

- Relieve stress

- Communicate effectively

- Empathize with others

- Overcome challenges

- Defuse conflict

It also involves recognizing and understanding the emotions of others, which is essential for building and maintaining healthy relationships, both personally and professionally.

Emotional intelligence is often broken down into four core skills, grouped under two main competencies - personal and social.

On the personal side, you have self-awareness and self-management.

Self-awareness is really understanding your own emotions, strengths, weaknesses, and having that self-confidence.

Self-management is controlling impulses, managing emotions healthily, taking initiative, following through on commitments, and adapting as needed.

Socially, it's about awareness and relationship management.

Social awareness means understanding the emotions, needs and concerns of others, picking up on cues, feeling comfortable in groups, and recognizing power dynamics.

Relationship management involves developing rapport, communicating clearly, inspiring and influencing people, collaborating well, and managing conflict productively.

To be a good CFO, you’ve got to step into the roles of not only leadership, but the role of coach, motivator, and collaborator - all of which requires a high degree of emotional intelligence.

Reliable & trustworthy

For a CFO, being seen as reliable and trustworthy is non-negotiable. It's an essential leadership quality.

People need to know beyond a shadow of a doubt that they can count on their CFO to be completely honest, ethical, and consistent through and through. This bedrock of trust lays the foundation for everything - from having a loyal, dedicated finance team to instilling confidence in investors and stakeholders.

When a top CFO makes a commitment or says they'll do something, it's ironclad. Their team and colleagues know it's as good as done. They never have to second guess or worry.

A CFO who projects an aura of trust elevates their whole organization. It fosters an environment of accountability and integrity.

Integrity like that is priceless. It gives CFOs true authority and gravitas that money can't buy. Their teams know they can always be relied upon to do the right thing, to have their backs, to give it to them straight. And that's what allows top CFOs to rally people and inspire excellence.

Critical thinking & problem solving

Critical thinking and problem-solving are very important CFO skills. After all, the business world can be messy - full of complex problems and unexpected challenges popping up left and right. As a CFO, you can't just take things as they come. You've got to always be thinking several steps ahead, analyzing situations from every angle to find the best solutions.

The best CFOs are able to anticipate potential issues before they even happen and put measures in place to prevent them from impacting the business.

By leveraging their sharp critical thinking and problem-solving abilities, CFOs can cut through the noise and complexity to get to the heart of an issue quickly. They size things up with a clear head and objectivity. And then they take action - decisively driving solutions that nip problems in the bud.

Regulatory and compliance understanding

Global compliance

With businesses operating across borders and multinational regulations, CFOs have to stay up-to-speed on compliance requirements worldwide.

It's not just the local rules anymore. Top CFOs deeply understand global compliance demands - taxes, trade, labor laws, you name it. They make sure their companies follow the letter of the law in every market they do business.

Ignorance isn't an excuse when millions are on the line. Global compliance mastery is a must-have for CFOs.

Ethical standards

At the end of the day, CFOs are stewards of the financial conscience. They have to embody the highest ethical standards to protect the company's integrity and reputation. From adhering to accounting principles to ensuring ethical business practices, the buck stops with the CFO.

They lead by example, instilling a culture of honesty, transparency, and moral fortitude. An ethical CFO earns stakeholder trust and sets the right tone for the whole organization. Cutting corners is never an option when ethics are at stake.

Strategic business skills

Business acumen

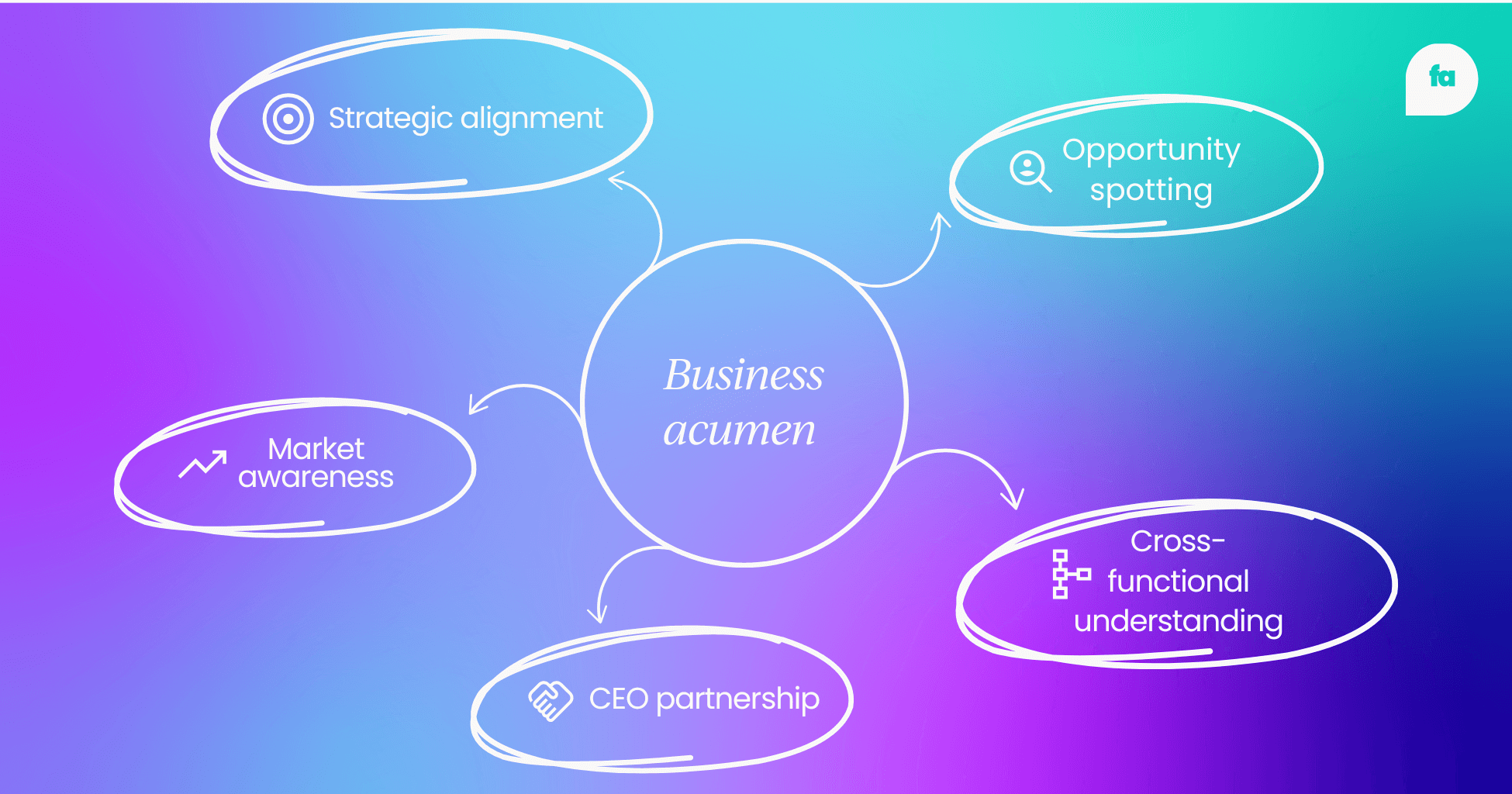

One of the most vital CFO skills is having that sharp business acumen - seeing the company through a wide-angle lens. It's about understanding the bigger business landscape that exists outside of just the finance department's four walls.

A top CFO is always plugged into how external factors - market trends, what competitors are doing, regulatory changes and so on - impact their specific business.

But it goes even deeper than that.

True business acumen means aligning the financial strategy and planning with the overall goals for the company as a whole.

Every financial decision a CFO makes should tie back to supporting the core mission and vision. It's about having that holistic perspective that connects the dots between finance and the big picture strategy.

With business savvy like that, CFOs can anticipate potential roadblocks and challenges before they happen. But they also spot exciting opportunities that others might miss. Their wide-angle vision makes them indispensable advisors to the CEO and the board.

The CEO knows they can rely on the CFO's business smarts and counsel. It's why the best CFOs have a seat at that leadership table - adding immense value with their cross-functional business prowess.

Some tips to help you build your business acumen skills include:

- Get out of the finance bubble. Shadow colleagues in other departments like sales, marketing, or operations. See firsthand how different business functions operate and the challenges they face.

- Read industry publications and analyst reports. Stay up to speed on broader market trends, competitive dynamics, emerging technologies, and macroeconomic factors impacting your industry.

- Attend cross-functional meetings. Don't just stick to the finance team's meetings. Regularly sit in on product, strategy, or leadership team huddles to get that big picture perspective.

- Meet regularly with the CEO. Set recurring 1-on-1 time with the chief executive. Get their vision and priorities and make sure the financials align with and support the overarching company strategy.

- Take an online course. Enroll in a business strategy, management, or leadership program to build more holistic business skills outside of just finance and accounting.

- Find a mentor. Seek out someone preferably a former CFO, who has walked the path you're on. They can provide invaluable advice on elevating business smarts.

Innovation & adaptability

The business world is in a constant state of flux, with new technologies and business models emerging at a rapid pace. CFOs must therefore embody innovation and adaptability. This means being open to new ideas, whether it's adopting new financial technologies or rethinking traditional business processes.

But it's not just about being open to change; it's about being a change agent within the organization.

By fostering a culture that values creativity and flexibility, CFOs can lead their teams in adapting to changes seamlessly, ensuring the company remains competitive and agile.

Negotiation CFO skills

Negotiation skills are absolutely vital for modern CFOs. It's really an art form that they have to master.

Think about it - CFOs are constantly negotiating high-stakes deals across the business. Whether it's hammering out terms with investors, finalizing contracts with suppliers, or closing agreements with key strategic partners, their negotiation prowess can make or break the company's bottom line.

Top CFOs strike just the right balance - they're assertive and fight hard for the best deal, but they also have empathy. They deeply understand the perspectives and priorities of everyone involved. And that allows them to get creative and structure true win-win solutions where everybody walks away happy.

When a CFO can negotiate with skill and nuance, it opens the door for them to secure incredibly favorable terms and conditions that support the health of the business both financially and strategically. They're not just checking boxes but aligning all the pieces.

FAQs: CFO skills

What are the core skills every CFO needs?

Every CFO needs a robust set of core skills, including deep financial expertise, strategic planning abilities, proficiency in risk management, leadership and communication skills, technological savvy, and an understanding of regulatory and compliance issues. These skills enable a CFO to manage a company's financial health and contribute to its strategic direction.

What are the key responsibilities of a CFO?

CFOs are responsible for financial planning and analysis, managing the company's finances, strategic planning, risk management, data analysis, and ensuring compliance with financial regulations.

What are the qualities of a CFO?

Key qualities include strategic thinking, analytical skills, integrity, adaptability, emotional intelligence, and a forward-looking perspective.

How important is technological proficiency for a CFO?

Technological proficiency is increasingly critical for CFOs, as financial technologies (FinTech) play a pivotal role in streamlining operations, enhancing data analysis, and securing financial transactions. A tech-savvy CFO can leverage these tools to drive efficiency, inform strategic decision-making, and protect against cyber threats.

Why are strategic partnerships important for a CFO?

Strategic partnerships are important for CFOs because they can open up new growth avenues, facilitate access to new markets and technologies, and optimize operational efficiencies. By building and maintaining strategic alliances, CFOs can support their company’s growth objectives and enhance its competitive edge.

Is the CFO role stressful?

Yes, the CFO role can be stressful due to its high level of responsibility, the need for accuracy in financial management, and the pressure to support strategic decisions.

What makes you the ideal candidate for a CFO position?

The ideal candidate possesses a blend of financial acumen, strategic thinking, leadership qualities, and the ability to adapt and innovate, along with a track record of contributing to business growth and efficiency.

Develop your skills at our CFO Summit!

This is an exclusive, invite-only gathering of C-suite finance leaders. Request your invite to take advantage of this unrivaled networking, and learning opportunity so you can:

- Build local a network of connections within our global CFO community.

- Turn your finance function into a world-class operation.

- Gain a strategic edge by leveraging the latest trends & emerging tech.

- Improve your CFO skills and smash your career goals.

...and so much more!

Follow us on LinkedIn

Follow us on LinkedIn