Top-down vs bottom-up forecasting: Which method should you use to create accurate sales forecasts?

Top-down and bottom-up forecasting are two commonly-used techniques for building sales forecasts. However, the debate on which one is superior is still ongoing.

Choosing the right forecasting method for your business is important, which is why we’re exploring the ins and outs of both to help you choose the right method for you and your business.

Topics covered:

- What is top-down forecasting?

- What is bottom-up forecasting?

- Differences between top-down forecasting vs bottom-up forecasting

- Advantages of using a top-down forecast approach

- Advantages of using a bottom-up forecast approach

- Which forecasting method should you choose?

What is top-down forecasting?

Top-down forecasting, as the name suggests, starts from a high-level perspective, and then trickles down to the specifics. This vantage point makes it easier to gather essential intel to predict a company's financial trajectory, including:

- Historical company performance

- Growth rates across the industry

- Key economic indicators

Once the overall projections are established, they’re divvied up among individual departments, teams, or product lines. These projections shape detailed sales budgets and production capacity plans.

The top-down approach to forecasting has earned a fan base among large organizations and those juggling multiple divisions as it grants a holistic perspective of the entire business.

Wall Street Prep describes the top-down approach as estimating "future sales by applying an implied market share percentage to a total market size estimate." (see formula image below).

The charm of top-down forecasting lies in its knack for weaving a cohesive narrative of a company's financial future, grounded in its strategic goals and aspirations.

However, top-down forecasting isn't without its drawbacks. Since this method relies heavily on historical data and market trends, it doesn't always account for sudden changes in the market.

What is bottom-up sales forecasting?

Bottom-up forecasting takes a more granular approach to sales forecasting. It starts from the ground level and builds up toward the overall financial outlook. This method is all about nurturing the wisdom of individual departments and teams. It's a great option because it focuses on using their insights to create detailed forecasts tailored to specific areas of the business.

Collaboration is at the heart of bottom-up sales forecasts. Each team rolls up its sleeves and crafts its own sales, revenue, or production forecasts. All of which, are informed by their knowledge of the market, customer demands, and in-house capabilities. Once these customized forecasts are wrapped up, they're woven together to form a comprehensive financial tapestry for the entire organization.

Wall Street Prep summarizes bottom-up forecasting as "breaking a business apart into the underlying components that ultimately drive its revenue generation, profits, and growth." (see formula image below).

The allure of bottom-up forecasting lies in its ability to harness the unique insights of those who are deeply immersed in the day-to-day operations of the business. This can lead to more accurate and realistic forecasts, as it reflects the current market conditions and the capabilities of each department.

However, bottom-up models also come with some challenges. Since this method is built on the input of various departments, it can be time-consuming and resource-intensive to collect and consolidate the data. Plus, without a unifying framework or guidance from the top, it's easier for forecasts to stray from the company's overarching goals.

Top-down vs bottom-up forecasting: What are the main strengths and weaknesses?

The great forecasting debate between top-down and bottom-up methodologies continues. While both methods aim to predict a company's financial future, they differ significantly in their approach, focus, and implementation.

To help you make an informed choice, let's dive into the main differences between these two forecasting techniques:

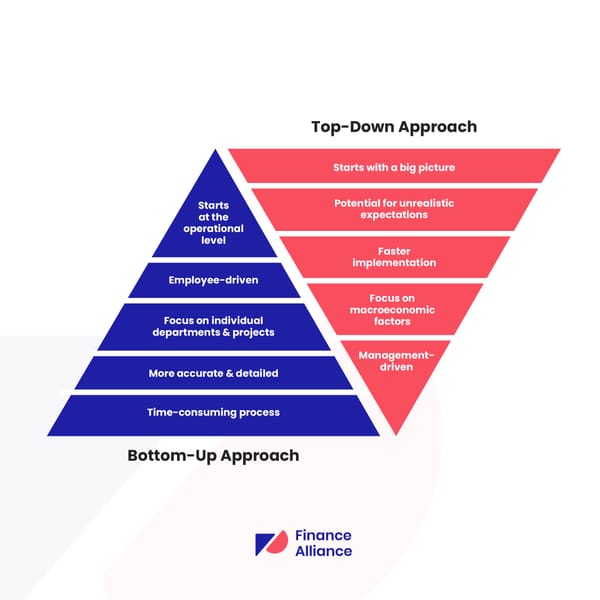

Top-Down Forecasting:

Starts with a big picture

Top-down forecasting begins with a macro view of the market, industry trends, and overall economic conditions, and then works its way down to specific departments and teams.

Management-driven

This approach is primarily driven by the management team, who sets financial goals and expectations for the company.

Focus on macroeconomic factors

Historical company performance, industry growth rates, and economic indicators heavily influence top-down forecasting.

Faster implementation

Since the top-down method relies on high-level data and projections, it can be implemented more quickly than its bottom-up counterpart.

Potential for unrealistic expectations

Due to its reliance on historical data and macro-level trends, top-down forecasting may not always account for unique circumstances or sudden market changes. This can result in unrealistic expectations for individual departments or teams.

Bottom-Up Forecasting:

Starts at the operational level

Bottom-up forecasting begins at the ground level, focusing on the input and expertise of individual departments, teams, or product lines.

Employee-driven

This approach is rooted in the knowledge and insights of employees involved in business operations.

Focus on individual departments & projects

Bottom-up forecasting considers the unique needs, capabilities, and market conditions of each department. Doing so results in tailored forecasts for specific areas of the business.

More accurate & detailed

By leveraging the expertise of those closest to the action, bottom-up forecasting can yield more accurate and detailed financial projections.

Time-consuming process

Collecting and consolidating data from various teams is a labor-intensive and time-consuming process in the bottom-up approach.

Top-down forecast advantages

Saves time

One of the most significant advantages of top-down forecasting is the time it saves. This method is considerably faster than bottom-up forecasting, as it avoids the detailed data analysis that can slow down the process.

Positive viewpoint

Top-down forecasting often presents a more optimistic outlook on future sales performance. By focusing less on hard numbers, companies can emphasize future opportunities and potential growth, rather than being bogged down by current capacity or limitations. This positive perspective can help boost morale and encourage teams to strive for better results.

Variability

This forecasting method is great for pre-revenue companies or those with irregular revenue streams. Since it’s less reliant on granular business data and real numbers, it allows for variability within a forecast period without significantly impacting accuracy. This flexibility makes top-down forecasting a more suitable choice for businesses with fluctuating financial performance.

Alignment

Top-down forecasting begins with the company's strategic goals and aligns departments and teams to work together towards a shared vision. This unified approach keeps everyone on the same page and focused on achieving the company's objectives.

Consistency

One of the strengths of top-down forecasting is the consistent outlook it promotes throughout the company. This consistency makes communication and decision-making more efficient, as everyone is working with the same set of expectations and goals.

Simplicity

The top-down approach is user-friendly and easy to understand. So, it's a great choice for a wide variety of companies, regardless of their size or industry.

Bottom-up forecast advantages

Grounded goal-setting

While top-down forecasting leaves room for subjectivity, bottom-up forecasting hones in on actual performance figures. This method may not offer as optimistic a view as top-down, but it ensures your forecasts are rooted in reality and more likely to be accurate, leading to attainable goals.

Detailed predictions

A key strength of bottom-up forecasting is its attention to detail. In contrast to top-down forecasting, which adopts a wide-angle lens on revenue and sales performance, bottom-up forecasting enables precise predictions related to specific products or services, customer segments, or geographic regions.

Increased employee engagement

Employee involvement is crucial for any organization striving to achieve sales targets. Bottom-up forecasting takes into account historical and current sales data, meaning employees contribute to its collection and offer valuable context. By involving and engaging employees in the forecasting process, they're more likely to be motivated to work toward the forecasted outcomes.

Adaptability

Bottom-up forecasting is very adaptable, making it ideal for sudden market changes and unexpected situations.

Bottom-up forecasting is adaptable. This is because it relies on the insights and expertise of employees who are directly involved in business operations. These employees are closest to the action.

Which forecasting method should you choose?

Choosing the right forecasting method for your organization is essential for effective financial planning and decision-making. To help you select the best approach, consider the following tips and advice:

1. Evaluate your organization's size and structure

Smaller companies or startups may find bottom-up forecasting useful. It offers detailed, ground-level insights.

On the other hand, larger organizations with multiple divisions may prefer top-down forecasting. This method provides a big-picture perspective.

2. Consider the nature of your business and industry

The adaptability of bottom-up forecasting may be a better fit if your industry experiences rapid changes. Alternatively, it could also be suitable for businesses that operate in a niche market. However, if your company is part of a more stable industry, top-down forecasting could be sufficient.

3. Assess the availability and quality of your data

If your organization has access to reliable, high-quality data from various departments and teams, you can leverage this information for more accurate predictions using bottom-up forecasting. On the other hand, if data collection and consolidation are challenging, top-down forecasting might be more practical.

4. Determine the level of employee involvement desired

Bottom-up forecasting may be the way to go if you're looking to foster employee engagement and ownership in the forecasting process. But if your focus is on aligning the entire organization with strategic goals, top-down forecasting might be a better fit.

5. Consider the time and resources available

If you need a faster forecasting process, top-down forecasting can save time and resources by using high-level data. On the other hand, if you have the time and resources to invest in a more detailed and accurate forecast, bottom-up forecasting may be worth the effort.

A blended approach

In many cases, organizations can benefit from combining the best of both worlds.

A blended approach is effective for financial planning. It ensures alignment with the company's strategic goals and provides detailed insights and adaptability through bottom-up forecasting.

You can combine the advantages of both approaches to create a more reliable, precise, and comprehensive financial forecast. This forecast can help you make better decisions and create better, more accurate sales forecasts.

FAQs - Top-down forecasting vs bottom-up forecasting

What is the main difference between top-down and bottom-up sales forecasting approaches?

Top-down forecasting starts with a broader market perspective, then narrows down to the company's sales. Bottom-up forecasting begins with individual sales units and aggregates them to reach the overall sales forecast.

Which approach is more accurate: top-down or bottom-up sales forecasting?

It depends on the industry and company. Bottom-up forecasting tends to be more accurate because it considers granular details, but it requires more time and resources. Top-down forecasting is quicker but may not account for all factors influencing sales.

When should I use a top-down forecasting approach?

Top-down forecasting is best for industries with relatively stable market conditions, limited product offerings, or when a company has limited historical data to base forecasts on.

When should I use a bottom-up forecasting approach?

Bottom-up forecasting is ideal for industries with rapidly changing market conditions, diverse product lines, or when a company has extensive historical data to base forecasts on.

How can I improve the accuracy of my sales forecasts?

Continuously review and update your forecasting models, incorporate historical data, consider external factors, and use a combination of top-down and bottom-up approaches if feasible. Additionally, involve input from sales teams and other stakeholders.

Follow us on LinkedIn

Follow us on LinkedIn