The role of finance within organizations is changing. Gone are the days when you spent most of your time manually inputting data into spreadsheets (yawn!).

Thanks to new technologies, many of the most tedious and mundane tasks can be (or have been) automated. Finance can now step up and offer its unique expertise to influence better-informed decisions that help drive the business forward.

But what is finance transformation? And why is it so important to modern CFOs and their teams?

In this article, we’re diving into what finance transformation means, the key drivers of it, and why it’s something that needs to be on your radar in 2023 and beyond.

Topics covered:

- What is finance transformation?

- Why is finance transformation so important?

- 10 Key drivers of digital transformation.

- Finance transformation progress within organizations.

- Budgeting for finance transformation.

What is finance transformation?

Finance transformation refers to tactical initiatives that help transform the finance function by assessing and improving its strategy, vision, processes, and systems to better align with the company’s overall strategy.

Finance transformation is evolving exceptionally fast, and things have escalated that much faster (and further) since the dawn of COVID-19.

The pandemic saw a spike in demand for more effective and efficient ways to complete repetitive and mundane tasks. From collecting data business-wide to automating daily processes, finance transformation has proven to generate positive change across the entire organization.

Suddenly, finance professionals are no longer siloed to adding numbers to lengthy spreadsheets. Those days are a thing of the past. Or at least they can be if your organization invests in new technologies to help streamline existing processes and ease the workload.

Why is finance transformation so important?

It’s the question on top of everyone’s minds, so let’s address it. Why should finance professionals care about implementing technology at all? And why is it so important?

Finance transformation is important for several reasons. It can help organizations improve the efficiency and effectiveness of their financial operations, which can lead to cost savings and increased profitability. It can also help organizations better understand and manage their financial performance, which can inform decision-making and strategy.

Additionally, finance transformation can help organizations adapt to changing business environments and regulatory requirements and can position them for future growth and success.

In our recent State of Finance Transformation Report 2022, we asked a few finance experts to share their thoughts on why more finance teams need to become advocates for finance transformation within their organizations.

Here’s what they had to say:

What is finance transformation: 10 Key drivers

What drives interest in adopting new technologies within the finance function? To find out, we asked finance professionals to identify the main drivers of finance transformation in their organizations.

Here are 10 key drivers of finance transformation within organizations (ranked according to the results from our State of Finance Transformation Report 2022):

1. The desire for more efficient processes

2. Improved controls

3. Improved reporting and stakeholder visibility

4. Meeting customer demands

5. Pressure to digitalize finance processes

6. Increased business complexity

7. Shorten cash cycles

8. Globalization

9. Uncertainty

10. Need for supplier integration

Finance transformation progress within organizations

A successful finance transformation journey takes more than blindly investing in some jazzy new technology. You won’t get very far without a clear plan and long-term strategy in place.

The good news is that it looks like most of our respondents are taking a strategic approach to finance transformation with 70.4% reporting that their organization has a specific strategy in place, while 29.6% said that a strategy was absent.

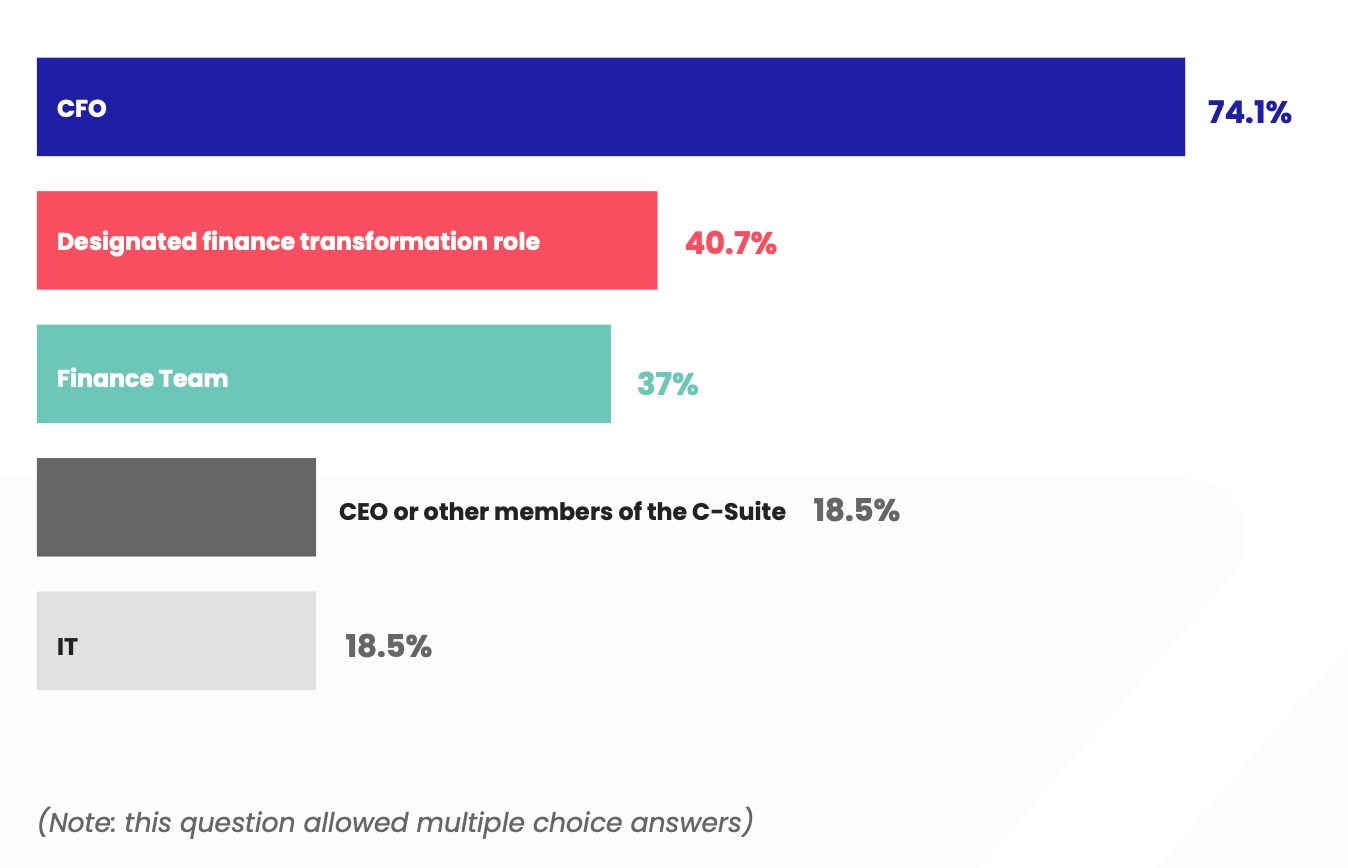

Who oversees finance transformation?

We were keen to find out who, if anyone, was responsible for implementing finance transformation.

Do companies hire roles dedicated to finance transformation? Or, is somebody else or an entire team responsible for identifying which technology to use, who gets to use it, and to what capacity?

We weren’t overly surprised to see that 74.1% of respondents reported that the Chief Financial Officer (CFO) is the one who oversees finance transformation in the workplace.

However, 40.7% said that their company has hired a designated finance transformation role, while 37% reported that the finance team had been given full control over how they want to leverage technology.

The results showed that finance transformation is typically overseen by senior finance leaders, such as the Chief Financial Officer (CFO) or other members of the C-suite. These leaders are responsible for identifying the need for financial transformation, developing a plan to implement it, and ensuring that it is carried out effectively.

They may work with other members of the finance team, as well as external consultants, to implement changes to processes, systems, and organizational structures. Depending on the scope of the transformation, other stakeholders within the organization, such as the CEO, board of directors, and business unit leaders, may also be involved in overseeing the process.

Why do some companies fail?

When digital transformation fails to meet expectations, it’s usually not because of the new technology itself, but how that new technology was onboarded. After all, if the people using the technology don’t know how it works or are unsure of the answer to the question - what is finance transformation? - what’s the point?

We wanted to find out just how ‘ready’ finance professionals are for this new wave of technology we’ve seen flooding through the gates of finance departments from around the world.

We asked our survey respondents to rate not only their knowledge of technology in finance but their entire finance team’s knowledge of what finance transformation means and to see if there’s an evident training gap when it comes to adopting new technology.

59.3% of finance professionals surveyed rated their knowledge as average, while 18.5% rated their knowledge as poor. On the bright side, 14.8% considered themselves to be technology experts.

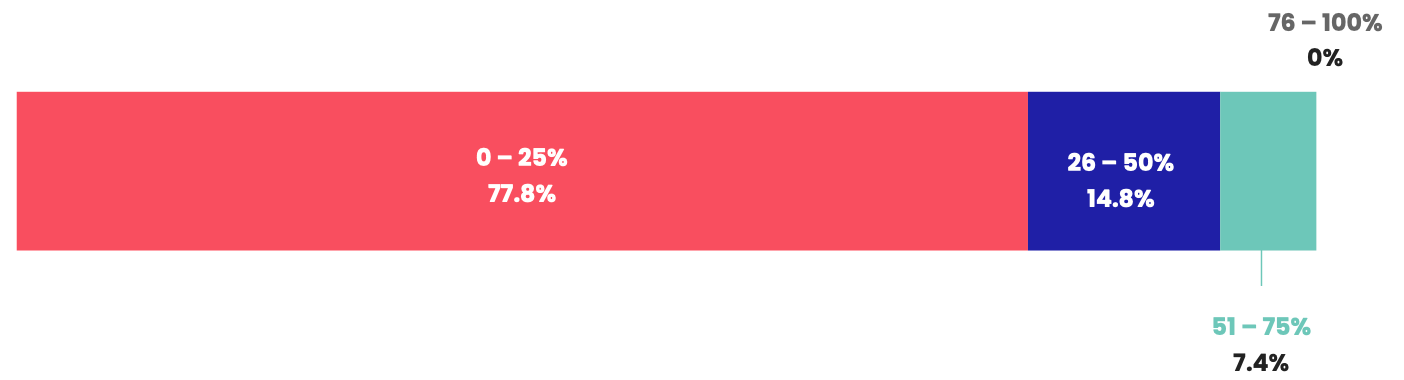

Budgeting for finance transformation

How much does it cost to invest in the best technology to streamline financial processes? And how much of a company’s budget is going towards finance transformation?

According to 77.8% of finance professionals surveyed, between 0% – 25% of the overall company budget is set aside for technological investments that could benefit them within their roles.

14.8% of respondents reported that their companies allocated between 26% – 50% of the budget to finance transformation and only 7.4% reported over 50% of the company’s budget is invested in technology for the finance function.

Can technology impact the bottom line?

Yes, finance transformation can potentially impact business profits in several ways. By improving the efficiency and effectiveness of financial operations, an organization may be able to reduce costs and increase profitability.

For example, if a company can streamline its billing and collection processes, it may be able to reduce the amount of time and resources it spends on these activities, which could lead to cost savings.

Want to see more key findings from the State of Finance Transformation Report?

Grab your copy today and discover the real impact of finance transformation on not just organizations, but the everyday life of finance pros like you!