Time is money, especially when it comes to acquisitions. Deal fatigue can drag negotiations on for months and every day a deal remains unclosed is another day of lost opportunities and unrealized profits.

But that’s only the case if you don’t know how to leverage negotiation tactics to your advantage.

By the time you finish reading this guide, you’ll know some of the best secrets of the trade to help you gain an advantage at the negotiation table and close deals quicker.

Negotiation strategies:

4. Identify the ‘real’ decision-maker

1. Preparation and research

Acquisitions are massive investments, and protracted negotiations can bleed your company dry. For that reason, you must put the time and work in to make sure you’re properly prepared for the negotiation phase of the acquisition.

Being prepared will help you:

- Secure the desired price

- Navigate deal structures

- Identify potential risks

And, most importantly, it’ll put you in a stronger position to maximize value for the company.

82% of top performers (those exceeding their quotas) say they "always" perform research before reaching out to prospects.

For CFOs, this means doing due diligence and looking into things like the target’s financials and identifying their strengths, weaknesses, and any hidden liabilities. With this knowledge, you can negotiate confidently, ensuring you get the best possible deal.

But successful acquisitions aren't just about maximizing your own gain. Researching the target's situation and industry trends allows you to anticipate potential counter-offers. This foresight will help you formulate the best responses and navigate negotiations better.

Finally, don't underestimate the power of a structured process. Huthwaite International's research found that companies lacking a clear negotiation strategy suffered an average net income decline of 63.3%.

A well-defined roadmap keeps you focused, prevents costly missteps, and increases the odds of securing a deal that creates value for both your company and the target (or vice versa).

2. Build trust

The saying "people buy from people they like and trust" holds true not just in sales, but also in acquisitions.

HubSpot reports that 82% of sales professionals consider building relationships the most crucial (and enjoyable) aspect of their work. This translates directly to acquisitions where building trust with the target company is key to smooth negotiations.

By building trust, you can allow for open communication where exchanging information flows better without hitting as many roadblocks. When both sides trust each other, it helps to create transparency, which leads to confidence, and more productive negotiations.

So, how can you build trust?

A good place to start is by demonstrating genuine interest in the target company and its goals.

You should also be open and transparent about your own company’s objectives and limitations. If you hide something important and it pops up down the road, you risk breaking the trust you’ve spent so long building.

The best way forward is to be open and honest, which can go a long way in building trust and securing a lasting deal.

3. Be an active listener

Active listening isn't just about hearing the words; it's about fully absorbing the message. It might sound easy in theory, but it can be difficult to maintain and showcase interest, especially in drawn-out negotiation conversations.

CFOs who prioritize active listening gain a deeper understanding of the target company's needs and position themselves to craft win-win deals that benefit both parties.

Here are some useful tips to help you practice active listening:

Negotiation isn't just about getting the best deal; it's about building bridges.

When you truly listen to the other side (and their needs and concerns) you create a sense of respect and understanding. That makes all the difference in an acquisition.

People want to feel heard and valued, and active listening shows them you care. It might sound simple, but it can be one of the best negotiation tactics that turns a tense deal into a win-win for everyone involved.

4. Identify the main decision-maker

A key part of any negotiation is doing some detective work to avoid a common mishap. Imagine this, you're in the middle of negotiations, you’ve come prepared, you’ve done your research and you’re ready to make the deal. The problem though, is the person you’re negotiating with lacks the authority to make any real decisions, never mind closing the deal.

The result?

Frustration, wasted time, and a lot more back and forth down the road.

To avoid this from happening, Forbes suggests you find out what kind of authority the other person has. In other words, are they the ultimate decision-maker? Or are they acting as the voice of the company, but lacking true authority?

That leads us onto the next hurdle - how do you go about identifying the real decision-maker?

The obvious answer is to ask. It’s best to do this early in the conversation to find out more about the other person’s role and decision-making authority.

You could ask something like “Who will ultimately approve this agreement?” or “If we reach an understanding, who will I need to discuss it with for final approval?" – these types of questions will help you get a straight answer a lot faster.

“Negotiations tend to go on for too long when direct questions aren’t asked. Open up discussions to get both sides on the same page.” - Mara Garcia, CFO of Phonexa.

If you don’t want to take that approach straight away, there are some other ways you can identify the key decision makers without asking them outright.

For example, take time to research the target company's structure (and do this before the negotiation). You can look at tools like LinkedIn to understand the hierarchy and identify key decision-makers.

You can also often tell when someone lacks the authority to make final decisions by keeping an eye out for some early signs.

You might notice that the person you’re negotiating with says things like "I can't agree to that" or "I need to run this by my manager" repeatedly. These types of phrases are clear signals they lack the final say.

Another giveaway is if the person avoids specific deal points or seems uncomfortable discussing certain aspects, which may suggest they need higher-level approval.

5. Utilize the framing effect method

Have you ever noticed how the way someone presents information can completely change your perspective? That's the power of the framing effect, which is a cognitive bias you can actually use to your advantage during negotiations.

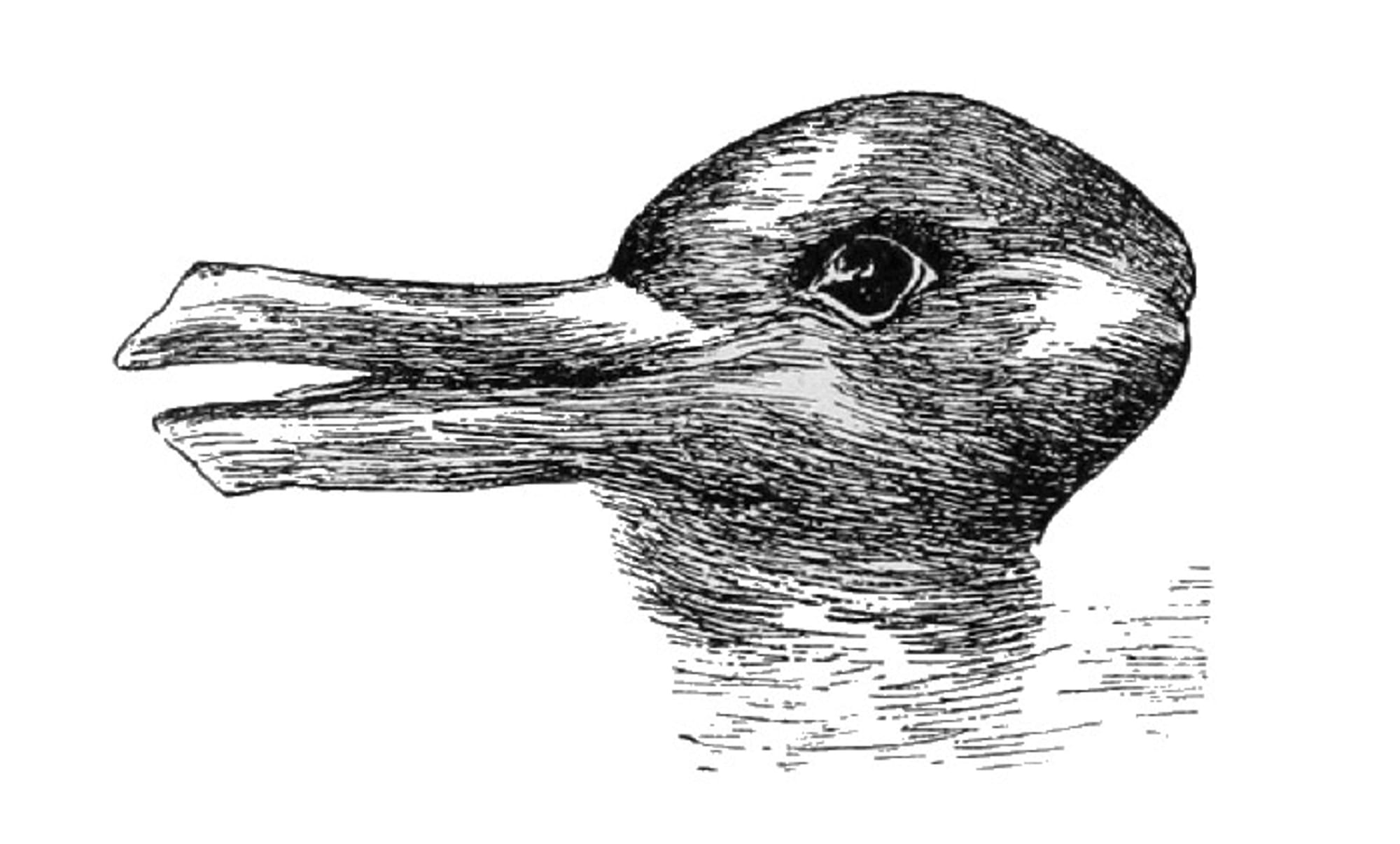

Take this image for example.

You’ve probably seen it before. It's a great example of how perceptions change according to how it’s presented and your own perception.

Neil Patel talked about how you can use this principle as a negotiation tactic:

“Ask yourself, “How can I frame this solution so we both win?”

“Keep in mind that you are not necessarily changing the end result. You are simply changing the way you frame the conversation.” Neil Patel, co-founder of NP Digital.

For a CFO working on closing an acquisition deal, you could take the framing effect, which suggests people react to a particular choice in different ways depending on whether it’s presented as a loss or a gain, as one of your best negotiation strategies.

For example, you could highlight the possible benefits of an acquisition to create a more favorable perception compared to focusing on the drawbacks or risks involved.

Some other ways you could use this principle in your negotiation include:

Use comparisons

Comparing your offer to competitors can be a smart way to make the benefits more tangible.

Tailor your message

Frame your message to align with what each stakeholder values most.

Focus on immediate gains

During acquisition negotiations, focus on the "what's in it for them" factor. People tend to prefer immediate rewards over future benefits.

6. Win-win paradigm

The win-win paradigm is one of the most effective negotiation strategies that focuses on finding solutions that benefit everyone involved.

In acquisition deals, this philosophy proves particularly valuable because it helps to build:

- Stronger relationships

- Smoother collaboration

- Sustainable success

According to Adam Webb from Sunder Energy (as quoted in this Forbes article on the art of negotiation):

“The win-win paradigm is the key to all successful negotiations, so infuse it into your being. Lay the foundation by discussing it at the start of every sales pitch and negotiation.”

If you want to take this approach, take time to understand the goals, concerns, and interests of the other party. This will help you to come up with better solutions that address their needs as well as your own.

“Many people think in terms of either/or: either you’re nice or you’re tough. Win-win requires that you be both. It is a balancing act between courage and consideration.” - FranklinCovey

The win-win approach goes beyond short-term success. CFOs who embrace it pave the way for lasting, productive partnerships. These partnerships drive long-term growth and success for both companies involved.

FAQs

Why is active listening important in negotiations?

Active listening is crucial in negotiations because it allows you to fully understand the other party's interests, concerns, and underlying motivations.

What does BATNA stand for?

BATNA stands for "Best Alternative to a Negotiated Agreement." It's basically your Plan B – what you'll do if the negotiation falls through. Having a strong BATNA gives you confidence and prevents you from settling for a bad deal.

What is anchoring in negotiation?

Anchoring is the first number thrown out in a negotiation. It sets a reference point for future offers.

What are the tactics of negotiation?

Negotiation tactics are tools you use to influence the other side. This can include things like active listening, using your BATNA, positively framing the deal, and making counteroffers.

What is the number one rule in negotiation?

Know your walk-away point. Be clear on the minimum acceptable terms for you, and be prepared to walk away if you don't get them.

What is negotiated acquisition?

A negotiated acquisition is when two companies agree on the terms of a merger or acquisition through discussion and compromise.

How to negotiate a merger and acquisition?

Negotiating a merger and acquisition involves carefully valuing the target company, structuring the deal terms (cash, stock, asset vs stock purchase, etc.), conducting thorough due diligence, and aligning leadership teams and company cultures.

What is the role of the CFO in acquisition?

The CFO usually investigates the target company's finances, crafting financial models to assess value, and then negotiates key terms with the seller. After the deal closes, they ensure a smooth financial integration, making sure the acquisition delivers on its promise.

Finance Alliance Pro Membership

Our Pro Membership offers a unified source of trustworthy value for finance professionals to gain new knowledge and access templates and tools to help you optimise your daily activities and skyrocket your finance career to new heights.

This membership plan helps you to gain access to the most recent resources, and a supportive community of peers who share your passion for achievement.

Learn more about our Pro Membership here.

Follow us on LinkedIn

Follow us on LinkedIn