What is acquisition financing?

Acquisition financing is how companies get the money to buy other businesses or assets.

For example, let’s say you're running a small company and you see an opportunity to grow fast by buying out a competitor. It’s a move that could potentially skyrocket your company to new heights.

The catch?

A move like that takes some serious cash - likely more than you have lying around.

That's when you look into acquisition financing. This refers to different ways of raising capital so you can obtain, or acquire, something of value - like another business. It's essentially getting financial backing to realize your company's dreams of expansion.

The process involves:

1. Understanding how buying another company supports your long-term vision.

2. Assessing the impact on your finances.

3. Figuring out how to integrate the acquisition.

Done right, acquisition financing fuels growth. Done poorly, it can sink the whole ship. The sweet spot is structuring a deal that makes strategic sense and positions your now-bigger company for continued success into the future.

Acquisition funding vs M&A funding: What’s the difference?

Acquisition funding and merger and acquisition (M&A) funding are often used interchangeably, but there are some key differences.

Acquisition funding refers to the capital needed for one company to acquire another or purchase a significant share of its assets.

It deals with the buyer's side of the equation - securing the money to make the acquisition possible through debt, equity, or a combination.

The focus is on how the purchase will be funded, the loan terms and interest rates, and how acquiring this new asset or company impacts the buyer's finances.

M&A funding is a broader term that encompasses funding for both acquisitions and mergers.

In an acquisition, it’ll still deal mostly with the buyer's funding needs. But in a merger, where two companies join forces to create a new combined entity, the funding complexities multiply.

Now the focus must encompass how both companies' assets and liabilities come into play to finance the deal, or how new shares are issued if it’s a stock transaction.

Types of acquisition financing

As CFO, you have a number of routes to consider when financing an acquisition. So, let's walk through some of the common options:

1. Stock swap transaction

Using company shares instead of cash to buy another business lets you expand without draining your cash reserves. It shows you've got faith in the new mega-company you're creating too.

2. Equity acquisition

This involves the acquirer paying for the target company by issuing new shares of its own stock to the target's shareholders. It's similar to a stock swap but focuses on expanding the ownership base to include the shareholders of the acquired company. Taking this route dilutes the existing shareholders' stakes but avoids increasing the company's debt load.

3. Acquisition through debt

Borrowing money is probably the most affordable way to buy another business. Banks will lend company acquisition money through loans, bonds, etc. Debt financing makes it possible to make large acquisitions without diluting shareholders' equity, but it increases the company's leverage and financial risk.

4. Leveraged Buyout (LBO)

Here, most of the money needed to acquire the target company comes from loans backed by the assets being acquired. LBOs are a high-risk, high-reward strategy, often used by private equity firms.

5. Cash acquisition

A straightforward method where the acquiring company pays cash for the target company's shares. This is often preferred by the sellers because it provides immediate liquidity. For the buyer, it means using either available cash reserves or raising new capital specifically for the acquisition, potentially through issuing debt or equity.

6. Seller’s financing / Vendor Take Back (VTB) Loan

In seller’s financing or VTB, the seller of the company extends a loan to the buyer to cover part of the purchase price. This can be beneficial in the case where the buyer is unable to secure sufficient financing from other sources.

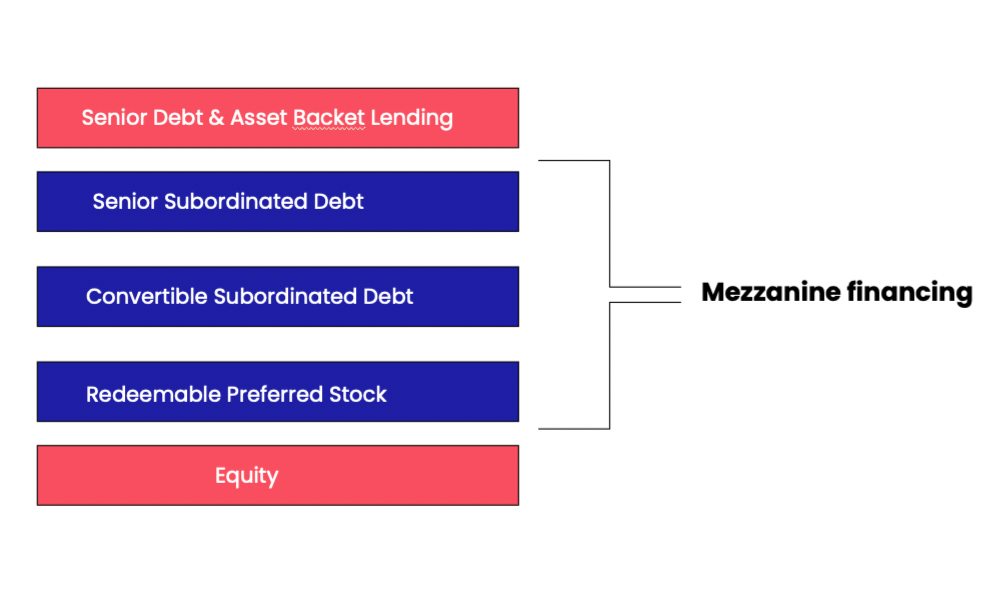

7. Mezzanine financing

Mezzanine financing is a hybrid form of capital that combines elements of debt and equity financing.

It provides lenders the right to convert to an ownership or equity interest in the company if the loan is not paid back in time and in full. It’s often used to finance the expansion of existing companies and is subordinate to debt provided by senior lenders like banks.

The CFO’s role in managing acquisitions and obtaining M&A funding

When a company decides to acquire another company, the CFO plays a pivotal role in making it happen. As the chief financial officer, the CFO manages the financial planning and execution of the entire merger and acquisition (M&A) process. Their intimate knowledge of the company's financial position and access to capital markets makes them a leading player in acquisition strategy.

The CFO typically takes the lead in identifying potential targets, valuing them, and determining the optimal deal structure. They work closely with the CEO, board and management to align the acquisition rationale with broader corporate strategy.

When it comes to securing financing, a CFO’s key duties include:

- Modeling expected cash flows, acquisition costs and financing options

- Arranging meetings with banks and investors to pitch the deal

- Evaluating debt vs equity tradeoffs for proposed financing packages

- Negotiating agreeable terms, rates, warrants with creditors/investors

- Fulfilling due diligence document requests from financiers

- Drawing up paperwork for loan agreements, securities filings, regulatory compliance

- Developing contingency plans and backup financing channels if needed

Post-acquisition, the CFO leads the financial integration, directs accounting procedures, monitors cash flows and keeps the board updated on the deal’s performance.

The success of an acquisition relies heavily on the CFO’s financial leadership throughout the process. Their extensive M&A expertise and deal-making savvy enable strategic growth through targeted, well-funded acquisitions.

With both operational and strategic financial stewardship, the CFO is therefore a mission-critical ally in building shareholder value through M&A execution. Their central role coordinating key aspects streamlines capital raising, negotiations, due diligence, and reporting of major transactions.

The future of M&A and acquisition funding

Finding the money to fuel a major acquisition can often leave even the savviest CFOs sweating bullets and downing late night coffee.

The quest for the optimal acquisition funding strategy is a high-stakes game, influenced by a myriad of factors including market conditions, regulatory landscapes, and strategic objectives.

As we venture into 2024, it's clear that the M&A market is on the brink of entering a new, distinctive phase. Brian Levy, Global Deals Industries Leader and Partner at PwC, predicts:

“The M&A market is entering a new phase in 2024 that will differ from prior ones. The upturn will almost certainly be more measured than the surge of dealmaking activity which occurred during late 2020 and in the record-breaking year of 2021.” - Brian Levy, Global Deals Industries Leader, Partner, PwC.

This prediction suggests a shift from the frenetic pace of M&A activity experienced in the recent past towards a more deliberate and strategic approach. The implications for acquisition funding are significant:

Strategic financing decisions

CFOs will need to navigate this measured upturn with a focus on strategic financing decisions that align with long-term corporate goals. The emphasis will likely be on securing funding options that offer flexibility and resilience in the face of market uncertainties.

Diversification of funding sources

The anticipated change in dealmaking velocity underscores the importance of diversifying funding sources. Companies might explore a broader mix of financing options, including equity, debt, mezzanine financing, and even novel instruments like Special purpose acquisition companies (SPACs), to mitigate risks associated with economic volatility.

Enhanced due diligence

With the market dynamics evolving, there will be a greater emphasis on thorough due diligence to scrutinize potential acquisitions more closely. This means not just evaluating financial metrics, but also considering ESG factors, integration challenges, and potential regulatory hurdles in more depth.

Emphasis on value creation

The shift towards a more measured upturn in M&A activity will require CFOs to focus on deals that offer clear paths to value creation. This may involve prioritizing acquisitions that provide strategic synergies, access to new markets, or technological capabilities, rather than pursuing growth for growth's sake.

Adaptability and resilience

Finally, the key to thriving in the new phase of M&A activity will be adaptability and resilience. CFOs will need to remain agile, ready to adjust their strategies in response to shifting market conditions and emerging opportunities.

As the M&A market enters this new phase, the role of the CFO becomes ever more critical. Balancing strategic foresight with financial prudence will be paramount in navigating the complexities of acquisition funding.

By anticipating the measured pace of dealmaking activity, CFOs can position their companies to seize opportunities while mitigating risks, ensuring sustainable growth in an evolving market landscape.

FAQs: Acquisition financing

What does M&A stand for in finance?

M&A stands for Mergers and Acquisitions, a term used to describe the consolidation of companies or assets through various types of financial transactions.

How are mergers and acquisitions funded?

Mergers and acquisitions are funded through debt (loans, bonds), equity (issuing new shares), cash reserves, or alternative financing methods like mezzanine financing or seller financing.

What are the financing strategies of M&A?

Financing strategies include leveraging debt to fund the acquisition, using company equity, employing a combination of debt and equity, or utilizing alternative financing options like mezzanine financing.

What is the meaning of financial acquisition?

Financial acquisition involves acquiring a company or assets through financial means, using methods like cash payments, debt, or equity to complete the purchase.

What is the acquisition method of finance?

The acquisition method of finance involves using various financial instruments (debt, equity, cash) to fund the purchase of a company or assets.

Become a Finance Alliance Pro member

Our Pro membership offers a unified source of trustworthy value for finance professionals to gain new knowledge. It's the all-in-one platform for finance professionals committed to lifelong learning, networking, and career advancement.

- Pre-built financial models

- Templates & frameworks

- 100+ hours of OnDemand insights

- FinIQ competency framework

- Mentor program

- Members-only networking & webinars

- Ungated access to reports

- Workshops & webinars

- Discounts on events

Secure your spot at the forefront of the finance industry with access to expert-driven tools and insights that promise to amplify your career trajectory.

Follow us on LinkedIn

Follow us on LinkedIn