There’s no denying that we’re living in the era of Software-as-a-Service (SaaS), especially considering that 70% of apps used by companies today are SaaS-based (and this will likely increase to 85% by 2025). But what does this mean for you as a finance professional?

Well, for one, it has significantly reshaped the landscape of financial management within SaaS companies. Forget about just crunching numbers, you’re now navigating the ins and outs of SaaS finance, which focuses on recurring revenue and the never-ending quest to reduce churn.

Join us as we dive headfirst into the world of SaaS finance, helping you to better understand the industry, how it operates, and strategies to help you succeed in your role.

Learn about:

- How a SaaS business model operates

- The power of recurring revenue

- Types of SaaS finance and pricing models

- Tips and strategies to scale subscription revenue

- Why SaaS companies lose money

What is a SaaS finance business model?

The SaaS model involves accessing software through a subscription online, rather than purchasing and installing it on separate devices.

SaaS business models can be confusing if you’re accustomed to more traditional industry frameworks. There are new metrics to consider, such as:

- Monthly Recurring Revenue (MRR)

- Annual Recurring Revenue (ARR)

- Customer Acquisition Cost (CAC)

- Lifetime Value (LTV)

- Churn rate

These metrics, though different from the typical balance sheet ratios, paint a clear picture of the health of a SaaS business.

Take MRR, for example. It reflects the predictability of your revenue stream, a key factor for investors and stakeholders. Meanwhile, LTV and CAC together indicate how sustainable your growth is. Understanding and keeping an eye on these metrics is a key success factor for any SaaS finance professional.

One of the unique characteristics of SaaS is the subscription model, where cash flow management is paramount. Cash flows in a subscription model differ from those in traditional models due to the nature of recurring payments. Therefore, mastering the art of managing these cash flows and optimizing recurring revenue is vital.

SaaS finance: The power of recurring revenue

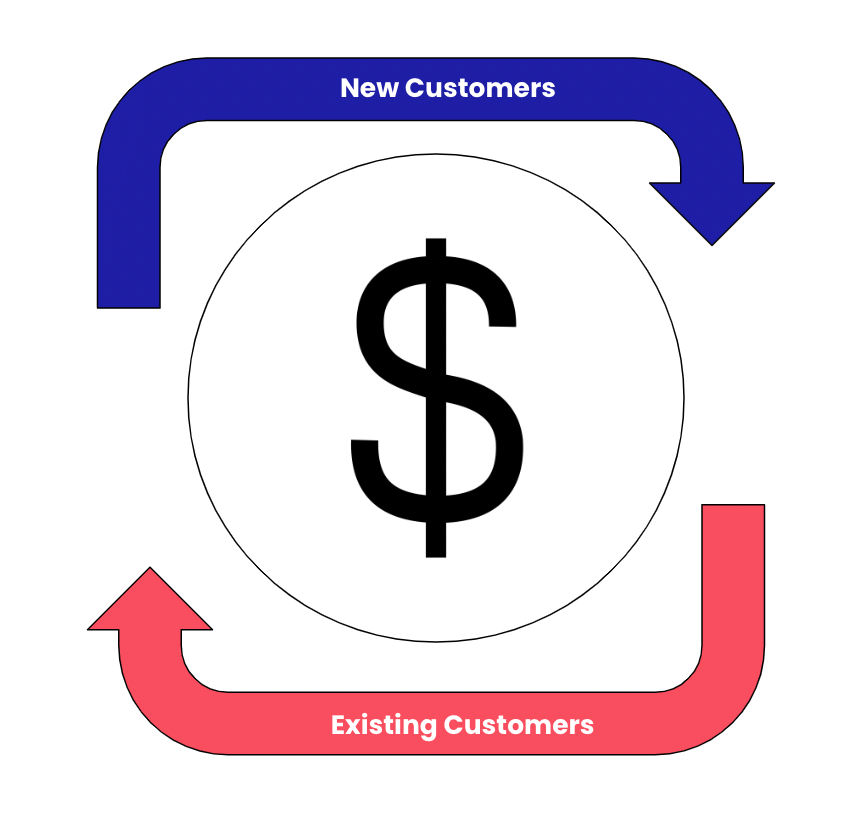

SaaS is different from traditional software because it makes money from repeat customers.

In SaaS, you earn money by offering a service that customers use often, instead of just selling something once. In a way, your customers are "renting" a valuable business service from you, resulting in a steady, predictable cash flow.

But recurring revenue doesn't just involve bringing new customers on board - it's also about keeping the old ones. Hence, you need a balanced focus on acquiring new customers and retaining existing ones.

However, here's the catch with recurring revenue – it's all about timing.

Cash inflow occurs daily, as your service is being utilized. But a common mistake made by these companies is spending money they haven’t earned yet. This can happen when you spend this month’s profits too soon and before the month ends, you’re up against service disputes and an influx of refunds. To avoid this nightmare, keep a tight grip on your cash flow.

Types of SaaS financing & pricing models

Picking the right pricing model for your SaaS business is a critical decision that can make or break your revenue goals. Here are a few SaaS financing and pricing models to consider:

Pay-Per-User: This is the most common SaaS pricing model. It's simple: you charge for each individual user on the platform. It’s akin to selling tickets to a show - the more, the merrier.

Pay-Per-Active-User: A twist on the traditional per-user model. Here, you only charge for users that are actually using the product. It’s a great option if your service is used sporadically by different team members.

Volume Pricing: Also known as tiered pricing, this model offers discounts for larger user volumes. It's like buying in bulk at the supermarket - the more you buy, the less you pay per unit (hopefully).

Per-Storage Pricing: Mostly used by cloud storage services, this model charges customers based on the amount of storage they use. Think of it as renting a storage unit but in the cloud.

Feature-Based Pricing: With this SaaS finance model, you charge based on the features a user wants access to. If they want more features, they have to pay more.

Pay-As-You-Go: Just like it sounds, customers pay for what they use. It’s flexible but can be unpredictable. You may associate this one with mobile phone usage options where you pay for the data you consume.

Flat-Rate: This is a one-size-fits-all model where you offer unlimited access to your service for a set price.

Free, Ad-Supported: This model offers your service for free but generates revenue from ads shown to users. It's like watching network television - the shows are free, but you'll have to sit through some commercials.

11 strategies to scale subscription revenue

To navigate the complex SaaS landscape, there are a few strategies to help you keep profits flowing.👇

1. Create a robust pricing strategy

The 'right price' for a SaaS product isn't just about covering costs and securing a profit. It’s a delicate balance that considers customer value, competitive landscape, and company goals.

As a SaaS CFO, you need to create a pricing plan that earns money and reflects the worth of your service. This involves understanding the value perception of your customers, studying competitors, and frequently reassessing and fine-tuning your pricing.

Remember, the 'right price' isn't static - it evolves with your business and market dynamics.

2. Cultivating customer relationships

SaaS companies thrive on customer loyalty. As a CFO, you have a role in understanding customer behavior and driving initiatives that enhance customer lifetime value (LTV).

3. Revenue recognition

Recognizing subscription revenue isn't as straightforward as it seems. The rules can be tricky, and you'll need to ensure compliance and accuracy in your financial reporting.

While subscriptions provide a steady stream of income, when should you recognize subscription revenue? Is it when payment is received? When the service is delivered? Or should it be spread over the subscription period?

Generally, revenue should be recognized when it's earned and realizable, not necessarily when it's received.

To navigate this, you'll need a comprehensive understanding of financial standards. Training can help your finance team stay up-to-date and regular updates ensure financial reports are accurate and comply with regulations.

4. Cloud cost optimization

Cloud services are vital for SaaS, but without strategic management, costs can spiral. The key to cloud cost optimization is understanding your cloud spending thoroughly.

Talk to your tech team about cloud services, costs, and usage. Use cloud cost management tools to see how much you're spending in real time. Remember, the saved penny today is the growth investment for tomorrow!

5. Growth investment

Speaking of growth investment, this is another critical area where finance SaaS teams can make a significant impact. Balancing the need for growth with the realities of burn rate and cash flow is a vital role that CFOs play in SaaS companies.

A great way to create a smart investment strategy is to focus on one that balances short-term cash needs with long-term growth objectives. This could involve investing in new features, market expansion, marketing, or even mergers and acquisitions.

6. Managing cash flows

In the subscription-based world of SaaS, managing recurring revenue and cash flow is crucial. CFOs need to ensure they have a strong handle on cash flow forecasts and take steps to optimize the timing of cash inflows and outflows.

7. Tailor your Chart of Accounts (CoA)

Your Chart of Accounts is more than just a list of accounts where you record your company's financial transactions. It's a structured representation of your business operations, which can drastically influence your financial analysis and decision-making.

With that in mind, you'll want to tailor your CoA to reflect the unique aspects of SaaS finance economics. Consider elements like deferred revenue, capitalized software costs, and various revenue streams. Remember, a well-crafted CoA is your first step toward clear and actionable financial reports.

8. Staying compliant

Regulations in the tech industry can change rapidly, and non-compliance can lead to significant penalties. As a CFO, it's your responsibility to stay on top of these changes and ensure your company is always compliant. This may involve regular audits, maintaining robust internal controls, and investing in compliance training for your team.

9. Promoting a data-driven culture

SaaS companies are rich in data. CFOs should promote a culture that values this data and uses it to drive decision-making. Invest in analytics tools, train staff in data analysis, and make data accessible and understandable to all relevant team members.

It’s also wise to take time to get to know your data sources. Each source gives you unique insights and understanding these data sources, their interconnections, and their potential for insights is crucial. With this knowledge, you can leverage analytics tools effectively, turning raw data into strategic actions.

10. Master financial SaaS forecasting

In the SaaS industry, forecasting can sometimes feel like trying to predict the weather in a tornado. But despite the inherent unpredictability, there are techniques and tools to make this process more accurate.

Scenario planning, for example, can help manage the inherent risks. By forecasting multiple outcomes based on different assumptions, CFOs can prepare for a range of possibilities and ensure the company is ready to pivot as needed.

11. Leveraging technology

SaaS CFOs have a host of technology tools at their disposal to streamline financial operations. From automated billing systems to sophisticated financial modeling software, these tools can save time, increase accuracy, and provide more insights for better decision-making.

Automation can be a game-changer for financial operations. It can remove manual tasks, reduce errors, and free up time for more strategic initiatives.

Why do SaaS companies lose money?

SaaS companies often lose money, especially in the early stages, due to high customer acquisition costs (CAC) and upfront investments in product development and infrastructure. They are betting on the fact that the lifetime value (LTV) of a customer will eventually exceed these initial costs.

Let’s take a closer look at some of the key reasons why SaaS finances can often get worse before they get better:

High customer acquisition costs

In a competitive market, attracting new users demands substantial investment in marketing and sales efforts. This might include costs associated with advertising, sales team salaries, incentives, and even freemium offerings to entice users.

Upfront product development costs

Creating innovative, user-friendly, and reliable SaaS products requires significant initial expenditure. From hiring skilled engineers to licensing necessary technologies, the expenses can quickly pile up before any revenue streams in.

Infrastructure expenditure

SaaS companies need robust and scalable infrastructure to support their services. The investment in servers, storage, cybersecurity, and compliance measures can lead to substantial outlays.

Recurring revenue model

Unlike traditional sales, the SaaS finance model banks on recurring subscriptions which means revenue trickles in slowly over an extended period. This time lag between investment and return can cause a temporary deficit.

Investment in growth

To keep up with the fast-paced SaaS industry, companies need to continuously innovate and expand their product offerings. Whether it's adding new features or expanding to new markets, these growth strategies necessitate further investment.

Remember, though, that this is a calculated gamble. SaaS firms believe that customers will bring in more money than the cost of acquisition. This makes the business profitable in the long term.

SaaS finance FAQs

How does SaaS make money?

SaaS companies make money primarily through subscription fees charged to users for access to their software. Other revenue streams may include upselling additional features or services, and in some cases, ad revenues or transaction-based fees.

What is the subscription model for SaaS?

The subscription model for SaaS is like a gym membership for software. Users pay a recurring fee, usually monthly or annually, for access to the software. This approach provides businesses with predictable revenue and users with the flexibility to discontinue the service when they no longer need it.

What are some crucial financial strategies for SaaS companies?

Key financial strategies for SaaS companies include implementing a robust pricing strategy, effectively managing revenue recognition, optimizing cloud costs, investing in growth while balancing cash flow, and promoting a data-driven culture.

Join our finance community!

The Finance Alliance community is the ultimate space for finance pros who want to accelerate their careers.

Connect with our fellow finance leaders to network, discuss and share. Join now to be a part of the conversation.

Follow us on LinkedIn

Follow us on LinkedIn