Ever wonder what could actually happen if a company doesn’t follow the rules? Like…what if all that talk about compliance isn't just red tape but something that could land your business in real trouble?

Well, here’s the thing: it’s not just a “what if.” According to research into the state of risk and compliance, nearly one in five of those surveyed said their company faced legal or regulatory action in the last three years. That’s not a small number, and it wasn’t because they forgot to file one form. Not only that, but it was the third most common compliance issue reported.

The truth is that compliance reporting isn’t just about lawyers and legal departments. Finance pros are often right in the middle of it. They pull the numbers, track the spending, and help prove that everything’s above board. If the reports are wrong or missing? That’s when things can spiral.

Compliance reporting isn’t just about checking boxes, it’s about building trust and reducing risk.

Keep reading to learn more about what a compliance report actually is, why it’s more important than most people think, and how finance teams end up doing a lot more than just crunching numbers.

What you'll learn from this guide:

- What a compliance report is

- Benefits of compliance reporting

- Types of compliance reports

- What's included in one

- Compliance in finance

- Compliance tracking and reporting

- How to create a compliance report

- FAQs

What is a compliance report?

A compliance report is a clear, no-fluff document that shows how your company is following the rules. These could include local laws, industry standards, or internal policies, etc.

Compliance reports answer questions like:

- Are we meeting the rules we’re supposed to?

- Where are we slipping up?

- What are we doing to fix it?

A solid compliance report shows what’s working, what’s not, and (this is key) what you’re actually doing about it. They help your team stay accountable, avoid fines, and build trust with regulators, clients, and leadership. Basically, it’s how you prove you’re not cutting corners.

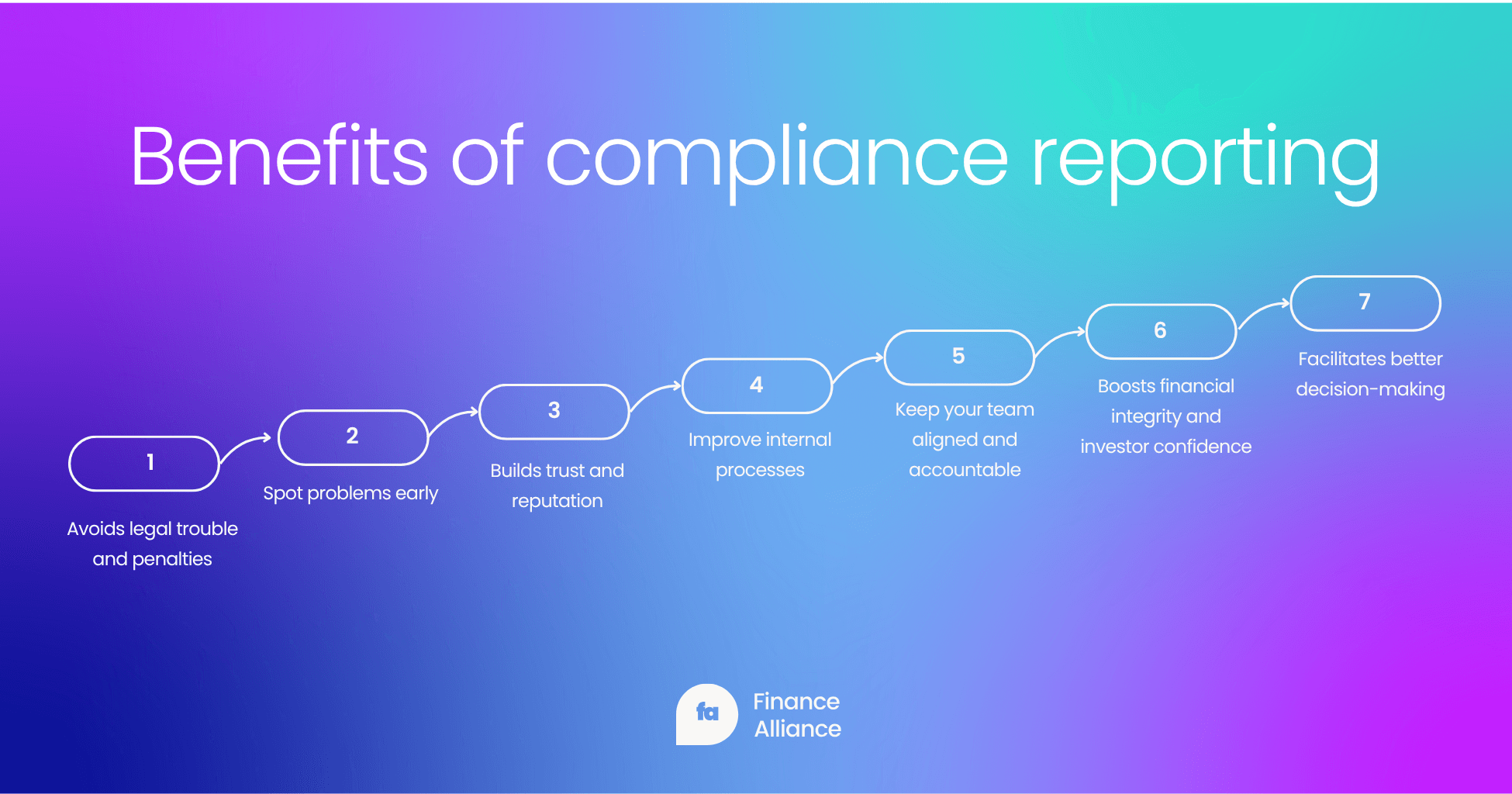

Benefits of compliance reporting

Compliance reporting offers a wide range of benefits for businesses, extending far beyond simply avoiding penalties. Here are the key advantages:

Avoids legal trouble and penalties

This is the most direct benefit. Regular and accurate compliance reports demonstrate adherence to laws, regulations, and industry standards, significantly reducing the risk of fines, lawsuits, and other legal repercussions.

Spot problems early

Compliance reporting forces you to dig into the details, which is a good thing because it helps you catch risks, errors, or shady behavior early. You know, before they turn into costly issues?

Builds trust and reputation

Transparency in compliance efforts fosters trust with all stakeholders – customers, investors, employees, and regulators. A company that consistently demonstrates its commitment to ethical practices and regulatory adherence builds a strong, positive reputation, which can attract more business and investment.

Improve internal processes

Compliance reporting shines a light on what’s working, and what’s not. If you’re constantly flagging the same issue, it might be time to rethink the process behind it.

Keep your team aligned and accountable

When you’re regularly reporting on compliance, people pay attention. Teams know what’s expected, what’s being measured, and what needs fixing.

Boosts financial integrity and investor confidence

Especially for financial compliance, accurate reporting ensures that a company's financial practices align with accepted standards and regulations. This provides investors and auditors with the necessary information to assess financial health, leading to increased confidence.

Facilitates better decision-making

Compliance reports provide valuable insights into an organization's overall health and risk profile. This data empowers leaders to make more informed strategic decisions about resource allocation, future planning, and risk mitigation.

Types of compliance reports

Understanding the different types of compliance reporting helps you stay ahead of deadlines, avoid duplication, and make sure the right data gets to the right people.

Here are five of the most common types of compliance reports you'll come across and finance's role in preparing or contributing to them:

1. Regulatory compliance reports

Regulatory reports are submitted to government agencies or industry bodies to prove you're meeting the legal requirements tied to your business. They vary depending on your industry but often include things like tax filings, AML reports, or disclosures under SOX or GDPR.

2. Financial compliance reports

These reports focus on how well your financial practices align with rules and standards, including both external (like GAAP or IFRS) and internal ones. They’re often reviewed by auditors, execs, or boards to check that your books are clean and your controls are solid.

3. IT compliance reports

Technology touches every part of your business and so do the risks. IT compliance reports show how your systems are protected, how data is secured, and whether you’re meeting cybersecurity standards like SOC 2 or ISO 27001.

4. Operational compliance reports

These reports track whether business processes are running in line with internal rules and external expectations. This might include things like procurement controls, vendor oversight, employee conduct policies, or supply chain compliance.

5. Data privacy compliance reports

Privacy regulations like GDPR, CCPA, and HIPAA have raised the bar on how businesses collect, use, and protect personal data. These reports demonstrate that you’re handling sensitive info (including customer and employee data) properly and transparently.

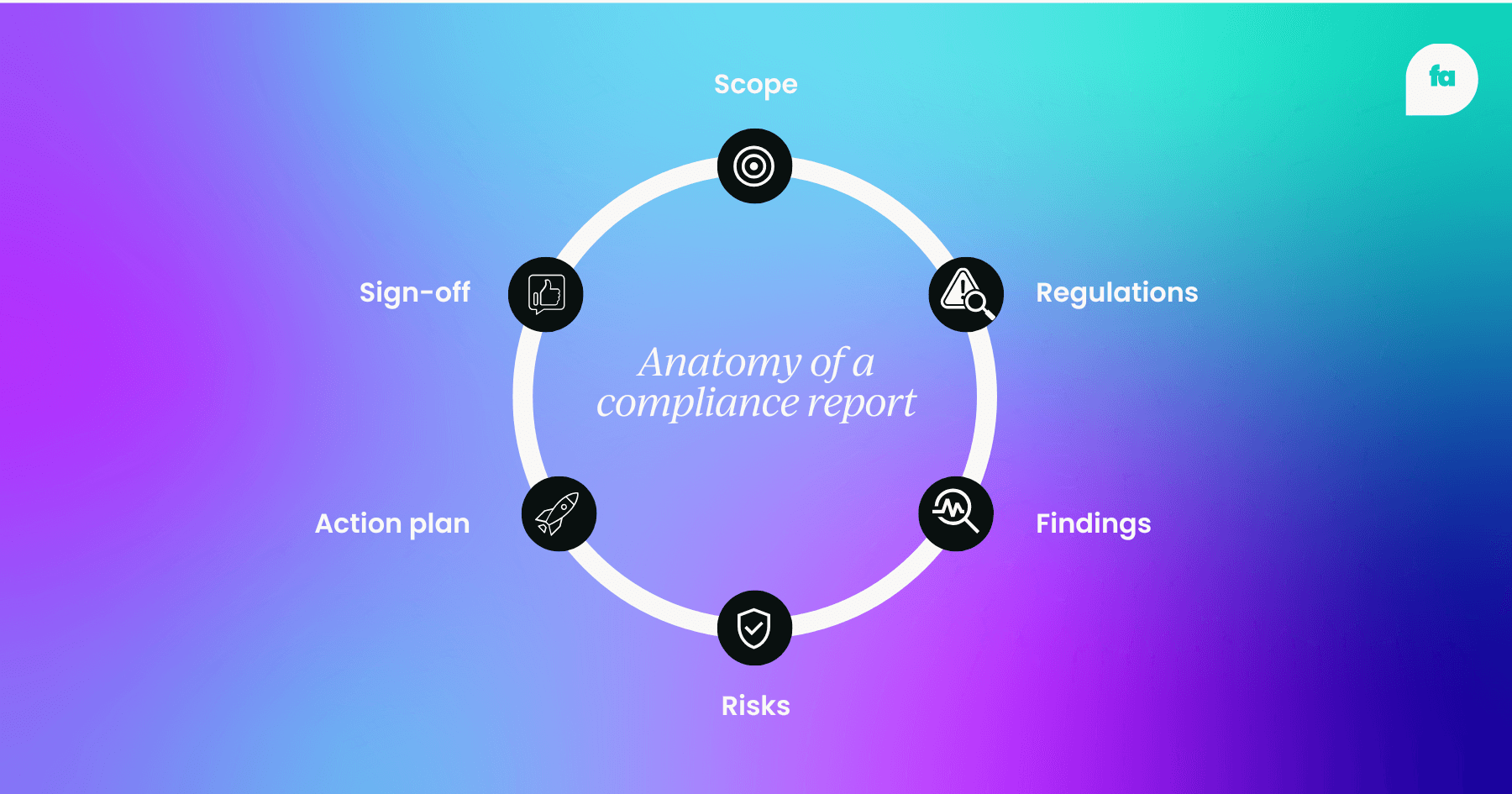

What’s included in a compliance report?

If you work in finance, chances are you’ve touched parts of a compliance report at one time or another. Budgets, audit trails, expense records, financial controls… they all feed into the bigger picture. So, knowing what goes into these reports isn’t just useful, but essential to compliance in finance.

Here’s a simple overview of what’s actually inside compliance reports:

1. Purpose & scope

First, you define what the report covers and what you’re reporting on. Is it about data privacy? Financial reporting? Environmental regulations? This is to help readers know what to expect.

2. Rules you're following

This is where you spell out the specific laws, standards, or policies you’re measuring against like GDPR, HIPAA, SOX, or ISO standards.

3. Findings

Now it’s time to detail your findings, which will show where your organization is compliant and where it’s falling short. Remember, it’s better to spot issues early than pretend they don’t exist.

4. Risks

What’s at stake if those gaps aren’t addressed? This section lays out the potential impact such as legal trouble, financial loss, or damage to your brand, etc.

5. Next steps

Here’s where you show you’ve got a plan. What actions are being taken to fix issues, improve systems, or stay ahead of future risks?

6. Sign-off and approval

The final stage usually includes sign-off from a compliance officer or manager. This gives the report authority and confirms that the right people are paying attention.

Compliance reports don’t need to be complicated. Remember to keep the language clear, avoid jargon and focus on what matters. The goal is to make it easy for anyone (whether it's a regulator or your own team) to understand.

What is compliance in finance?

When it comes to money, the rules get even tighter, and the stakes go way up. In fact, finance and healthcare organizations face the highest risk of cybersecurity attacks. In the past year alone, a striking 58% of financial organizations and 55% of healthcare organizations reported experiencing a data breach through a third party. That’s why compliance in finance isn’t just important... it’s non-negotiable.

So, what is compliance in finance, exactly?

Well, it’s all about making sure financial institutions like banks, investment firms, fintech startups (or anyone handling money) are following the rules. And we’re not talking about light guidelines here. We're talking about strict legal, regulatory, and ethical standards that are meant to protect clients, markets, and the business.

This includes laws like:

- Anti-money laundering (AML) - to stop dirty money from being cleaned through legit businesses.

- Know your customer (KYC) - to make sure you’re not working with shady actors.

- Financial reporting standards - to ensure transparency and accuracy in financial statements.

But you can’t forget internal controls in all this. Things like fraud prevention, risk monitoring, and even keeping insider trading in check. That’s where finance teams step in. You’re the ones making sure the numbers add up, the risks are flagged, and the reports are airtight.

Now here’s where it gets really interesting: a recent study found that 72% of compliance and risk professionals say their third-party due diligence programs help cut down legal, financial, and reputational risks in a big way.

That’s huge because when finance teams are involved in vetting vendors, managing transactions, or flagging suspicious patterns, you’re directly helping protect the company from costly mistakes (and sometimes even lawsuits).

Compliance tracking and reporting

In finance, compliance tracking and reporting is a critical part of managing risk, protecting the firm’s reputation, and keeping regulators off your back. Tracking keeps things in check behind the scenes while reporting proves you’re doing it right. Do both well, and you’re protecting your company from fines, fraud, and nasty surprises.

Here are a few no-nonsense tips to make compliance tracking and reporting a lot smoother:

Know your data inside and out

You can’t keep tabs on what you don’t understand. For that reason, you need to know where your financial data lives, how it’s being used, and who’s getting their hands on it. The better your visibility, the easier it is to spot problems early.

Automate the boring stuff

If you’re doing things manually, you could risk human error feeding into the process. So, consider using tools that can automate compliance alerts, track policy updates, and log activities in real time. Finance software with built-in compliance features can be a huge help and free up some time that you can use on other things.

Create a reporting rhythm

Don't wait until someone's breathing down your neck for a compliance report to start scrambling. Set up a regular schedule such as monthly, quarterly, or whatever works best for you. That way, nothing gets forgotten, and you'll always be prepared.

Make your reports readable

It’s better to keep things as simple as possible and skip the jargon. Whether your audience is a regulator, an exec, or your own team, your compliance reports should be clear, visual, and easy to understand. To help with this, you could try using summaries, charts, and real language to get your message across.

Keep a risk-first mindset

Compliance is about avoiding risk. Always be asking, “What’s the risk if we don’t catch this?” That kind of thinking will help you focus on what truly matters.

Compliance tracking and reporting go hand-in-hand. One without the other is like having receipts you never check. But when they work together, finance teams can prevent big problems, which every company needs.

How to create a compliance report

So how do you actually create a compliance report without losing your mind (or your weekend)?

Compliance reporting requires a clear process, clean data, and structure. With the right steps (and mindset), building a solid compliance report becomes just another part of doing business the right way.

Here’s how to get started:

1. Know what (and who) you’re reporting to

Start with the basics. Before you pull a single number, get clear on a few things:

- What are you required to report?

- Who needs the report? (Regulators? Internal auditors? The board?)

- What format does it need to be in?

Don’t wing this. Depending on your industry, you might be dealing with financial reporting rules, tax laws, ESG disclosures, or all of the above. A quick checklist can save you from scrambling later.

2. Pull the right data

Next, grab the data you need. Clean, accurate data is the backbone of all good compliance reports.

Focus on pulling:

- Financial statements

- Transaction and payment data

- Risk metrics

- Any metrics specific to the regulations you're tracking

3. Check for accuracy and consistency

Before you hit “submit,” review your numbers. Actually, double-check everything.

Ask yourself:

- Do these numbers match across reports?

- Do they reconcile with the general ledger?

- Would someone outside the team understand what they’re reading?

This is especially important now because 70% of risk and compliance professionals say their companies are moving away from checkbox compliance and toward more strategic, thoughtful practices. That shift means regulators are paying closer attention to the details.

4. Use templates and automation where you can

There’s no need to start from scratch every time. Use templates that match regulatory requirements. Better yet, use compliance software that automates parts of the process like data pulls, calculations, formatting, and even reminders.

5. Build a rock-solid audit trail

Good compliance reporting isn’t just about what’s in the report, you also need to focus on how you got there.

Keep clear records of:

- Where the data came from

- Who reviewed it

- When changes were made

- Why decisions were made

6. Submit on time and store everything

Sounds obvious, but it’s worth repeating: follow the format, meet the deadline, and submit to the right place. Then, back everything up in a secure and searchable system.

This isn’t just about avoiding chaos later. It’s also about building trust.

Right now, 60% of executives say they’re investing more time and resources into compliance, but only 31% of consumers believe companies are doing enough. That gap shows one thing: if you’re doing the work, you need to show it clearly. Transparency is everything.

FAQs

Q. What is the meaning of a compliance report?

A. A compliance report is a document that shows how a company is following rules, laws, or internal policies. It highlights where things are working and where they need fixing.

Q. What is an example of compliance reporting?

A. Filing a report to show your company meets anti-money laundering (AML) regulations or submitting quarterly financial controls under SOX are both examples of compliance reporting.

Q. Who are the recipients of compliance reports?

A. The recepients of compliance reports tend to be regulators, auditors, board members, executives, and sometimes clients or investors. Basically, anyone who needs proof that your company is staying compliant.

Q. What are some challenges in compliance reporting?

A. Common issues related to compliance reporting include missing or messy data, manual processes, tight deadlines, lack of clarity on regulations, and poor internal communication.

Q. What is financial reporting compliance?

A. It means making sure your financial statements follow rules like GAAP or IFRS, and that your reporting practices meet legal and regulatory standards.

Ready to take your compliance game even further?

If this guide helped clear the fog around compliance reporting, you’ll love what we share with our Insider Members.

Join our FREE membership to unlock exclusive articles, on-demand videos from top finance events, expert insights, and real-world strategies from finance pros who’ve been there, done that.

Follow us on LinkedIn

Follow us on LinkedIn