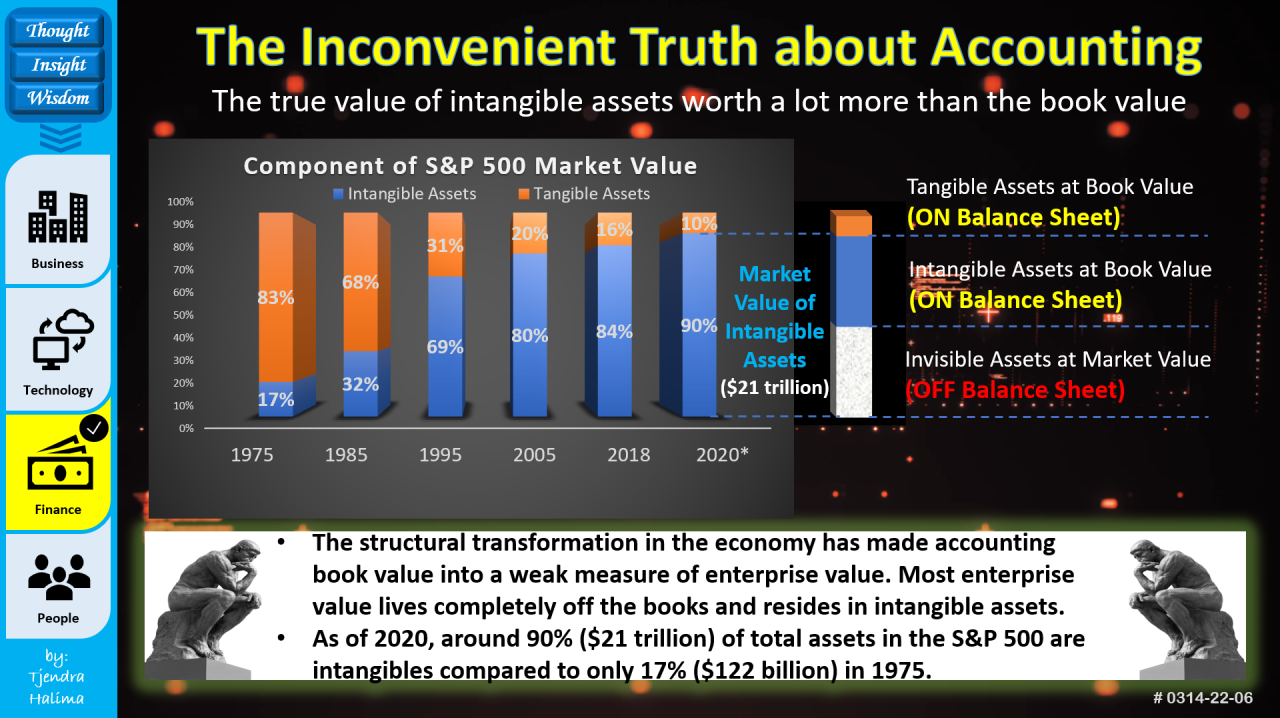

At least for once, your accountants didn’t tell the truth. The real value of intangible assets is worth a lot more than the book value as some intangible assets are invisible and off the balance sheet.

The structural transformation in the economy has made accounting book value a weak measure of enterprise value. The new economy is knowledge-based and technology-driven. Hence, most enterprise value lives completely off the book and resides in intangible assets.

Facts and figures

As of 2020, around 90% of total assets in the S&P 500 are intangibles compared to only 17% in 1975.

In dollar terms, it's risen from $122 billion in 1975 to over $21 trillion in 2018. In other words, only 10% of the value can be measured in financial statements, which means that book value represents only a fraction of the overall value for the S&P 500 companies.

The driving forces

Not only is this a historical high in terms of percentage (90%) and value ($21 trillion,) but it's also a nod to just how dominant technology has become in our lives.

Technological innovations have dramatically affected where companies acquire capital, what they invest that capital in, and how the value they create is measured. The influence of tech and thus intangible assets will continue to be prevalent with the innovation and widespread adoption of digital technology in everything we do.

Over the last 40 years, businesses have been transformed from industrial manufacturing foundations to knowledge-based, idea-based, and technology-driven foundations.

We are entering an era of “capitalism without capital”. The world economy had pivoted from industrial economy to knowledge economy and digital economy – a shift from predominantly tangible capital to intangible capital.

Economy development

Here is a brief description of the evolution of economic development. We will discuss starting from the industrial economy despite there being an agrarian economy at the early stage of economic development.

- Industrial economy: The economic activities that combine the factors of production (materials, labor, capital, and enterprise) to produce goods and services intended for the market.

- Financial economy: This one puts more focus on financial transactions and assets, capital structure (debt and equity) management, cost of capital optimization, liquidity and cash flow management, financial engineering, merger, and acquisition, etc.

- Knowledge economy: This is the economy where the production of goods and services is based on knowledge-intensive activities provided by the highly skilled workforce.

- Digital economy: The economy that relies heavily on Information and Communication Technology (ICT). It transforms the conventional notions of how businesses are structured, how consumers obtain their information, products, and services, how the future of works evolves, etc.

Accounting evolution

Accounting started more than five centuries ago (the year 1494) when Luca Pacioli, the father of accounting, introduced double entry accounting with basic financial statements.

In the industrial economy era, accounting had served well the needs of businesses as most of their capital are tangible assets, such as inventory, property, plant, machinery, equipment, etc.

In the financial economy era, there's always a debate about whether accounting is part of the problems that created the financial weapon of mass destruction, which brought down the world economy into a severe global financial crisis.

Fast forward, we are now in the era of “capitalism without capital”. The world economy had pivoted from an industrial economy to a knowledge economy and digital economy. The economy is pivoting from one where value was measured by “touch” – tangible assets – to one where value is driven by “thought” – intangible assets.

This shift is one of the most under-exploited themes in contemporary finance and accounting. In the knowledge economy, people are the most valuable assets for the company; and in the digital economy, data are the most valuable assets for the company. However, it is a sad truth that people and data do not have a place and value in the balance sheet.

Deficiency in the balance sheet

Though Intangible Assets represent most of the value in the new economy, they are virtually invisible on the balance sheet. We typically won't find a company's intangible assets listed on its balance sheet, but the value of these assets is important for understanding the true value of a company.

Businesses can create or acquire intangible assets. Intangible assets created by a company do not appear on the balance sheet and have no recorded book value. On the other hand, intangible assets acquired by a company will appear on the balance sheet.

Under Generally Accepted Accounting Principles (GAAP,) internally created intangibles are not recognized as assets. Intangible asset values only affect the financial statements if there are strategic events, such as mergers, acquisitions, or divestitures.

As intangible assets created by a company do not appear on the balance sheet, often when a company is purchased, the purchase price is above the book value of assets on the balance sheet. Hence, the purchasing company records the premium paid as an intangible asset on its balance sheet.

Intangible assets are often difficult to value due to rigid accounting standards and at times must be estimated based on transactions or the difference between company book value and market value. The balance sheet has become the scrapyard or dumping ground to dump any differences in accounting to balance the book.

In short, book value doesn’t accurately account for intangible assets of value within a company. Traditional accounting methods haven’t evolved to measure the value of intangible assets as effectively as tangible assets.

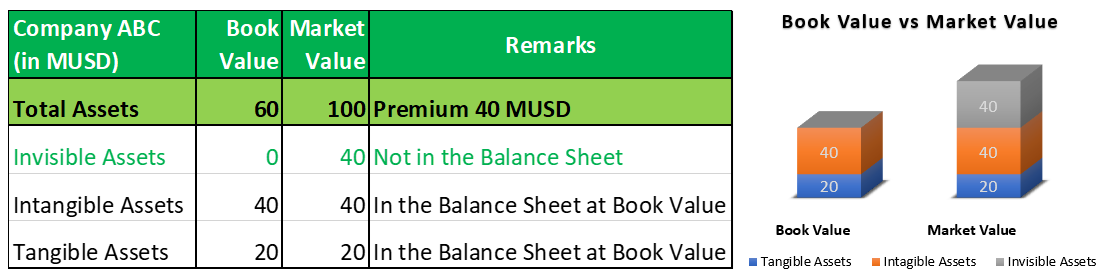

To have a better grip on the concept, here is a simple illustration.

Simple illustration

Restaurant ABC has total assets of $60M, of which tangible assets ($20M) and intangible assets ($40M). The $40M intangible asset was the patent paid for the secret recipe.

Restaurant ABC is very famous and has attracted investors for acquisition due to its top-notch professional management, loyal and well-trained operation team, the unique skillset of the chef, the authenticity of the food menu, the strategic and convenient location, and the loyal customer base.

Investors valued the restaurant at $100M and were willing to pay a $40M premium for the book value of only $60M. Despite Restaurant ABC having a market valuation of $100M, the $40M invisible intangible asset will not be recorded in the balance sheet of ABC unless it is acquired by other companies.

Assuming XYZ paid $100M to acquire ABC, the invisible intangible asset ($40M) will now become a visible intangible asset in XYZ balance sheet. Put simply, XYZ will record intangible assets ($40M + $40M) and tangible assets ($20M) for the $100M paid.

As illustrated above, the market value of intangible assets internally created by ABC does not appear on its own balance sheet. However, it will appear on the balance sheet of XYZ after the acquisition to record the difference between the price paid ($100M) and the book value ($60M) as goodwill in the balance sheet of XYZ.

You can refer to IAS 38 (Intangible Assets) if you are interested to understand further the technical accounting detail on intangible assets.

Key takeaways

We are in the era of “capitalism without capital.” The world economy had pivoted from industrial economy to knowledge economy and digital economy – a shift from predominantly tangible capital to intangible capital.

Businesses have transformed from industrial manufacturing foundations to knowledge-based, idea-based, and technology-driven foundations. It is a shift from one where value was measured by “touch” – tangible assets – to one where value is driven by “thought” – intangible assets.

This structural business transformation is one of the most under-exploited themes in contemporary finance and accounting. Under Generally Accepted Accounting Principles (GAAP,) internally created intangibles are not recognized as assets. Intangible asset values only affect the financial statements if there are strategic events, such as mergers, acquisitions, or divestitures.

Searching for more resources and advice?

Sign up to our free Finance Alliance Slack community and start networking with other CFOs and finance leaders today!

Follow us on LinkedIn

Follow us on LinkedIn