Over the past decade, we’ve watched artificial intelligence seep into every corner of our professional lives. But something feels different now. The buzz isn’t just about potential anymore, it’s about impact.

When ChatGPT reached 100 million users in just two months, it was a wake-up call that we’re in a new era of productivity and innovation. At the intersection of finance and technology, a transformation is underway, and financial planning and analysis (FP&A) professionals are uniquely positioned to lead it.

I want to share what I’ve learned about how we can leverage AI in financial forecasting, so in this article, I’ll cover:

- Understanding AI and it’s role in FP&A

- How AI is impacting FP&A

- AI algorithms to use

- Practical AI: From data to forecast

- Explainable AI (moving away from 'black box' AI)

- AI tools for forecasting

- How to prepare for AI and ML in FP&A

Understanding the role of AI in FP&A

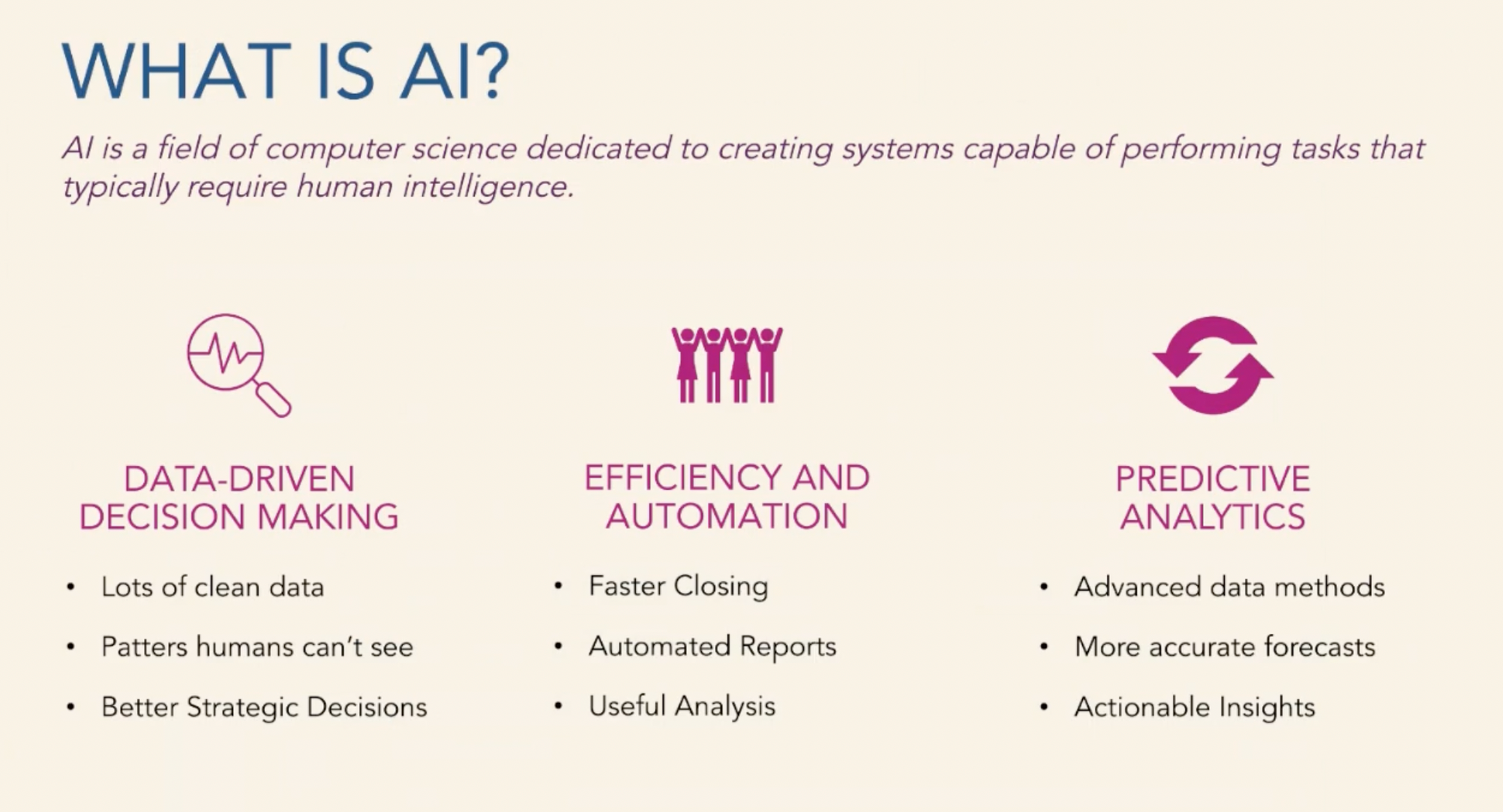

Let’s take a step back. What exactly is artificial intelligence?

At its core, AI is the science of creating machines that can perform tasks that normally require human intelligence. In finance, AI is used in three main ways:

- Data-driven decision making

- Automation and efficiency

- Predictive analytics

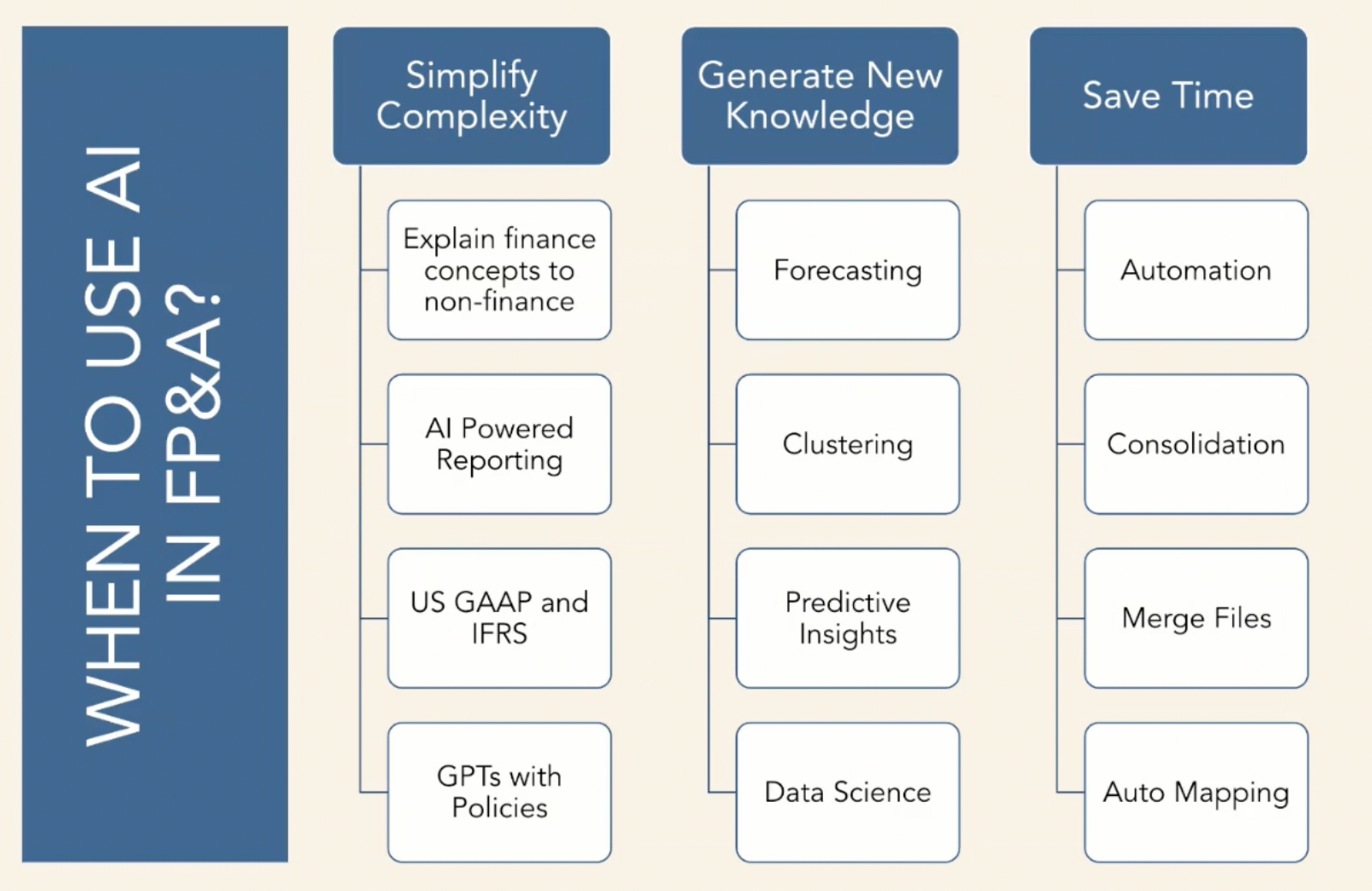

In FP&A specifically, AI offers a wide range of opportunities. I like to categorize its use into three pillars:

- Simplifying complexity

- Generating new knowledge

- Saving time

Let’s unpack these a bit more.

1. Simplifying complexity

AI tools like ChatGPT, Microsoft Copilot, and Google Bard/Gemini have made it easier than ever to demystify financial concepts. Imagine asking a chatbot to explain IFRS 10 to your marketing manager, and getting an answer that makes sense.

AI-powered reporting is another major benefit. It consolidates your financials and provides real-time reporting capabilities. You can even build your customized version of GPT, embedded with your company’s internal policies so that it becomes an expert in your context.

2. Generating new knowledge

This is where financial forecasting comes into play.

AI allows us to go beyond basic reporting into predictive and prescriptive analytics. It not only tells us what might happen (predictive) but also what we should do about it (prescriptive).

AI can help identify patterns, uncover hidden trends, and generate insights. Beyond forecasting, AI can be used for clustering, predictive insights, and scenario planning.

Follow us on LinkedIn

Follow us on LinkedIn