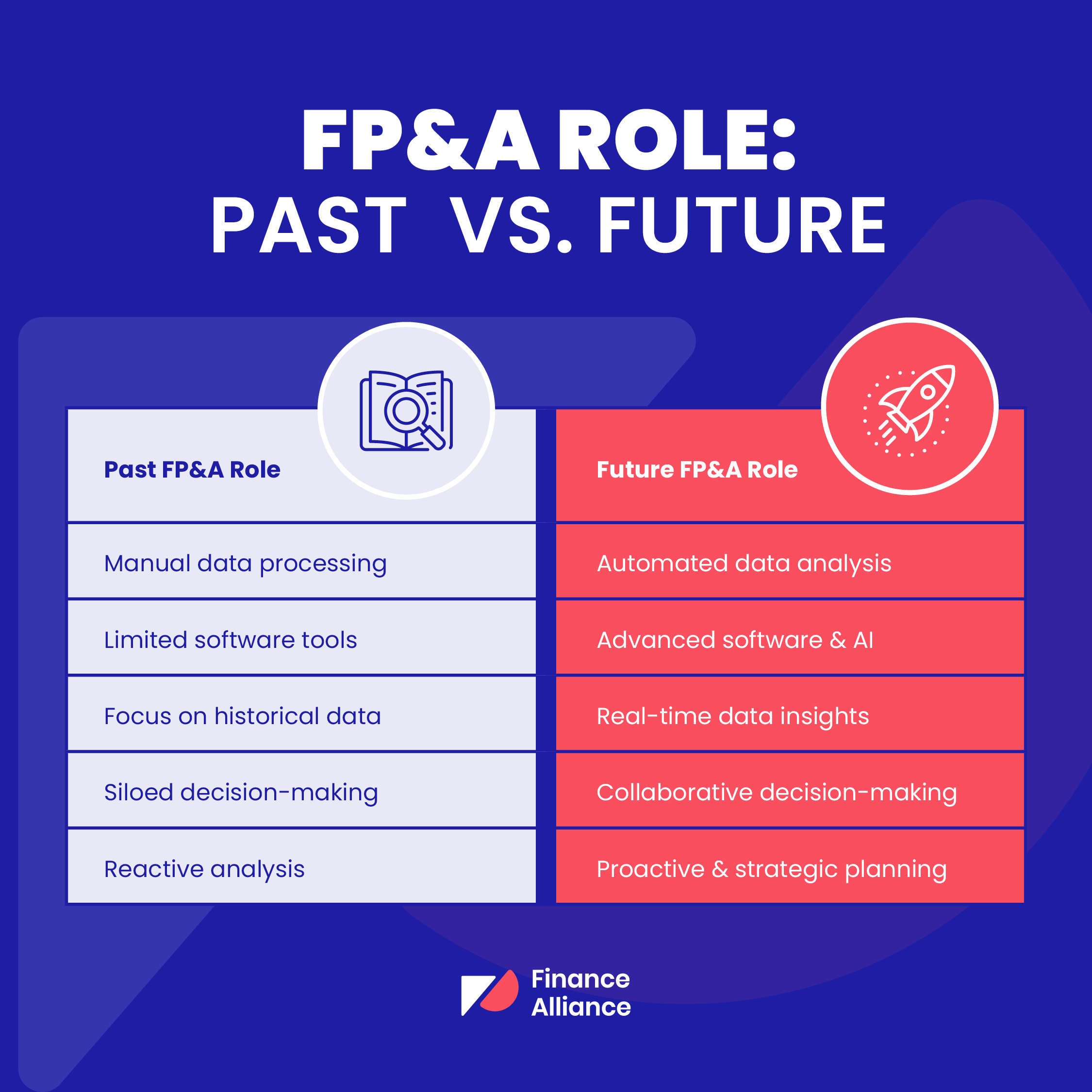

The role of FP&A is transforming before our very eyes, and it's high time we explored why.

In this post, we're diving into the FP&A journey, analyzing its dynamic evolution, and mapping the road ahead.

Here's what's on the agenda:

- The FP&A role of the past

- The future of the FP&A role

- Three key building blocks for the future of FP&A

The FP&A role of the past

Manual data processing

Think back to when FP&A professionals were knee-deep in manual data processing. Remember those never-ending hours of data collection and processing? Even the most diligent among us couldn't entirely avoid the odd mistake making its way into our reports.

According to Datarails research, 96,000 hours were wasted on manual FP&A tasks (based on a conservative estimate of two hours per week of manual work by those surveyed). Manual data processing is a painstaking process, to say the least, and made it challenging to provide timely and accurate data when needed.

Limited software tools

Not too long ago, FP&A teams had to work with a limited selection of software tools. Admittedly, we still have a soft spot for old-fashioned spreadsheets, but those tools often fell short when it came to some of the advanced capabilities seen in today's software.

Hindered by these limitations, FP&A professionals grappled with mountains of manual tasks and struggled to deliver crucial insights for strategic planning.

Focus on historical data

FP&A roles were once all about diving deep into historical data to make sense of past performance and spot trends. While the info was useful, it didn't necessarily give us a crystal-clear view of what lay ahead.

By fixating on past data, we found ourselves somewhat blindsided by changes in the business landscape or industry trends.

Siloed decision-making

FP&A professionals often worked solo, with minimal interaction across departments. This "lone wolf" approach led to limited shared understanding, making it tricky for teams to coordinate and work towards common goals.

As a result, decision-making took its sweet time, causing organizations to miss out on opportunities for growth and expansion.

Reactive analysis

FP&A roles used to be more reactive, diving into data and providing insights after the fact. This approach made companies sluggish in adapting and hampered their ability to pounce on opportunities or mitigate risks swiftly.

With a focus on reactive analysis, FP&A teams faced an uphill battle in helping companies maintain a proactive stance.

The future of the FP&A role

Automated data analysis

PWC carried out an FP&A survey and found that 60% of FP&A data requires manual data manipulation while upwards of 80% of FP&A tasks are somewhat or significantly done in offline databases and spreadsheets.

Thankfully, this is set to change very soon because, in the not-too-distant future, FP&A teams will tap into the power of automation to supercharge data analysis.

Thanks to automating data collection and processing, FP&A professionals can focus on what they do best: delivering top-notch insights and strategic recommendations. This exciting automation revolution promises to boost efficiency and take the quality of analysis to new heights.

Advanced software and AI

Get ready for cutting-edge software solutions and artificial intelligence (AI) to take center stage in the FP&A world. These trailblazing technologies will arm FP&A teams with formidable tools to analyze massive datasets, identify patterns, and generate predictive insights.

We're already seeing more FP&A teams embracing AI such as learning to use ChatGPT for Excel and implementing Microsoft's Copilot in Excel. As FP&A pros continue to harness the power of advanced software and AI, they'll unlock unparalleled levels of accuracy and detail in their analysis. The result? Organizations make data-driven decisions with newfound confidence.

Real-time data insights

Soon, FP&A teams will be embracing real-time data insights, paving the way for faster and better-informed decision-making. With access to up-to-the-minute information, FP&A professionals can keep a watchful eye on performance and tweak forecasts as needed (rolling forecasts).

Real-time data insights will enable FP&A teams to be nimbler and more proactive, ultimately fueling strategic growth and boosting their competitive edge.

Collaborative decision-making

The future of the FP&A role will have collaboration and cross-functional teamwork at its core. By breaking down the silos that once stifled knowledge-sharing and insights, FP&A teams can better align strategies and ensure stakeholders have the intel they need for informed decision-making.

This teamwork-driven approach will foster a more unified and agile organization, one that's well-prepared to conquer challenges and grab opportunities with both hands.

Proactive and strategic planning

FP&A's future is all about transitioning from reactive to proactive and strategic planning. By wielding advanced tools, automation, and real-time data insights, FP&A teams can:

- Anticipate changes in the business landscape

- Pinpoint opportunities

- Craft contingency plans

This forward-thinking mentality will empower organizations to make strategic decisions and stay ahead of the curve in an ever-competitive market.

3 key building blocks shaping the future of FP&A

Here are three critical elements molding the future of FP&A:

1. Digital transformation: FP&A's brave new world

The business landscape is being revolutionized by digital transformation, and FP&A is riding that wave. As organizations welcome digital transformation with open arms, FP&A teams need to stay on their toes, adapting to novel technologies and processes to remain relevant and valuable.

The influence of finance digital transformation on FP&A encompasses the integration of cutting-edge software, AI, automation, and real-time data analysis. By embracing digital transformation, FP&A pros can boost efficiency, sharpen accuracy, and provide more strategic insights for better decision-making.

2. Unleashing the power of data: FP&A's growth accelerator

Data is the beating heart of contemporary organizations, and mastering its power is key for FP&A's future. To wield data, FP&A teams must excel at gathering, managing, and analyzing vast volumes of information from diverse sources.

This demands the cultivation of new skill sets, such as data visualization, data mining, and statistical analysis. By honing these skills and deploying the right tools, FP&A can transform raw data into actionable insights that inform strategic decisions and propel business growth.

3. Analytics: The secret sauce for informed decisions

Analytics will take center stage in the future of FP&A, empowering teams to extract meaningful insights from intricate data and guide better decision-making. Advanced analytics techniques, like predictive analytics, machine learning, and artificial intelligence, enable FP&A teams to spot trends, reveal hidden patterns, and forecast future performance.

By harnessing these formidable analytics tools, FP&A professionals can offer organizations a deeper comprehension of their financial performance, pinpoint opportunities and risks, and deliver data-driven recommendations to back strategic initiatives.

Liked this article? Why not download it in eBook format, so you'll always have these insights at your fingertips? 👇

FAQs: Future of FP&A

How has the FP&A role evolved from its past to the future?

In the past, FP&A roles focused on manual data processing, limited software tools, historical data analysis, siloed decision-making, and reactive analysis. The future FP&A role involves automated data analysis, advanced software & AI, real-time data insights, collaborative decision-making, and proactive & strategic planning.

How will automation benefit the future FP&A role?

Automation will streamline data analysis, reduce time spent on manual tasks, and minimize the risk of errors. This will allow FP&A professionals to focus on delivering valuable insights and strategic recommendations, ultimately improving efficiency and the quality of analysis..

What are the different FP&A roles?

Different FP&A roles include FP&A analysts, who focus on data analysis and forecasting; FP&A managers, who oversee the FP&A team and coordinate with other departments; and FP&A directors, who develop strategic financial plans, manage budgeting processes, and ensure alignment with overall business objectives.

What are the areas within FP&A?

Key areas within FP&A include budgeting and forecasting, financial modeling, performance management, strategic planning, and risk assessment. These areas contribute to the overall goal of informing and driving data-driven business decisions, optimizing financial performance, and achieving long-term growth.

Ready to level up your FP&A game? Don't miss the FP&A Summit!

Join us at the FP&A Summit and propel your FP&A function into the future.

🗓 Mark your calendar: June 15, 2023

📍 It's virtual, so you can attend from anywhere!

Why should you attend?

🎓 Earn those valuable CPE/CPD credits.

🧠 Discover the latest industry trends and emerging technologies to give you that competitive edge.

📱 Collaborate, exchange ideas, and connect with 500+ fellow finance professionals just like you.