Ever struggled to explain an investment's true value to a client or stakeholder?

It can be hard to communicate the impact of potential or even existing investments without a clear understanding of Multiple on Invested Capital (MOIC). This important metric cuts through the jargon and reveals the true return on investment.

MOIC serves as a crucial indicator of investment success, offering a solid foundation for making well-informed financial decisions.

In this article, we’re zeroing in on MOIC to uncover what it is, its role in private equity, and more importantly, how you can use it to sharpen your investment evaluation skills.

Key takeaways 👇

- MOIC measures how many times your investment has paid off, making it a clear and simple way to see an investment's success.

- It doesn’t consider how long it takes to see returns, unlike metrics like IRR, so it’s best used alongside other measures.

- A high MOIC signals a profitable investment, often influencing further funding and investment decisions.

What is MOIC?

MOIC stands for "Multiple on Invested Capital” – a financial metric used to evaluate the value of an investment relative to the initial capital invested.

- It’s worth noting that the term MOIC is often interchangeable with terms like cash-on-cash return and multiple on money (MoM).

If we were to define MOIC in simple terms, we’d sum it up as a ratio to help determine the potential return on investment. It does this by calculating how many times the initial investment (cost) will be returned. Both profits and losses are included.

MOIC is calculated by dividing the total value (current or projected) of an investment by the initial capital invested.

For example, if an investor puts $100,000 into a project and expects to receive $300,000 in returns, the MOIC would be 3.0 (300,000 / 100,000).

What is MOIC in private equity?

MOIC is widely used in private equity, venture capital, and other investment sectors to evaluate and compare different investment opportunities. It provides a straightforward way to assess the potential profitability and efficiency of an investment relative to the capital required.

This makes MOIC private equity a simple yet powerful way to see if an investment is worth it.

But what exactly does MOIC tell you about private equity?

There are three key insights:

1. Performance: A high MOIC proves the fund is generating strong returns for its investors.

2. Comparison: It allows you to compare the performance of different investments or funds.

3. Potential: By analyzing the MOIC of past investments made by a fund, you can get a sense of their potential for future deals.

What is the average MOIC in private equity?

There isn't a single, universally accepted "average" MOIC for private equity. However, some sources report that a MOIC of 2.0x or higher is generally a “good benchmark for investment performance in private equity.”

Of course, it’s still difficult to land on a concrete number. For one thing, the year an investment is made (vintage year) significantly impacts the MOIC. A fund launched during a booming economic period might have a higher average MOIC compared to one launched during a recession.

Not only that, but different private equity funds have different investment strategies (e.g., growth capital, buyouts). These strategies can lead to different average MOICs.

Risk profiles also vary. Higher-risk investments typically have the potential for a higher MOIC, but also come with a greater chance of failure.

MOIC formula and calculation

How to calculate MOIC

Calculating MOIC is quite straightforward. You simply divide the total value you get back from your investment by the original amount you put in.

The MOIC calculation gives you a clear number showing how many times your investment has paid off.

Here's the MOIC formula:

Here's a breakdown of the terms:

Total value of investment: This includes all the cash received from the investment, such as dividends, profits, and the eventual sale proceeds. It also considers the unrealized gains, which is the potential future value of the investment if it were sold today.

Total invested capital: This is the total amount of money initially invested in the deal.

Examples of calculating MOIC with the formula

Let's put the calculating MOIC formula into practice with a couple of scenarios:

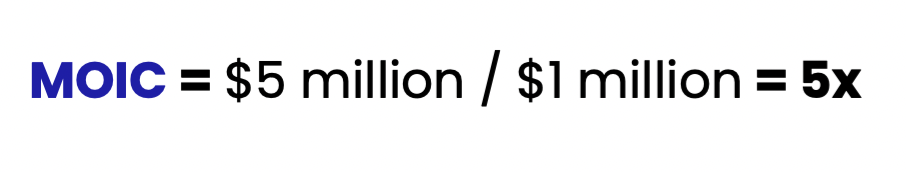

Scenario 1: You invest $1 million in a startup.

After a few years, the company is acquired for $5 million, and you receive your share of the proceeds.

In this case, your total value of investment would be $5 million (acquisition proceeds).

Since you initially invested $1 million, the MOIC would be:

The MOIC calculation indicates a very successful investment, generating a fivefold return on your initial capital.

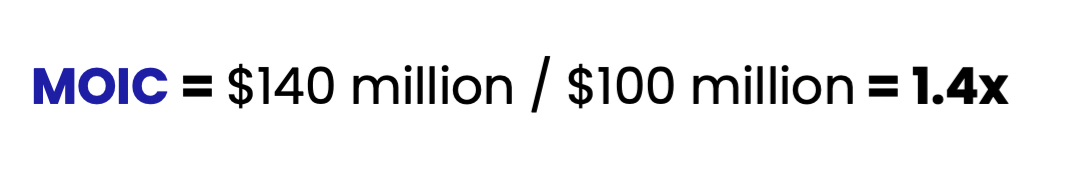

Scenario 2: A private equity fund invests $100 million in a company.

Over a five-year holding period, the fund receives $20 million in dividends and ultimately sells the company for $120 million.

Here, the total value of investment would be $20 million (dividends) + $120 million (sale proceeds) = $140 million.

So, the MOIC formula would be:

It’s a more modest return, but it's important to consider factors like the holding period and the overall investment strategy of the fund.

Unrealized vs. realized MOIC

When discussing MOIC, it's important to distinguish between unrealized and realized MOIC.

Unrealized MOIC

This is like a progress report. It uses the current value of your investment (think market price for a stock or an expert's guess for a company) to estimate how much you might get back if you cashed out today.

It's a good way to track how your investment is doing over time, but it's not guaranteed - the value could go up or down before you sell.

Realized MOIC

Realized MOIC is calculated only after you've completely sold your investment and received all the money. This is the true picture of how much money you made (or lost) on the investment.

The key difference is that unrealized MOIC is a forecast or estimate, while realized MOIC is the definitive, actual return on investment.

What's the difference between MOIC and IRR?

The key difference between MOIC and IRR (Internal Rate of Return) lies in how they measure and express investment returns.

They’re both important metrics to assess the performance of an investment, but they approach it differently.

MOIC focuses purely on the total return, telling you how much the investment has grown compared to what you initially put in.

IRR, on the other hand, measures the annualized rate of return on an investment. It considers the timing of cash flows, providing a more comprehensive view of an investment's performance over time.

What factors impact MOIC?

MOIC can be a bit of a moving target. There are a few things that can swing the number up or down. Knowing these factors helps you understand what the MOIC means for an investment's success.

Here’s a breakdown of factors that can impact MOIC:

- How the investment does: Strong investments with big returns naturally lead to a higher MOIC. The opposite is true for losses.

- The time you're invested: MOIC doesn't consider how long you hold an investment, but faster wins can be more attractive even if the MOIC is the same as a long-term play.

- Fees and costs: Just like any purchase, fees and expenses take a bite out of your return, lowering the MOIC.

- How you cash out: Selling at the right time or through a good deal can boost your return (and MOIC). The opposite can hurt it.

- The overall market: Big economic swings, changes in what people buy, and industry trends can all affect how much you make on your investment, impacting MOIC.

By understanding these factors, you can get a better sense of what an MOIC really means and make smarter investment choices.

What are the disadvantages of MOIC?

Yes, MOIC is an incredibly valuable metric, especially for finance teams. But it has some limitations to consider…

- Doesn't account for the time value of money

MOIC compares the total return to the initial investment. It doesn't consider when the cash flows occur.

An investment that delivers a large return all at once might have the same MOIC as one that provides smaller returns spread out over time. However, the first option is generally considered more favorable due to the time value of money.

- Limited view of risk

MOIC doesn't tell you anything about the risk involved in an investment. A high MOIC could be the result of a very risky investment that just happened to pay off.

- Sensitive to exit strategy

The final value of an investment, and therefore its MOIC, can be significantly impacted by how you exit the investment.

A well-timed sale can maximize returns, while a forced sale might result in lower returns and a lower MOIC. MOIC doesn't account for the skill of the investor in achieving the exit strategy.

- Focuses on overall return, not performance

While MOIC tells you how much you made in total, it doesn't provide details about the investment's performance over time. This can be a drawback for investors who want to understand the investment's consistency and stability.

How MOIC influences decision-making

MOIC plays a significant role in shaping investment decisions, particularly in private equity. Here's how it can influence decision-making and help companies make smarter business choices:

1. Choosing investments

MOIC is often used as a screening metric when evaluating potential investment opportunities. Investors often set a minimum MOIC they expect. Deals with a lower projected MOIC might get passed over in favor of those with a higher potential return.

2. Risk assessment

MOIC provides insight into the risk-return profile of an investment. A high MOIC could mean a high potential return, but also potentially higher risk. Investors use MOIC with other tools to see if the expected return is worth the risk.

3. Performance evaluation

MOIC is a simple way to measure how well an investment is doing. It tells you how many times you've gotten your money back. This helps investors decide whether to hold, sell, or invest more in something based on its performance.

4. Attracting investors

For companies and fund managers, showcasing investments with high MOIC can be a powerful tool in fundraising efforts and maintaining positive investor relations. A strong track record of achieving high MOICs shows they’re good at managing money, which attracts more investors and funding.

5. Resource allocation

Investments with a higher MOIC might get more resources because they're seen as a better use of the money. This can also help CFOs when it comes to allocating the budget across departments.

6. Exit strategy

If an investment hits or surpasses its MOIC target, investors might be more likely to cash out and take the profits.

7. Portfolio construction

Fund managers use MOIC to balance their portfolios and allocate capital across different investment opportunities. They may aim to maintain a certain average or targeted MOIC for their overall portfolio, which influences how they distribute their investments.

FAQs: MOIC

What is typical Moic in private equity?

While a definitive average is elusive, typical MOICs in private equity can range from 2x to 3x the invested capital. This means for every $1 invested, the expectation is to receive $2-$3 back. However, some successful funds might achieve MOICs well above 3x, while others might struggle to reach 2x depending on the factors mentioned above.

What is MOIC and DPI?

PI (Distribution to Paid-In Capital) is another metric used in private equity. It measures the total amount of cash returned to investors relative to the amount they originally invested. MOIC, on the other hand, considers both the cash received and the unrealized gains (potential future value) of the investment.

What is the MOIC return multiple?

The MOIC return multiple is simply another way of saying "MOIC." It emphasizes that MOIC is a multiple of the initial investment.

How is MOIC calculated?

MOIC is calculated by dividing the total value of the investment (including realized and unrealized gains) by the total invested capital.

Is IRR or MOIC more important?

There's no single "more important" metric. MOIC is simpler and quicker to calculate, offering a snapshot of overall return. IRR is more complex but provides a more nuanced picture by considering the time value of money. Use MOIC for a quick comparison, and IRR for a deeper analysis.

Does higher IRR mean riskier?

Not necessarily. A higher IRR can indicate a potentially better investment, but it doesn't automatically mean higher risk. You should always consider other factors alongside IRR.

What is the difference between MOIC and ROI?

ROI (Return on Investment) is a broader term used for any investment. MOIC is specific to private equity and considers both cash received and unrealized gains.

What is a good MOIC multiple?

A "good" MOIC depends on the context. In general, a higher MOIC is better, but consider the risk involved and compare it to similar investments.

Follow us on LinkedIn

Follow us on LinkedIn