FP&A professionals play a vital role in the organization by helping to unlock the full potential of business with the help of key decision-making inputs backed by thorough research and data analysis.

They not only help businesses make key decisions by analyzing the possible outcomes, but they also establish the annual budget and carry out regular forecasting to keep businesses aware of upcoming events.

How can an FP&A professional add value in the organization?

The ultimate goal of any business is to generate wealth for its shareholders.

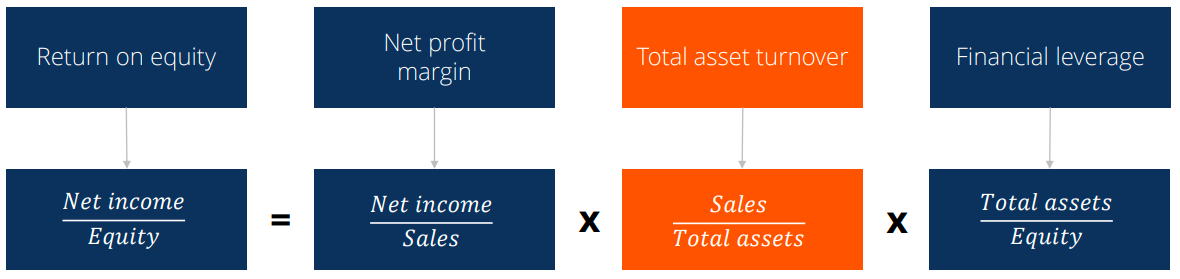

The returns earned by shareholders is measured in terms of Return on Equity (ROE).

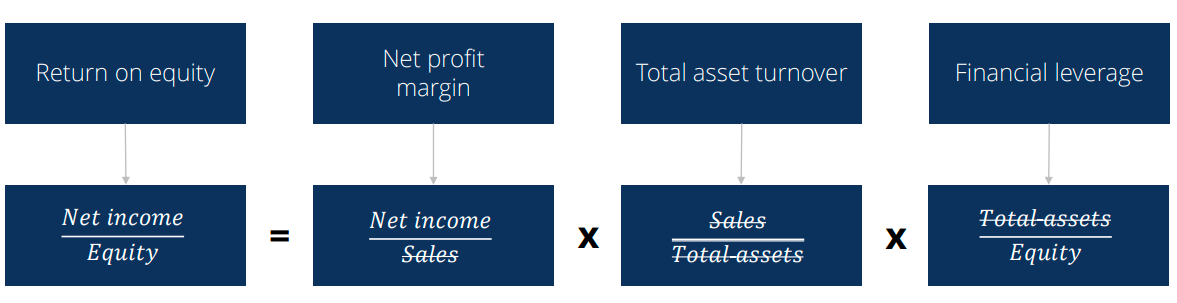

ROE = Net profit/owner's equity.

FP&A professionals can add value in the organization by helping business to maximize the ROE.

However, higher ROE is a by-product of improved net margins, efficient asset management, and financial leverage management. Therefore, ROE can also be expressed as a product of net profit margin, asset turnover, and financial leverage. In order to maximize the ROE in the business, one needs to bring improvement in all three aspects.

How to improve net margins

- Increase the sales - As an FP&A professional, one needs to find the optimum scalable sales mix which not only leads to growth in revenue but also gross margins. They should work closely to shorten the customer funnel cycle by identifying the key delay areas such as product non-availability, higher delivery lead time, etc.

- Optimize the cost - FP&A professionals need to do a thorough analysis of fixed and variable cost drivers of the business and look for means of reducing the cost wherever possible and generating other investment income with close coordination with the treasury team.

- Benchmark - FP&A professionals must do an industry trend analysis and compare it with their own business to find out the major delta in key margins such as gross profit, EBITDA, and net profit. This helps in identifying the areas of improvement in comparison to industry trends and building a roadmap to achieve the set improvement targets.

How to improve asset turnover

Before diving deep into asset turnover improvement measures, let us first understand what asset turnover is

Asset turnover indicates how much revenue a business generates on each $ invested in it.

Asset turnover = Revenue/asset.

Improve working capital days gap

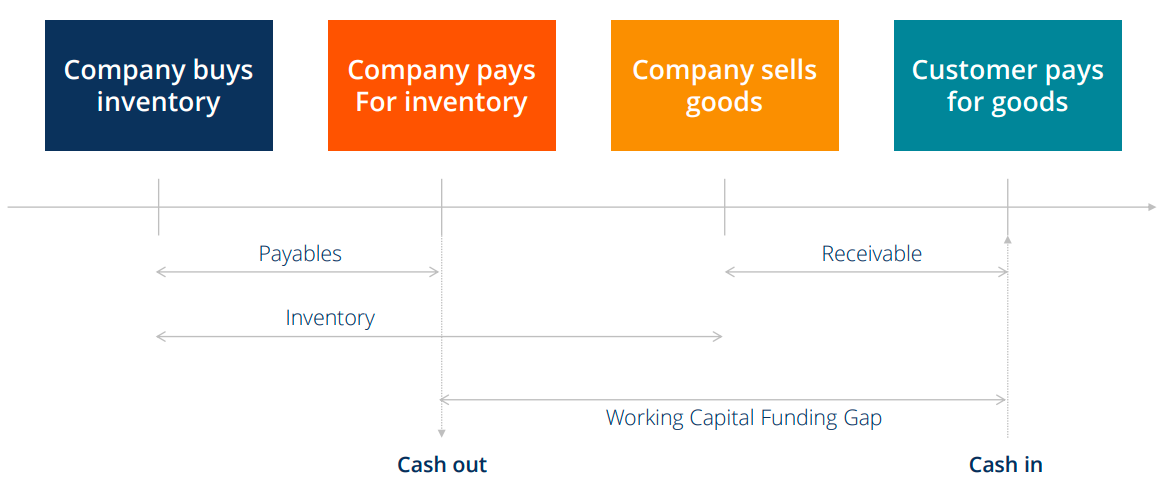

Prime components of working capital in a business consist of inventory, receivables, and payables. Working capital days of a business can be derived by adding inventory and receivable days and subtracting payable days from them.

Working capital days = Inventory days + Receivable days - Payable days.

In order to improve the working capital days gap, one can incentivize customers to make payments before due dates, negotiate with vendors for additional credit days, and opt for just in time inventory management model.

Efficient capital budgeting

FP&A teams need to do capital budgeting and employ discounted cash flow, or internal rate of return methodology with anticipated cash flows to ensure that any investment in capex is generating positive returns for the business.

However, there’s an exception to this rule, i.e. when the business is in its early stages, the fixed asset turnover may be lower due to high capex investment in the beginning, along with lower revenues.

How to improve financial leverage

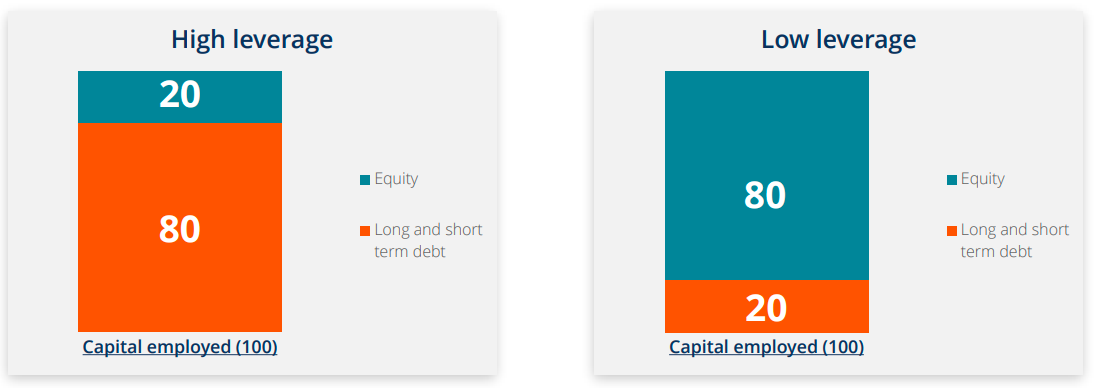

Financial leverage is used to identify how much business is funded by the owner's capital and vice-versa. The usual approach for this is to find out debt/equity.

However, a more holistic approach can be to find out the total asset/equity. Here, any source of funding not invested by owners is considered to find out financial leverage. E.g. the total asset of the company is $100 and equity is $80, so the financial leverage is $100/$80, which equals 1.25 times or 125%.

Below are the measures to improve the financial leverage:

Increase total asset

The financial leverage can be increased by the addition of assets of the business without infusing the additional owner's equity.

However, here, the impact of increasing total assets works against our strategy if the business is not able to generate incremental revenue on the additional asset introduced, and gets canceled with the asset turnover. E.g. certain growth projects may require heavy investments which may not be available with the company as equity.

In this case, the company can use the leverage with the matching tenure of the project, resulting in higher revenue with the same equity, and higher ROE. Also, it saves the business from diluting its equity.

Decrease owner's equity

In case the organization is not able to generate any additional revenue with its available capital, it should consider returning its equity capital back to shareholders in the form of buyback, bonus issue, or dividends.

A lower equity base leads to higher financial leverage and results in a higher return on equity, e.g. if a business earns $10 on its $100 equity, then the ROE is 10%. However, if the earning remains the same but the owner's equity becomes $50, then ROE doubles to 20%.

Want to learn from FP&A experts?

Attend our next virtual FP&A Summit and hear from some of the brightest minds in FP&A including world-class speakers and some well-known faces in finance.

The next virtual FP&A Summit is on June 15, 2023!

🎓 Earn CPE/CPD credits.

🧠 Uncover the latest industry trends and emerging technologies to gain a competitive edge.

📱 Collaborate, share ideas and connect with 500+ fellow FP&A professionals.

…did we mention it’s free to tune in live?

All you have to do is register and you’re all set!👇

Follow us on LinkedIn

Follow us on LinkedIn