This article was adapted from one of our previous virtual FP&A Summits, featuring Amit Kurhekar, when he was Head of Data at MoneyLion. Amit is currently a Fractional Chief Data & Digital Officer at TransformTechX.

Unless you’ve been consistently offline over the last few years, you’ll know that the financial industry is undergoing a significant transformation driven by AI and machine learning technologies.

This revolution isn’t just about adopting new technologies but about changing how financial services and processes are delivered and experienced by consumers.

In this article, we’ll explore some of the most compelling AI and ML strategies in finance with use cases to show how they work in real-life scenarios.

Whether you're a financial professional or simply interested in the evolving landscape of FinTech, this article offers valuable insights into the intersection of finance, AI, and digital transformation.

Case study: Day in the life of ‘financially savvy’ John

Let me introduce you to John. He considers himself to be very financially savvy, he’s in his 30s, intelligent and he uses a smartphone like so many of us.

One day, he receives a notification on his phone that reads “John, your utility bill of $50 is due tomorrow. Do you want to pay now?” A few seconds later, another notification comes through, “John, your net-worth increased by 1% last week with Apple stock making the maximum gains.”

John gets on with his day. He goes to work, enjoys chatting to his co-workers, and then in the afternoon, he notices yet another notification on his phone. This one says, “John, you have excess balance in your savings account. Invest 20% of the amount to earn an extra 8% vs keeping in your savings account. Invest now?”

These are smart notifications and nudges and in today’s financial world, it's a reality. If you’re not using technology to help improve your finances, you’re missing out.

By embracing AI and ML, you can make a huge impact not just in your role but also in your daily life.

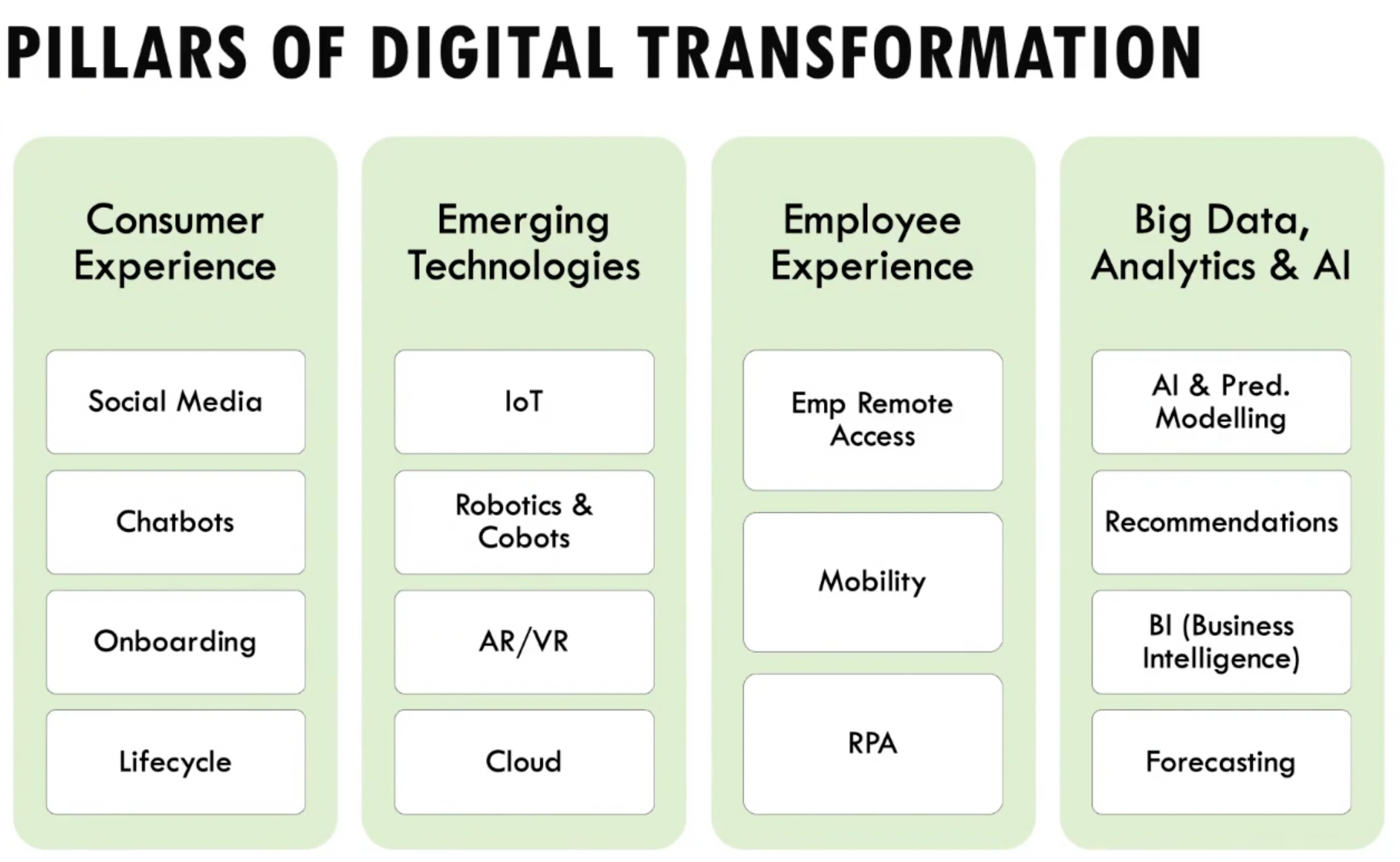

Pillars of digital transformation

Within digital transformation, there are emerging technologies.

Most companies are utilizing these emerging technologies to drive and improve consumer experiences.

These include things like internet of things (IoT), robotics, AR/VR and Cloud.

Before 2020, not many people were working online or working from home, and then almost the majority of the IT workforce moved into remote working.

The transformation from almost everyone working in-office to everyone working remotely because of Covid meant that many people had to embrace technology in new ways.

There was a huge mobilization of IT and IT infrastructure. I think that both AI and ML are critical pieces that are enabling today's world.

So, a part of that could be coming as simple as receiving smart nudges throughout the day on your smartphone or you could even have nudges to help you forecast numbers for your financial forecast.

Applications of AI and analytics in FinTech

Now I’d like to talk about some applications and use cases of applications of AI and analytics in finance and FinTech.

Personal finance and wealth management

Personal finance and wealth management is one of the largest domains which adopted and started leveraging digital transformation.

When you’re swiping your credit card or spending money on your savings account, basically what you're doing is putting those transactions on your savings card.

With that, you’re enriching those transactions and getting key insights to help you improve your finances.

You can do your all your financial planning and budgeting through a simple app. So, think about that when you are thinking about asset allocation or wealth management.

Using technology in finance is so common. If you think about it, nobody goes into a bank to open a new bank account. Nowadays, everything happens online (at least for the most part).

Here are some more key areas in personal finance where AI is extremely helpful:

- Aggregation of financial portfolio and enrichment

- Expense tracking and budget management

- Intelligent alerts and recommendations for personal finance and wealth management

Credit history: Automated underwriting

If you’re an unorganized sector, and you don’t have the equivalent of a credit rating, it’s extremely hard to get loan. So, what do you do in that case?

Well, you can utilize AI and ML to help with the underwriting process. It can even help you borrow a loan instantaneously.

Areas where AI and ML can assist with underwriting:

- Financial data aggregated/PDF statements

- Identify income/salary

- Identify existing loans, recurrent spending and monthly expenses

- Predict monthly income and date

- Predict probability to pay back and eligibility

- Instant online loan approval for applicant

What tends to happen in the credit industry today is that if someone doesn't have any rating available, which could the case with a small or medium sized business, you would have to upload your data which can include financial records, a PDF account statement, etc. and this data is read by the AI and ML algorithm.

AI and ML algorithms can identify where a user is spending, their existing loans, and their income or salary.

For salary income, the algorithms predict recurring spending patterns, monthly income, and the date when the next salary or income is expected. They also assess the probability of payback and eligibility for a loan.

When considering AI for automated underwriting, the system predicts the user's likelihood of repaying the loan and evaluates their legal standing.

This makes borrowing a loan online a simple process, leading to instant online loan approval, which is common in today's credit industry.

Many organizations, including Moneylion and others worldwide, use automated underwriting.

Fraud detection

Another critical use case for AI in the financial industry is fraud detection. Think about credit card fraud detection, those alerts you get when your credit card is used in a different location for an unusual amount.

This is enabled by AI and is one of the most common and relatable use cases for users.

During COVID-19, there were numerous insurance claims submitted across cities and countries due to government support. However, not all of these claims were legitimate, leading to a rise in fraudulent bills.

Companies had to develop algorithms to identify these fraudulent claims based on user profiles and historical health metrics. These algorithms could detect similarities in amounts, names, and other details to pinpoint fraudulent activities.

AI and ML have also played a crucial role in banking authentication for payments and transfers, enabling almost real-time fraud detection. This makes fraud detection one of the most important areas in the financial and FinTech industry.

Here are some of the ways technology can assist with fraud detection:

- Credit card fraud detection – Alerts for fraudulent transactions

- Insurance claim fraud detection – Identifying fraudulent bills based on user profile and health metrics

- Banking authentication for payments and transfers

Banking and online verification

In the banking and financial industry, eKYC (electronic Know Your Customer) processes have become crucial.

In India, for instance, the Aadhaar infrastructure allows users to open a bank account online with just one SMS. By installing the bank's app, users can complete their verification and KYC process online.

KYC, which stands for Know Your Customer, involves the identification of customers to open a bank account. AI enhances this process by enabling video KYC, reducing the probability of fraud by validating user information.

When users scan their passport or ID card, AI can identify any mismatches in the information, ensuring a more secure and efficient verification process.

Conversational AI and chatbots

Chatbots have become essential in modern financial services, offering various functionalities:

- Customer support: Chatbots provide personalized and efficient customer support, handling queries and resolving issues quickly.

- Site navigation and product decision support: They assist users in navigating websites and making early product decisions by providing relevant information and recommendations.

- Form filling: Chatbots streamline form-filling processes, making it easier for users to complete necessary documentation.

AI and ML are the common factors driving these chatbot use cases. Conversational AI and chatbots have been around for some time, significantly improving customer support.

When you interact with a service and receive personalized responses, there's a good chance a chatbot is behind it.

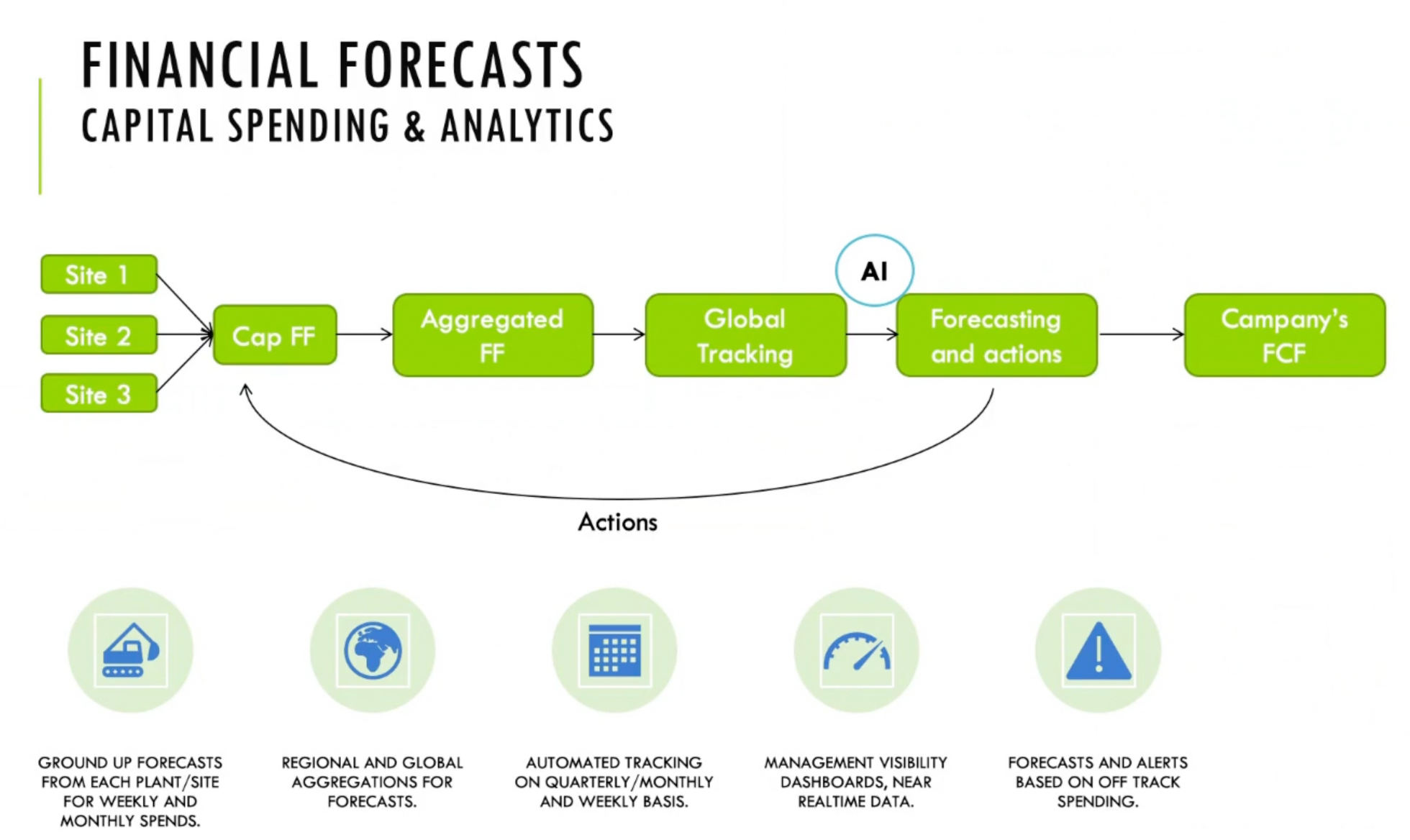

Financial forecasts

According to McKinsey, most capital investment projects face cost and schedule overruns. In fact, 79% of such projects encounter these issues, with only 5.4% meeting their cost and schedule targets.

This highlights the critical need for effective capital expenditure management, which is one of the quickest and most efficient ways to preserve cash.

Drawing from my experience as a certified Capital Systems Manager at Procter & Gamble, I can attest to the challenges in this area. In the past, financial forecasting was a complex and labor-intensive process.

However, today, AI and analytics have revolutionized how we handle financial forecasts.

Analytics and AI simplify the process by providing accurate and timely data. For example, companies now have global tracking mechanisms and standardized dashboards that offer near real-time visibility across all manufacturing sites.

This capability enables organizations to adjust their forecasts and manage capital spending more effectively.

By capturing data at every step, AI models can forecast financial outcomes for the coming days, weeks, and quarters. This predictive ability helps companies meet their free cash flow targets by providing actionable insights and enabling proactive adjustments.

Ten years ago, every site required a dedicated Capital Systems Manager, and there were regional and global heads overseeing the process.

Today, much of this work is automated. Reports and complete visibility are available at the click of a button, and adjusted forecasting can be driven by percentages and historical averages, leading to highly accurate predictions.

This transformation in financial forecasting is one of the most significant advancements, demonstrating how AI and data analytics can streamline operations and improve efficiency in capital expenditure management.

Purchase to payments and accounts payable

Another important use case in the financial industry is the purchase to payment process, also known as accounts payable.

This area involves several complexities, including the acquisition of equipment and supplies across various sites within a company.

To manage this effectively, companies use data cataloging and recommendation mechanisms.

These systems capture purchase data and provide suggestions based on previous transactions, such as what similar items were bought and at what price.

This process relies on machine learning (ML) solutions that use natural language processing (NLP) to understand queries and search capabilities within the catalog, unifying data across multiple sites.

Today's payment systems are highly automated. Standard, off-the-shelf products assist with invoice scanning, capturing payment dates automatically, and ensuring payments are released on specific dates.

These platforms can also optimize payment cycles and schedules by predicting the time needed to complete payments. They can alert you if payments are too early or too late, helping maintain the company's reputation.

AI and analytics have significantly improved the purchase to payment process. They provide real-time insights and automate many tasks, making financial forecasting and accounts payable much more efficient.

This transformation highlights how AI and analytics are simplifying and streamlining processes in both conventional companies and the FinTech world.

I hope this gives you a clear picture of the current advancements in purchase to payment systems. I'm happy to answer any questions you might have and am delighted to share these insights at FB and assembly.

Our Slack community is the space for finance leaders to share ideas, offer and receive advice from peers, grow their network, and so much more.

Follow us on LinkedIn

Follow us on LinkedIn