Have you ever looked at a company’s profit and loss statement and thought, “Okay, but how much are we actually making?” That’s where EBITDA comes in (short for earnings before interest, taxes, depreciation, and amortization). It’s one of the clearest ways to cut through the noise and figure out how a business is really performing.

While EBITDA isn’t perfect (and we’ll go over why soon), it’s still very practical. It strips away things that can cloud your judgment like financing choices, tax strategies, and accounting quirks, so you can zero in on actual operating performance.

In this simple guide, we’ll break it all down: what EBITDA is (and isn’t), how it compares to EBITA, when to use it, and we'll also include a free EBITDA calculator you can use right away.

No fluff, no filler - just straight talk on how this metric can help you make smarter financial decisions.

Sound good?

Let’s get into it…

This guide covers:

- Definition of EBITDA

- What is EBITDA?

- Why use it?

- EBITDA vs. EBITA: Differences explained

- EBITDA formula

- EBITDA calculator

- What you can learn from EBITDA

- The limitations

- Operating Profit vs. EBITDA

- Gross Profit vs. EBITDA

- EBITDA vs. Operating Income

- Operating Earnings vs. EBITDA

- Net Income vs. EBITDA

- FAQs

EBITDA definition

What is EBITDA?

EBITDA tells you how much money a company makes from its core operations before all the financial and accounting extras come into play.

Think of it like this: you're running a business. You're making sales, paying employees, keeping the lights on, those things make up your day-to-day. EBITDA focuses on just that part.

It ignores how you financed the business (interest), what country you're in (taxes), or how your accountants handle your equipment (depreciation and amortization).

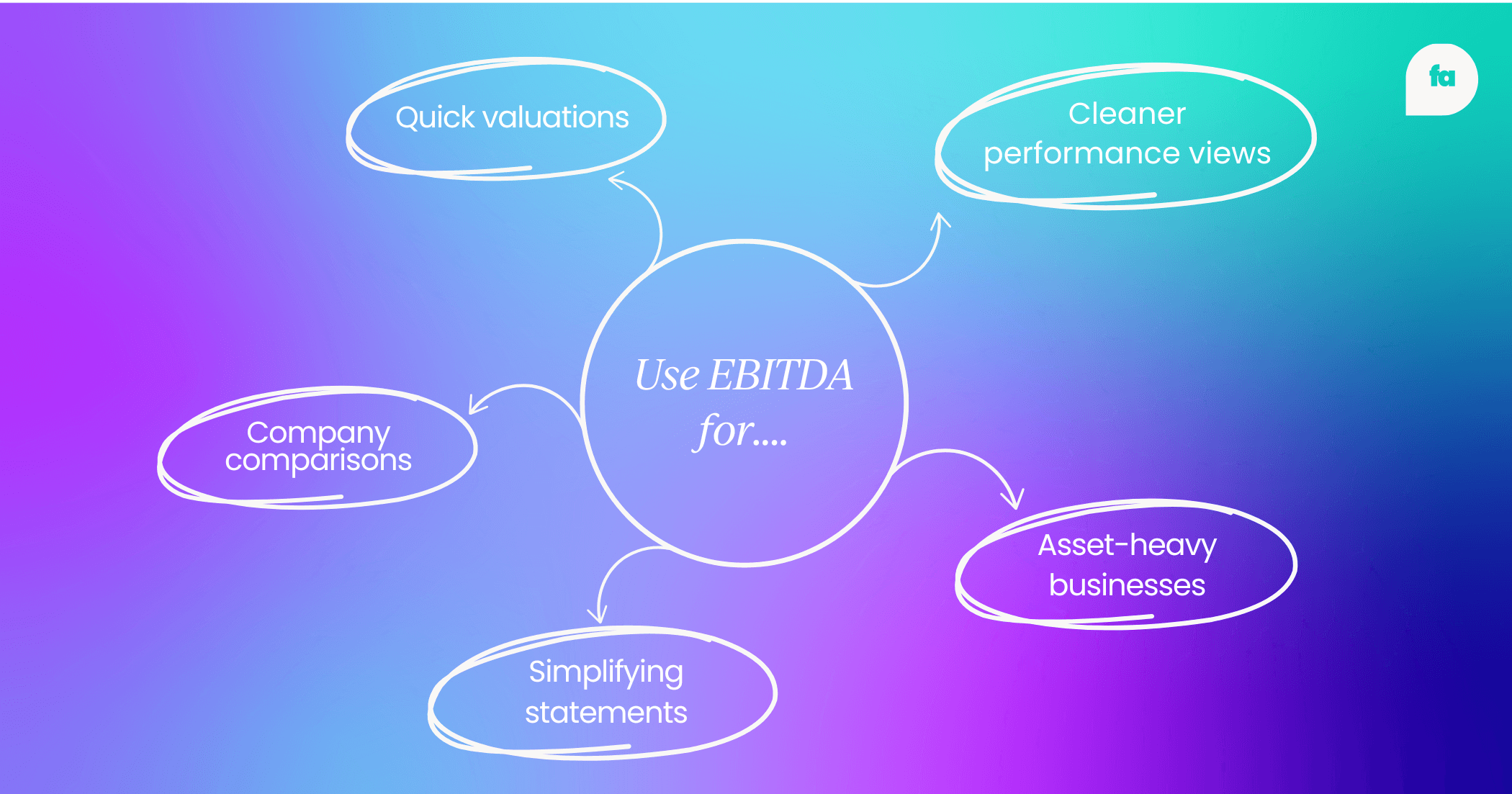

Why use EBITDA?

EBITDA gives you a clean, high-level look at operational performance with no distractions.

It’s especially handy when you’re:

- Comparing companies across industries or countries.

- Evaluating a business without messy accounting tricks.

- Trying to figure out what the business might be worth.

Here’s a quick example to help understand how EBITDA works.

Let’s say a company has:

- $2 million in revenue

- $500K in operating costs

- $100K in interest payments

- $200K in taxes

- $150K in depreciation and amortization

EBITDA is just revenue minus operating costs = $1.5 million. It skips the rest because it focuses on how well the core business runs.

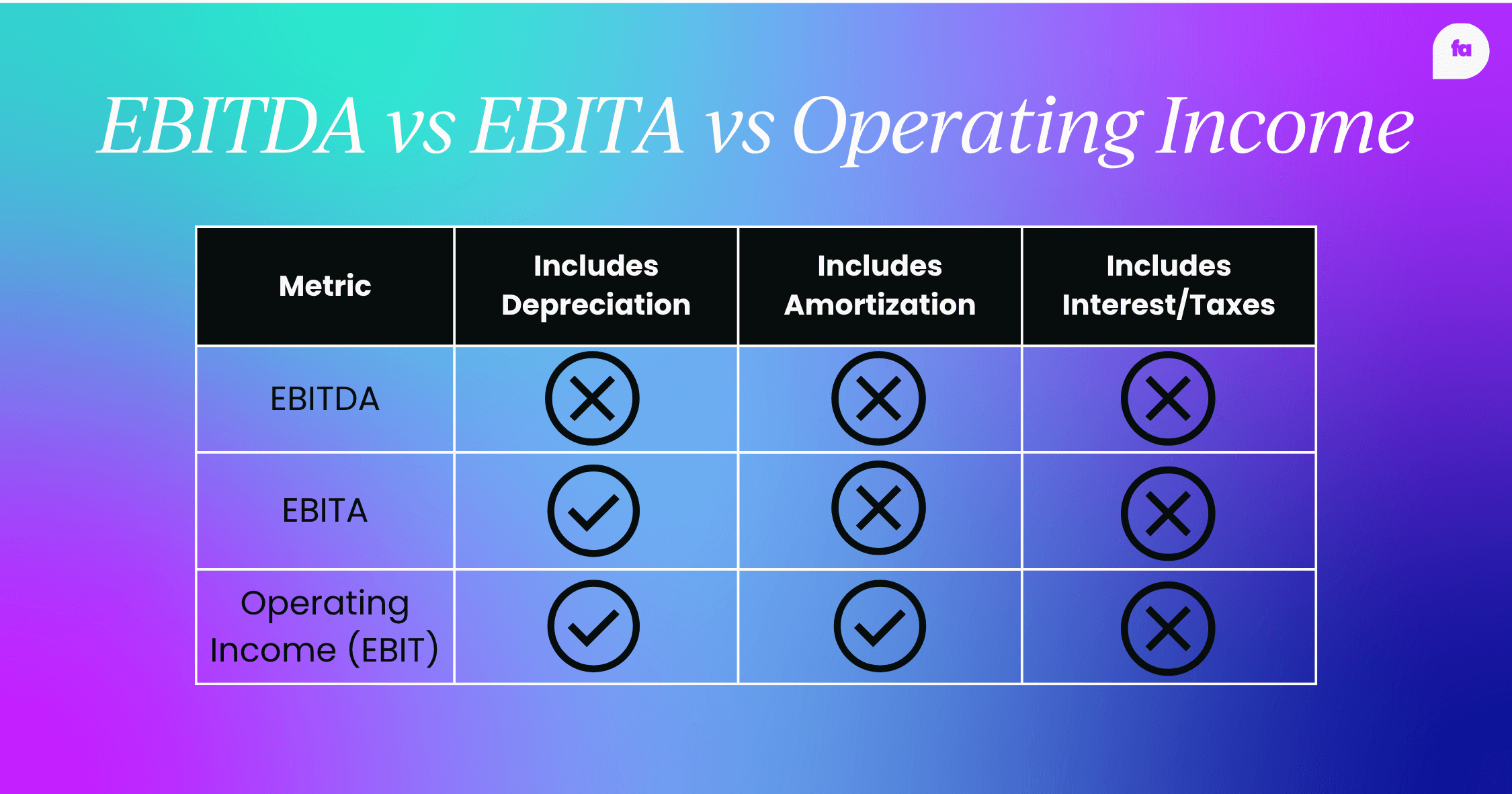

EBITDA vs. EBITA: Differences explained

Okay, so now you know what EBITDA is, but what about EBITA? Yes, it’s one letter shorter, but that letter (the “D”) actually matters.

First, what does EBITA stand for?

EBITA means Earnings Before Interest, Taxes, and Amortization. Sound familiar? That’s because it’s almost the same as EBITDA, but with one key difference: EBITA includes depreciation.

Here’s a quick visual to make it clearer:

EBITDA = Earnings before interest, taxes, depreciation, and amortization

EBITA = Earnings before interest, taxes, and amortization (depreciation is already deducted)

While EBITDA shows earnings before all major non-cash expenses, EBITA includes depreciation. This means EBITA offers a slightly more realistic view of profitability by accounting for the wear and tear on physical assets.

Why does that matter?

The distinction between depreciation and amortization is crucial because they relate to different types of assets. Depreciation applies to physical assets like machinery, buildings, or vehicles, reflecting their wear and tear. Amortization, on the other hand, typically applies to intangible assets such as patents or goodwill.

Depending on the kind of company you’re looking at:

- EBITDA might be more useful for asset-heavy businesses (like manufacturing), where depreciation could skew performance.

- EBITA might be better if depreciation is a meaningful cost that shouldn't be ignored - say, for companies with lots of physical infrastructure.

How to calculate EBITDA

EBITDA is super easy to calculate once you know what to look for.

Here’s the basic formula:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

Not into net income? You can also go this route:

EBITDA = Operating Profit (or EBIT) + Depreciation + Amortization

Same idea, just starting a bit higher up the income statement.

EBITDA calculator

Use the EBITDA calculator below to estimate your company’s earnings before interest, taxes, depreciation, and amortization.

Just enter your figures, and the calculation will be done automatically. It’s a simple way to get a quick view of operational profitability.

EBITDA Calculator

How to use the EBITDA calculator

- Enter your Net Income – This is your company’s total profit after all expenses.

- Add interest – Input any interest expenses the business paid.

- Add taxes – Enter the total tax amount paid.

- Add depreciation – Include non-cash expenses related to asset wear and tear.

- Add amortization – Input any amortization of intangible assets.

- Click "Calculate EBITDA" – The EBITDA calculator will instantly display your EBITDA.

That’s it - no spreadsheet required!

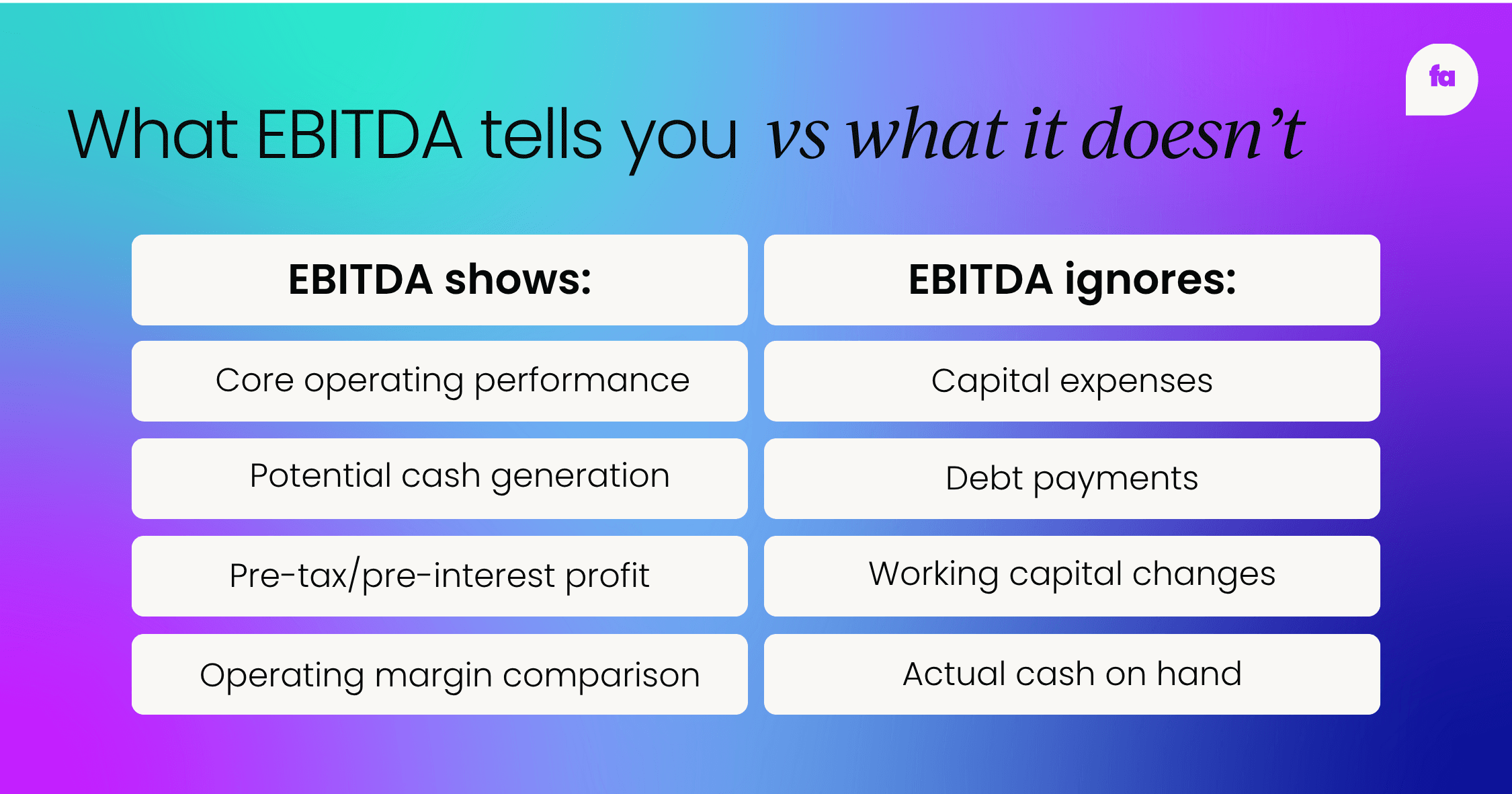

What you can learn from EBITDA

So you’ve got your EBITDA number. Great. Now what?

EBITDA is more than just a fancy acronym, it’s a shortcut to understanding how healthy your business is at its core. Let’s break down what it actually tells you.

1. How well the business runs, stripped to the basics

EBITDA zooms in on operational performance. It shows you how much money the company is making from just running its business before interest payments, tax bills, or non-cash accounting stuff mess up the picture.

2. How much cash your business might generate

EBITDA is not cash flow, but it gets you in the ballpark. Since it adds back depreciation and amortization (which are non-cash expenses), EBITDA can give you a rough sense of how much money the business is generating before it starts writing checks to the government or the bank.

3. How your business stacks up to others

EBITDA helps you understand how your business compares to other companies or competitors. Because it removes interest and taxes, you can easily compare apples to apples, even if one business is in the U.S. and the other’s in Germany.

4. A starting point for valuation

Investors love EBITDA because it’s a go-to metric for valuing a business. Many use EBITDA multiples (like 6x EBITDA, 8x EBITDA) to estimate what a company might be worth. So if you’re gearing up for a sale, acquisition, or pitch, knowing your EBITDA is like knowing your weight before stepping on the scale.

The limitations of EBITDA

EBITDA can be super useful, but it’s definitely not perfect. So, before you start treating it like the one number to rule them all, let’s talk about what EBITDA leaves out, and where it can lead you astray.

1. It’s not real cash flow

As we mentioned, EBITDA is not the same as cash flow. Yes, it feels like cash flow because it adds back non-cash expenses like depreciation and amortization. But it ignores actual cash going out the door like capital expenditures, loan repayments, and changes in working capital.

2. It ignores debt and interest

EBITDA acts like debt doesn’t exist. That’s fine for comparing companies, but if you’re evaluating your own business? You can’t just pretend loan payments don’t matter.

3. It skips taxes

Sure, ignoring taxes helps when comparing companies globally. But taxes are real. You can't pay employees with pre-tax profit. If you're trying to understand how much money you'll actually keep at the end of the day, EBITDA won’t get you there.

4. It hides capital intensity

Some businesses need to constantly invest in equipment, tech, or upgrades just to keep going. EBITDA says, “No worries, depreciation is non-cash!”

But here’s the catch: those assets eventually need replacing, and that costs real money. So a capital-heavy business with high EBITDA might not have much left to reinvest or grow.

5. It can be easily manipulated

EBITDA can often make things look better than they are. Some companies use it to smooth over poor performance or distract from weak cash flow.

Ever seen “Adjusted EBITDA”? Be careful. That’s often code for: We added back a bunch of stuff to make ourselves look more profitable.

Operating Profit vs. EBITDA

Operating profit (also called EBIT, or earnings before interest and taxes) and EBITDA are pretty similar, but there’s one key difference: EBITDA adds back depreciation and amortization, while operating profit doesn’t.

That means EBITDA gives a slightly more “inflated” picture of earnings, especially for companies with a lot of fixed assets. Operating profit, on the other hand, reflects more real-world costs tied to using up equipment or intangible assets.

Gross Profit vs. EBITDA

Gross profit is all about what’s left after subtracting the cost of goods sold (COGS). It shows how efficient your production or service delivery is. EBITDA goes several steps further by accounting for all operating expenses except interest, taxes, depreciation, and amortization.

So while gross profit looks at just the direct costs of making your product, EBITDA gives a broader view of profitability from core business operations.

EBITDA vs. Operating Income

This one’s easy to mix up. Operating income is your profit after all operating expenses (including depreciation and amortization) but before interest and taxes. EBITDA is just a version of operating income with depreciation and amortization added back in.

Operating Earnings vs. EBITDA

These terms sound interchangeable, and sometimes they are. Operating earnings is just another name for operating profit or EBIT, depending on who's talking.

But here’s the distinction: EBITDA takes it one step further by removing depreciation and amortization, making it less conservative than operating earnings.

While both tell you how the business is doing before debt and taxes come into play, EBITDA can make things look rosier, especially for capital-heavy companies where depreciation is a big number.

Net Income vs. EBITDA

Net income is your bottom line: everything accounted for, including taxes, interest, depreciation, amortization, and even one-time charges. EBITDA, on the other hand, strips away all that to focus on operational performance.

Net income shows what you actually earned at the end of the day. EBITDA shows what you could have earned if those other factors didn’t exist. It’s great for analysis and comparisons, but if you want to know how much money is actually in the bank, stick with net income.

FAQs

Is EBITDA the same as gross profit?

No. Gross profit is just revenue minus the cost of goods sold (COGS) — basically, how much you make from selling your product or service. EBITDA goes much further, factoring in all operating costs except interest, taxes, depreciation, and amortization. Gross profit shows production efficiency. EBITDA shows overall operating performance.

Is EBITDA the same as operating income?

EBITDA isn't quite the same as operating income. Operating income (aka EBIT) includes depreciation and amortization. EBITDA adds those back, giving you a higher number. So EBITDA is more of a “clean” version of operating income that strips out non-cash expenses.

Why is EBITDA flawed?

EBITDA is flawed because it leaves out some pretty important things like capital expenses, debt payments, taxes, and changes in working capital. It can make a business look more profitable than it actually is, especially if you're ignoring how much cash is actually going out the door.

What does EBITDA actually tell you?

EBITDA tells you how much profit your business is generating from its core operations, before taxes, interest, and non-cash accounting items mess with the picture. It’s a way to see whether the engine of your business is running well.

Why use EBITDA instead of net income?

Net income is great, but it includes everything such as interest, taxes, depreciation, and one-time items. EBITDA cuts out that noise, which makes it easier to compare companies or focus purely on operational performance. It’s not better, just more focused.

Is EBITDA just revenue?

Definitely not. EBITDA is what’s left after subtracting operating expenses (but before subtracting interest, taxes, depreciation, and amortization). Revenue is the top line — EBITDA is a more refined look at profitability.

Which industry has the highest EBITDA?

Generally, industries with low capital costs and high margins — like software, pharmaceuticals, and financial services — tend to show high EBITDA margins. But it varies a lot, so comparisons only make sense within the same industry.

What is considered a good EBITDA?

It depends on your industry, but a 15–20% EBITDA margin (EBITDA ÷ revenue) is generally solid. For high-growth or low-overhead businesses, margins can go even higher. Just remember: “good” always depends on context.

Want to level up your finance career?

Join the Finance Alliance Insider Membership (it's free) and get access to exclusive content, expert-led sessions, private community channels, and actionable resources designed for high-performing finance professionals.

If you found this guide useful, becoming an Insider unlocks even more tools to help you stay sharp, stay ahead, and stay connected.

Follow us on LinkedIn

Follow us on LinkedIn