Looking for better ways to create more efficient and accurate budgets and forecasts?

You’re not alone.

Precision and speed in planning, forecasting, and budgeting aren’t just ‘nice to haves’ – they’re necessities.

But that’s not always easy to achieve, especially if you’re solely relying on historical data and assumptions to drive your financial plans. This tired approach isn’t always the best option and if you want to create more accurate and agile FP&A processes, it’s time to get familiar with driver-based planning.

Driver-based planning identifies and models the key operational drivers behind your company’s financial performance. With these in place, you can transform budgeting and forecasting from a labor-intensive grind to a seamless, automated process.

Find out how in this guide, where we share a proven framework to help you build and embed driver-based planning into your financial planning and analysis processes.

Learn how to:

- Use driver-based planning to create responsive reports

- Identify your company’s key drivers (internal vs external)

- Get your boss on board (benefits of driver-based planning)

- Build a driver-based planning framework (tailored to your needs)

- Create a single source of truth for your data

What is driver-based planning?

Driver-based planning is a financial planning approach whereby you identify the key factors influencing your company’s performance, rather than just relying on past data.

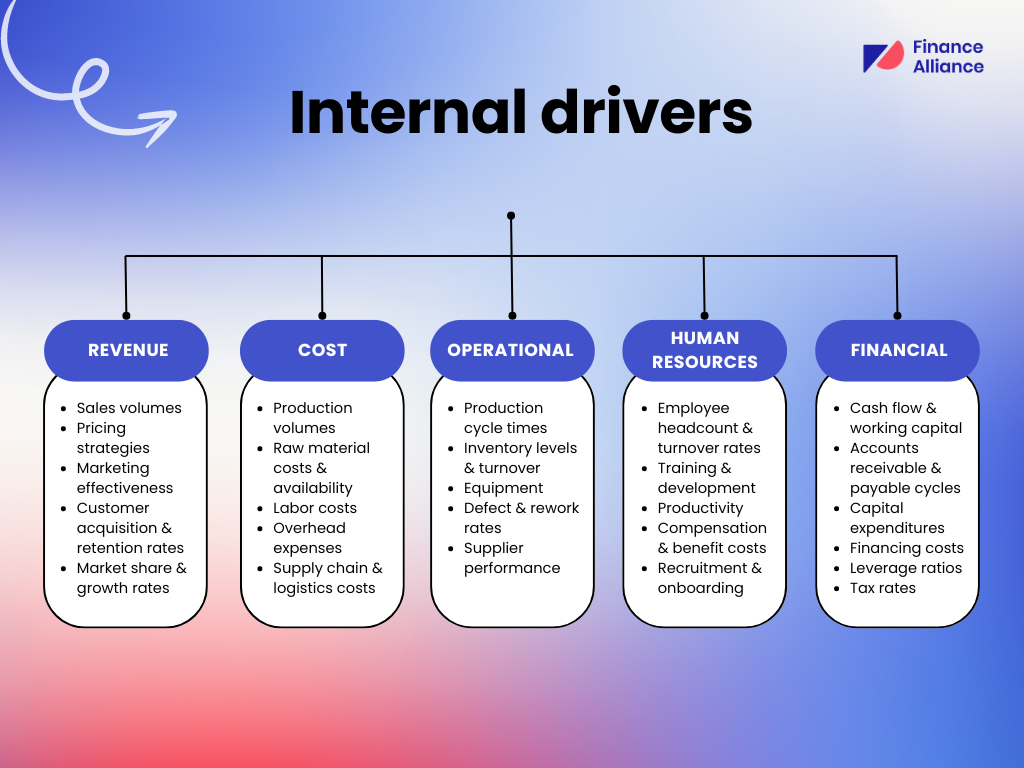

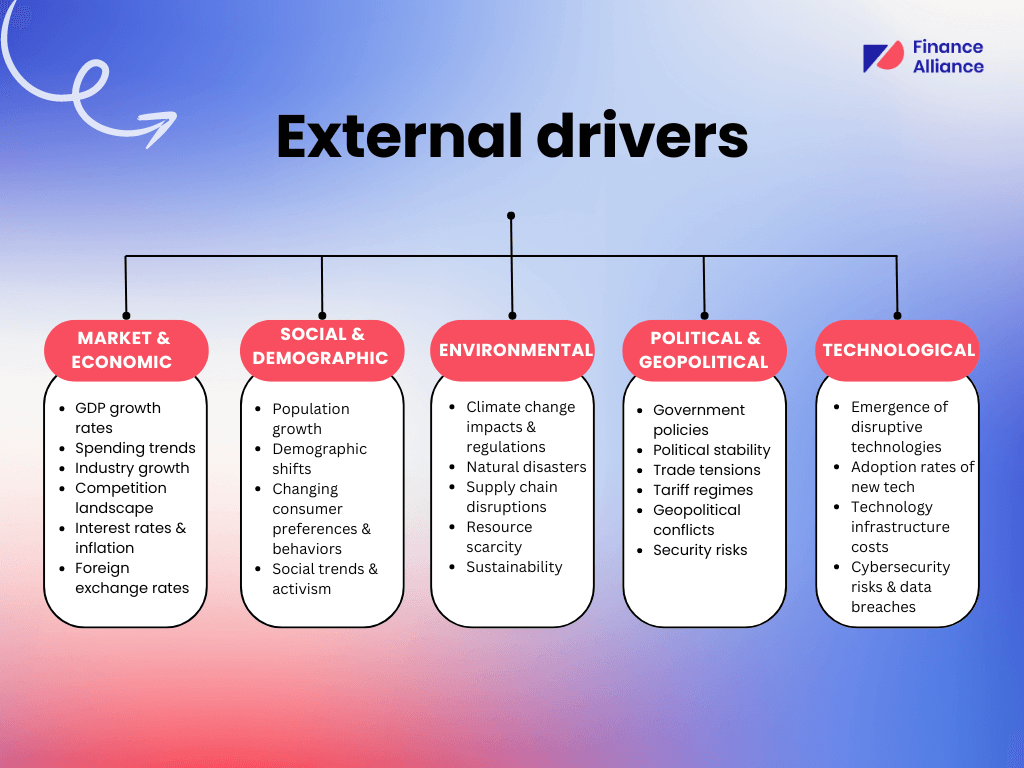

These factors, called ‘drivers’, can be internal, like the number of employees or production volume, or external like market conditions or commodity prices.

By identifying and understanding these drivers, you can create more dynamic and responsive financial plans, forecasts, and budgets.

Driver-based forecasting & driver-based budgeting

Driver-based forecasting and budgeting are two sides of the same coin: a financial planning approach that focuses on the key factors (drivers) that influence a company's performance.

You can use these drivers to create forecasts (predictions) and budgets (financial plans) that are more dynamic and adaptable to changing circumstances.

What is a revenue driver?

A revenue driver is a key variable directly influencing and impacting a company's ability to generate revenue.

Each revenue driver represents a business activity or operational driver that can lead to increased sales or profits. Some examples include things like sales volumes, units sold, market share, number of subscribers (or customers), customer retention rates, and so on.

If you can pinpoint and track these important revenue drivers, you’ll better understand the levers that drive your company’s top-line performance.

With these insights, you can build valuable financial plans to help senior management (including the CFO and CEO) make informed decisions to optimize revenue streams.

Examples of drivers (internal vs external)

On top of internal operational drivers, it's also important to account for relevant external drivers that can impact your company’s performance.

Here are some examples of external drivers that could be incorporated into a driver-based framework:

Advantages of driver-based planning

If you’re set on transforming your FP&A processes with driver-based planning, you’ll be glad to know it comes with more than a few benefits:

- By focusing on key factors that truly drive your company's performance, you’ll create forecasts grounded in reality – not ones solely based on historical data.

- You can be proactive rather than reactive to changing market conditions. Say you need to see the impact of a potential marketing campaign. Simply tweak the driver for marketing spend and you’ll see how it ripples through your financial projections.

- It’s a less subjective approach to financial planning because it relies on quantifiable operational data, cause-and-effect relationships, and continuous calibration.

- Driver-based planning considers both internal and external drivers, providing a holistic view for better financial planning.

- It's not a solo act. Instead, this approach encourages collaboration between finance and other departments, like sales and operations.

How to build a driver-based framework

Building a driver-based framework is all about making your financial planning smoother and more aligned with the core operations driving your business.

Rather than working with high-level assumptions, you'll identify and model the specific operational metrics that truly move the needle on finances.

So, how do you go about setting this up?

Below, we take you through the steps to create a driver-based framework to use for forecasting, budgeting, and planning.

Step 1: Define business goals

People who set goals are 43% more likely to achieve them. So, start by identifying your business goals. This could be anything from increasing revenue to expanding market share, or improving profitability.

The key here is to make sure your goals tie back to your company's mission (why you exist) and vision (what you want to achieve).

Once you have a list of goals, prioritize them based on their importance and impact. Consider factors like their strategic fit, how achieving this goal will move the business forward, the financial impact, and whether the goal is achievable with available resources and market conditions.

According to the Corporate Finance Institute, goals that are specific are more likely to be accomplished. To refine your goals, consider answering the following questions:

Who: Who is involved in this goal?

What: What do I want to accomplish?

Where: Where is this goal to be achieved?

When: When do I want to achieve this goal?

Why: Why do I want to achieve this goal?

Step 2: Identify key operational drivers and KPIs

Now that you have all the data where you need it, you can start to identify the key operational drivers and what key performance indicators you’ll use to measure them in your model.

For each business goal, determine the quantifiable metrics (KPIs) that’ll measure progress. These KPIs could be sales figures, customer acquisition costs, or profit margins.

Then, you can move onto identifying the key drivers that influence those KPIs. Typically, you'll begin by outlining a few high-level targets - things like your revenue growth percentage, sales volume, or projected cost of goods sold for the period.

From those top line targets, you then branch out and split into multiple branches of more detailed drivers below it. As you work on building your framework, you’ll notice it getting increasingly granular the deeper you get into each level.

For example, under the revenue target, you might have branches for sales volumes by product line, pricing strategies, marketing spend effectiveness, etc.

Those branches could then split even further and go on to things like sales volumes breaking down into new customer acquisition rates versus existing customer retention. And those retention rates might be influenced by customer satisfaction scores, product quality metrics, and so on.

Most robust driver-based frameworks will cascade to several levels. So, while you may only have a couple high-level targets up top, by the time you trace all the branches, you could be modeling and integrating inputs from way more operational drivers across the company.

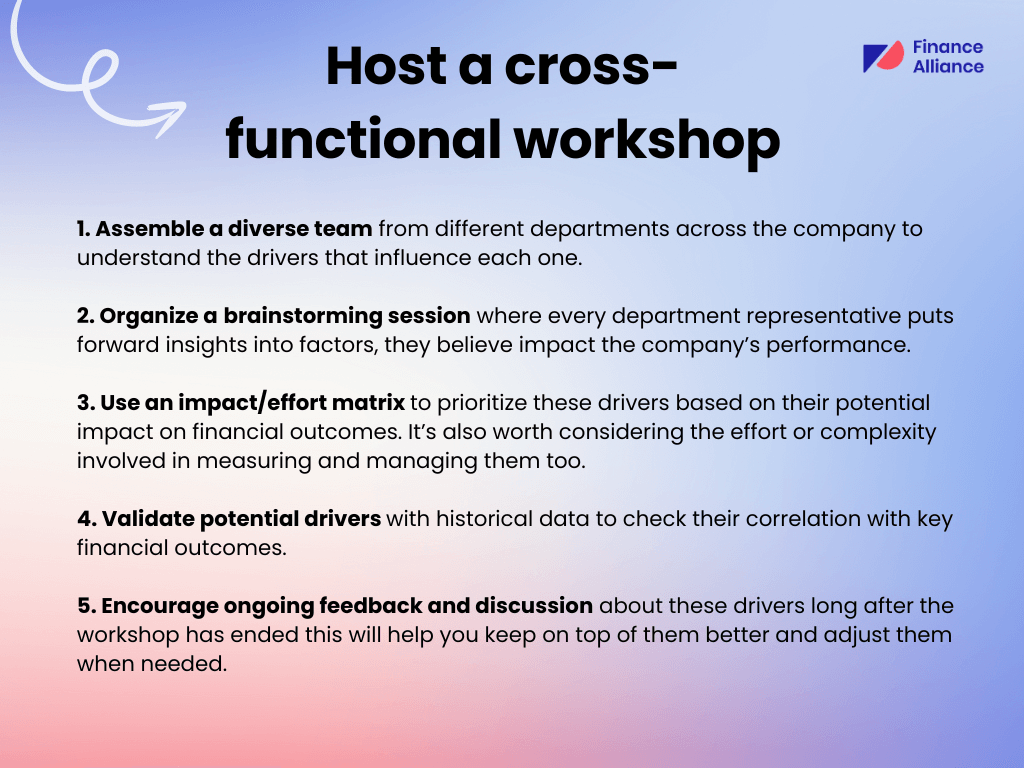

Need help identifying the right drivers? Here’s what we suggest:

Step 3: Assumptions and results

For each driver, you must define the underlying assumptions that’ll impact its performance. This is key in order to model drivers and assumptions that forecast results aligning with your business goals.

When you link these components, you can generally rely on a few key drivers to generate most of your planning outcomes.

Let’s look at an example to help put this into perspective.

Example: Customer retention rate

First, choose your goal. For now, we’ll go with customer retention rate as the primary goal. Here’s a breakdown of what to do next to help form your driver-based planning model:

1. Identify the driver

In this case, the primary driver for customer retention is the quality of customer support. The number of customer support representatives and their effectiveness can really influence retention rates.

2. Define assumptions

Assumptions are the elements that form the logical foundation for your driver. For example, when defining the assumptions for customer retention, you might consider:

- Response time: The average time it takes for customer support to respond to inquiries.

- Resolution rate: The percentage of customer issues resolved on the first contact.

- Customer satisfaction score: The average satisfaction rating given by customers after interacting with support.

- Support training: The effectiveness of training programs for customer support representatives.

In driver-based planning, bad guesses (assumptions) lead to wrong predictions (projections). You want to make educated guesses based on reality to get closer to where you actually land.

3. Forecast results

Accurate assumptions lead to reliable drivers, which then produce the desired results. For customer retention, the results might include:

- Retention rate: The percentage of customers retained over a period.

- Customer loyalty: Measured by repeat purchases or subscription renewals.

- Customer lifetime value (CLV): The total revenue expected from a customer over their lifetime.

This same method can be applied to different business goals.

Consider building a financial model that incorporates the identified drivers and assumptions. This will let you simulate different scenarios and see how they impact your KPIs and overall business goals.

Create a single source of truth

A lot of the key drivers of your company will be buried under mountains and silos of data. If that sounds bad, we’ve got worse news for you. Unless you’re working with some extremely organized people, there’s a fair chance all that data is running haywire because it’s coming from different departments within the business.

Technically speaking, you could have different people collect and sort the data. But that would take a painstakingly long time to complete.

So, one of the most important steps of creating a driver-based planning framework is to centralize the data (and with it, all key business drivers), within a unified enterprise performance management (EPM) system – establishing a single source of truth for reporting, planning, and forecasting.

KPMG reports that having an integrated and unified framework:

“…connects finance with the essential drivers from across the company—operations, sales and marketing, HR, and more—using agreed-to inputs and values that are vetted by cross-functional teams.”

Driver-based frameworks highlight the value of collaboration, shared understanding, and strategic influence across the business.

FAQs

What is the driver-based planning process?

Driver-based planning is a method where you identify key business drivers that influence your financial outcomes. You then use these drivers to create models that forecast results. Think of it like mapping out what truly impacts your revenue or costs and using that map to plan ahead.

What is an example of driver-based forecasting?

Imagine you're running a retail store. A driver-based forecast might look at how the number of store visitors (driver) impacts sales revenue (result). By tracking visitor numbers and average spend per visitor, you can predict future sales more accurately.

What is an example of a driver-based budget?

In a tech company, a driver-based budget could focus on the number of new product features released (driver) and how this influences R&D costs and projected revenue. If each feature costs $10,000 to develop and brings in $50,000 in revenue, you can budget accordingly.

What is a driver-based financial model?

A driver-based financial model uses key drivers—like sales volume, customer acquisition cost, or churn rate—to forecast financial outcomes. It helps in understanding how changes in these drivers impact overall financial health.

What is data-driven forecasting?

Data-driven forecasting uses historical data and statistical methods to predict future outcomes. It’s like looking at past sales data to predict future sales, ensuring decisions are backed by data trends.

How to create a driver-based forecast?

Start by identifying the key drivers that impact your business outcomes. Collect data on these drivers, create a model linking them to financial results, and use this model to project future outcomes. Regularly update your model with new data to keep forecasts accurate.

What is a driver-based cost analysis?

Driver-based cost analysis looks at the specific factors driving your costs. For instance, in manufacturing, it might analyze how raw material prices and labor hours impact overall production costs.

What is a driver in budgeting?

A driver in budgeting is a factor that significantly influences your budget outcomes. For example, the number of employees is a driver for salary expenses, and sales volume is a driver for revenue projections.

Unlock your full potential in FP&A

Elevate your career with our FP&A Certified Core course, meticulously crafted for professionals like you who are driven to excel.

Whether you're looking to refine your analytical skills, master budgeting, or steer strategic decisions, this course provides the tools you need to succeed.

By enrolling today, you gain access to expert-led tutorials, real-world case studies, and interactive simulations designed to boost your confidence and credentials.

Don't just meet the industry standards—set them.

Enrol now and transform your professional journey with every module you complete.

Follow us on LinkedIn

Follow us on LinkedIn