The COVID-19 pandemic has reinforced the importance of cash management. Of course, cash management is paramount in business operations and our personal lives. Yet, there appear to be two strong views about cash from two different perspectives.

In the business world, cash is king.

In the investment world, cash is trash.

But... are these two views really that different? Or, do they contradict each other?

Keep reading to demystify these two perspectives as we uncover the true 'cash king'. We also dig into:

- The meaning of 'cash is trash' in the investment world

- The meaning of 'cash is king' in the business world

- Identifying the strength, worth, and health of a business

- Why cash flow is the real king

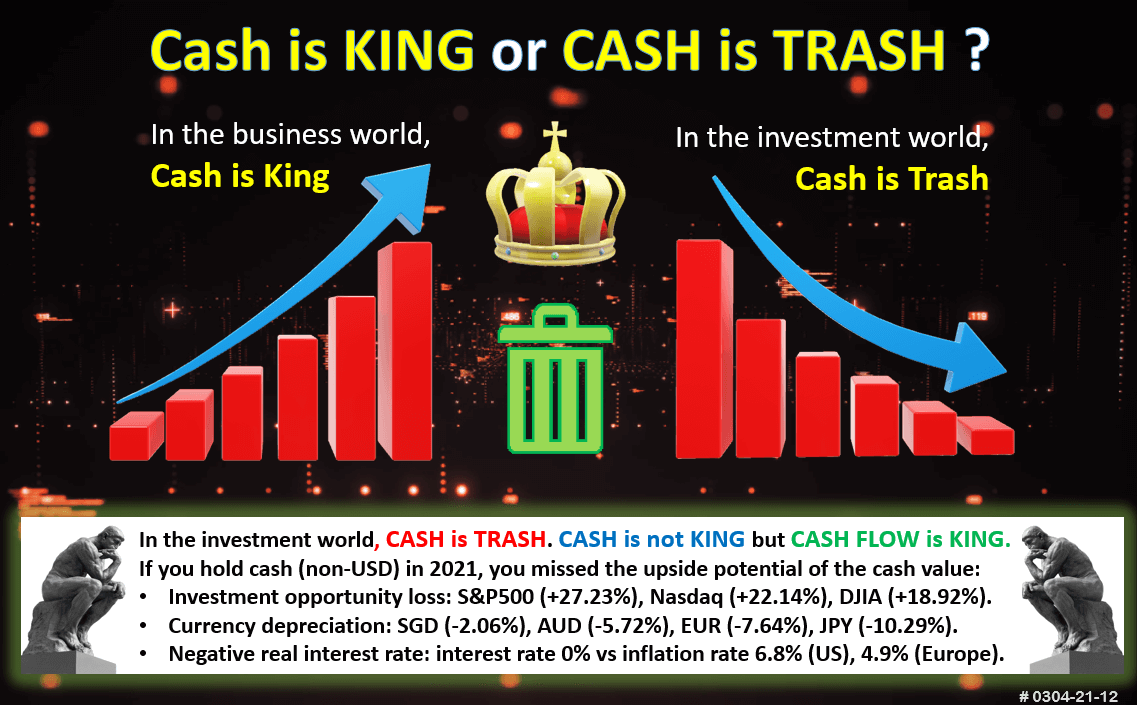

CASH is TRASH

In the investment world, cash is trash. It has always been the case for almost one century since the Wall Street Crash, also known as the Great Crash in 1929 (escalated by the Great Depression).

The Great Depression began in the United States in the summer of 1929 and continued until early 1933. Real output and prices fell precipitously. Between the peak and the trough of the downturn, industrial production declined by 47%. And real GDP fell by 30%.

Despite the severe economic impacts during the great depression, if you were holding cash and waiting on the sideline, you were holding “trash.” If you stayed invested in the stock markets, you would have reaped the benefits in the medium term and for sure in the long term.

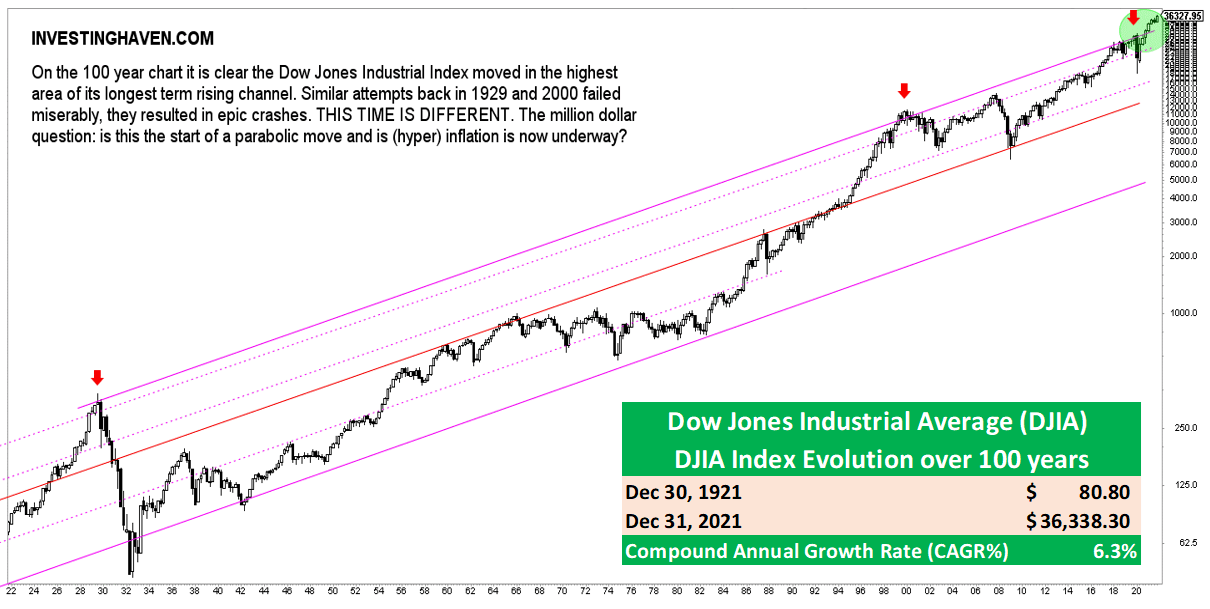

History has proven this to be true as you can see in the 100 years DJIA historical chart below, where the DJIA index logged in CAGR (Compound Annual Growth Rate) of 6.3% over 100 years.

It is true that in the long run, we all die. If one hundred years seem too long, let’s zoom into these last one or two years during the Covid-19 pandemic crisis.

As you are fully aware, interest rates in most developed economies (US, Europe, Japan, etc.) were close to zero or below zero during these two years (2020-2021).

If you were to hold cash, the purchasing power or the real value would have eroded due to negative real interest rate: interest rate at 0% vs inflation rate in the US (6.8%), Europe (4.9%), UK (5.1%).

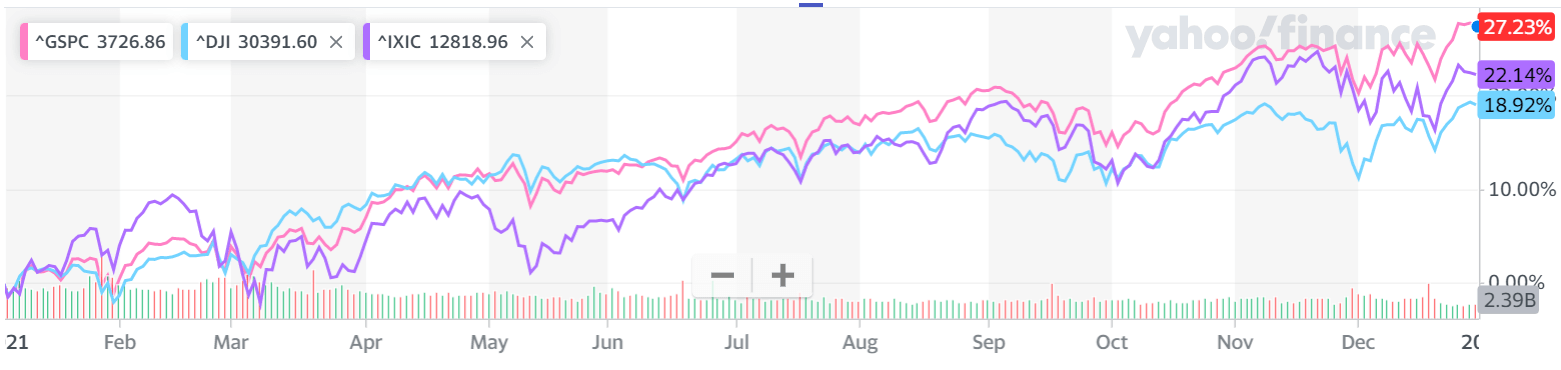

However, if you were to stay invested, you would be able to beat the inflation and also increase the overall value of your wealth.

As you can see from the following one-year chart, if you were to stay invested passively in 2021, you would have gained +27.23% (S&P 500 index), +22.14% (Nasdaq index), or +18.92% (DJIA index). By the way, STI Singapore closed at 3,123.68 (+9.84%).

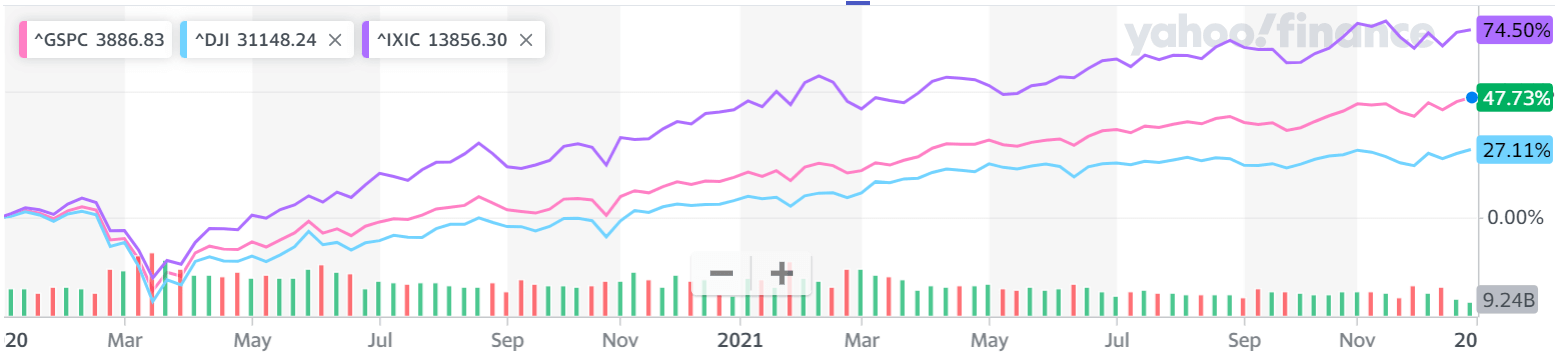

If you were to stay invested passively for two years (2020-2021), you would have gained a lot more with +47.73% (S&P 500 index), +74.50% (Nasdaq index), or +27.11% (DJIA index) as you can see from the two-year chart below.

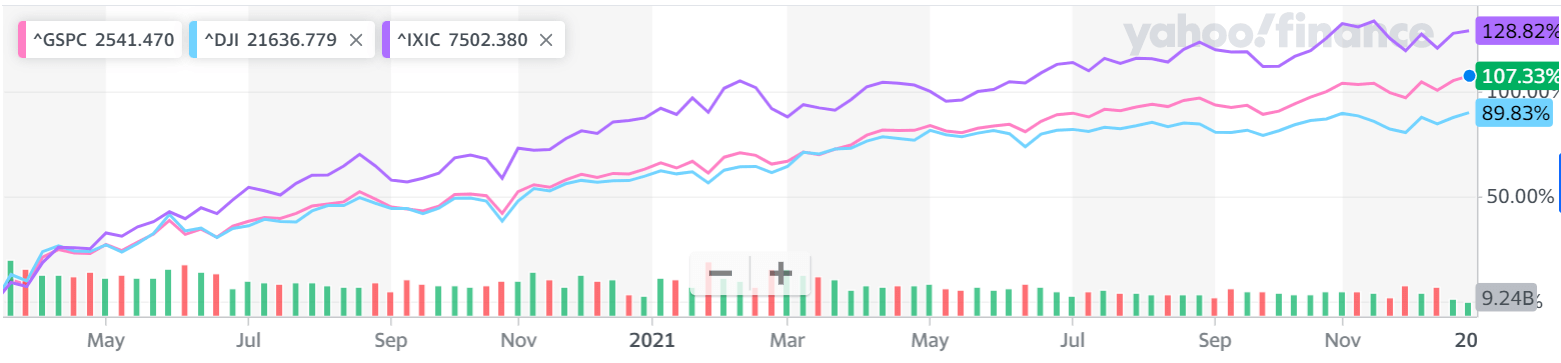

By the way, if you were to buy at the lowest dip in the pandemic on March 23, 2020, you could have double your gains compared to entering the market on January 2, 2020, with +107.33% (S&P 500 index), +128.82% (Nasdaq index), or +89.83% (DJIA index). Of course, it is impossible to time when to enter the market.

"Investment is all about time in the markets not timing the markets." - Tjendra Halima

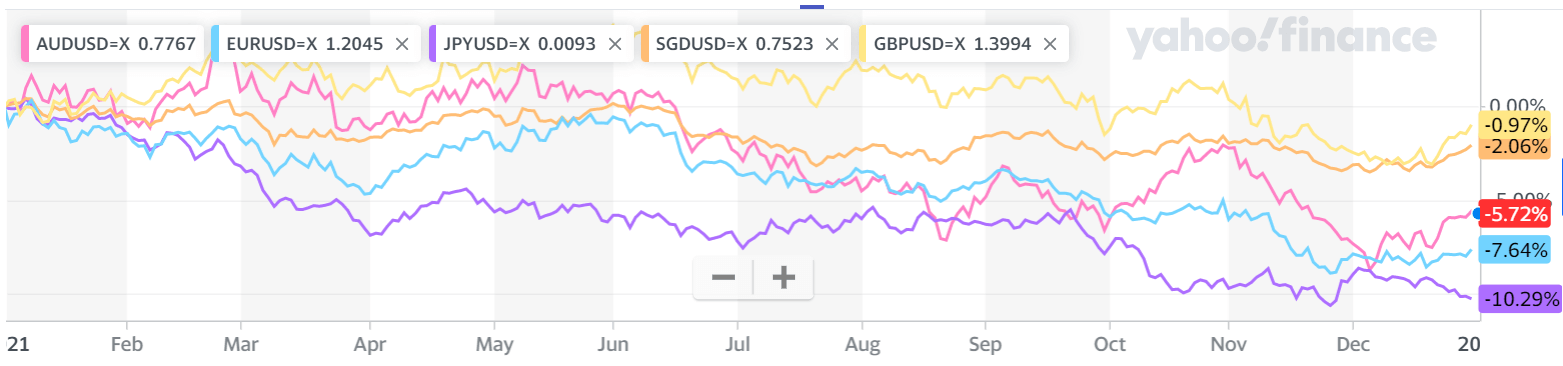

The above illustrations are for the USD-based cash holders. If you were the non-USD-based cash holders, you might have lost even more due to the depreciation of the non-USD currencies.

As you can see from the chart below, all major currencies had depreciated vs USD in 2021: GBP (-0.97%), SGD (-2.06%), AUD (-5.72%), EUR (-7.64%) and JPY (-10.29%).

In summary, if you were holding non-USD cash and staying on the sideline, your losses consisted of opportunity loss from not investing, the depreciation in non-USD currencies, and the impact of negative real interest rate due to high inflation.

This is the reason why we always hear “Cash is trash” in the investment world. However, we also heard that many investors got burnt by investing in the stock markets. Again, it is all about time in the markets rather than timing the markets. You cannot out-smart the markets.

Please remember that past performance is not necessarily a guide to future performance or returns. Don’t put all your eggs in one basket.

CASH is KING

In the business world, cash is king. Cash is the lifeblood of a business. It has always been the case and now becomes paramount for business owners/business leaders and their finance team during this uncertain time.

The Covid pandemic crisis presents unique challenges and put many organizations to a hard stress test on their financial resilience. The cash and liquidity needs are now a critical priority and an essential part of any business survival plan.

The STRENGTH, the WORTH, and the HEALTH

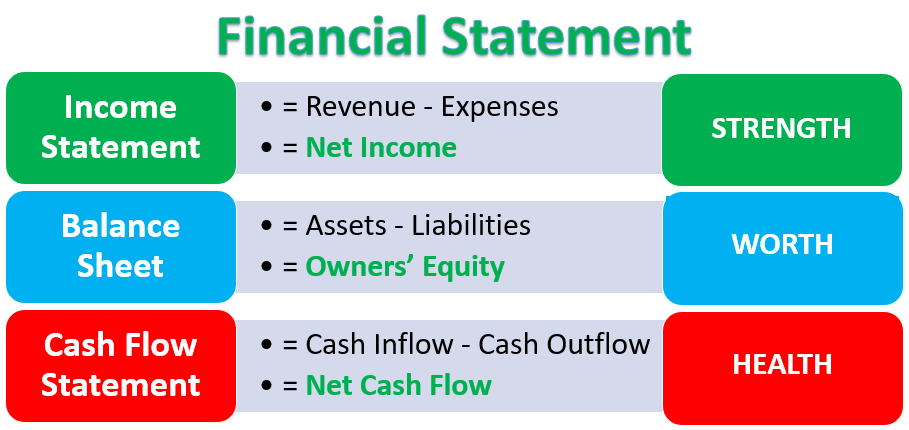

The financial statements convey the business activities and the financial performance of a company. These statements are used by investors and creditors to evaluate a company's earning power, worth or value, and financial health.

The three major financial statements are the...

- Income statement

- Balance sheet

- Cash flow statement

All three measure the strength, worth, and health of the company:

Cash flow Statement

Cash management encompasses how an organization manages its operating activities, investing activities, and financing activities. This information is in the cash flow statement. The cash flow statement is normally published by the finance department.

A company’s cash flow is tied to its...

- Operation activities (the revenues, the costs, and the expenses)

- Investment activities (the sale of capital assets, etc.)

- Financing activities (debt or equity funding, shares buyback, the retirement of debts, etc.)

A company needs to generate adequate cash flow from its business to cover its expenses, repay investors, and expand the business. Poor cash flow management can lead to excess debt and even bankruptcy.

"In the same way that blood pumps through the human body to keep it alive, a healthy cash flow is critical for the survival of the business." - Tjendra Halima

A company needs to generate adequate cash flow from its business to cover its expenses, repay investors, and expand the business. Poor cash flow management can lead to excess debt and even bankruptcy.

Balance Sheet

In addition to generating cash from its activities, a business also needs to manage its cash position. This is essential to ensure it holds the right amount of cash to meet its short-term and long-term needs.

There is always a balance between having too much cash on hand and having an inadequate cash supply. On one hand, if a business is too conservative and stockpiling idle cash, it misses out on the opportunities to invest, grow, and generate additional profits. On the other hand, if it does not have an adequate cash supply, it will have to borrow money and pay interest or sell off other liquid assets or investments.

The company’s balance sheet is where we can find relevant information to do proper cash management. Some basic financial analysis that use ratios such as acid-test ratio, current ratio, debt-equity ratio, debt service ratio, etc. provides an idea of the financial health of the company.

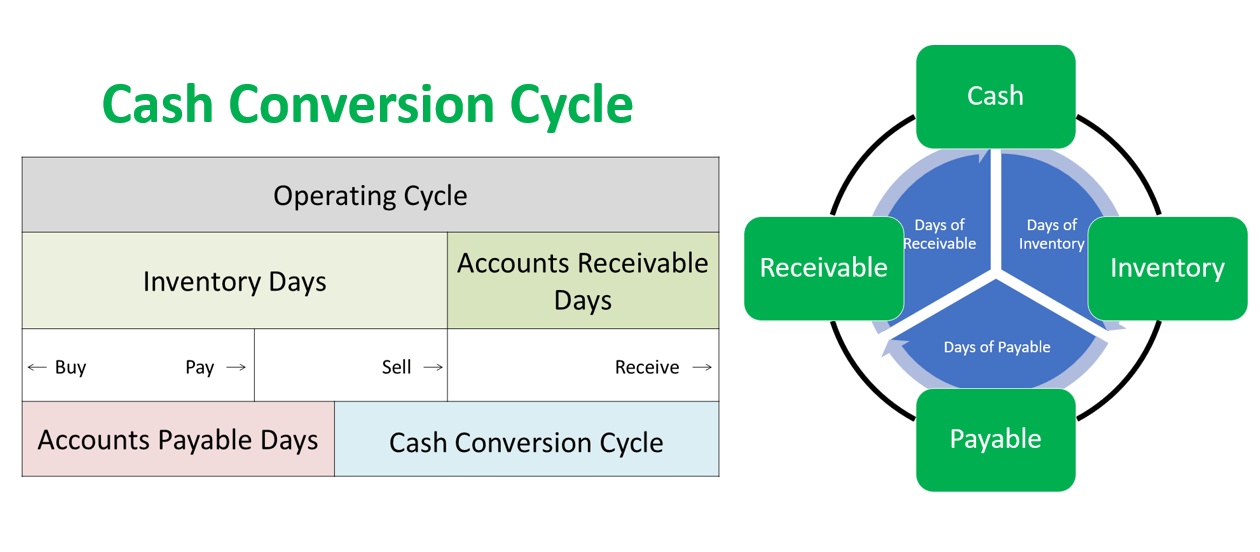

Important areas that offer possibilities for better cash management include accounts receivable, accounts payable, and inventories. The analysis of the cash conversion cycle by incorporating DIO (Days of Inventory Outstanding), DSO (Days Sales Outstanding), and DPO (Days of Payable Outstanding) can help to provide a better understanding of working capital and to come out with action plans to shorten the cash conversion cycle.

Income Statement

An income statement or P&L (profit and loss) statement is a financial report that shows a company’s ability to generate sales, manage expenses, and deliver profits. It is prepared based on accounting principles that include revenue recognition, matching, and accruals, which makes it different from the cash flow statement.

This is the most important statement but also the most prone to manipulation to show better than the real business performance. Most of the information in this P&L statement is used in calculating the performance bonus payout and in the share price valuation by the analysts and investors.

Profits may not tell the whole picture since a company can fudge its earnings and find ways to make its performance look better. But its cash flow provides a better reflection of its real financial health and true wellbeing. Cash flow never lies.

Cash flow management is not so much about revenues and expenses, it is about the movement of cash throughout the end-to-end cycle of a business operation.

CASH FLOW is the KING

As we had seen in the above discussion, cash is considered trash in the investment world, and cash is considered king in the business world.

But are there contradictory views?

If we don’t have the cash needed on hand, then we need to find that cash. Hence, cash is king. However, if we have idle cash or excess cash on hand, then we need to find a way to grow that cash by investing, directly or indirectly, into the marketplace to generate continuous cash flow and drive the appreciation of cash value.

KEY TAKEAWAYS

Depending on the circumstance, CASH can be KING or TRASH. However, continuous positive CASH FLOW is the eternal KING.

"Cash is NOT King...

CASH FLOW is KING" - Tjendra Halima

Want to be the first to know about new blog posts, podcasts, upcoming events, reports, and industry news? Subscribe to the Finance Alliance Fix newsletter today!