Ilana Esterrich, former Chief Financial Officer at American Coatings Association, gave this presentation at the Chief Financial Officer Summit in January 2023.

Whether you started your career in accounting and auditing, came into finance through operations or management consulting, or made a career change from a non-financial profession, we can all agree the nature of our work has changed.

Doesn’t matter if you started your career way back in the days of flip charts which then became PowerPoint, or multi-column ledgers which evolved into Lotus 1-2-3, and eventually into Excel. Or whether you started much, much later in the automation and digitization era, our work is evolving away from the merely technical, which in large part is automated, or in the process of being automated, and is transitioning into work that relies on strategic thinking and people skills.

These are two things that aren't always taught in undergraduate and graduate business programs or tested for on our various professional certification exams.

Increasingly, companies are looking to their finance leaders and teams to be agile, cross-functional business leaders with a broader skill set than just closing the books, preparing financial statements, and completing audit requirements.

Today's financial professionals are increasingly being asked to adapt and embrace a changing operating model that’s responsive and ready to adapt, embrace the automation of traditionally manual processes, and invest in new skill sets to provide useful analytic insights and strategic guidance across an organization at multiple levels.

The bottom line is that finance is shifting from tactical to strategic.

- What sets the modern finance professional apart from the old-school, traditional finance professional?

- How does the finance function move from static, rearview reporting work to a fast-evolving, highly effective source of competitive advantage?

- And how do we move from being a cost center to being a value driver?

Let’s find out…

Where does finance fit in?

Finance has a fundamental advantage that gives us more than a fair seat at the table:

- We have access to financial and non-financial data.

- We have strong analytic skills.

- We can see across the entire organizational value chain.

- We have business acumen.

But let's look at the progression of finance and accounting using a high-performance vehicle as a stand-in for our enterprises.

First, we look out the back window. These are our financial statements, our tax statements, and other statutory reporting documents. This is basically: how did we do in a past time horizon?

Back seat drivers

We're in the back seat giving advice and making recommendations to the driver. This makes us the prototypical backseat driver. Not everyone enjoys being those or even being on the receiving end of those.

We’re checking the fuel situation and kicking the tires. Do we have enough cash to meet our goals? Do we have enough fuel in the tank to get where we want the organization to go?

Are we in the right vehicle to begin with? In the same way you wouldn't take a Lamborghini off-roading, we should be asking ourselves, Does the infrastructure, tools, and human resource we have support the strategy and objectives of the organization? Are we using the right vehicle for the road or path we’re on?

We're also checking out the GPS. This might be a mandate set by our shareholders or in the case of not-for-profits and associations, our boards of directors. Where are we going? Did we get where we needed to go? And what course correction, if any, is needed?

Taking the front seat

More and more often, we're being invited from the back seat to sit up in the front passenger seat to navigate with our CEOs.

This means we can also keep our eye on the front windshield to check for the proverbial potholes, speed bumps, and other obstacles in our path, as well as look up through the sunroof to anticipate future impacts that will require adjustments to how the vehicle is being driven, such as impending inclement weather.

In this example, that might include things like growing interest in DEI or diversity, equity, and inclusion, ESG initiatives, the demand from consumers for extended producer responsibility, post-pandemic/return to office impacts, changes in market behavior or the stock market, or product features demanded by our customers and other future factors which just cannot be ignored.

The finance spectrum

There's nothing inherently wrong with the way finance departments have worked in the past, but there's no way to stay status quo and be able to adequately serve the needs of the company of the future.

The most valuable CFO competency today is knowledge, or how to transform finance from operating as a hindsight-looking, spreadsheet-driven accounting and reporting center, to a value-added, top-line, and forward-looking predictive hub.

And we can't do that without strong skill sets in the basics.

The basics

These are table stakes, and we can't move forward if these don't exist.

CFOs and their finance and accounting teams need to be firmly grounded in the basics of the profession first, such as financial reporting, accounting and controls, treasury, capital markets, budgets, and forecasting. But we’re moving away from only being the holders of the purse strings, the keepers of historical records, and the proverbial bean counters and coin stackers.

These skills require context, however, so finance teams of the future need to know how their business works, who the key players are in and out of the company, and be aware of broader economic market conditions.

We’re moving from being holders of the purse strings and keepers of financial records, and are now future-focused strategists who are capable of providing guidance and data-driven business insights for businesses that need them most.

This means adopting a horizontal mindset, where there's a more direct collaboration with other business units beyond the traditional boundaries of the CFO's office.

That might mean getting on the ground with manufacturing and walking a production line or production center to understand how your products are made, understanding the ins and outs of the sales and marketing teams, getting a feel for the R&D area and what drives decisions in product development, and understanding firsthand what customers want.

It also means understanding and addressing what keeps leadership across the entire enterprise, not just your CEO, up at night.

Let's automate what can be automated, wherever consistency can be implemented, or errors avoided.

Automation

These days, what can be automated is pretty significant thanks to systems, software, RPI, artificial intelligence, etc. If you don't know what solutions are out there, professional conferences, in-person and virtual, are a great way to learn what's in the marketplace, and what’s perfect for your team or organization.

The first step in establishing a data-driven culture is to increase automation and let software handle back-office, transactional jobs. This allows greater human focus on strategic initiatives and advanced analytics.

Upgrades to a company's accounting and finance software may be required, and this can be scary for so many of us. But it’s time to move away from outdated legacy systems and a reliance on spreadsheets by adopting new automation technology that makes the accounting process as effective as possible.

An average finance team spends about 70% of their time trying to do their job, whether it's collecting, assembling, recording data, or creating spreadsheets, and only about 30% of their time providing actionable, data-driven decisions to support the organization.

The application of ERP systems, automated business intelligence analytics, and artificial intelligence will liberate finance professionals from monotonous, error-prone manual tasks, enabling them to make impactful decisions that could add value across the organization.

This will help shift resourcing to 30% doing the monotonous and tedious work, and 70% on the value-added work that helps with impactful data-driven decision-making.

Analytic capabilities for business partnering

It's time to move away from a focus on historical data only and shift to the utilization of real-time analysis, predictive modeling, and forecasting that helps businesses see around corners rather than just looking in the rearview mirror.

Instead of, “Where did we land the plane last year?” We ask, “Where do we anticipate landing the plane on 12/31?” Or whatever your fiscal year-end date is. And what are the implications for the next year?

In the digital world, data flows everywhere in the business. Finance needs to collaborate and build relationships to gain access to all of that data.

Not only does the CFO have to understand how this process works, but they also have to train other departments on how the data works and how to properly interpret it.

The CFO should be so familiar with the data that it's treated as if it's just another component of the decision-making process, another member of the team. This means increasing collaboration and relationships across the entire enterprise spectrum and not just within the CFO functional area.

Future looking

To be clear, the CFO’s job is not going anywhere. CFOs will only be at risk in the future if they fail to understand how data can be used and how to interpret it to make the very best decisions for the business.

We want to treat the organization like it's yours, essentially, and then invest in the people, skills, and capabilities that are most needed by your organization. That means upskilling, reskilling, and hiring for new and missing skill sets.

A fresh perspective on the office of the CFO

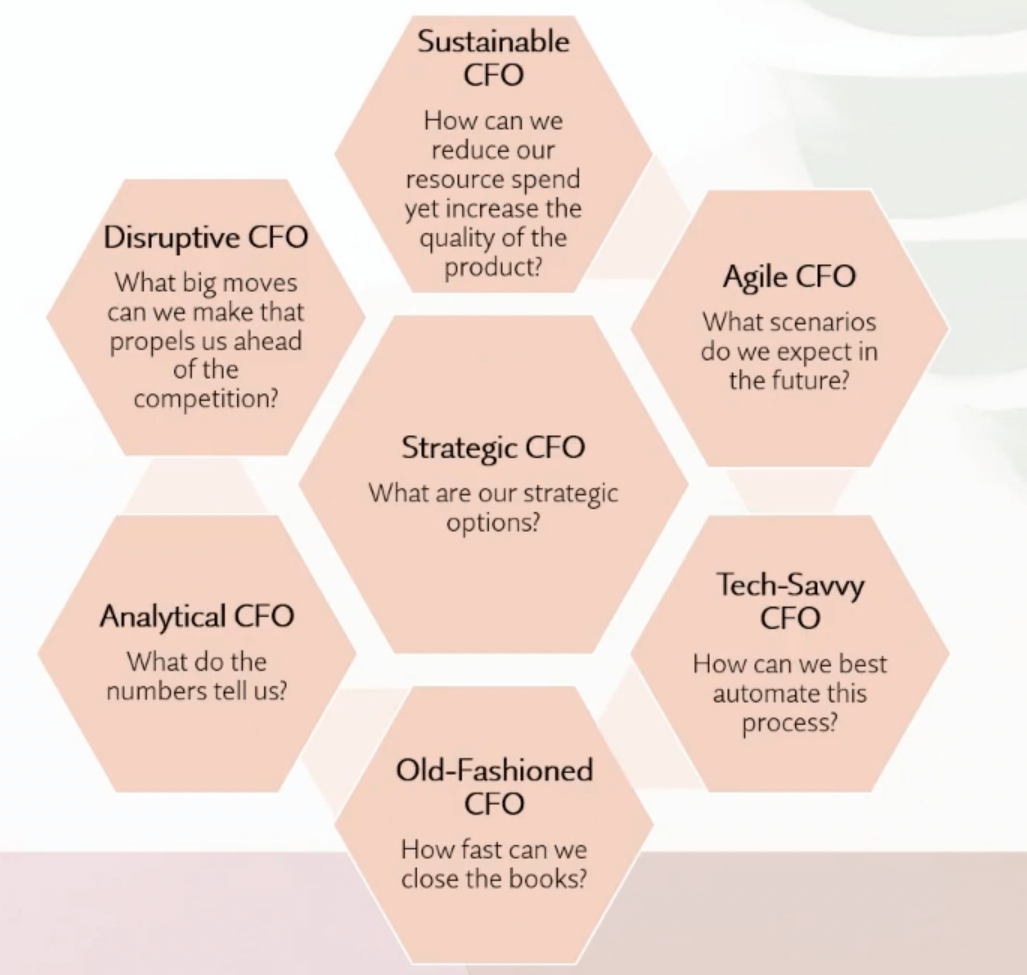

I mentioned table stakes earlier, the table stakes of the profession. Here they are, the old-fashioned CFO and the analytic CFO. Let's move on to the next set of competencies or what other capabilities we need to be developing.

We want to be tech-savvy and agile, so what scenarios can we expect in the future?

We also want to be disruptive and sustainable, so what big moves can we make that propels us ahead of the competition? And how can we reduce our resource spend yet increase the quality of the product?

And what rounds all of this out? Strategic. The capstone of this future-focused CFO is the ability to be strategic.

Essential skills for future finance

I've talked about the overarching concept of the future-focused CFO. Now, let's talk a little bit about the tactical specifics of the future-focused CFO.

Hard skills

Strategic partnering is about serving as an equal, active member of our respective leadership teams and being a key partner in the development of the organization's strategic plans.

Operational business partnering is about partnering with organization leaders across the entire corporate spectrum to provide timely, relevant analysis, benchmarks, and business insights that inform business decisions to drive profitable, common-sense growth.

We seek to support the innovation process without squashing it. The skills here include developing workarounds, operational alternatives, and plan Bs.

This is why I often explain that our role is shifting from ‘CF no’ to ‘CF go,’ or at least ‘CFO will find a way.’

Financial planning and analysis is about developing long-range and alternative scenarios, recommending actions for operational improvements, managing performance dashboards, tracking changes in KPIs and other metrics and measures, providing leadership with support for ongoing business, and developing new growth opportunities.

The skill set here ranges from being able to provide standard compliant reporting, being accurate and timely in using advanced analytics for unbiased forecasting, and long-range modeling, and being able to predict future events.

Then we have M&A, business development, and investor relationships. Risk management can include modeling the future using advanced techniques such as predictive analytics and Monte Carlo simulation to have a probabilistic conversation with the business on its high and low scenarios.

And finally, we have board/stakeholder relationship management. But let's talk about some that we as a profession may not be as strong in, but will be critical for success.

Soft skills

Building elite teams includes recruiting, training, retaining, and developing top-quality talent to ensure high performance and productivity, to maintain business continuity as staff develops up and across an organization, or unfortunately sometimes out of the organization. The emphasis should be on integrity, accountability, and transparency.

Hire the very best and give them the cultural and organizational safety to do their jobs. Make recommendations for becoming faster, better, more efficient, more effective, and the trust that allows them to give you feedback. Train and develop these resources to keep them.

There's a quote attributed to Sir Richard Branson, the British billionaire Founder of the Virgin Group, that says:

“Train people well enough so they can leave, but treat them well enough so they don't want to.”

I'll follow that up with a quote from Henry Ford:

“The only thing worse than training your employees and having them leave is not training them and having them stay.”

Sometimes, investing in your elite team means your team members get promoted up and maybe out to other areas. But don't look at it as losing team members. Look at it instead as investing in people in a way that enhances the overall enterprise.

If you aren't doing this, you risk losing elite team members from your entire enterprise altogether.

As for ethical leadership, I shouldn't have to say too much on this because it should always be foremost and paramount. We’ll always do the right things for the right reasons at the right time. The numbers should never lie.

Communication skills include providing a clear, concise, and transparent message, both verbally and written, and using business terminologies to gain credibility by being able to simplify complexity when communicating an advanced analytics message.

This is the proverbial, what story do the numbers tell us? And by story, I'm not suggesting we tell stories and fables, but rather, how do we convert the numbers into plain English and concepts that can be used by our non-finance peers for action and direction?

How many times do we say, “Revenue X is down 6%,” and expect our non-finance peers to understand the relevance? Versus, “Revenue x is down 6% because of a new entrant into our marketplace. But with the launch of new feature Y in two months, we expect the revenue decrease to reverse by 20%. We’ll continue to work with the sales and marketing team and will have an update at our next quarterly meeting.”

The difference here is just dropping numbers and various percentages, versus showing the organization that we‘re fully looped in and collaborating across the entire management spectrum.

Change management is a systematic approach to dealing with the transition or transformation of an organization's goals, processes, or technologies. The purpose of change management is to implement strategies for effecting change, controlling change, and helping people adapt to change.

The key here is the ability to communicate in written form and verbally, and often deciding when a meeting should be an email, and an email should be one or more meetings.

This is about communicating early and often in crafting communications that are adapted and appropriate to all levels and are specific to your key audiences.

Leadership and EQ skills

Then there's leadership and EQ skills. Leadership is the ability of an individual or a group of individuals to influence, guide, and motivate followers or other members of an organization to contribute toward the organization's goals. In other words, setting the vision and framework in a way that motivates the team to get there collaboratively.

It differs from management in that management consists of controlling a group to accomplish a goal. I don't believe they’re mutually exclusive. At the end of the day, we’re both leaders and managers. We have to manage people to accomplish what needs accomplishing in the here and now, the must-do's and the must-haves. But we can't do that and sacrifice the focus on the longer term.

Here, I'll use a quote from Steve Jobs of Apple:

“Management is about persuading people to do the things they do not want to do, while leadership is about inspiring people to do the things they never thought they could.”

By EQ, I mean the ability to understand, use, and manage your own emotions in positive ways to relieve stress, communicate effectively, empathize with others, overcome challenges, and diffuse conflict. I think we all found that to be a growing and important skill set during and after the pandemic.

Putting all of this together creates long-term value and increased relevance for the office of the CFO.