My name's Herber De Ruijter and in this article, I'll be covering topics around the fusion of traditional brands and SaaS business models with Fintech technologies from an emerging trend called embedded finance.

Keep reading to learn more about topics such as:

- The evolution of software revenue models

- How embedded finance has grown

- How embedded finance has impacted SaaS business segments

- The definition of a re-sell model and an embedded solution model

- An overview of incremental revenues

- Where clients and service providers want finance embedded

- How to integrate with Fintech

- Open banking and open finance

- How BaaS enables brands to embed complex financial products

Evolution of software revenue models

Let me first start with a bit of the evolution of the traditional revenue models for typical multi-enterprise software.

In the left corner, we all know we come from a world where things were licensed on-premise, perpetual license, one-time fee plus maintenance.

Moved into subscription models where most of the subscriptions were sold to the business themselves, the business was the entity the subscription was sold to.

Mostly, I would say today, more to different models, freemium, metered trials, and mostly unlocking the capabilities of a software package to an individual. I think we've seen all the solutions that we use each day there.

In the new reality, Fintech as an emerging trend standalone, there are a lot of, as you might know, Fintech companies doing tremendous growth. They're tying themselves or embedding their solutions within traditional verticals, typical applications, or SaaS applications just in general.

These products range from traditionally cars, payments, loans, bank accounts, and benefits (more on that in a moment). That's pretty much what we see on the horizon happening now.

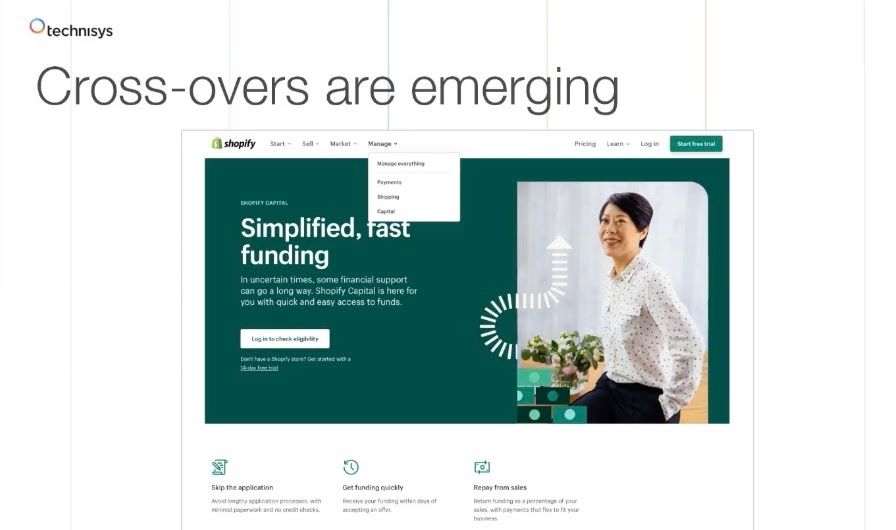

Cross-overs are emerging

This interesting cross-over is being made look here, for example, to Shopify, which recently decided to open up capital based on the insights they have on their clients.

As Shopify is processing transactions on behalf of the merchants they represent, they have a lot of information about how that business is going. And what they, for example, have proposed is that a merchant can use based on the information he has, his transactions or sales to pay off a loan, that the merchant might need to continue running his services.

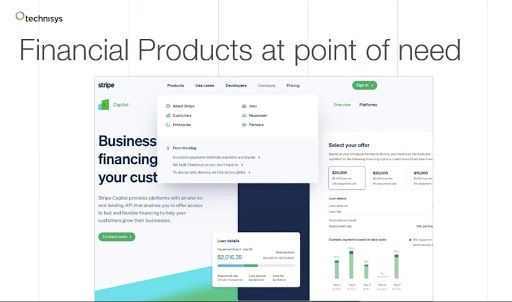

Financial products at point of need

If you look to, for example, Stripe. Stripe I think is an interesting one, because they really tied themselves into what they call the point of need. That means they tied themself as a product, an embedded product, at the moment the customer might need, for example, a loan.

At the moment of truth, when you're at the point of sale and you're short of balance, they allow you to opt-in for a microloan or a short-term loan, with various installments and payments.

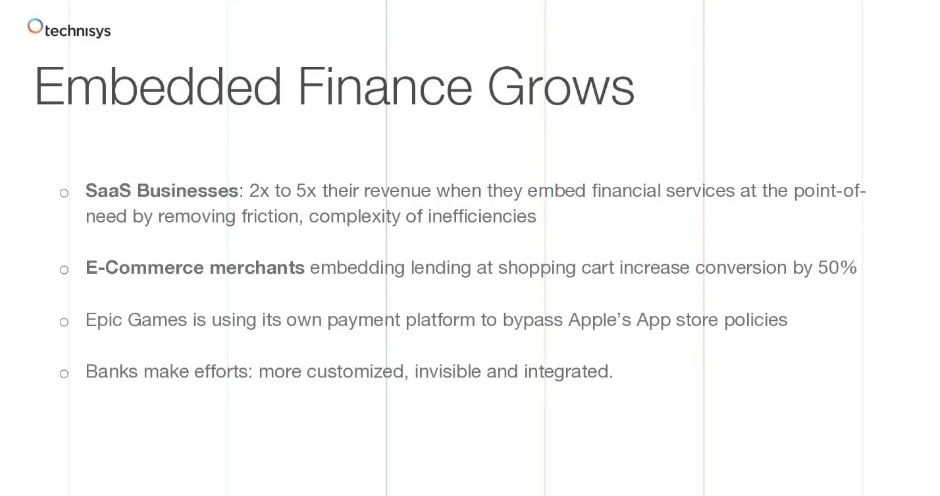

Embedded finance grows

The takeaway is we see embedded finance grow tremendously. The examples I've just shown you scratched the surface, these are just emerging and we see a tonne of applications and use cases coming on our radar quite soon.

What has been estimated is that if SaaS businesses, traditional software businesses will embed financial services at the point of need, or just as a part of the composition of their service or product they offer, their revenues can grow two to five times.

We've also seen that, for example, eCommerce merchants have been able to convert during the checkout process of their clients a conversion increase of around 50%.

That means people that want to buy something, not sure if they have the funds, tend to take a quick loan on that part and drive the conversion.

But there are also other use cases that are interesting. For example, Epic Games, and you guys have probably read about their struggles with Apple's App Store policy, they just decided to build or use their own, in this case, payment platform to bypass the tight policies Apple put on them.

So that's pretty much what we see as a landscape where on the other side banks are also not sitting silent. They realize that based on their traditional legacy distribution model and the way they operate the only way forward to drive new incremental revenues, is to become more customized.

And customization is not something they can do themself. On the back of the partnerships they form, they become a bit more invisible, they become more customized and more integrated. But more on that later, where I think the drivers really are in terms of the market momentum.

New untapped market for providers

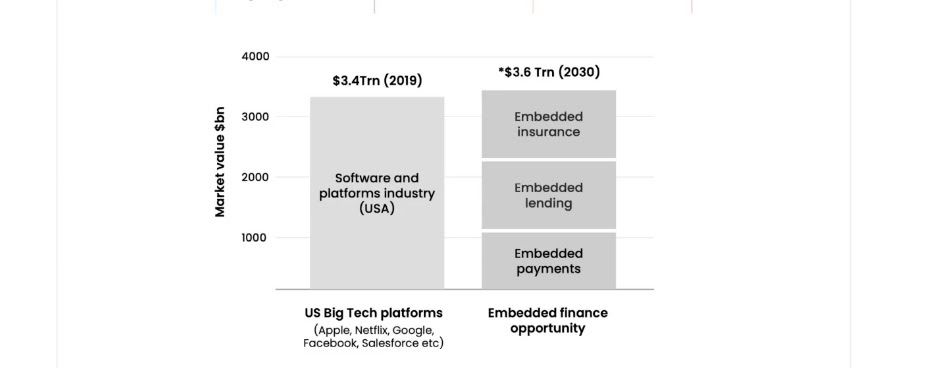

Let's start first on both sides of the coin. There's an opportunity for SaaS business models, and banks, but also an emerging market of providers, traditionally called Fintechs, or the big banks themselves.

If you look at the US market, the US big tech platforms last year did around $3-4 trillion in terms of revenue and market value. If we look at the use cases of embedded finance, ranging from insurance to payments, lending, cards, and so on, in 2030, we see a market that's equally that size, and that market has not been taken by anybody yet, including the bank.

It's pretty much I would say, a new market of incremental revenue for providers that provide a financial product or a service or an ingredient to their services to the market itself.

SaaS segments first: verticals

What we see is where it happens most intensely is on the vertical segments.

So if you look at the SaaS business segments, we have horizontal, or more generic solutions and verticals. The reason why we see the verticals going first or becoming early followers of this is that they have strong access to micro-segments.

That means areas where you need a bit more customization or specific financial solutions that are too complex for the banks to cover or not profitable enough to deal with. It's mostly those what I called fit-for-purpose software solutions, where the clients are quite sticky.

That means most of the customer base of a company that uses a vertical SaaS solution will consolidate mostly its needs or emerging needs around that suite of products. And they keep on growing, they go on to expand modules, use cases, and so on, they like to stick to one vendor who serves them best.

Various models

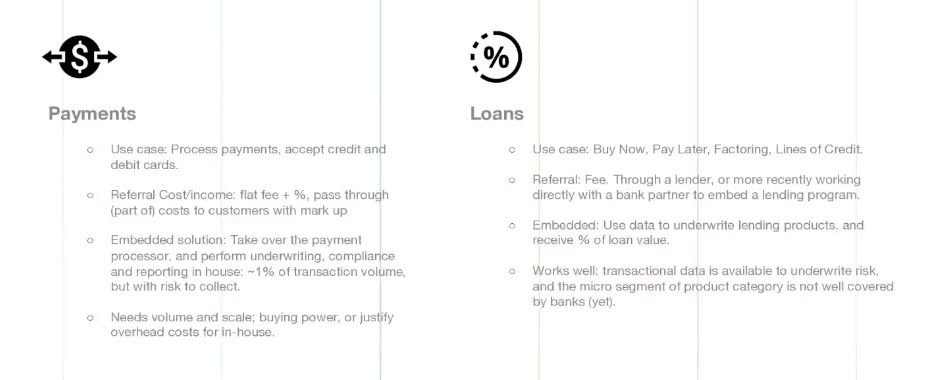

There's a variety of models we see emerging here. On the top, you'll see the various groups of financial products.

Re-sell model

There are pretty much two models we see emerging. One model is what we call the re-sell model. For example, for a loan, we pass the client through to Lending Club or Kabbage, they handle the loan, and so on. It's kind of a referral solution.

Embedded solution model

But the more interesting, the more compelling ones to attract, I would say, a new audience and create for a SaaS business in new markets is when the financial service is completely embedded into the customer journey or the task that the customer wants to do with your SaaS solution, where a financial instrument is needed, again, at the point of need.

Incremental revenues

We see incremental revenues in different shapes and forms. Payments are the oldest I would say, and the traditional model of PayPal embedding themselves into eCommerce sites is a well-known one. But in general, payments will evolve quite hard I would say in areas where, of course, payments need to be processed both credit and debit cards, or soon cryptocurrencies.

And the traditional model we've seen so far, with, for example, embedding PayPal and others have been paying a flat fee plus a percentage, you're passing through a part of the cost to the customers, we have a markup. Pretty much that's the model of how it works today.

What we see happening with companies like Epic Games, for example, they take over a big part, if not all of the entire payment process it means that also the risk profile goes up because they become responsible for getting the payments in and doing the collection part.

But in contrast, as I mentioned, also with Shopify, they're sitting on such a tremendous amount of data knowing the behaviors and the health and wealth of their clients. So they have a different way of how they can underwrite those risks.

Of course, the reward is a bigger percentage or a relatively high percentage, 1%, typically I would say of transaction for you will be added to the revenue stream. That's mostly quite substantial.

This embedded solution model, of course, causes overheads - you have to take care of regulatory compliance, and so on. Building an infrastructure, taking the risk. It's a model that mostly works very well if you have large volumes of payments, which means the SaaS business can shop around to the providers of the rails where the payments are being executed and getting there for better percentages.

Buy now pay later

On the long side, I think one of the most emerging trends is, for example, the buy now pay later model, instant factoring, or short lines of credits, which we see, for example, Goldman Sachs offering to the merchants on the Amazon kind of brand.

Other incremental revenues

Different models here too - referral and embedded, both seem to work very well.

Embedded has a higher conversion, higher usage, higher risk, but also higher reward.

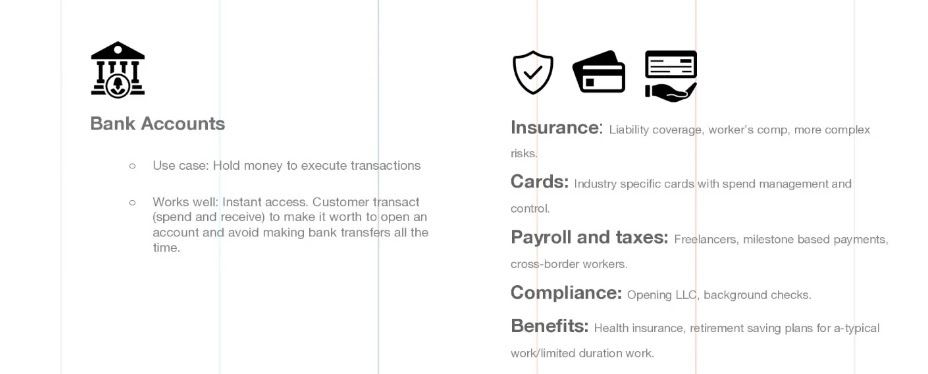

Bank accounts

Other areas are bank accounts, for example, Uber. Uber decided to enable paying their drivers five times a day based on the income they generated and therefore has a facility to move money in and out of this driver’s account.

Works fairly well when you're in a vertical or in a business model where there's a lot of money moving in and out for the user of your SaaS platform.

Other areas that relate back to the micro-segments that the vertical SaaS providers or brands are quite active are what those verticals have most in common they have very special needs.

Insurance

For example, on the insurance side, liability, coverage, workers comp, in for example areas or industries where there's a lot of risks or distinct risk, where insurance companies stay away from it or it's overpriced because it's too much unknown or too specific, is an area of interest.

Cards

Cards which are tied to spend management and control, for example, for industries where people travel a lot. I once spoke with a pilot in the US Air Force who told me that if they would fly to a different country, they're carrying literally cash with them in one of the planes for when they need fuel, for example, to fly back with their fighter jets, and so on.

These are fairly specific needs for specific industries, where cards can play a role.

Benefits

The same thing on the compliance side on things like benefits and benefits is always an interesting one, for example, where health insurance is needed for people who work on small assignments.

Payroll and taxes

Or when money and payroll need to be released based on milestones, not once or twice every month but when they deliver something specifically to a client.

The funds considered their form of payroll being released is a very interesting application where Fintech and embedded finance address specific needs, taking friction out of a process where the banks don't touch them.

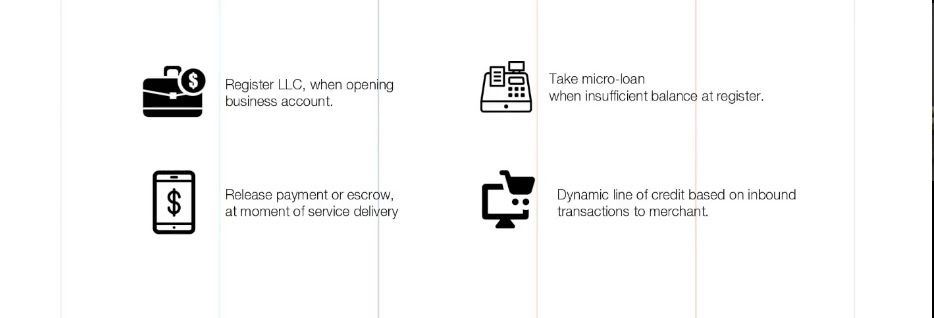

Clients want finance embedded at Point of Need: composite products

Just in general, clients want finance embedded the best way at the point of need, where you really need it, not something I have to plan for upfront.

At the moment, for example, I'm opening a business account, bank, or Fintech, take care also registering my LLC, for example, when I'm at the cache, I have to pay for my TV and I'm just short of the balance that I initiate a five or six installment microloan.

These are really the use cases where the conversions are relatively high.

Service providers, at different levels

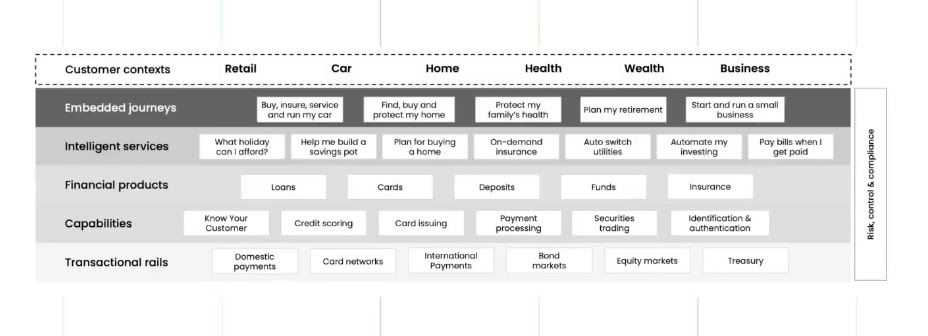

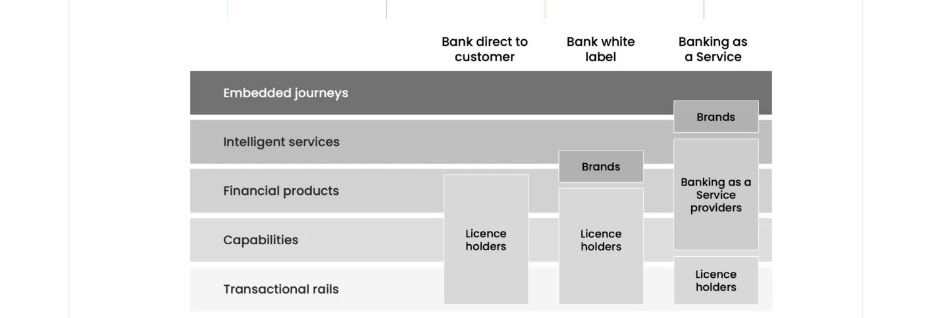

How does the playing field look or work? As you see service providers at different levels.

One thing, what's on top, and what's most important, is we have to start thinking in embedded or composite journeys.

That means something like, for example, I want to buy insurance service and run my car. It's pretty much covering the entire lifetime of moving myself around in a form of transport in this kind of car.

What you see is the intelligence is mostly at the touchpoint, the interaction point between that user or client and that service or that product, which is a combination, again, of a traditional SaaS product, and its embedded financial products.

That's pretty much where I think the value is, and where the micro-segmentation and customization really happens.

If you go down the food chain, you'll see that on a certain point, you need to have loan products or cards products, and so on. Within those loan products, you have different capabilities.

For example, if I want to sign up for a loan, I have to do a KYC check (know your customer check), or a credit score in seconds. These are all capabilities that today, I can find the different spots, or you have the data already, or the data is somewhere else available, including outsourcing the entire business process or sub-process within that financial product.

In the end, on the lowest level, you mostly need rails, you need infrastructure to process or execute the content section.

This is pretty much the entire food chain at different levels.

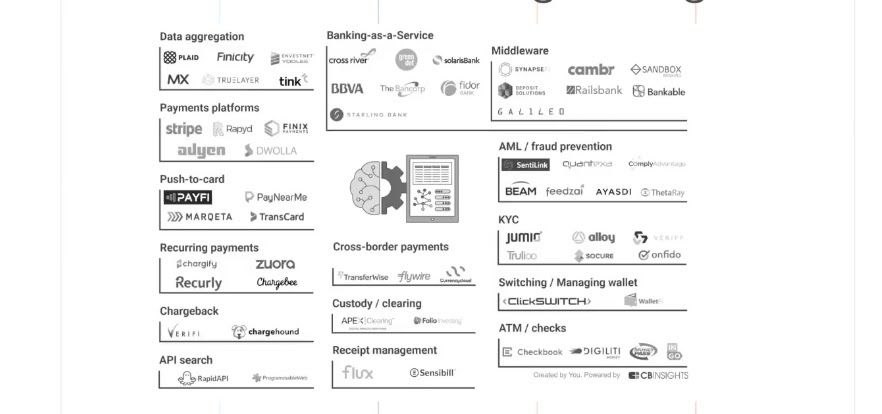

Fintech providers are growing

What you see happening is, not surprisingly, there's a lot of companies who find this as almost their holy grail.

You see the whole ecosystem industry emerging, which is now called Fintech. Or on the bank side, you see what they call banks offering banking as a service. That means the highly regulated complex products that you typically go to a bank for completely opened up accessible through APIs.

So you can tie those services into your SaaS application or into wider spread your brand with a variety of products you have covered through that breadth.

If you need a solution to say, I need to have access to my customers’ accounts for underwriting a risk. There are data aggregators for that part. If you need to have something, for example, that handles recurring payments, or things like eBills, and so on. There's a solution for it.

Pretty much for every ingredient or capability you want to provide as part of your suite of products, there's one or many solutions and vendors who are happy to provide that to you as a hatless capability.

That means it comes with APIs in a very standardized way. This is also the world like in industries, where the world is standardized on restful APIs, nicely documented authentication providers, it became a pretty standard world.

So it almost becomes plug and play, I would say. This enables people to just, for example, buy your own car, where you can buy parts from various places, you make your own design, you build something around those ingredients.

But you also need to have access to infrastructure, you still need to have to deal with the regulations, the road demands, and the laws demand, you also still need to driving licence.

All those things together, enable people to build in this case, their own car or their own financial services embedded in their solution.

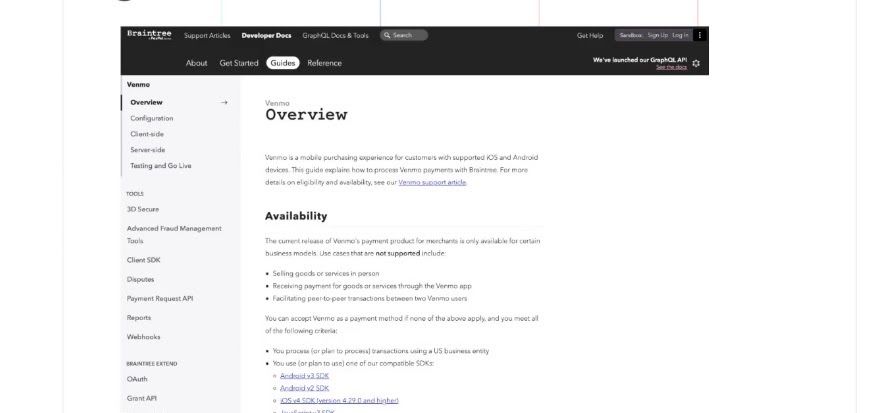

Integrate with a Fintech

As I mentioned before, integrating with Fintech in your progress is a very simple affair. These days, they all have developer portals, like every modern software product does these days, well documented, with sandboxes fully standardized.

Need for data: open banking and open finance

There's only one thing that is not commoditized yet, it's about if you build your own financial services, you want to know as much as possible about the clients you're going to onboard. So there's a high need for data.

There's a couple of initiatives around the globe that makes the process quite easy. One is open banking, starting with PSD2 in Europe, mostly, which was mandated by governments where the banks were pushed to expose that data, overlaid with an opt-in mechanism to protect privacy and where content is being used.

That initiative spread out through Europe and allowed people to get more control over their data or how their data is being used. Also, for example, as part of an underwriting process.

In the US it's a bit different - on the left-hand side, you'll find the US doesn't have that mandate on a domestic level, but you see the market is driving those initiatives now.

Traditionally, there were mechanisms, aggregators like Plaid, Teller, Envestnet, and Yodlee who enabled banks to get access to people's, for example, bank and transaction information at another bank, through an opt-in and login message.

A bit dodgy, I would say, the granularity on the consent that the user giving was kind of shaky, and the way those connections are made, likewise, through multi-screen spread.

Right-hand side, what we see emerging now are initiatives like open finance, underwritten by consortiums of banks, which tried to build an API ecosystem for read-only data.

That means both Fintechs or anyone else that needs that data, through an opt-in mechanism, from the owner of the data, of course, which is the consumer itself becomes more widespread.

Open banking globally

Open banking globally is not a new phenomenon by itself, it's pretty much spreading itself around the globe. There are many open banking-like initiatives.

A couple of ones to mention that are far ahead of the market are, for example, in India through UPI. Likewise, some forward-thinking use cases emerging in Singapore.

The banks themself are not sitting silently here. We're used to the banks as clunky closed ecosystems, and so on.

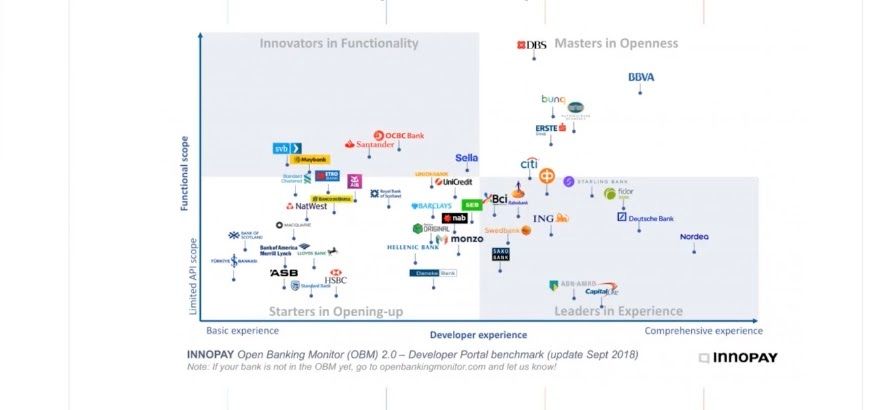

Banks facilitate integrations

But if you browse around and look on Google today for bank and developer portals, you'll see a lot of great examples where the banks have published their API's, enabling others to integrate the products and services they have in a typical traditional way, how we're used to integrating applications over the last five years or so.

We see also that most of the banks you find here, they're quite far, they not only tried to open up their endpoints to their services but also try to make that process as seamless and easy as possible.

State of developer experiences

I think the experience of a developer is quite nice these days on how easy it is to embed bank services into your own applications. But there's still a lot of complexities there.

BaaS providers abstract bank’s complexities

You see another category on the horizon, which is called BaaS providers.

What they're doing is they become the glue or aggregators between all the services that banks, a bank, or multiple banks provide and add the friendly layer on top of that, to make it even easier to abstract all the complexities, but also inserting or adding regulatory frameworks and abstractions to that.

BaaS enables brands to embed complex financial products

We see that BaaS, business as a service, enables brands to easier embed complex financial products.

Here you see an overview of some of the providers that are quite active these days, I think the US only has around 17. And we see almost all banks adding BaaS as an extension of new revenue streams and products, month by month.

Building and running a bank has never been so cheap

It even goes so far that if you want to build a bank on top of other banks, infrastructure, its services that it provides, it's never been as easy as today to build and run a bank themselves by just consuming the services of a BaaS provider combined with several Fintechs and as your own user experience layer on top of that.

Banks build marketplaces

The banks are not also waiting to be integrated. They also take an active role to integrate with others themselves. Here's an example of a challenger bank, a fast-moving bank Starling in the UK, and the variety of integrations they build.

They made sure they are well integrated into the embedded journeys of their clients. Mostly the more complex one in the business banking segment, where there's more expected what the bank should offer to offload the clients so the smaller medium businesses can focus on his business and less on the financial things that he or she needs to do.

What’s the motivation for the banks?

What's in it for the banks themselves? If you look at the trends, the recent trends, and even before the pandemic, there was something wrong.

Banks haven't grown, they've even shrunk and I think COVID just exposed more of the challenges they have, ranging from tighter margins, writing off more loans, dropped interest rates, and so on.

But in contrast, for example, in the same vertical around financial services, the Fintechs grew tremendously at that time.

The reason a very simple one. I think the Fintechs were better able to look to the embedded journeys, the points of needs, and solved market problems in a more tailored, integrated, cohesive, and user-centric way. And built and distributed their product differently.

Whereas the banks still run on their traditional lending and deposits model and stick to their distribution models. Although, as I just mentioned, that has changed since the banks are open to partner with other providers or owners of clients in a specific segment. That's hard to catch up for them.

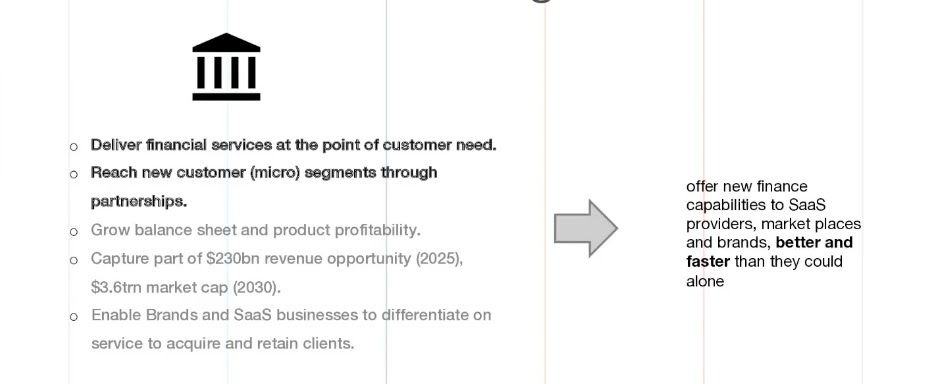

Where can banks still gain?

There's still a lot to gain for the banks here from their perspective, at least.

They're able, despite the limitation to deliver their financial products at the point of need, by partnering with interaction points that have access to those clients, and therefore reaching those micro-segments themselves.

We see it also back in the numbers because as I mentioned there, for example, in the US only around 17 or 18 banks have embraced the banking as a service model, which means they embed themselves into the value chain of others.

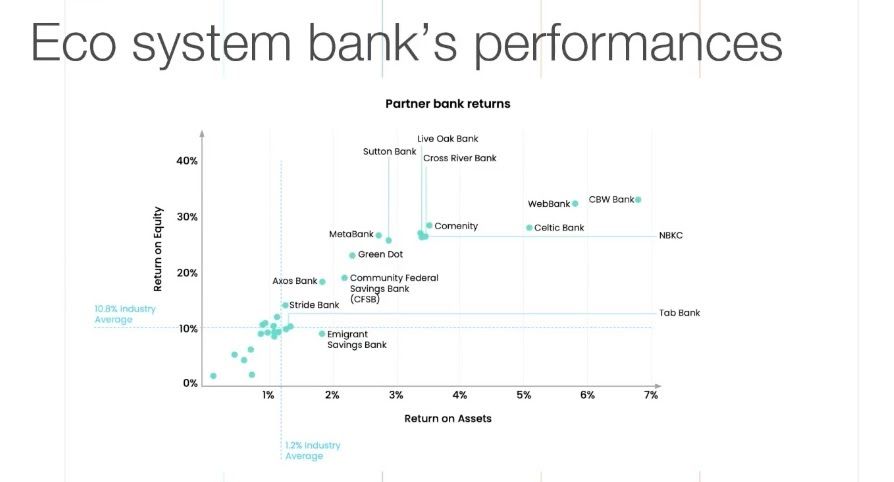

We really have seen that compared to the traditional banks that don't have a bank as a service or embedded finance in their strategy, those banks have a way higher return of equity and on assets.

All brands will embed finance

What we will see in the near future, is that traditionally, today still we have what we call the traditional brands that we all know, ranging from car manufacturers to retailers and so on.

Emerging today, the strong digital brands, but what we anticipate is that quite soon, in the next years, all brands will embed finance and have financial products embedded into their products.

We might even see a future that's almost like building a bank or a niche bank or a group of embedded or separate financial products that might even become as simple as opening up an online store.