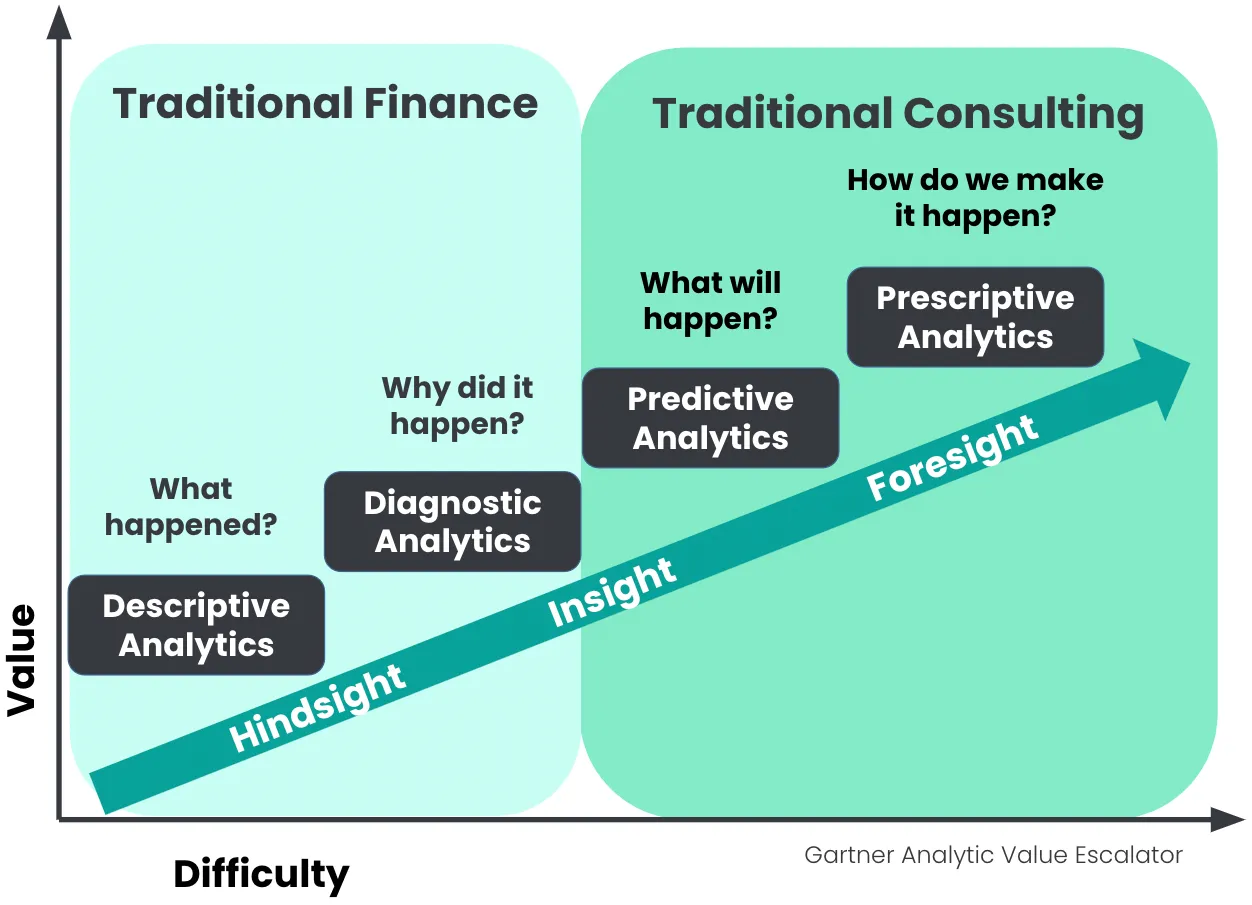

The Gartner Analytic Value Escalator (Perception)

FP&A has, until recently, been considered a back/middle office function. However, a few recent trends have thrust FP&A into the spotlight:

- Gartner’s Magic Quadrant recognition of FP&A.

- Broad adoption of FP&A as part of the go-to-market team’s competitive advantage.

- “Business partnership” appears frequently in job posts.

- Finance as an enablement function vs. a compliance or administrative function (ex. Deal Desk movement).

- An explosion of financial data in both size (number of rows) and scope (number of data sources).

- Financial data integration into R&D-owned production systems.

- Popularization of Revenue Operations, and the VC-funded marketing engines of their products.

Mysteriously, the in-house analytics have mostly remained focused on answering “what happened” and “why did it happen” (Descriptive & Diagnostic).

For decades, consulting practices have focused on Predictive and Prescriptive analytics (ex. pricing equilibrium models). However, organizations are often unable to execute the top-down strategies and recommendations provided.

With access to the underlying data sources required to perform deep analysis in-house, forward-thinking organizations attempt to apply consulting tools (ex. balanced scorecards, BCG matrices) to push the organization up the value escalator.

While often these efforts are focused, intentional, and executed with the full support of the organization, they fall short due to a fundamental flaw in the perception of the Analytic Value Escalator.

Reality of the Analytic Value Escalator

The difficulty in bridging the gap from Reactive to Proactive is due to an often-overlooked chasm. The chasm is represented by a gap in technology, personnel, expertise, information, data collection, and/or capitalization. With an understanding that this chasm exists, we can bucket the Gartner Analytic Value Escalator into 3 main phases: Reactive, Iterative, and Proactive.

The Reactive phase is well understood, and processes are often governed by regulated principles and procedures. Movement between Descriptive and Diagnostic Analytics is fluid and natural.

This phase is managed by leadership (Controller, CFO, etc.) all the way through individual contributors (Accountants, Analysts). A firm typically builds out a robust and well staffed organization to support these deliverables.

The Iterative phase is implemented by organizations wishing to understand their business on a deeper level, often due to missing targets, exponential growth, additional funding, or low gross margins.

The Iterative Phase is usually underfunded, often staffed by a single analyst with a focus on systems, or funded by broadening the responsibility of those managing the Reactive Phase.

In a standard Finance organization, the Proactive phase is typically owned by the Senior Leadership Team (SLT) with analytic support from contributors at all levels.

Objectives and targets are set using experience, and backed up by Descriptive and Diagnostic Analytics, ending with directives being established.

This is best illustrated by the standard implementation of an Annual Operating Plan – typically characterized by a once-per-year target set by management (or investors), followed by a series of modeling gymnastics performed by management and analysts to support the targets.

During this commonly practiced approach, there is no Iterative Phase, but rather an extension of Descriptive and Diagnostic Analytics applied to a Proactive state hypothesis. The team driving this (AOP) process is usually well-funded and staffed. Success with the AOP process gives organizations a false sense of a successful transition to the Proactive phase.

Understanding the Chasm

The Proactive State is typically visualized by the Senior Leadership Team members, translated into metrics, and pushed down to those managing Reactive Analytics.

The Reactive Analytics team then stretches the most versatile players to put the bare minimum processes and analytics in place to report on the SLT-defined metrics that matter. However, the SLT team is rarely aware of the assumptions and efforts taken by those tasked to deliver, often clouding the results. Further, those tasked to deliver are rarely fully informed of the original problem, making it impossible to anticipate future requests and, therefore, implement scalable processes and systems from the outset, leading to a high level of effort and further stretching of the team.

To make matters worse, the metrics are still lagging indicators performed by teams that often revert to the tools available to them (Reactive analytics). This leads to a large productivity stall in the Iterative Phase.

Signals you are entering the Iterative Phase of FP&A

Characteristics of FP&A during the 3 phases

Reactive Phase

- Focus on financial statement actuals

- Standard industry KPIs

- Informal planning cycle

- Excel-based system and models

- Manual processes with low automation

- Tribal knowledge and information gaps

- Minimal collaboration

- Basic allocations

- Minimal understanding of unit economics

- Small & simple data sets

Iterative Phase

- CFO, VP/Director, 1-2 FP&A Analysts

- Focus on Income Statement

- Company-specific KPIs

- AOP + Quarterly reforecasting

- Bridge systems, disparate data sources

- Semi-automated processes

- SOPs as primary documentation

- Business Partnership focus, but little true interlocking

- Ad hoc profitability analysis

- Basic understanding of unit economics

- Some data, poor quality

Proactive Phase

- Data-science driven FP&A organization

- Data-driven OKRs & KPIs

- Rolling forecasts with snapshots for plan(s)

- Integrated systems with high automation

- Integration with GTM teams

- Automated profitability analysis

- Deep understanding of unit economics

- Big data, ETL processes

Recommended approach to crossing the FP&A Chasm

Once we recognize that we are about the enter the Iterative Phase, we can plan accordingly. I call this the Iterative Phase because an organization doesn’t know what additional requirements and roadblocks will emerge until they’ve embarked on the journey.

For example, investing in a large system before gaining a clear understanding of data requirements, and unit economics, or before implementing a driver-based forecasting process, typically puts the Finance team right back into Excel for everything but the most basic storage and reporting needs.

I’ve found a successful approach is to recognize this period of uncertainty, get the team comfortable with it, and step through it using available systems and resources, followed by short-term bridge systems and scaling the team based on permanent requirements.

Take these six actions to successfully cross the value escalator chasm:

- Outline (document or brief) the Transformed State, and ensure you have the right team (internal or advisors) to help you chart the path to get there

- Document "What Constitutes Success" at each stage of the journey, and couple these with Primary KPIs

- See Y Combinator video on Primary KPIs, which is relevant for any sized business, but shapes the message for the team

- Ensure everyone in the organization understands what you are setting out to do, why you are setting out to do it, and recommendations for how you intend to accomplish the goals are sourced

- Don't enter into an implementation unless you have prototypes, detailed documentation, and clear success criteria for the post-transformation state

- See our blog on implementations for a breakdown

Originally appeared on analystintelligence.com

Ready to advance to the next level in your FP&A career?

Our FP&A Certified Core course is your gateway to becoming a leader in the finance industry. This course is specifically tailored to provide you with the insights and techniques used by top FP&A professionals.

Through a series of comprehensive modules, you'll learn how to harness sophisticated financial tools, perform impactful analysis, and deliver results that propel your company forward.

With our expert guidance, you’ll not only achieve certifications but also gain a competitive edge in your career.

Follow us on LinkedIn

Follow us on LinkedIn