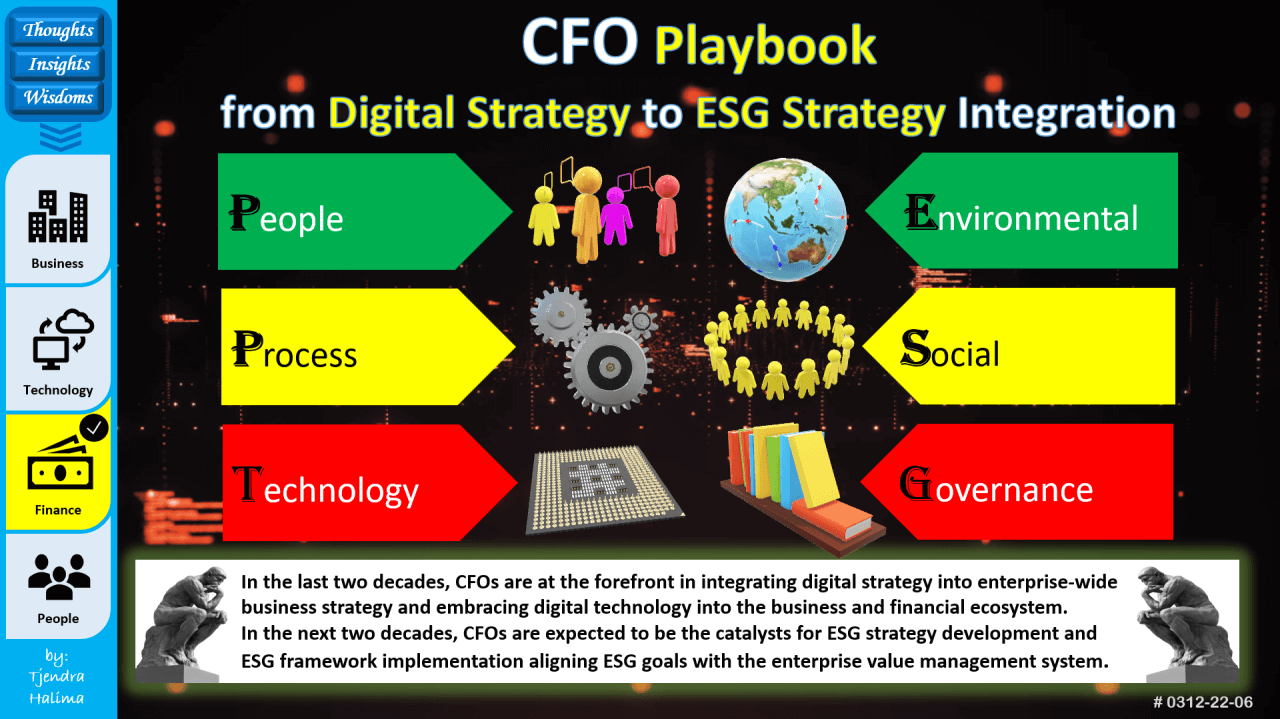

CFOs, as co-pilots of CEOs, are always the catalysts to drive business transformation and align visions and strategies across the entire organization.

In the last two decades, CFOs are at the forefront of integrating digital strategy into enterprise-wide business strategy and embracing digital technology into the business and financial ecosystem. Organizations that managed to ride safely through the wave of digital transformation had captured the financial, operational, and commercial benefits.

In the next two decades, CFOs are expected to take the lead in ESG strategy development and ESG framework implementation aligning ESG goals with the enterprise value system. Organizations that are focusing on ESG investment to create competitive advantages are also expected to capture the financial, operational, and commercial benefits. It's possible to do good things and still do well.

As a start, CFOs should assess their ESG maturity curve just like we assess the digital maturity curve when we rollout digital transformation. It's important to have a baseline to measure the progress of ESG adoption.

ESG is not an end in itself. ESG will impact business performance and finance resilience on how we measure, disclose, and report to the stakeholders to secure investments, engage customers, and attract talent in driving business performance.

Financial performance needs to harmonize with the desired contribution to the environment and society. Therefore, ESG reporting, disclosure, performance, and compliance will become an integrated part of the company’s financial reporting, performance management, and compliance governance.

It’s a matter of time before CFOs have to lead the deployment of a comprehensive and integrated reporting system that includes both financial accounting and sustainability disclosure. Soon, ESG performance metrics will be part of the monthly, quarterly, and annual financial reports.

ESG in a nutshell

The ESG acronym is new, but the concept is not. Triple bottom line (TBL – People, Planet, and Profit,) CSR (Corporate Social Responsibility,) and now ESG (Environmental, Social, and Governance) are all ways to assess the business from the perspectives of multiple stakeholders.

Below is a brief explanation of TBL, CSR, and ESG.

TBL (Triple Bottom Line)

TBL is a sustainability framework that incorporates environmental, social, and economic impacts into the value creation model by maximizing three bottom lines:

- People (contribution to the betterment of the employees and communities,)

- Planet (contribution to sustainability thru engagement in environmental-friendly activities,)

- Profit (generation of total economic profit to the society in addition to accounting profit.)

ESG (Environmental, Social, and Governance) was born after CSR (Corporate Social Responsibility).

CSR is about accountability whereas ESG is about the methodology that makes the CSR efforts measurable. In simple terms, CSR is the qualitative part and ESG is the quantitative part.

CSR (Corporate Social Responsibility)

CSR is the guidance that companies can follow to be socially accountable to themselves, their stakeholders, and all other audiences. It allows companies to be conscious of how their business can affect the world and society through the economy, the environment, and social interactions.

ESG (Environmental, Social, and Governance)

ESG criteria are more specific and actionable than CSR initiatives. The ability to quantify ESG efforts and present them in ways that are meaningful and understandable across industries makes ESG the most relevant and adopted option to evaluate and determine whether business operations are socially responsible to the world and society.

Driving force from the business community

The World Economic Forum in the January 2020 annual meeting has issued the white paper “Integrated Corporate Governance: A Practical Guide to Stakeholder Capitalism for Boards of Directors,” advocating a shift to stakeholder, not shareholder capitalism and calling for a realignment of business metrics to measure value creation to stakeholders not just shareholders.

This has rapidly developed and has now translated into actionable plans in the financial sector. The banks and financial institutions play an important role as the catalyzer in reorienting financial flows toward sustainable activities and supporting industries and governments in meeting their sustainability targets.

A wave of guidance and regulations have built up, making the ESG topic more tangible and actionable. This is a wake-up call to all organizations to integrate ESG into their business model, internal reports, and external disclosures.

Eco-conscious consumers, investors, financial institutions, policymakers, regulators, NGOs, and government bodies have been putting increased pressure on corporations and companies to adapt to sustainable business models.

In the past, a company’s standing in terms of ESG has often depended less on substantive practices and more on how good the company’s public relations department is. Today, it's no longer the case.

More institutional and retail investors have started to focus on ESG metrics when making investment decisions as there is increasingly more evidence that companies with promising environmental, social, and governance (ESG) metrics tend to produce superior financial returns.

The sustainability reporting ecosystem

The current financial system is an unsustainable economic model as it facilitates the movement of capital across the globe to evade control, maximize private profits and the expense of public values, and ignores structurally ecological and social values. However, public pressures are building up on tax evasion, executive bonuses, monster profit, etc.

A wide range of constituencies—including investors, companies, policymakers, regulators, NGOs, and civil society—use corporate sustainability reporting to inform a wide range of decisions. Disclosure standards and frameworks are the foundation of this reporting ecosystem. They facilitate the disclosure of comparable, consistent, and reliable sustainability information.

The Sustainability Accounting Standards Board (SASB) connects businesses and investors on the financial impacts of sustainability. SASB Standards enable businesses around the world to identify, manage, and communicate financially material sustainability information to investors. Today, ESG measurement is the most adopted option despite it being still under continuous refinement.

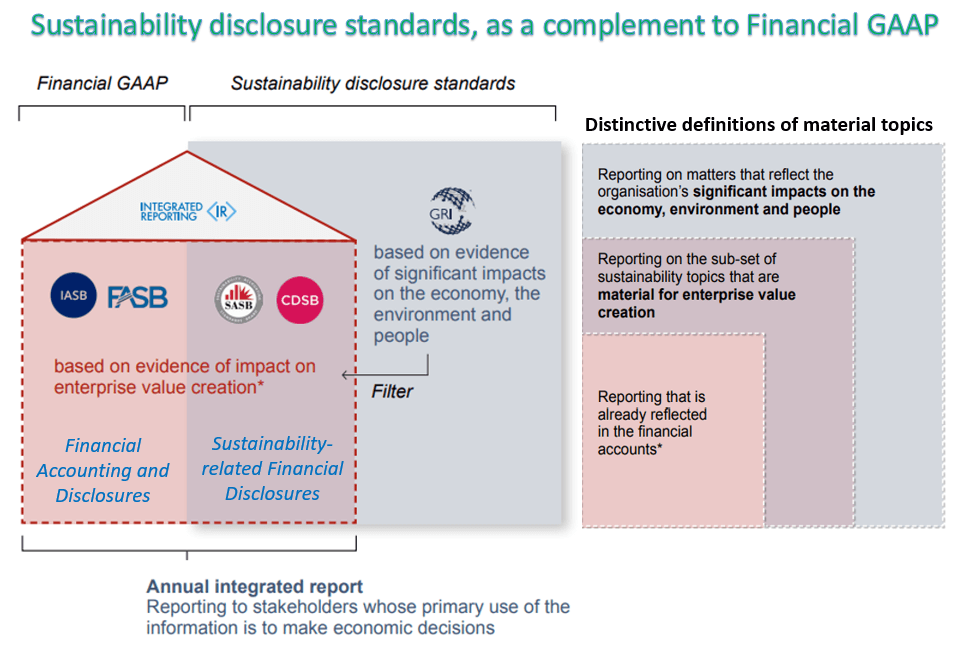

In September 2020, five leading framework and standard-setting organizations—CDP, CDSB, GRI, IIRC, and SASB—announced a shared vision for a comprehensive corporate reporting system that includes both financial accounting and sustainability disclosure, connected via integrated reporting.

The joint statement outlines how existing sustainability standards and frameworks can complement generally accepted financial accounting principles (Financial GAAP).

Here is the link to the Statement-of-Intent-to-Work-Together-Towards-Comprehensive-Corporate-Reporting

In December 2020, a prototype climate-related financial disclosure standard was published.

There's no doubt that ESG reporting is increasingly essential and even required. However, without definitive standards, sustainability reporting remains complex and a barrier to progress. Corporate disclosure on ESG is not just for the sake of disclosure. It should focus on materiality to avoid wasting the company’s time and everyone’s time on things that don’t matter.

Integrated Reporting (IR) = Financial GAAP Standard + Sustainability Disclosure Standard.

Today, ESG efforts are often ad-hoc, siloed, and manual with data scattered across disparate systems. CFOs have to lead the transformation to implement an Integrated Reporting (IR) system that connects financial, non-financial, and ESG data.

Accounting can help to integrate sustainability issues into the financial and performance reports. Reporting helps to better communicate to stakeholders and is crucial for companies to raise capital.

Recent development

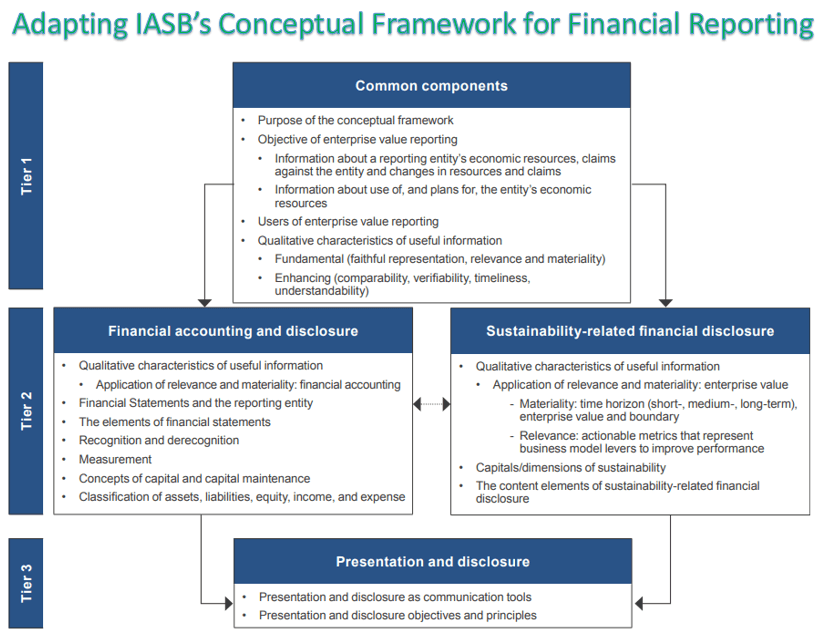

At the World Economic Forum on May 2022 in Davos, Mr. Emmanuel Faber, chair of the newly created International Sustainability Standards Board (ISSB), said that efforts to create a global framework for disclosures on environmental, social, and governance issues bring “challenges all over the place,” such as the risk of leaving smaller businesses behind.

The ISSB, which sets sustainability-related disclosure standards that jurisdictions can choose to adopt, was founded in late 2021 by the IFRS (International Financial Reporting System) Foundation which oversees the International Accounting Standards Board (IASB). The purpose of the ISSB is to provide companies with a “common language” to speak about ESG with bankers, insurers, and investors.

The ISSB released two draft sustainability standards in March, with comments due by the end of July. With small companies in mind, proportionality is crucial, Mr. Faber said: “You can’t request the same thing from a $10 million company and a $100 billion company.”

In May 2022, the U.S. accounting standard-setter, the Financial Accounting Standards Board (FASB), said that it will consider crafting rules for how companies should account for climate-related transactions, a key step to providing clarity for firms and investors on deals involving items such as renewable-energy credits and carbon offsets.

Carbon offsets are credited companies buy and count toward their targets to reduce greenhouse gas emissions. Renewable-energy credits are certificates regulators offer to energy providers when they deliver wind, solar or hydroelectric energy to a power grid.

So far, there aren’t specific accounting rules companies must follow when recording the purchase of renewable-energy credits and carbon offsets. Some companies expense the credits at the time of purchase, while others capitalize and write them off later.

The FASB’s move comes two months after the Securities and Exchange Commission (SEC) proposed sweeping disclosure requirements around climate risk for U.S. public companies. The SEC’s proposal would compel companies to disclose how carbon offsets and renewable-energy credits play in their climate-related business strategies.

In May 2022, the SEC also voted to issue two proposals that aim to give investors more information about investment funds that take into account ESG factors. One of the proposed rules, if adopted, would broaden the SEC’s rules governing fund names, while the other would increase disclosure requirements for funds with an ESG focus. The proposals will be open to public comment before the SEC decides whether to issue a final rule.

Sounding Good or Doing Good: ESG is a SCAM?

After years of being critical of ESG investing, the buzzword ESG investing scam is starting to unravel. Similar to the Crypto investing booming era, Warren Buffett believed that crypto investing is a scam and labeled bitcoin as a 'rat poison squared".

On 18th May 2022, Elon Musk tweeted that "ESG is a scam" when Tesla was kicked out of the S&P ESG index and Exxon is crowned as the top ten best in the world for ESG. See the tweet below.

If you are a CFA or CFA candidate, you should know Professor Aswath Damodaran, a renowned New York University finance professor also known as the "Dean of Valuation". He is the author of many books on valuation that are used as preparation study material to take the CFA exams. He is not a fan of ESG investing. (See sources: Sounding Good or Doing Good? and The “Goodness” Gravy Train Rolls On).

Below are a few bold statements from Prof. Damodaran.

"I believe that ESG is, at its core, a feel-good scam that is enriching consultants, measurement services, and fund managers, while doing close to nothing for the businesses and investors it claims to help and even less for the society."

"More than ever, I believe that ESG is not just a mistake that will cost companies and investors money while making the world worse off, but that it creates more harm than good for the society."

"I am convinced that there will soon be room for only two types of people in the ESG space. The first will be the useful idiots, well-meaning individuals who believe that they are advancing the cause of goodness, as they toil in the trenches of ESG measurement services, ESG arms of consulting firms, and ESG investment funds."

"The second will be the feckless knaves, who know full well the void behind the concept, but see an opportunity to make money." - Professor Aswath Damodaran

Prof. Damodaran sees that companies are learning to play the ESG game and using the ESG framework and disclosure process to tick the boxes and increase their scores.

What are your thoughts on ESG? Let us know inside our free Slack community!

Follow us on LinkedIn

Follow us on LinkedIn