If you've ever had to plan a budget, make a big purchase, or justify expenses to leadership, you've probably come across the terms CapEx (Capital Expenditure) and OpEx (Operating Expenditure). But what do they really mean and why does understanding CapEx vs OpEx matter for your bottom line?

Understanding the difference between CapEx vs OpEx can shape how your business spends money, manages cash flow, and even scales over time.

In this article, we’ll break down the key differences, look at real-world examples, and help you figure out when to choose one over the other.

What is CapEx vs OpEx?

At a high level, CapEx (Capital Expenditure) and OpEx (Operating Expenditure) are two ways businesses spend money, but they serve very different purposes.

CapEx refers to the money a company invests in acquiring, upgrading, or maintaining long-term assets. These are the big purchases like buildings, vehicles, heavy machinery, or new technology systems. These are long-lasting investments that show up on the balance sheet and are paid off (on paper) slowly over time.

On the flip side, OpEx covers the day-to-day costs of running a business. These are operating expenses that keep the lights on and the wheels turning. This includes things like salaries, rent, utilities, marketing, and supplies. Operating expenses are recurring, more flexible, and fully deducted in the period they’re incurred.

In short:

OpEx = Everyday spending. Fast, flexible, and hits your books right away.

If you’re still unsure about which is which, ask yourself this question: “Is this something I’ll use for years, or just something I need to keep things going right now?” If it’s long-term, it’s CapEx. If it’s month-to-month, it’s OpEx.

Examples of capital expenditures

So, what actually counts as a capital expenditure? Let’s look at some real examples to make it clear which kinds of business expenses fall into the CapEx bucket.

Property and buildings

Purchasing land, constructing a new facility, or acquiring an office space all fall under CapEx. Even significant renovations or extensions to existing buildings qualify, since they increase the value or extend the life of the property.

Equipment and machinery

For companies in manufacturing, logistics, healthcare, or construction, large-scale equipment is a typical capital expense. This includes items like production machinery, medical devices, commercial ovens, or forklifts, etc. – basically anything that plays a critical role in operations and lasts multiple years.

Technology and hardware

When a company upgrades its computer systems, buys a new fleet of laptops, or installs new servers, those costs are treated as CapEx. These purchases support business operations over the long term and aren’t part of the regular monthly budget.

Vehicles for business use

Company-owned vehicles used for deliveries, transportation, or field service are capital expenses. This includes delivery vans, sales fleet cars, or even electric trucks purchased as part of a sustainability initiative.

Renovations and infrastructure upgrades

Major improvements (like updating HVAC systems, rewiring an entire office, or installing solar panels) also count as capital expenditures. These upgrades extend the useful life or enhance the value of existing assets.

How to calculate CapEx

To calculate CapEx, you don’t need a finance degree, just the right numbers.

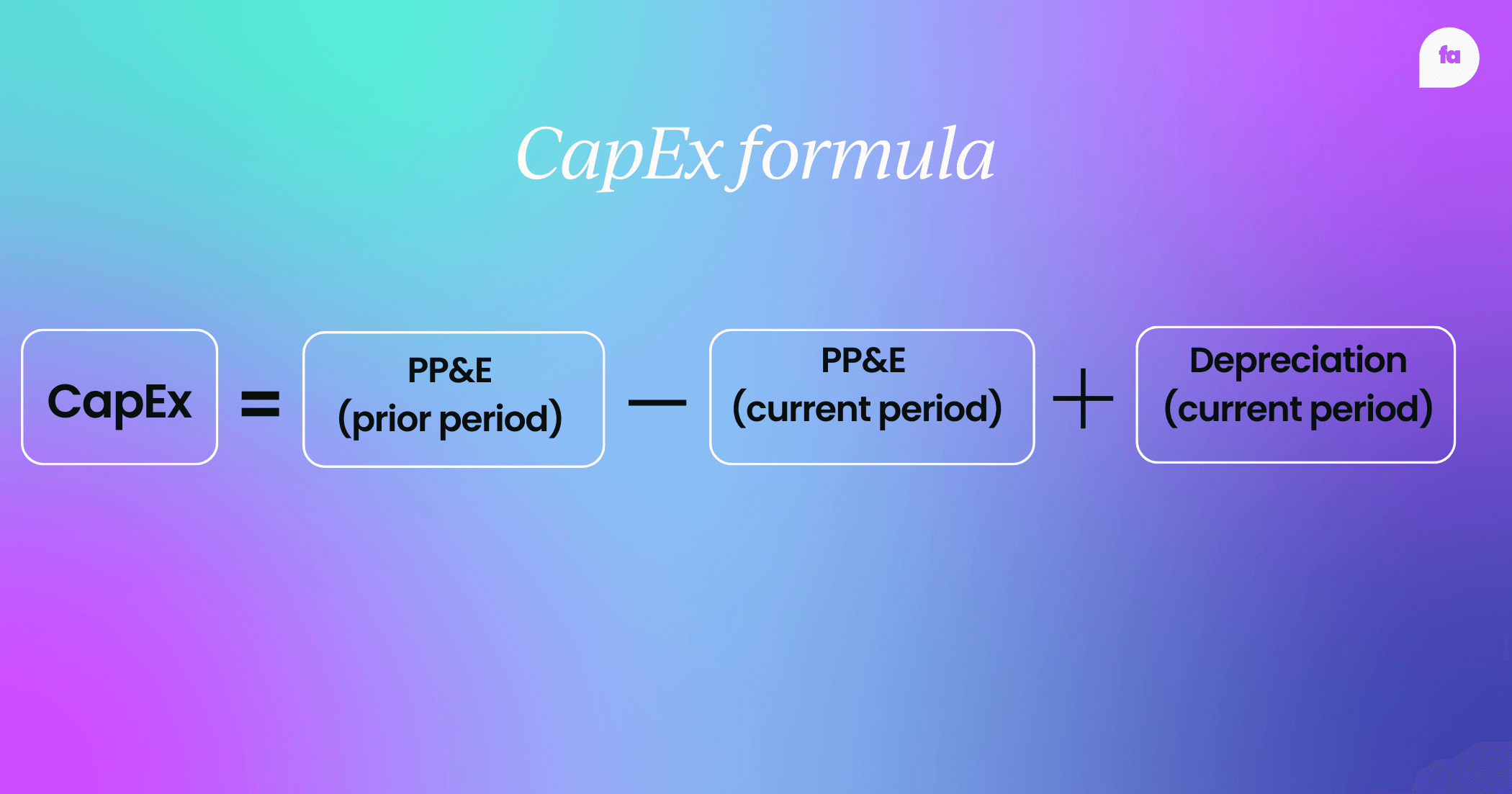

Here’s the CapEx formula:

CapEx = (PP&E (prior period) - PP&E (current period)) + Depreciation (current period)

PP&E = Property, Plant, and Equipment (from the balance sheet)

Depreciation = Total depreciation for the period (from the cash flow statement)

CapEx calculator

Use this quick CapEx calculator to get an instant estimate. Just plug in your current and previous PP&E (Property, Plant & Equipment) values and your total depreciation for the period. The calculator will do the math for you.

CapEx Calculator

CapEx: –

Examples of OpEx

OpEx are the regular, ongoing costs a business needs to stay up and running day-to-day. Unlike CapEx, these costs don’t create long-term value or assets, they're the fuel that keeps everything moving, month after month.

Here are some of the most common examples:

Salaries and wages

Paying your team is one of the most consistent operating expenses. This includes not just base salaries, but also bonuses, overtime, and any employee benefits that are paid regularly.

Rent and utilities

Whether you lease office space, a storefront, or a warehouse, that monthly rent payment is an operating expense. Same goes for utility bills like electricity, water, internet, and heating.

Marketing and advertising

Marketing expenses like Facebook ads, hiring freelance copywriters, paying for trade show booths, etc. represent a major chunk of OpEx. These are recurring or campaign-based costs tied to promoting the business.

Software subscriptions

Most businesses today rely on SaaS tools like CRM platforms, project management apps, cloud storage, accounting software, etc. These monthly or annual subscription fees are classic examples of operating expenses.

Office supplies and materials

This includes everything from pens and printer ink to packaging materials and cleaning supplies. If it’s something you buy regularly to keep the business functioning, it’s OpEx.

Insurance and professional services

Business insurance, legal fees, accountant retainers, and consulting services are all considered operating expenses too, especially if they’re part of your ongoing operations.

How to calculate Opex

Calculating OpEx is simpler than CapEx because you’re just adding up the regular, recurring expenses that keep the lights on.

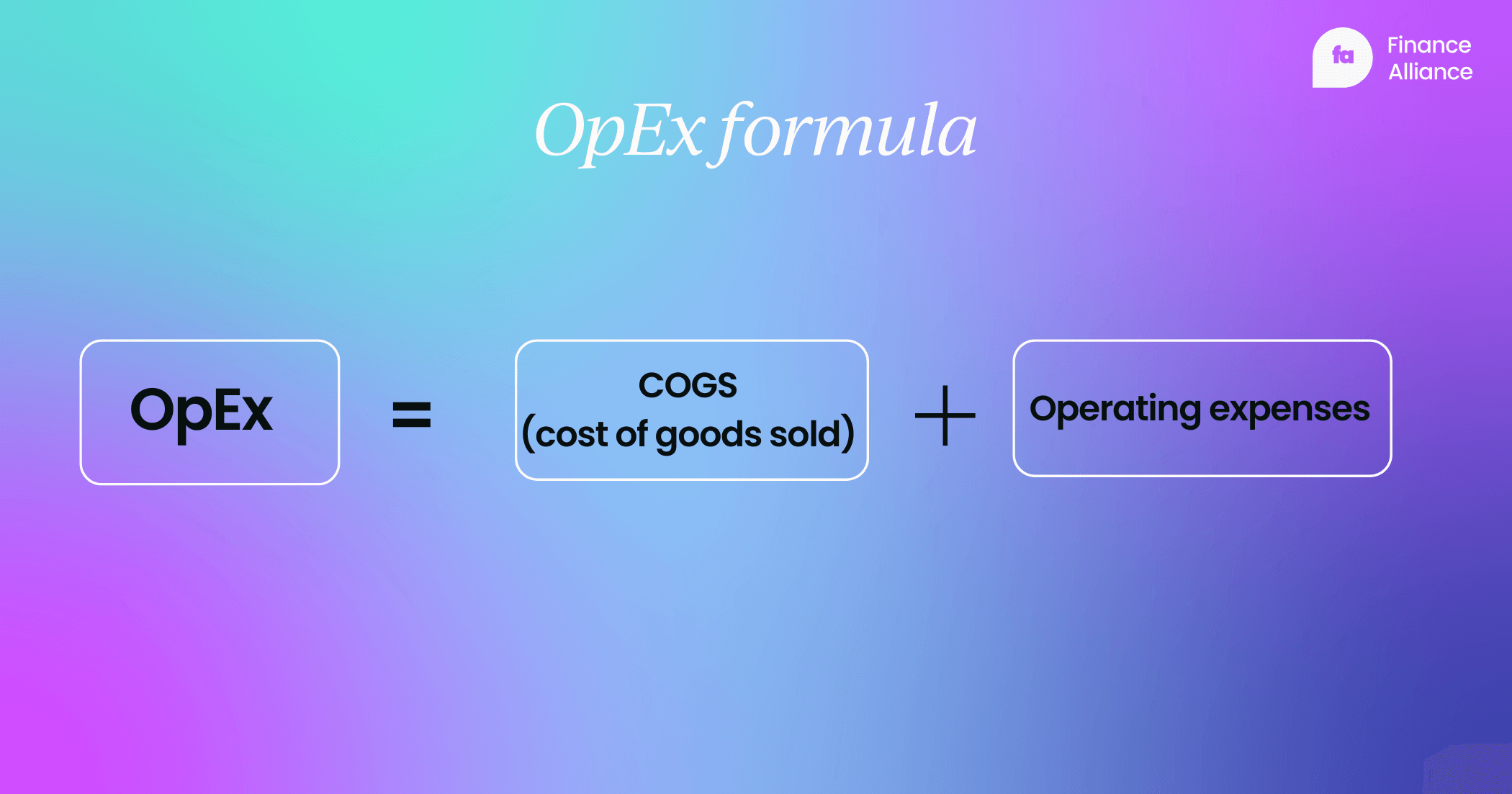

Here’s the basic formula:

OpEx = COGS (cost of goods sold) + Operating expenses

OpEx calculator

Want to get a quick snapshot of your business’s operating expenses? Enter your main costs below (like salaries, rent, and marketing), and we’ll crunch the total for you.

OpEx Calculator

Total OpEx: –

Pros and Cons of CapEx vs OpEx

Knowing the difference between CapEx vs OpEx is one thing, but understanding the trade-offs? That’s where the real decision-making happens. Let’s break it down.

CapEx: Capital expenditure

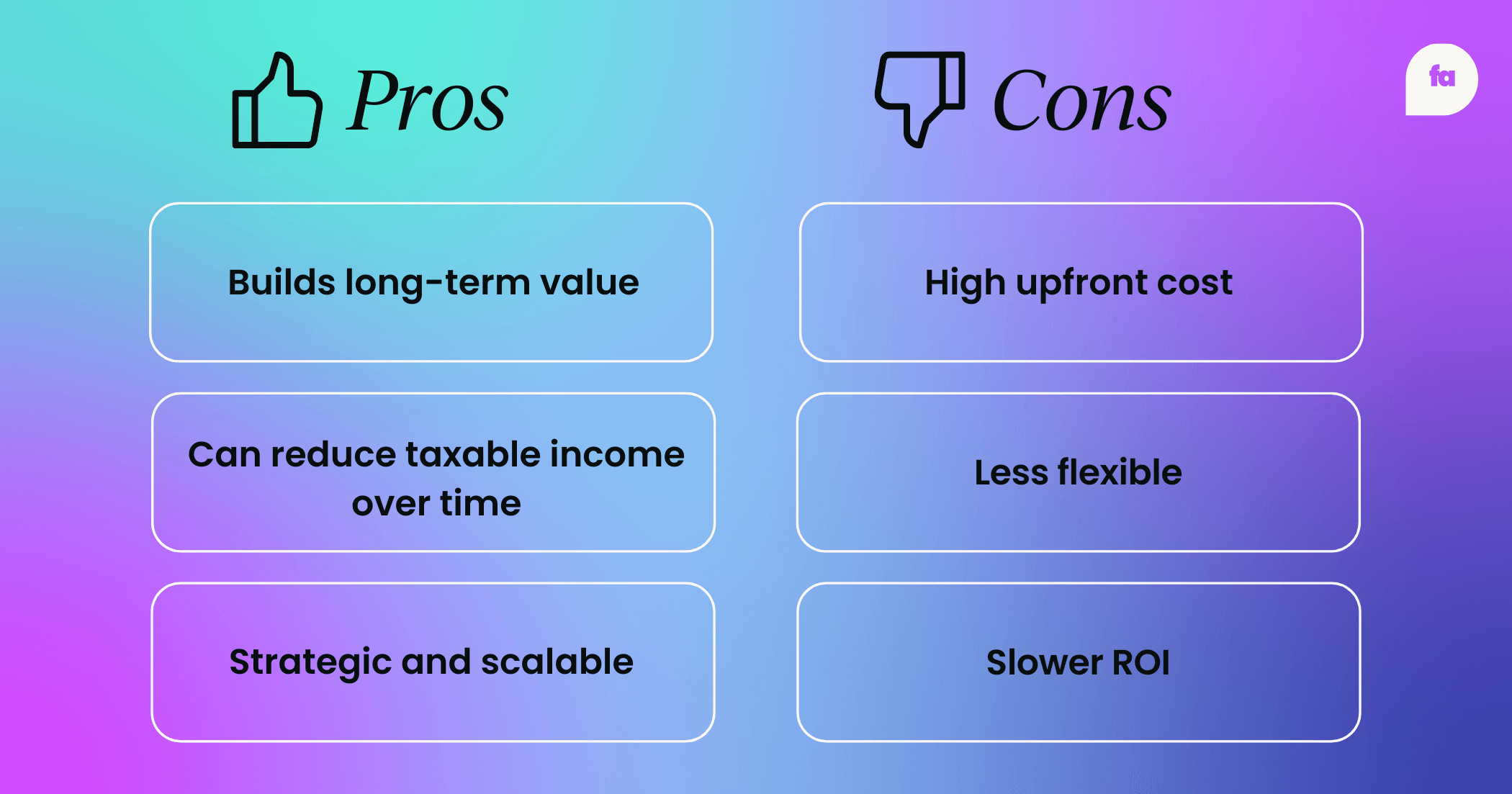

👍 Pros

- Builds long-term value: CapEx investments (like property or equipment) become assets that hold value on your balance sheet.

- Can reduce taxable income over time: Through depreciation, you spread the cost over multiple years, which is great for long-term financial planning.

- Strategic and scalable: Major purchases lay the groundwork for future growth and expansion.

👎 Cons

- High upfront cost: These aren’t light purchases. You’ll need serious cash (or financing) to make them happen.

- Less flexible: Once you invest, you’re locked in. You can’t easily walk away from a building or machinery.

- Slower ROI: Because these are long-term assets, it can take years before the benefits truly show up in your bottom line.

OpEx: Operating expenditure

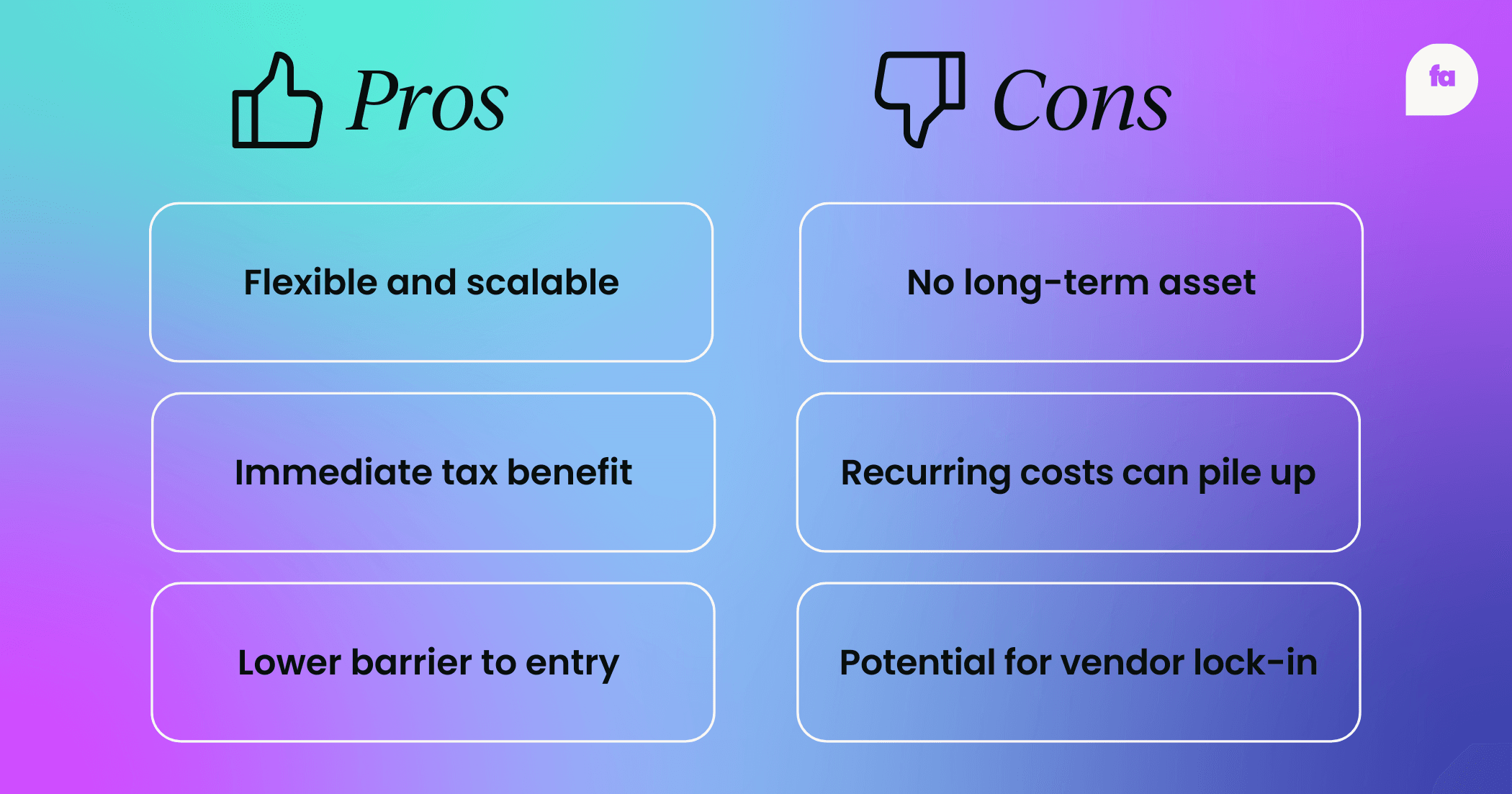

👍 Pros

- Flexible and scalable: OpEx gives you the freedom to scale expenses up or down based on current needs.

- Immediate tax benefit: You can usually deduct OpEx in the year it’s incurred, so no need to wait around for depreciation schedules.

- Lower barrier to entry: Subscriptions and rental models mean you can access tools and services without large upfront investment.

👎 Cons

- No long-term asset: OpEx spending keeps things running, but it doesn’t build owned value over time.

- Recurring costs can pile up: What feels small month-to-month can add up quickly if not managed closely.

- Potential for vendor lock-in: With SaaS or rental models, you may be stuck with ongoing payments, even if your needs change.

Differences between Capex and OpEx

CapEx and OpEx aren’t just accounting terms, they affect how a business spends money, reports financials, plans for taxes, and drives growth. Here’s how they compare across the areas that count.

1. Type of investment

- CapEx: Big, long-term investments like property, equipment, or infrastructure. You’re buying something you’ll use for years.

- OpEx: Day-to-day operational spending such as rent, payroll, marketing, or software subscriptions. It keeps the lights on and the business moving.

2. How it’s recorded on financial statements

- CapEx: Shows up as an asset on the balance sheet. Instead of expensing it right away, it’s capitalized and depreciated over time.

- OpEx: Appears as a regular expense on the income statement. It directly reduces net income in the same period it’s incurred.

3. Tax treatment

- CapEx: Can’t be fully deducted in the year it’s spent. Instead, it’s depreciated (or amortized for intangible assets) over the asset’s useful life.

- OpEx: Fully tax-deductible in the year the expense happens. This helps reduce taxable income right away.

4. Depreciation methods (for CapEx only)

CapEx is depreciated using methods like:

- Straight-line (spreads the cost evenly over time).

- Declining balance (accelerates depreciation earlier in the asset’s life). This helps spread out the tax impact of large purchases over several years.

5. Impact on cash flow

- CapEx: Big hit to cash flow when the asset is purchased and can impact liquidity in the short term.

- OpEx: Smaller, predictable outflows that are easier to manage month-to-month.

6. Business strategy & benefits

- CapEx: Supports long-term growth. Great for companies investing in expansion, infrastructure, or improving efficiency.

- OpEx: Offers more flexibility. Ideal for businesses that prioritize agility, cost control, and short-term responsiveness.

FAQs: OpEx vs CapEx

What is the difference between OpEx and CapEx?

OpEx (Operating Expenditure) refers to the ongoing costs of running a business on a day-to-day basis, like salaries or utility bills, while CapEx pertains to one-time investments in long-term assets. Typically, CapEx adds value to the company's balance sheet as it's treated as an asset, whereas OpEx is treated as an expense affecting the profit and loss statement.

What is a capital expense?

A capital expense (CapEx) is money a business spends on long-term assets like buildings, equipment, or vehicles, etc. - basically, things it plans to use for more than a year.

Is CapEx same as working capital?

No, CapEx and working capital are different. While CapEx refers to long-term investments in assets, working capital refers to the short-term liquidity available to a business, calculated as current assets minus current liabilities.

Is depreciation an operating expense?

No, depreciation isn't considered an operating expense. It’s a non-cash accounting method used to spread the cost of a capital asset over its useful life.

What is undepreciated capital cost?

Undepreciated capital cost (UCC) refers to the remaining book value of an asset after accounting for depreciation already claimed. It’s often used in tax calculations.

What is CapEx in finance?

In finance, CapEx (Capital Expenditure) refers to the funds used by a company to buy, upgrade, or maintain physical assets that support long-term growth.

What is OpEx in finance?

In finance, OpEx refers to the costs associated with a company's regular, daily operations, like wages and rent, which directly impact the profit and loss statement.

Is software CapEx or OpEx?

Software can be CapEx or OpEx depending on how it’s acquired. One-time purchases or custom-built software are typically CapEx, while cloud-based subscriptions (SaaS) are usually OpEx.

What’s included in capital requests?

Capital requests usually include a detailed breakdown of the proposed asset purchase, total cost, expected ROI, depreciation schedule, and how it supports business goals.

What is a good CapEx ratio?

A good CapEx ratio (like CapEx to revenue) varies by industry, but generally, lower ratios mean more efficient use of capital. For capital-intensive industries, higher ratios are normal.

What does CapEx tell you about a company?

CapEx spending gives insight into a company’s growth strategy. High CapEx often signals expansion or investment in infrastructure, while low CapEx may indicate stability or cost control.

What is a good OpEx percentage?

A good OpEx percentage (OpEx as a percentage of revenue) depends on your industry. Generally, keeping operating expenses under 60–70% of revenue is a healthy target for most businesses.

Ready to take your finance career to the next level?

Hundreds of finance pros have joined our Insider Membership to get early access to exclusive content, smart tools, and the kind of advice you won’t find on Google.

It’s free, easy, and made for people like you.

Follow us on LinkedIn

Follow us on LinkedIn