Managing complex change as a CFO can feel like a daunting task. After all, you're put in charge of leading your entire finance team through the organizational change. This involves handling not just the technical aspects, but also the human side, which is challenging since change often sparks resistance.

This resistance isn't due to stubbornness or incompetence though, it’s usually a natural reaction to the uncertainty of new territory. So, it's important to communicate why change is necessary. You also need to highlight the benefits it’ll bring to your team and the organization.

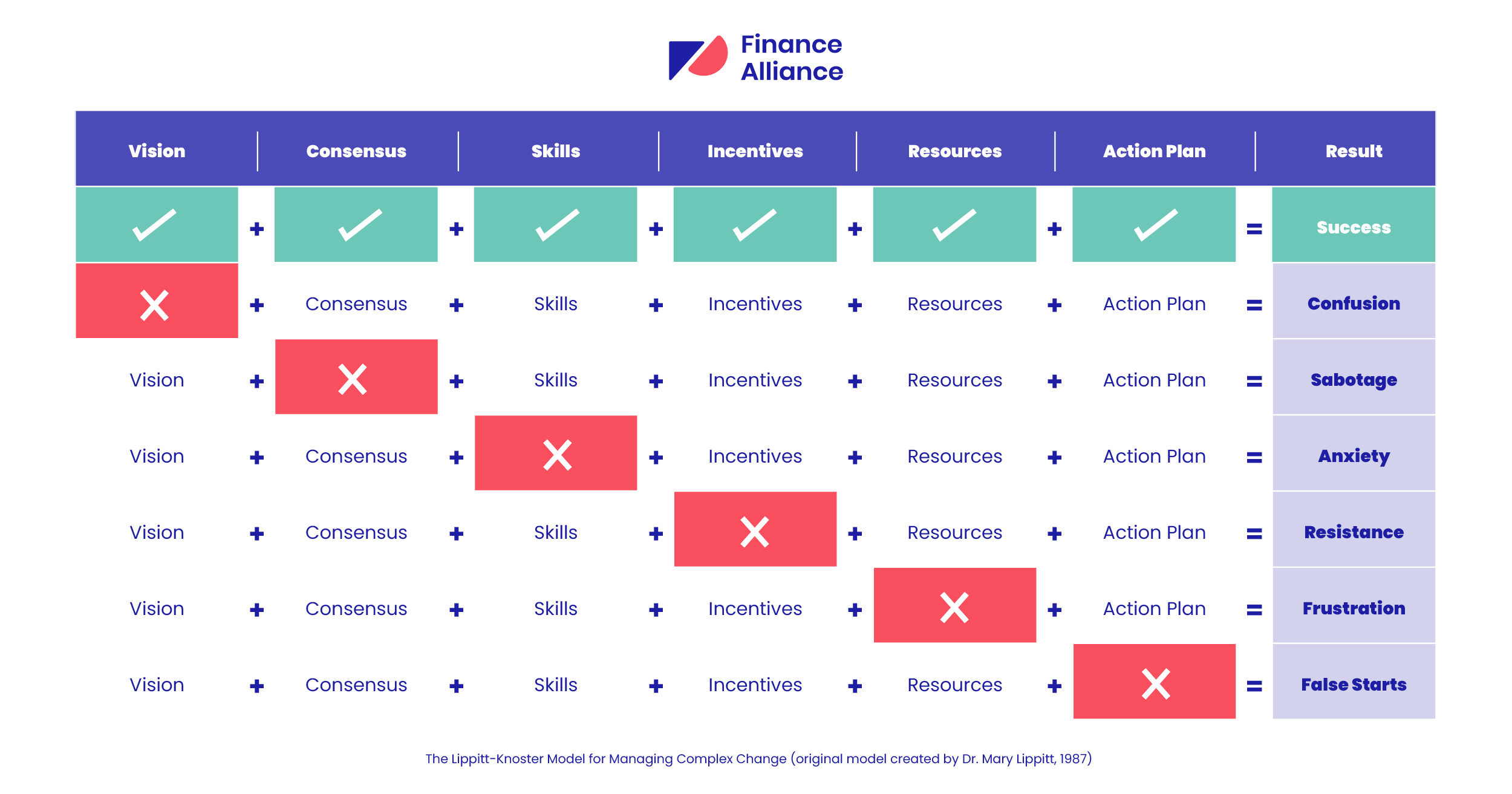

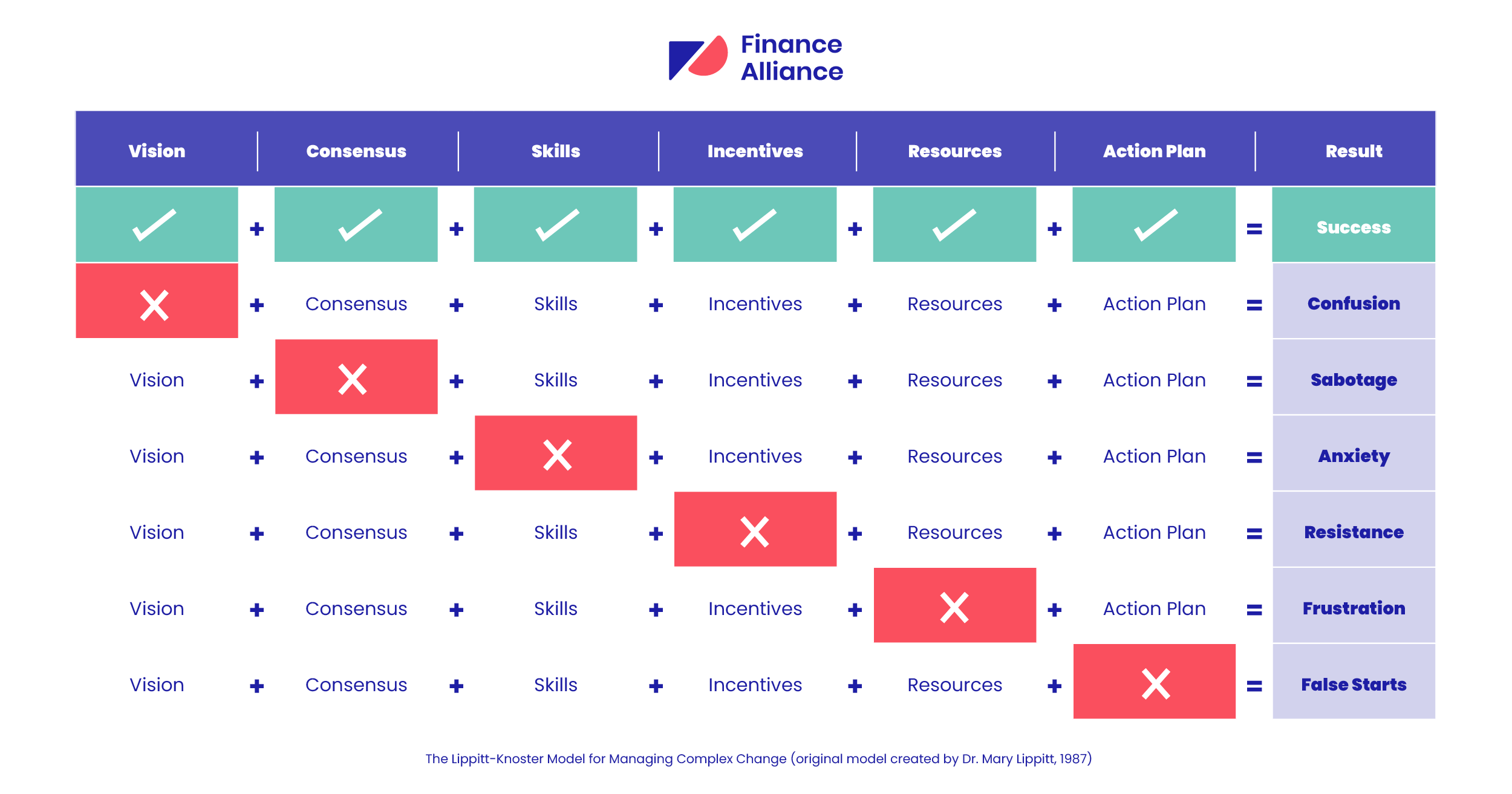

One tool that has proven helpful when leaders (and their teams) are faced with change is the Lippitt-Knoster Model for Managing Complex Change Matrix, which provides a clear framework for handling change.

This article guides you through the matrix, introducing its origin, concepts, and techniques to help you manage and guide your team through complex change successfully.

Table of contents:

- The Lippitt-Knoster Model for Managing Complex Change

- Components of complex change

- Types of organizational change defined as a complex change

- How to use the model for managing complex change

- Consequences of poor implementation

What is the Lippitt-Knoster Model for Managing Complex Change?

The Lippitt-Knoster Model for Managing Complex Change is an acclaimed tool that has significantly shaped the field of change management.

Developed by Dr. Mary Lippitt (and later adapted by Timothy Knoster), this model serves as a roadmap to navigate the winding paths of complex change. Timothy introduced his version of the model at the TASH conference back in 1991. Since then, it's become known as the 'Lippitt-Knoster model,' which is how we'll refer to it in this article.

Knoster is responsible for adding the extra element ‘consensus’ to the original matrix. The underlying rationale is that in many situations, leaders can't take the successful implementation of complex changes for granted without securing agreement and support from crucial stakeholders and team members who might be affected by these changes.

What are the components of complex change?

At the heart of the Lippitt-Knoster Model are six (five original and one added by Knoster) integral components:

- Vision: The picture of the future state you wish to achieve. Your vision will act as the guiding light, providing direction to the change process.

- Consensus (Knoster's extra component): The collective agreement and support from all stakeholders involved in the change. Consensus ensures the change process is collaborative, reducing resistance and creating a sense of ownership.

- Skills: The abilities and competencies required to implement the change. Skills ensure the team can convert the vision into reality.

- Incentives: The motivators or rewards that encourage teams to embrace the change. Incentives can be intrinsic (like personal growth) or extrinsic (like bonuses).

- Resources: These include the time, finances, personnel, and other assets necessary to support the change process.

- Action plan: The detailed roadmap that outlines the steps to be taken to achieve the vision. It includes who does what, by when, and how.

The brilliance of the Lippitt-Knoster Model lies in its emphasis on the simultaneous presence of all five elements for change to be effective. Each component is like a piece of a jigsaw puzzle; missing one can disrupt the entire picture.

“Applying the model to coalitions takes vision, skills, incentives, resources, and an action plan to get a coalition to produce change in a community. If you have all five, you will likely end up with change. And, if you leave one of the components out, you will likely end up with something different.”

What types of organizational change are defined as complex for finance teams?

Organizational change is deemed 'complex' when it involves multiple dimensions of the organization, is intertwined with numerous factors, and when it prompts a significant shift in how the organization and its members operate. For a finance team, complex changes can include:

1. Mergers and acquisitions

These changes can significantly alter the financial structure and operations of a company. For the finance team, integrating financial systems, policies, and procedures can be a complex task. They'll need to manage due diligence, valuation, and integration processes while maintaining regular financial operations.

2. Digital transformation

Implementing new financial software, shifting to cloud-based systems, or integrating artificial intelligence (AI) into financial processes are examples of digital transformation. These changes can be disruptive, as they require the finance team to learn new skills and adapt to new ways of working.

3. Restructuring

Organizational restructuring can have significant implications for the finance team. Whether it involves downsizing, upsizing, or reshuffling of roles, it directly impacts the financial planning and budgeting within the company.

4. Changes in financial regulations

New regulations or changes in existing ones can have a considerable impact. Adapting to new reporting standards or tax laws, for instance, can be a complex process requiring substantial adjustments.

5. Shifts in strategic direction

If a company decides to enter new markets, launch new products, or make major strategic changes, the finance team will be at the forefront of budgeting, financial planning, and investment analysis for these initiatives.

In each of these scenarios, the team needs support from the CFO to effectively manage the change. According to a recent survey by McKinsey:

“Finance leaders are deeply involved in determining how businesses adapt to significant changes in how work gets done—particularly in places where digital and finance intersect.”

There are a few main reasons why you'll need to support your team during this time, such as:

- Skill gaps: The team might need to acquire new skills or enhance existing ones to adapt to the change.

- Resistance to change: As with any change, there can be resistance due to fear of the unknown or comfort with current practices. This resistance needs to be managed for successful change.

- Workload: Complex changes often mean extra work on top of regular duties, which can lead to stress and burnout if not managed well.

- Uncertainty and risk: Complex changes involve uncertainty and potential risks, especially financial ones, which need to be managed effectively.

Using a model like the Lippitt-Knoster Managing Complex Change Model can provide a structured approach to navigating these complex changes, making the process more manageable and less stressful for the finance team.

How to use the Lippitt-Knoster model for managing complex change

As a CFO, you’ll often find yourself at the forefront of managing complex change within your organization. From mergers and acquisitions to digital transformation and strategic shifts, managing these changes can be a difficult task. However, having a structured approach can make this task significantly more manageable and effective.

As we discussed, this is where the Lippitt-Knoster Model can be used to help guide you through the process. Below, we’re diving into how you can use each of the components effectively:

Step one: Establish a clear vision

As a CFO, the initial step in managing complex change is to define your vision. Your vision should encompass the reasons why change is necessary and what goals you want to achieve because of the change. Think of it as your strategic blueprint, which will guide the subsequent steps.

Here’s how you can put this into action:

1. Define your vision: Use your understanding of the organization's financial position and future direction to develop a vision that aligns with the company's overall strategic goals.

2. Communicate your vision: Use meetings, newsletters, emails, or one-on-one conversations to communicate this vision to your team and stakeholders. Address questions like, "Why is this change needed?" and "What are the benefits of this change?"

3. Reinforce your vision: Regularly revisit and reinforce the vision to keep it at the forefront of all change-related activities.

Step two: Building consensus

Consensus forms a critical part of managing complex change, particularly in a leadership role such as a CFO. It involves gaining widespread agreement and support for the change from all stakeholders involved.

Here's how you can build consensus:

1. Identify key stakeholders: Determine who will be most impacted by the change. This could include your team, other departments, management, or even external partners.

2. Invite feedback: Encourage stakeholders to share their thoughts, concerns, and suggestions. This makes them feel valued and part of the change process, which leads to buy-in.

3. Address concerns: Address stakeholder concerns promptly and effectively. This might involve making adjustments to your plan or providing additional information to clarify misunderstandings.

4. Regular updates: Keep stakeholders informed about the progress of the change. Regular updates ensure that everyone remains aligned and any emerging issues are addressed promptly.

Step three: Identifying necessary skills

The next step is to identify the skills needed to execute your vision. You can approach this step by focusing on the following initiatives:

1. Skill assessment: Determine the skills your team currently possesses and the ones they'll need to acquire for the change. This might involve financial modeling for a merger or learning a new software tool for digital transformation.

2. Training opportunities: If gaps exist, plan for training opportunities. This could be internal workshops, online courses, or partnering with external training providers. Time for skill acquisition should also be factored into the change timeline to reduce anxiety and resistance.

3. Support continuous learning: Encourage a culture of continuous learning in your team. This not only helps in skill acquisition but also builds resilience to future changes.

Step four: Designing appropriate incentives

Incentives can significantly motivate your team to embrace change. To effectively use incentives:

1. Understand motivations: Each team member might be motivated by different things - some might value career progression, while others appreciate monetary rewards or recognition.

2. Design incentives: Based on these motivations, design a reward system. This could range from promotions and bonuses to public recognition or additional learning opportunities.

3. Communicate incentives: Clearly communicate how these incentives are tied to the change process. Ensure your team understands what rewards are available and how they can achieve them.

Step five: Gathering required resources

A lack of resources can lead to frustration and anxiety. To prevent this:

1. Identify resources: Determine what resources are needed for the change process like financial resources, additional personnel, equipment, etc.

2. Bridge resource gaps: If there's a gap between the required and available resources, devise a plan to bridge it. This might involve reallocating budgets, hiring temporary staff, or seeking external support.

3. Communicate resource availability: Ensure your team is aware of the resources available to them. This transparency can reduce anxiety and build confidence in the change process.

Step six: Creating an action plan

The final step in managing complex change is developing a clear action plan. Here's how you can do it:

1. Develop a detailed plan: Outline the steps to be taken to achieve your vision. This should include who does what, by when, and how.

2. Share progress: Regularly update your team and stakeholders on the progress of the change process. This keeps everyone aligned and informed.

3. Define success: Clearly define what success looks like. This will help your team understand the end goal and how their efforts contribute to it. Answering questions like, "How will we know when we have reached our goal?" can provide clarity and direction.

Consequences of poor implementation of change management components

The Lippitt-Knoster Model is a powerful tool for understanding the components needed for successful change. However, just as it illuminates the path to success, it also highlights the pitfalls and challenges that can arise when any of these components aren't executed properly.

By studying these negative outcomes — confusion, sabotage, anxiety, resistance, frustration, and false starts — we can better understand the importance of each component in the change management process. So, here's a breakdown of what happens when you miss the mark with any of the components:

Vision

If you have consensus, skills, incentives, resources, and an action plan, but lack a clear vision, the result will be confusion. The vision acts as the north star for your change process. Without it, there's no guiding light to steer your team, which leads to miscommunication and lots of confused looks shared around the room.

Lack of Vision = Confusion

Consensus

Without consensus, even if all other elements are in place, you risk sabotage. Consensus represents the collective agreement and support from stakeholders involved in the change. If key stakeholders don't buy in, they might openly or subtly work against the change, hindering its success.

Lack of Consensus = Sabotage

Skills

If you have everything in place but your team lacks the necessary skills to implement the change, you'll face anxiety within the team. Unprepared team members can become apprehensive about failing, causing stress and potentially undermining the change efforts.

Lack of Skills = Anxiety

Incentives

Incentives are crucial for maintaining motivation and engagement during the change process. If you have a vision, consensus, skills, resources, and an action plan, but fail to provide appropriate incentives, you'll likely encounter resistance. Without rewards or recognition, stakeholders may cling to old ways of doing things, slowing the change process considerably.

Lack of Incentives = Resistance

Resources

Resources are the fuel for the change process. You may have a solid plan and know how to accomplish it, but without the necessary resources, executing the change becomes an uphill battle.

Lack of Resources = Frustration

Action plan

An action plan is a roadmap to achieving your vision. If you have a vision, consensus, skills, incentives, and resources, but no detailed action plan, you'll likely experience a situation akin to running on a "treadmill" — exerting effort without making progress. In the absence of a clear action plan, you may face repeated false starts, as you're unable to advance towards your goal effectively.

Lack of an Action Plan = False Starts

FAQs: Managing Complex Change Model

What is complex change?

Complex change involves significant shifts in an organization's processes, systems, or culture, often occurring on multiple levels or areas simultaneously. It requires strategic planning, extensive communication, and careful management.

How do you manage complex change?

Managing complex change requires a clear vision, acquiring necessary skills, creating incentives, ensuring adequate resources, and developing a detailed action plan. Gaining consensus from stakeholders is also crucial.

How can CFOs use the Lippitt-Knoster Model effectively?

CFOs can use the model as a framework for planning and implementing change initiatives. Each element of the model serves as a critical consideration to ensure successful change. For instance, creating a clear vision, ensuring the team has necessary skills, providing incentives, allocating sufficient resources, and drafting a comprehensive action plan. Additionally, gaining consensus from stakeholders is crucial to ensure the change is accepted and implemented effectively.

What are some common obstacles to successful change management according to the Lippitt-Knoster Model?

Common obstacles often emerge from neglecting one or more components of the model. For instance, without a clear vision, the team can become confused. If there's no consensus, it could lead to sabotage. Lack of necessary skills can create anxiety, while missing incentives might cause resistance. Insufficient resources can lead to frustration, and without a solid action plan, the team might experience false starts or feel like they're stuck on a treadmill.

How can I avoid negative outcomes in the change management process?

Avoiding negative outcomes involves proactive planning and thorough implementation of all the components of the Lippitt-Knoster Model. Ensure there is a clear vision that is well communicated, equip your team with necessary skills, provide incentives, allocate sufficient resources, and create a detailed action plan. Moreover, gaining consensus from all stakeholders can help prevent resistance and sabotage.

Join our free Slack community!

The Finance Alliance community is the ultimate space for finance pros who want to accelerate their careers.

Connect with our fellow finance leaders to network, discuss and share. Join now to be a part of the conversation.