If you're a Chief Financial Officer (CFO), you're probably familiar with environmental, social, and governance (ESG) metrics. But understanding their complexities and navigating the ESG ecosystem can be a challenge for even the most seasoned CFO.

In this article, we demystify ESG metrics and provide actionable strategies to help you use them to drive sustainable business success.

Topics covered:

- What are ESG metrics?

- Why are ESG metrics so important?

- ESG standards and frameworks

- Examples of ESG standards, frameworks, and reporting

- Qualitative vs quantitative ESG metrics

- ESG metric examples and how to measure ESG metrics

- How to choose which ESG metrics to use

- How to leverage ESG metrics for business success

What are ESG metrics?

ESG metrics serve as key performance indicators to measure a company's operations in relation to environmental, social, and governance criteria. They shed light on a company's performance, potential risks, and overall corporate responsibility.

Businesses will often weave these metrics into the fabric of their company, influencing policies, reports, and operations. With ESG metrics, you can align company practices with the principles of environmental stewardship, social responsibility, and robust governance.

Is ESG reporting mandatory?

Back in May 2022, the US Securities and Exchange Commission (SEC) called for “amendments to rules and reporting forms to promote consistent, comparable, and reliable information for investors concerning funds’ and advisers’ incorporation of environmental, social, and governance (ESG) factors.”

Although SEC currently maintains a comply-or-explain regime with some mandatory reporting features, there's no universal mandate that applies across all industries. Some companies voluntarily include ESG disclosures in their annual reports. Many produce standalone sustainability reports, keeping investors and the wider public updated about their ESG actions and commitments. We advise researching your country's ESG reporting regulations to avoid any mishaps.

Although ESG reporting isn’t mandatory, 74% of finance leaders said they’d like reporting of ESG performance measures against a set of globally consistent standards to be a mandatory requirement. Interestingly, this increased to 89% for investors.

Why are ESG metrics so important?

ESG metrics are important because they paint a holistic picture of a company's health, highlighting potential risks and opportunities that might otherwise be overlooked. Notably, they also appeal to a rising breed of socially conscious investors, aligning financial gains with positive societal and environmental impact.

ESG metrics for companies make sustainability commitments more than just words. They hold companies accountable and turn bold claims into clear, trackable KPIs. Measuring ESG performance metrics offers a level of transparency that strengthens trust between the company and the consumer, regulator, or investor.

ESG standards and frameworks

When it comes to ESG reporting, standards, frameworks, and questionnaires often make an appearance. But what do these terms actually mean? And more importantly, how do they help convey ESG performance?

ESG standards

Think of a standard as your detailed roadmap for ESG disclosure. It gives you specific performance measures or metrics to report on, so there's no confusion.

ESG standards are created with a public interest focus, ensuring independence, due process, and public consultation. This governance process ensures standards are trustworthy. It also reinforces their purpose: providing clear criteria for reporting ESG performance, targets, and policies.

ESG frameworks

An ESG framework is a set of principles to guide and shape understanding of ESG topics. However, the framework doesn't necessarily lay down the methodology for data collection or reporting. Rather, it gives you high-level disclosures while leaving room for maneuvering.

Unlike standards, frameworks follow simpler advisory processes for creation. So, while they may not be as detailed, they’re flexible and adaptable to your specific circumstances.

ESG questionnaires

Finally, an ESG questionnaire is essentially a third-party audit of your ESG practices. These are surveys designed to evaluate your sustainability performance and result in an ESG rating or score. It's voluntary, and the questions usually align with existing standards and frameworks. However, questionnaires are usually confidential and the methodologies behind them are less transparent.

Examples of ESG standards, frameworks, and reporting

ESG frameworks are developed by global bodies like the World Economic Forum. They’re designed to help identify, assess, document, and measure a company’s commitment to ESG issues.

These ESG frameworks take the guesswork out of sustainability by laying down an ESG KPI list of sorts. These metrics act like milestones, giving tangible markers to measure your progress against. Think of it as turning ESG commitment into something of a science, ensuring you’ve concrete, comparable data to guide the company’s actions and decisions.

But what's the point of all these metrics and measurements?

The answer is transparency and accountability. This is where ESG reporting comes into play. ESG reports are detailed accounts of how you’re delivering on your ESG commitments. They're designed for all your stakeholders - governments, NGOs, investors, and of course, the public - providing clear insight into the company’s ESG initiatives and how you're progressing toward your goals.

To help you get your head around these metrics, here is a brief overview of some examples of ESG frameworks available:

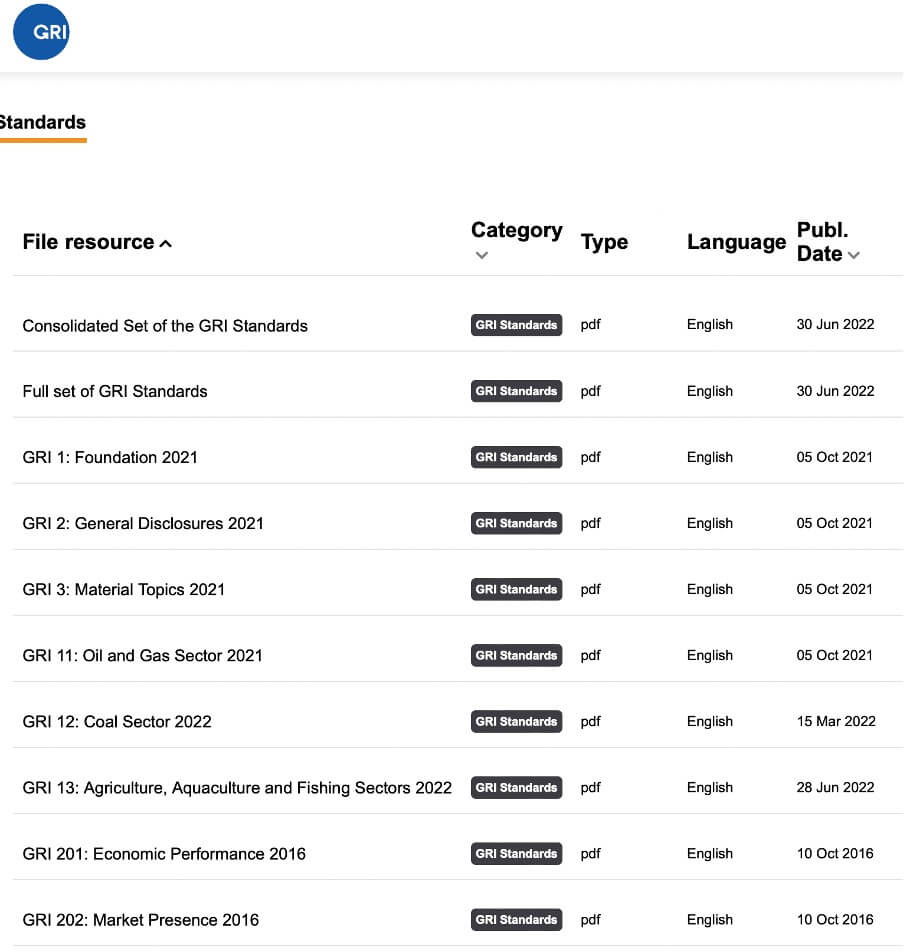

Global Reporting Initiative (GRI)

GRI is an independent, international organization dedicated to helping companies take responsibility for their impacts. According to KPMG, the GRI Standards remain one of the most commonly used anchors for sustainability reporting. They're used by over 10,000 organizations in over 100 countries.

GRI's approach is all about shining a light on an organization's contributions, both positive and negative, to sustainable development. The GRI Standards aren't a one-size-fits-all solution. They're a flexible, “modular system of interconnected standards”, broken down into three parts:

1. GRI Universal Standards: These apply to every organization out there.

2. GRI Sector Standards: These are tailored to the unique needs and impacts of specific sectors.

3. GRI Topic Standards: These focus on disclosures relevant to distinct topics.

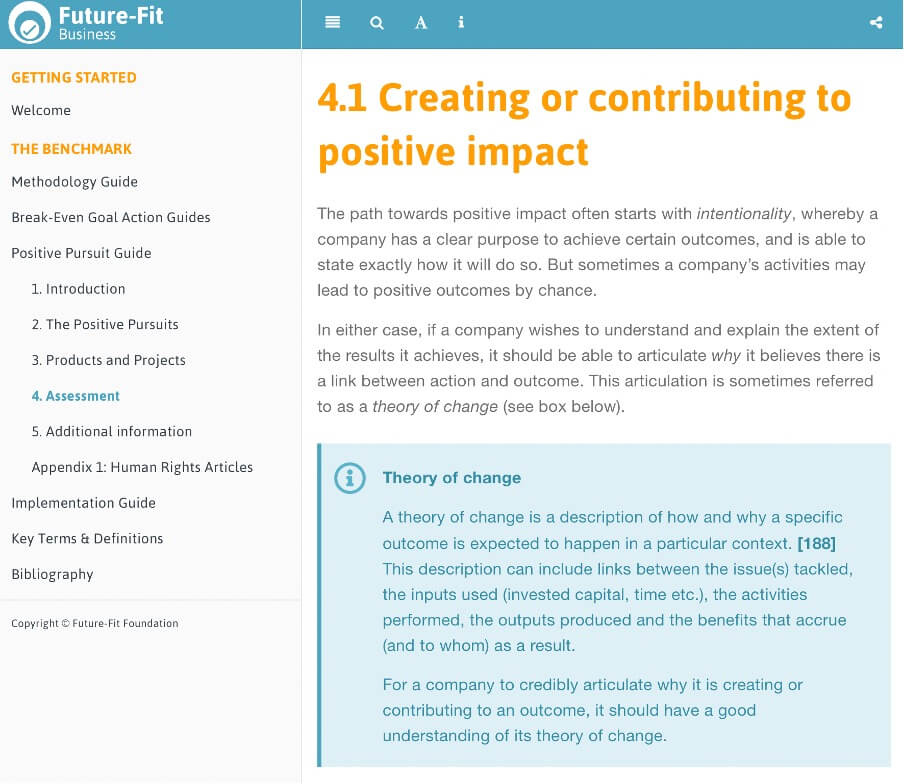

Future-Fit Business

Future-Fit Business (Foundation) is a charity dedicated to helping business leaders, policymakers, and investors “respond effectively to today’s biggest challenges” by being environmentally restorative, socially just, and economically inclusive.

The Future-Fit benchmark covers everything from how to avoid accusations of greenwashing to how to implement the benchmark in your organization as seamlessly as possible.

The Task Force on Climate-related Financial Disclosures (TCFD)

In response to the need for robust climate-related risk disclosures, the Financial Stability Board (FSB) set up the Task Force on Climate-related Financial Disclosures (TCFD). They aimed to construct guidelines on what information organizations should share, assisting investors, lenders, and insurers in making well-informed evaluations and appraisals of climate-associated risks.

TCFD’s framework includes climate-related risks and opportunities to help companies disclose these details effectively and covers how to disclose:

- Governance: Related to climate-related risks and opportunities.

- Strategy: Actual and potential impacts of related risks and opportunities on the company’s strategy and financial planning.

- Risk management: How a company identifies, assesses, and manages risks related to the climate.

- Metrics and targets: The relevant metrics and targets (related to the climate) the company uses.

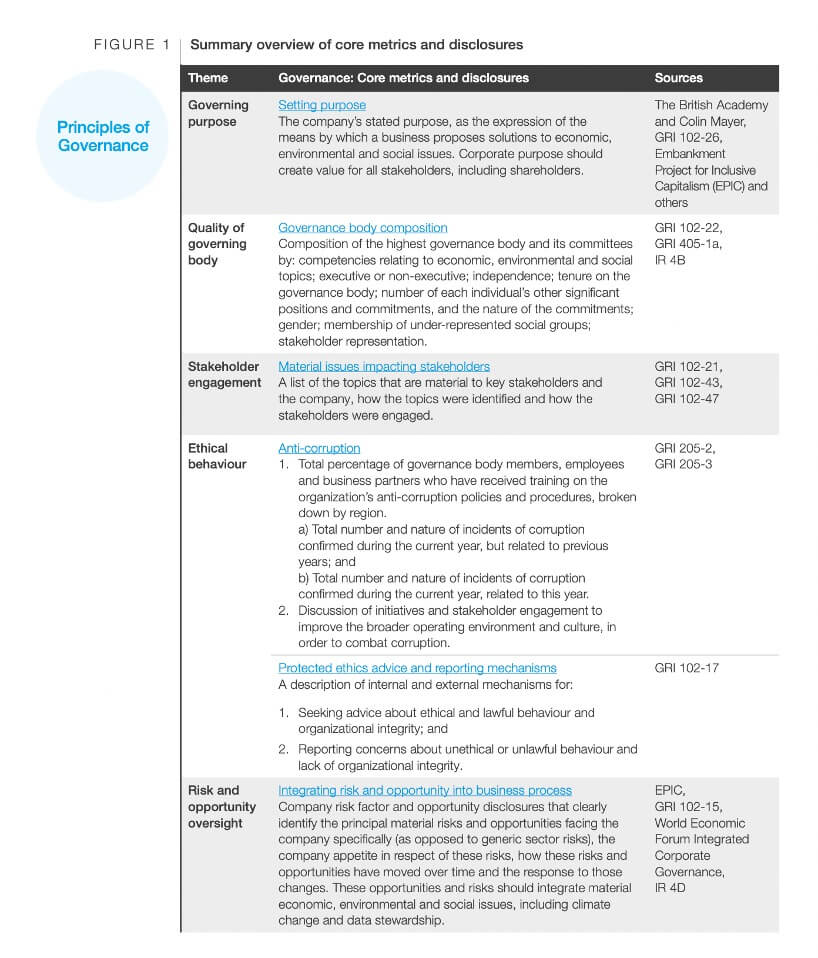

World Economic Forum (WEF)

Established in 1971, the WEF is an international organization for public-private cooperation. It engages the “foremost political, business, cultural and other leaders of society to shape global, regional and industry agendas.”

The World Economic Forum (WEF) developed a suite of ESG performance indicators, referred to as the 'Stakeholder Capitalism Metrics.' This aids businesses in standardizing ESG reporting and monitoring their strides toward Sustainable Development Goals (SDGs) on a consistent basis.

You can find everything you need to know in their report, Measuring Stakeholder Capitalism: Towards Common Metrics and Consistent Reporting of Sustainable Value Creation.

International Sustainability Standards Board

The International Sustainability Standards Board (ISSB) is committed to formulating standards that present a comprehensive, quality-assured global groundwork for sustainability disclosures, keeping in mind the requirements of investors and financial markets.

The ISSB has mapped out four primary goals:

- The creation of standards that constitute a global foundation for sustainability disclosures.

- Addressing information necessities of investors.

- Equipping businesses with the means to communicate extensive sustainability information to the global capital markets.

- Enabling coherence with disclosures that are region-specific and/or target broader stakeholder groups.

Qualitative vs quantitative ESG metrics

Qualitative ESG metrics are all about descriptive data that can't be crunched into numbers. They provide insights into a company's strategies, operations, and other unique traits that are tough to pin down numerically. This means when collecting data for this ESG metric, it’s easier to use words rather than numbers.

ESG quantitative metrics are data you can collect and assess in numbers (or numerical patterns). They can be set in hard stats and figures that can be plugged into a calculation or a spreadsheet. They dish out data in forms such as percentages, monetary values, or other measurable units, giving you a clear, numerical snapshot of your company's ESG performance. They might provide insights like how much product you're shifting, or the mileage your imports and exports are racking up.

So, while qualitative metrics weave the story, quantitative metrics give you the cold, hard facts. Both are essential for a holistic understanding of a company's ESG impact.

Common ESG metrics (and how to measure them)

If it helps, try to think of ESG metrics like a giant jigsaw puzzle, with pieces belonging to the environment, social, and governance pillars. The picture that comes into focus is influenced by the framework you choose to follow. But here's a tip: if your goal goes beyond just ticking the compliance boxes, it pays to adopt a wider lens.

Also, keep in mind that not all ESG metrics are created equal. You’ll discover that some can neatly fit into spreadsheets as numbers and percentages. On the other hand, you’ll come across others that might be a simple tick in a box.

Here is a list of ESG metrics to consider and how to measure them:

Environmental metrics

Environmental metrics center around how a business's activities influence the world around us - our air, water, land, and the various species that call this planet home. It's all about understanding the ecological footprint of a company's operations, products, and services.

Below, we’ll discuss some standard ESG environment metrics but it’s worth noting that you may want to include additional metrics according to your business and the framework you choose to use.

Greenhouse gas emissions (GHGs)

The amount of harmful gases a company releases into the atmosphere is a key ESG metric. Tracking CO2 and methane emissions allows businesses to identify the largest sources of their emissions and target those areas for improvement.

Companies can use carbon accounting methodologies and tools, considering direct emissions (from owned or controlled sources) and indirect emissions (from purchased electricity, steam, heating, and cooling).

Measure: Levels of methane (CH4), carbon dioxide (CO2), carbon monoxide (CO), and nitrous oxide (N2O).

Energy efficiency

This measures how much energy a company uses to produce its goods or services, with the goal being to achieve the same or better outcomes with less energy. It’s an important ESG KPI because the quantity of energy a company consumes to produce its goods or services can significantly impact its environmental impact. More efficient use of energy reduces both operating costs and reliance on fossil fuels.

Measure: Energy consumption per unit of output such as kilowatts per hour (kWh). You can use energy management software that provides insights into usage patterns to help with this.

Water use and management

With water scarcity affecting many parts of the world, efficient water usage is not only environmentally responsible but also essential for risk management.

Companies must monitor total water withdrawal, recycled water, and their water usage impact on local ecosystems.

Measure: Water footprint calculators and water accounting methodologies can help track this ESG KPI by measuring water consumption (liters or cubic meters).

Waste management

Sustainable waste management means a company is not only reducing the waste it generates but also maximizing its recycling efforts. This reduces environmental harm and can cut costs. Waste includes everything from solid waste such as plastic to hazardous waste, radioactive waste, and so on.

Measure: Regular waste audits can identify the types and amounts of waste produced, and waste tracking software can provide ongoing monitoring. Waste usage is measured in cubic meters, tons, and/or kilograms.

Air pollution

Beyond greenhouse gases, a company's operations can emit other harmful substances into the air, such as dust, dirt, soot, and sulfur compounds from burning oil and coal. Monitoring these emissions helps protect air quality and public health.

Measure: Emission measurement devices or calculations based on fuel usage can provide accurate measures. For example, a gas monitor.

Biodiversity impact

A company's operations can significantly impact local ecosystems, from changing land use to disrupting local species.

Tracking these impacts helps protect biodiversity, an essential component of a healthy planet. Ecological surveys or environmental impact assessments can provide this information.

Measure: Quantify and monitor elements such as land use, resource depletion, etc.

Raw material sourcing

Sustainable sourcing helps reduce the environmental harm caused by extracting and transporting raw materials. It also ensures the sustainability of supply chains.

Measure: Certifications like FSC (for wood products) or MSC (for fish) and life cycle assessments can track sustainable sourcing and assess overall environmental impact.

Social metrics

Social metrics are the pillars of social responsibility in an organization, addressing a broad spectrum of issues ranging from workforce diversity to human rights.

Social metrics don't only mirror a company's internal culture but also show how a business aligns its practices with societal expectations, fostering trust and enhancing its reputation in the process.

Charity and philanthropy

This captures the magnitude of a company's efforts to give back to the community, reflecting its societal contributions. From organizing volunteering programs to making financial contributions, this metric helps gauge the depth of a company’s philanthropic spirit

Measure: Add up your financial donations, volunteer hours, and the number of community initiatives you support.

Comparative living wages

A metric that establishes whether a company pays wages that align with or surpass the living cost in the regions it operates. By ensuring fair wages, businesses can positively impact their employees' living standards.

Measure: Wage comparisons against local living cost indexes can help measure this.

Diversity and inclusion

ESG diversity metrics quantify the level of workforce diversity across different demographic attributes like ethnicity, gender, or age. Furthermore, it examines how well the organization includes and values these diverse groups.

Measure: Employing methods like surveys, demographic data analysis, and gathering employee feedback can provide insights into these areas.

Employee engagement

This metric reveals the degree of employees' emotional connection and commitment to their organization, which typically signifies a positive company culture.

Measure: Regular employee surveys, attrition rates, and performance metrics can be excellent indicators of engagement levels.

Gender pay gap

This ESG metric highlights any pay disparity between men and women for the same job roles within a company, representing a crucial aspect of employment fairness.

Measure: Regular pay audits and comparative salary analysis will help measure this.

Health and safety

Health and safety is an important one because it assesses the work environment in terms of accident rates and health hazards, and the efforts made to promote employee well-being.

Measure: Tracking incidences of workplace accidents, sick leaves, and the implementation of wellness and safety programs helps in measuring these aspects.

Human rights

This metric embodies a company's commitment to upholding human rights within its premises and throughout its supply chain. Compliance with child labor laws, fair work conditions, and workers' rights are integral parts of this.

Measure: Regular audits and obtaining third-party certifications are methods to measure these aspects.

Reskilling and training

This assesses a company's investment in upgrading and enhancing the skills of its workforce.

Measure: This ESG metric can be quantified by the number of training hours per employee, funds allocated to training and development, and/or the number of employees who undergo training.

Wealth generation

Wealth generation evaluates the economic value a company creates for its stakeholders, which includes employees, shareholders, and the local community.

Measure: Calculating economic value added (EVA) or other financial impact tracking methods can measure this.

Governance metrics

ESG governance metrics focus on how a company is run and how well it adheres to ethical business practices. Here are some of the key governance metrics, what they mean, and how they can be measured:

Board composition

This refers to the diversity and independence of a company's board of directors. A diverse and independent board can foster a variety of perspectives and reduce the risk of conflicts of interest.

Measure: Companies can measure this by tracking the demographic diversity (such as gender, race, age, etc.) and professional backgrounds of their board members, as well as their independence (i.e., not having ties to company management).

Executive compensation

This involves the pay packages for a company's top executives and how well they align with the company's performance.

Measure: Compare executive pay to company performance indicators like profits or share price. They can also compare their executive pay ratios (the CEO's pay as a ratio of the median employee's pay) to industry norms.

Ethics and anti-corruption policies

This measures a company's commitment to ethical business practices and its efforts to prevent corruption.

Measure: You can track this through internal audits and compliance checks. Or, you can also monitor any violations of their ethics policies or any legal issues related to corruption.

Shareholder rights

This refers to how well a company respects the rights of its shareholders.

Measure: Keep track of shareholder votes, any disputes with shareholders, and their efforts to engage with shareholders.

Regulatory compliance

Regulatory compliance is how well a company adheres to laws and regulations.

Measure: Trail regulatory fines, warnings, and inspections.

Transparency and reporting

This refers to a company's openness about its operations, financials, and ESG performance.

Measure: Evaluate the quality and frequency of your financial and sustainability reporting, as well as any third-party recognition you receive for transparency.

How to choose which ESG metrics to use

As a CFO, choosing the right ESG metrics for your company can seem like a daunting task given the myriad of options available. But it doesn't have to be. Here are some tips to help you decide which ESG KPIs and metrics to focus on:

1. Know your industry and your company

Different sectors face different ESG challenges. The primary metrics for a manufacturing company will be different from those of a tech startup. Analyze your company's operations and sector to understand which ESG issues are most pertinent.

2. Align with company strategy

The selected ESG metrics should align with the company's overall strategy and values. If your company has committed to becoming carbon-neutral, for example, you'll need to track CO2 emissions closely.

3. Identify stakeholder concerns

The views and expectations of stakeholders, including investors, employees, customers, and the wider community, should be factored into your decision-making process. For instance, if your shareholders are particularly focused on social impact, metrics related to workforce diversity and community involvement would be important to track.

4. Consider legal and regulatory requirements

Depending on your geographical location and industry, there may be legal or regulatory requirements that dictate which ESG metrics you need to monitor and disclose.

5. Benchmark against peers

Look at the ESG metrics that your industry peers and competitors are using. This can provide useful insights into industry best practices and ESG trends.

6. Leverage ESG frameworks

Utilize established ESG frameworks and standards to help guide your selection of metrics. These frameworks have been developed by experts and provide a comprehensive approach to ESG reporting.

7. Ensure the feasibility of data collection

Lastly, it's important to consider whether you have the capabilities to reliably gather and measure the data required for your chosen metrics. The selected ESG metrics should be practical and feasible for your business to implement.

How to leverage ESG metrics for business success

Here's your quick guide to boost them to drive business success:

Link metrics to strategy

It's essential to make your ESG metrics part of your core business strategy. They're not just 'nice to have'—they're powerful tools for value creation and risk management.

Storytelling is key

How you communicate your ESG efforts matters. Craft a compelling narrative around your ESG performance, linking it to your business's broader vision and values. This will resonate with stakeholders and create brand loyalty.

Stay ahead with tech

Embrace technology. Advanced analytics and AI can help you track your metrics more accurately and identify areas for improvement more quickly.

Engage stakeholders

Keep the lines of communication open. Regularly engage with investors, employees, and customers to update them on your ESG progress. Their feedback can provide valuable insights for future action.

Continuous improvement

Make ESG a journey, not a destination. Regularly review your metrics and progress, adjusting your approach and goals as necessary.

Remember, successfully leveraging ESG metrics isn't just about the numbers. It's about embedding sustainable finance practices into your business DNA and using them to drive meaningful change and success.

FAQs: ESG metrics

What are ESG metrics and why are they important?

ESG metrics measure a company's environmental, social, and governance performance. They're vital because they help companies track their sustainability efforts, inform strategic decisions, and demonstrate their commitment to sustainable practices to stakeholders.

How do we select the right ESG metrics for our company?

Start with your company’s strategy and values. Consider your industry, size, geography, and stakeholder expectations. Use these factors to identify the most relevant ESG issues, and select metrics that align with these.

How can we ensure the accuracy of our ESG data?

Accuracy starts with robust data collection and validation processes. Technology can play a big role here. Using dedicated ESG software or platforms can ensure consistency and reliability in your ESG reporting.

What's the role of a CFO in ESG reporting?

As a CFO, you're a key player in ESG reporting. You'll help to select relevant metrics, oversee data collection and reporting, and communicate the financial implications of ESG performance to investors and other stakeholders.

How is ESG performance measured?

ESG performance is measured using a combination of qualitative and quantitative metrics, often aligned with established standards or frameworks. Data is gathered from various sources, analyzed, and then reported in a structured manner.

How do you evaluate an ESG report?

When evaluating an ESG report, look for comprehensiveness, relevance, accuracy, and transparency. Check if the company has used recognized standards or frameworks and whether the data is audited. Also, see if the report aligns with the company's overall strategy and operations.

Join the Finance Alliance Slack Community

Start networking with other CFOs and finance leaders inside our free Slack community for finance professionals.

Share ideas, ask questions, discover new talent, and grow your network within one of the most engaged communities of finance professionals in the world.