Thinking about making the move from FP&A to CFO?

Well, you’re not alone. Deloitte reports that 47% of CFOs had experience in FP&A before they transitioned to the top executive role… and you can too.

In this episode of the Two Cents: Finance Talk podcast, we had the pleasure of speaking with Paul Barnhurst, otherwise known as ‘The FP&A Guy.’

We talked about what it takes for an FP&A professional to become a Chief Financial Officer, covering topics such as:

- Can you transition from FP&A to CFO?

- Communication tips

- How FP&A professionals can get more involved in strategic discussions

- How to demonstrate leadership skills

- How CFOs can help to standardize data

- Reducing non-value add activities

- Top tips to get closer to the C-Suite

You can listen to Paul’s episode below, or keep reading for Paul’s insights in his own words:

Can you transition from FP&A to CFO?

The ability for FP&A to transition to the role of CFO is completely possible. You're seeing more and more people from FP&A transition to the role of CFO (or to the position of a virtual CFO or fractional CFO).

One of the software vendors out there recently did a study showing that more and more CFOs today are coming through FP&A versus the traditional way.

The vast majority came through controllership. Governance used to be key, and it was all about keeping people out of trouble and making sure the books were right.

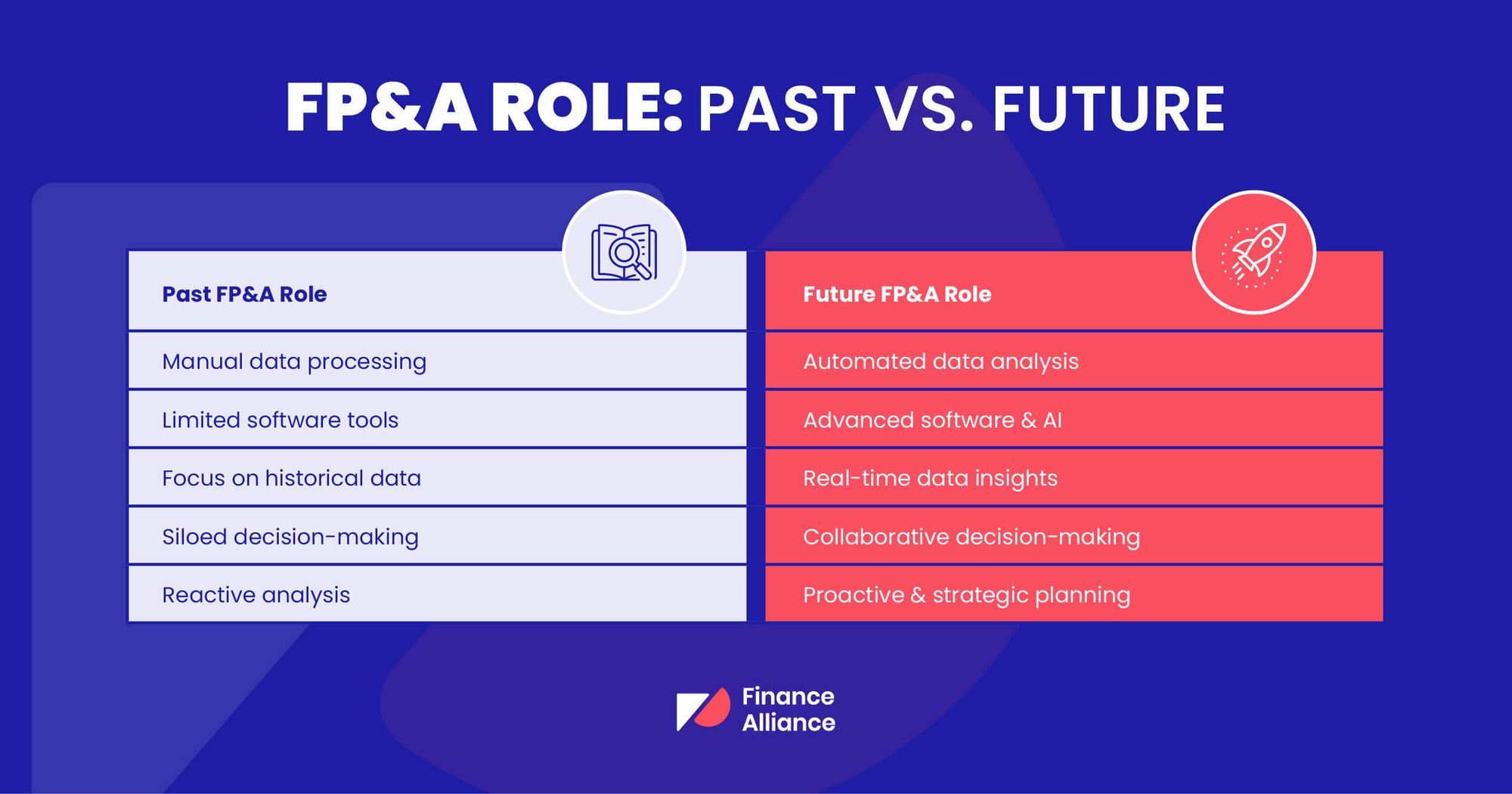

Today, the modern CFO is much more about data and commercials and really helping create value for the business. And because FP&A is one of the few organizations that's cross-functional, has a holistic view of the entire business, and works with every part of it, they're well positioned.

At the same time, you need more than just FP&A experience. You need to be well-rounded in finance.

There’s one person I really like, Jeff Marks. His company uses something they call the ‘finance passport.’ He says that if you want to be a CFO, you need to be a finance specialist. A specialist is like an athlete, where you do multiple different things. You’ve got to punch different parts of that passport.

It doesn't mean you have to be in all those roles, but you need projects that show you can demonstrate and lead a group that matches those things, from audit to tax, to accounting, to FP&A, to treasury.

Improving your communication skills to help move from FP&A to CFO

To improve your communication, I think the biggest thing is practice.

One person who speaks a lot about it on LinkedIn and is a fabulous presenter is Carl Seidman. He often talks about all the practice he’s put in. He used to be part of a comedy group, he did Toastmasters, and now he's part of a national speaking club.

He even had a voice coach at one point. He made a complete commitment to learn how to be able to command a room, and he’s put in hundreds of hours.

So, communication, whether written, verbal or whatever method it may be, really comes down to deliberate practice to get good at it.

How FP&A professionals can get more involved in strategic decisions

To go from FP&A to CFO, you need to be more strategic and there are a couple of things that go into becoming more strategic. First, you’ve got to know the business. For a long time, FP&A was viewed as what I call FP&R, Financial Planning and Reporting. For example, here's this 100-page deck that nobody will read which will end up in the round file basket.

Now you're seeing much more. It's about knowing the business and discussing commercials.

I remember one time knowing I'd really made an impact in the business when I was sitting in a meeting with our product team. We were working through some new pricing, and they turned to me and asked, well, what should the price be?

I tried to look at it strategically, but my response was:

“Here's what it needs to be from a margin perspective. But ultimately, setting the price should be the responsibility of product, the marketing, and the sales team. With finance, I'll give my input, but you guys need to decide what the market can bear here.”

…and so that was a strategic discussion.

We got to the point where I had that seat at the table, and we were working together. But the only way that happened was because I took the time to learn the business.

That's the biggest piece of advice I can give.

If you want to be involved in strategic discussions, make sure of two things. One, that you've learned the business, and two, that you're providing value and support to the leaders of your organization. You're not focusing on finance needs, you're focusing on business needs.

How to demonstrate leadership skills as an FP&A professional

At the end of the day, whether it's finance or an FP&A role, if you want to be a senior leader, you must demonstrate leadership. That can be done in different ways. There's a manager, and there's a leader.

I've been in roles where I've had a manager, but I’ve had my CFO telling me, “You're the leader of this group right now, even though you have a manager.” And in time, I ended up becoming the manager as well.

Demonstrating leadership comes from working to take control of situations and being proactive. By taking control, I don't mean going in and saying, “Hey, I'm in charge, I'm going to run this.” Instead, it’s showing you can help guide and move it forward and influence it regardless of whether you're the one officially in charge.

There are a lot of ways you can do that. Volunteering for assignments is always a great way when you don't have any leadership experience.

I had someone on my podcast called John Laudie, who's now a CFO. He wanted to get some leadership experience, but there just weren't enough people on the team. So, he proposed a program to bring in some college interns for the summer, and he managed both the program and the interns.

It was low cost, high value, and it gave him some really good CFO leadership experience. And then when a position came up to manage a team, he ended up getting the position.

So sometimes you need to be creative and think of different ways to get experience, even outside of work. For example, you could volunteer to be part of different leadership organizations during school. There are lots of ways you can demonstrate that.

How CFOs can help to standardize data

CFOs are the ones who are mostly responsible for implementing new technologies in the business, and this is certainly something you can get more involved with to help go from FP&A to CFO.

The reality is that more CFOs are putting the analytics and the data teams under them.

In the last job I had, we got a new CFO, and one of the very first things he did was stick analytics under him and get involved in the system side.

We were working on a CFO transformation and bringing in CPQ, configure, procure, and quote tools. And he immediately asked, “How do we move this forward? How do we get this done quicker?” He brought in a new person to manage the analytics and the operations, and you could see it was very data focused.

So, you're seeing a big push by CFOs because what's one of the few organizations that sees the data across the entire business? It's finance. And often they should be the ones calculating those metrics so they’re standard.

One huge problem is something I dealt with a lot in my last role. I was helping to standardize all our definitions for metrics. I went to marketing and asked how they defined churn. “Well, we're doing it this way.” In finance, we were doing it another way. Then you went over to the sales ops person, and they were doing it a completely different way as well.

And then the CFO says, “I want to see it this way.” Every number is different.

So that's the worst place to be for a leader, to sit in a meeting and spend the first 45 minutes arguing over the data and how it should be defined.

And so, the more a CFO can help with that transformation and push to ensure that systems speak together, and the data is standardized, the better.

Reducing non-value add activities in FP&A

We’re really in a golden age of software tools. I've talked to around 60 CEOs in the last year. Since I started doing this in the last 14 months, I’ve also demoed 60-70 tools. I talk to a CEO every week, around someone who's built a software tool.

The opportunity to use a tool is better than ever. And despite that, there are still times that Excel or Google Sheets, depending on the size and complexity of the business, may make sense.

But as companies start to scale, they deal with some real challenges such as collaboration, security, and data integration, which a tool such as a spreadsheet can't solve very well because they're not an enterprise platform.

An FP&A tool is great because it can help with collaboration, bringing in all that data, and helping a business automate a lot of things.

The reality is that most finance people spend 50-70% of their time on non-value add activities. Those types of things aren’t what they want to be doing and don't help them to be strategic and a senior leader, but they have to be done.

So, tools will continue to play a big role in making it so that you don't have to spend as much time on the non-value add activities, and you can focus on gaining insight from the data.

3 top tips to help you transition from FP&A to CFO

There are three key things that FP&A professionals can start doing now in their roles to help them get closer to a C-suite position. The biggest thing is to learn the business.

The second is to add value to the senior leaders. Make sure you're meeting their needs.

And the third thing is to be willing to speak up and speak about more than just financial issues. Speak up about strategic things in the business.

Don't take over conversations, but make sure you can add value and your voice can be heard because people will notice that. And when you start adding value, more opportunities will become open to you, and your career can grow from there.

FAQs: FP&A to CFO

Can FP&A lead to CFO?

FP&A serves as a solid foundation for pursuing a CFO role, providing crucial experience in financial planning, analysis, and forecasting. Although it's not the exclusive route, it equips you with an in-depth understanding of a company's financial well-being and strategic decision-making, which are vital for a CFO. Broadening your experience and showcasing leadership skills can significantly improve your prospects of progressing to a CFO position.

Can I become a CFO without an MBA?

Yes, you can become a CFO without an MBA, but having one can enhance your career prospects. Pursuing a relevant master's degree, such as an MBA or a Master's in Finance, can help you gain valuable skills, demonstrate your commitment to the field, and expand your professional network.

What skills do I need to transition from FP&A to CFO?

To transition from FP&A to CFO, you'll need to develop skills in strategic planning, financial management, risk assessment, leadership, communication, and understanding regulatory compliance. It's essential to gain experience across various finance functions and build a broad business perspective.

Can a Financial Analyst become a CFO?

Yes, a Financial Analyst can become a CFO. It's important to gain experience in various finance roles, including FP&A, and develop a broad range of skills in strategic planning, financial management, and leadership. Demonstrating your ability to think strategically and contribute to a company's overall growth will help you progress towards a CFO position.