“Enterprise Value” has become a catchword in business schools and organizations within the finance community. These organizations are under tremendous pressure to pivot from a financial controlling role to a business partnering role. They're also expected to deliver business value to the organization and its stakeholders.

So, what is the definition of enterprise value? How can you identify, create, and capture value? How can you deliver, distribute, and preserve value? And finally, how is it grown, sustained, determined, and destroyed?

I answer all of these questions and more in this article, covering topics such as:

- Why people, profit, and the planet should be viewed as the bedrock of business

- How value is distributed to different stakeholders

- The definition of enterprise value and why it is so important

- Enterprise value (EV) calculation

- How to calculate market capitalization

- A closer look at share price analysis, prediction, and determination

Background

The Nobel economist, Milton Friedman, argued that the primary purpose of a business is to maximize profit for its shareholders. This is the traditional view of the purpose of a corporation in the shareholder primacy theory.

But times are changing. Maximizing profit to shareholders without creating value for stakeholders is a step in the wrong direction. Without value creation, businesses wouldn't be in business at all. Value creation is an essential foundation to support the achievement of a lasting sustained profitable growth. At the same time, it must provide genuine value to the stakeholders.

Today, organizations are redefining the measurement of successful performance and value creation from more diverse and broader perspectives. They are achieving this by adopting the Triple Bottom Line (TBL) framework. TBL is a sustainability framework that incorporates social, environmental, and economic impacts into business operations. It guides organizations on value creation by maximizing the three bottom lines below:

- People: contribution to the betterment of the customers, employees & communities.

- Planet: environmental-friendly activities and their contributions to sustainability.

- Profit: total economic profit generated for society in addition to accounting profit.

This holistic value creation is the bedrock of business. It sets a company apart from its competitors and helps to secure new customers. Not only that, but it also retains existing customers, engages employees, and brings distinct meaning to the brand and the products, solutions, and services. It is also important to note that value is not just about monetary value. It can be in quantitative or qualitative terms.

- Creating value for customers helps maintain the sales growth of products and services.

- Creating value for employees results in higher operational efficiency.

- Creating value for shareholders translates into an increase in stock price and future investment capital.

- Creating value for the communities and the environment results in better support from society and government bodies.

Value System: What, Who, How, and Why

The activities that make up the economy are not a zero-sum game. Gains in one area do not have to come at the expense of losses in other areas. When organizations generate outputs more valuable than the sum of the inputs, the economy grows. Thus, it creates value for the stakeholders.

Defining value involves building up and focusing on your stakeholders. But, the business value is not determined and decided unilaterally by an organization. The business value is defined by customers, employees, investors, suppliers, and other stakeholders.

For the going concern of an organization, the business value needed to be fairly distributed among its key stakeholders, including:

- Shareholders (dividends)

- Employees (wages and benefits)

- Incentives for executives (performance-based bonus)

- Suppliers (purchases)

- Debtors (interest)

- Government (taxes)

- The organization itself (retained earnings for reinvestments).

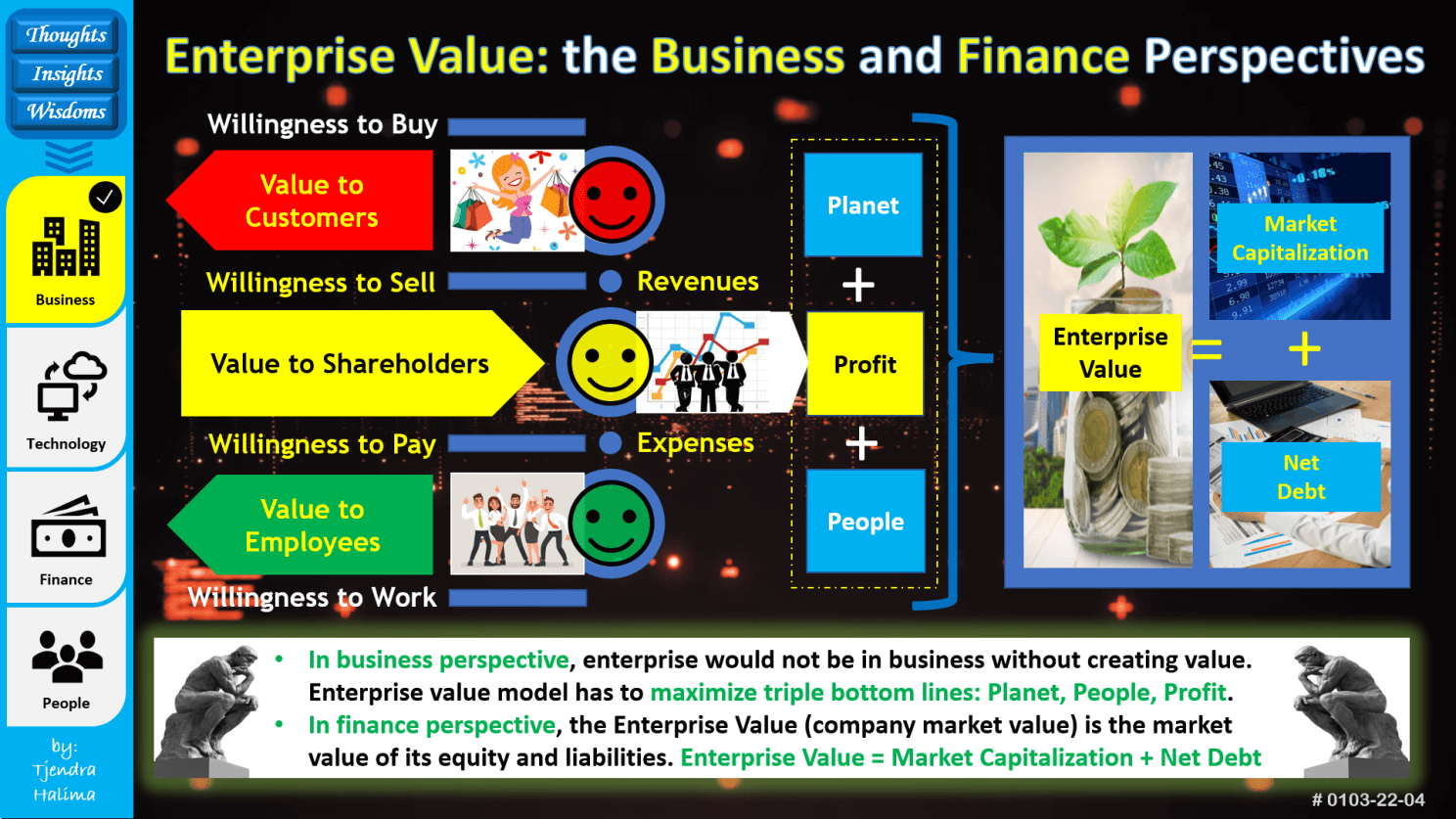

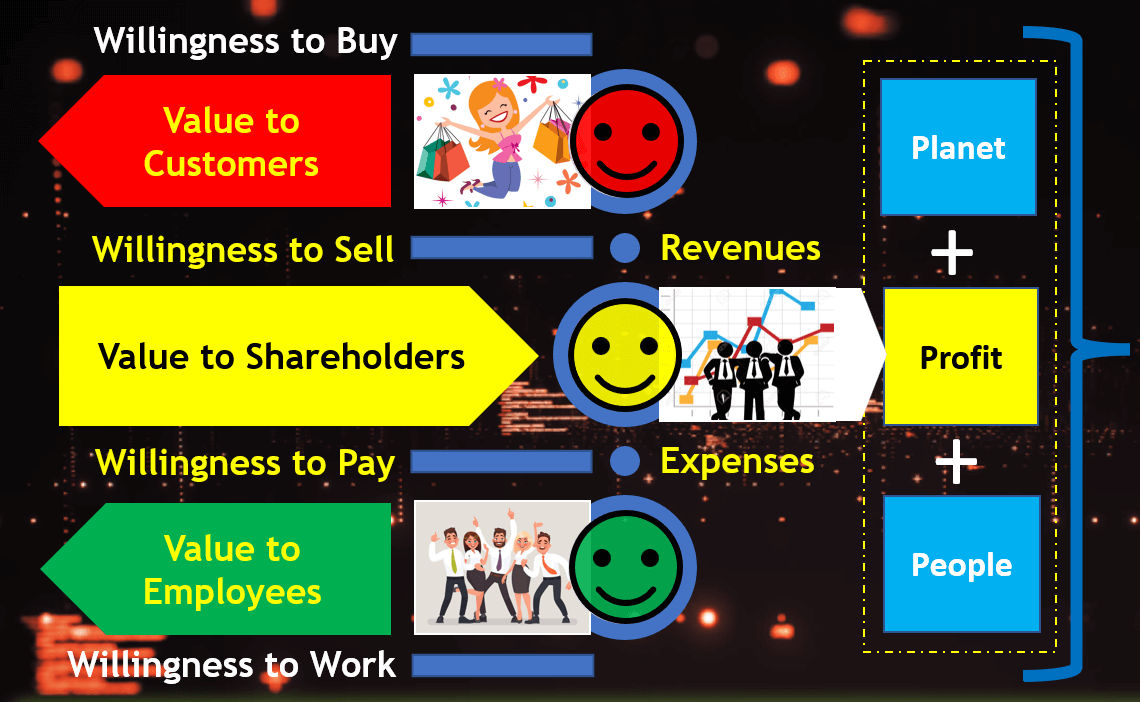

Below is an illustration of how value is distributed to the different stakeholders. For the sake of simplification, we use three groups of stakeholders: customer, employee, and shareholder. In reality, we have to consider other groups of stakeholders, such as the supplier, debtor, community, etc.

If we were to adopt the shareholder primacy theory, we will maximize the profit or value to the shareholders without leaving any value to the customers and employees. In the monopoly business environment where customers have no other options, we can deliver negative value to customers by selling higher than what the customers are willing to pay for. In an employer’s market environment where employees need the job badly to survive, we can deliver negative value to employees by paying lower compensation than what they are willing to work for. Therefore, by exploiting the customers and employees, we can deliver maximum value to the shareholders.

However, if we were to shift from shareholder capitalism to stakeholder capitalism, we have to distribute the value created and share it fairly with the customers, employees, and other stakeholders. In other words, organizations have to adopt the triple bottom line (TBL) framework by simultaneously maximizing three bottom lines: People, Planet, and Profit.

On the surface, adopting a triple bottom line approach may seem idealistic in the business world that emphasizes profit over purpose. However, a lot of successful and innovative companies have shown that it is possible to do the right thing and still do well – making money. You can have the cake and eat it too.

Everyone can prosper together. The triple bottom line does not inherently value societal and environmental impacts at the expense of financial profitability. Instead, many firms have reaped financial benefits by committing to sustainable business practices. There is very good reason to believe that solving the world's problems presents trillions of dollars worth of business opportunities.

Enterprise Value

We discussed how value is created and distributed to each stakeholder. It is more about the business value contribution of a company at present. How about value contribution in the future? Will customers continue to buy from us? Will employees continue to work with us? Will shareholders continue to own our shares? It is both the present and future events that determine the enterprise value of the company.

Customers might not continue to buy or use our products or services if they can get better value from our competitors. Employees might not continue to work in our organization if they can find a better organization to work for. It is not just about monetary value, it could be a non-monetary value such as better experience, better service, better environment, better management, potential to grow, etc.

Shareholders also might not hold our company shares indefinitely, and new investors might not want to buy our company shares if they can find better value somewhere else to invest their financial resources. This brings us to the discussion on the enterprise value of a company.

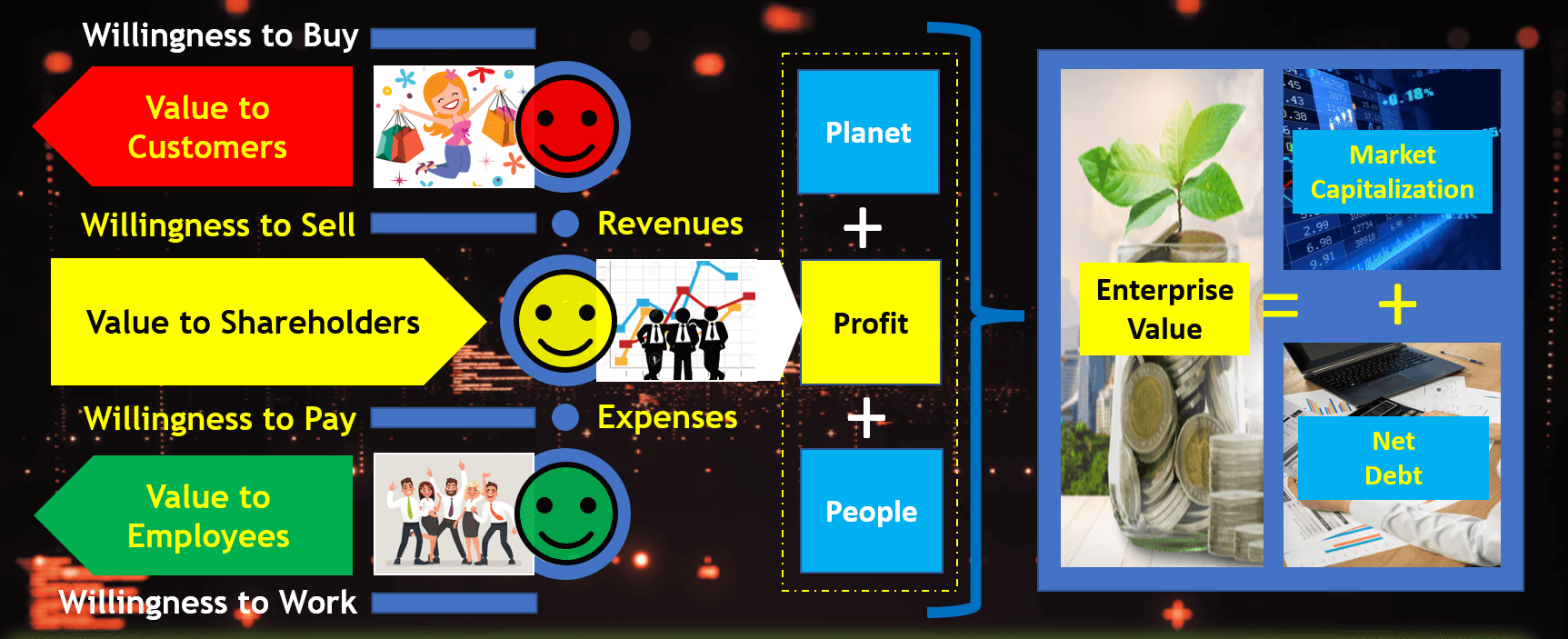

Enterprise value (EV) is a measure of a company's total value. It looks at the entire market value of the company rather than just the equity value based on market capitalization, so all ownership interests and asset claims from both debt and equity are included. Enterprise value is a popular metric used to value a company for a potential takeover. It is the theoretical price of a target company before a takeover premium is considered.

From here onward, you might need some basic finance and accounting knowledge to understand the discussion.

Enterprise Value (EV) Calculation

In theory, the enterprise value of the company can be derived from the total current value of assets it owns and the future income or cash it can generate. When we say value, we mean the current or market value of the company. However, obtaining the market value of every asset can be quite tedious, difficult, or impossible.

Therefore, the alternative is to look at how the assets have been paid for. In other words, it is the market value of the liabilities and the market value of the equity. This is in line with the simple accounting equation where assets are the application of funds and both liabilities and shareholder’s equity is the sources of funds used to finance those assets. The only difference is that it has to be at current or market value instead of historical value.

The basic formula is:

EV = MC + Net Debt

EV = MC + (Total Debt – Cash)

where:

MC = Market Capitalization. It is the current stock price multiplied by the number of outstanding shares.

Total debt = It is the sum of short-term and long-term debts.

Cash = Cash and cash equivalents. It is the liquid assets of a company.

The extended formula is:

EV = Common Shares + Preferred Shares + Market Value of Debt + Minority Interest – Cash and Equivalents.

Of course, it could be a lot more complicated in a real business situation.

Market Capitalization (MC)

Market Capitalization or equity value is calculated by taking the company’s fully-diluted shares outstanding and multiplying them by the current market price of the share. The fully diluted includes all in-the-money options, warrants, and convertible securities, besides the basic shares outstanding.

If you want to acquire a company, you need to pay that company’s shareholders at least the market capitalization (MC) value. However, this is not an accurate measure of a company’s true value, the enterprise value (EV). Refer to the above basic formula where EV = MC + Net Debt.

Share’s Market Price

Share price refers to the value of a company's stock. The price of a share is not fixed but fluctuates according to market conditions. The price movement of a stock indicates what investors feel a company is worth. The share price will likely increase if the company is perceived to be doing well, or fall if the company is not meeting the market expectations.

Shares are priced based on a company’s current earnings and the expectations of future growth and profitability. The profitable growth can be estimated by looking at the dividends payout, which makes sense for traditional companies but not for start-ups, especially in the tech industry which hardly pays any dividends. Other factors to consider are the company's future cash flows, its level of debt, and the amount of liquidity it has on hand. These are critically important to access if a company can meet both its long-term and short-term obligations.

Share Price Analysis

There are two areas to consider when analyzing share prices:

- Technical analysis is trying to assess the future share price movements by looking at historical chart data. By studying the historical share price trends, the technical analysts identify whether a stock is about to enter a bullish or bearish trend.

- Fundamental analysis is trying to identify whether a stock is overvalued or undervalued. This is done by analyzing the company’s financial information, industry information, macroeconomic data, senior management’s decisions, etc. to determine the company’s perceived ability to generate growth and profit.

Share Price Prediction

There are many quantitative techniques and formulas used to predict the price of a company's shares. Some are future earnings discount models, some are future cashflow discount models, and some are dividend discount models. All of these models are based on the concept that a stock's current price is equal to the sum total of all its future earnings, future cash flow, or future dividend payments when discounted back to their present value.

One of the most popular dividend discount models is the Gordon growth model.

Present value of stock price = (dividend per share) / (discount rate - growth rate)

Share Price Determination

The buyers with bid prices and sellers with ask prices trading in the capital market essentially determine the share price. The question is why a seller is willing to sell at a certain price and why a buyer is willing to buy at a certain price.

There are many theories on why stock prices fluctuate. The two most popular theories are:

- The Efficient Market Hypothesis: the stock price reflects a company's true value (enterprise value) at any given time. It disregards the market price predictions by the technical analysis of the price trends or the fundamental analysis of the company's fundamentals. Hence, we cannot outsmart the market by trying to predict the randomness of the market.

- The Intrinsic Value Theory: the stock price that a company can trade for more or less represents what the company is worth. The company's real value (enterprise value) is the net present value of its earnings or cash that can be extracted from now until the end of the life of the company.

At this juncture, we had just touched the surface of the enterprise valuation. If you are interested to learn more in-depth about this finance topic, you should look for courses in the financial management curriculum. And to be certified as a professional in this area, you have to pass the CFA (Certified Financial Analyst) exam.

Key Takeaways

The activities that make up the economy are not a zero-sum game. Gains in one area do not have to come at the expense of losses in other areas. When organizations generate outputs more valuable than the sum of the inputs, the economy grows and value is created.

Without value creation, businesses would not be in business at all. Value creation is an essential foundation to support the achievement of a lasting sustained profitable growth while still providing genuine value to the stakeholders.

From a business perspective, enterprise value has to be created and shared fairly with every stakeholder. To simply maximize profit for shareholders without creating value for stakeholders is a step in the wrong direction. Organizations are redefining their enterprise value creation model with more diverse and broader perspectives by adopting the Triple Bottom Line (TBL) framework, which maximizes simultaneously three bottom lines: People, Planet, and Profit.

Enterprise Value = Max. Value to (People, Planet, Profit)

From a finance perspective, the enterprise value is the market value of the company, which can be derived from the current value of its assets or the market value of the liabilities and the equity. Since obtaining the market value of each and every asset can be quite tedious, the alternative approach is to look at assets as the application of funds and both liabilities and shareholder’s equity as the sources of funds used to finance those assets.

Hence, Enterprise Value = Market Capitalization + Net Debt

Want to read more of Tjendra's articles? We don't blame you! Read more finance articles from Tjendra Halima right here!

Searching for more resources and advice?

Sign up to our free Finance Alliance Slack community and start networking with other CFOs and finance leaders today!