We live in an as-it-happens world and finance is happening in real-time. In today’s business landscape, the finance and accounting function is expected to operate like a media company distributing financial and business news as it happens. Yesterday’s news today is old news. Information that is one week old is ancient in this day and age.

Accounting closing should be a non-event or a “business as usual.”

Continuous accounting is the future of accounting. The benefits are evident as they reveal crucial business information in real-time. The publication of relevant, quality and timely financial and business stories can significantly influence the decisions made by management. It empowers decision-makers to think more strategically about the future rather than reacting to the past.

But how can you achieve six-hour financial closing?

In this article, I discuss continuous accounting. I also reveal how to achieve six-hour financial closing.

Keep reading to discover:

- The importance of people, processes, and technology

- A closer look at how Cisco achieved the one-day close

- The process of a traditional close with the Record-to-Report (R2R) process

- What is a continuous close?

- An overview of different accounting closes

People, process, and technology

The one-day close (pulling together a company's financials in a day or less) is not something new or unachievable. Most ERP systems can do a one-day close for more than 20 years. All they need is the required information.

"Finance transformation is less about technology and more about people and processes."

Technology isn't the barrier to achieving a one-day close. The real issues are the wasteful processes and human resistance to change. Finance transformation is less about technology but more about people and the process.

The financial close process is one of the most challenging processes to manage, optimize, and control. The finance leaders and their most senior and talented accountants often spend the bulk of their time crunching out the financial statements and investigating the errors, anomalies, or strange trends caused by the flawed closing processes or human errors.

For more than 20 years, major corporations, such as Motorola Inc., Cisco Systems Inc., etc. achieved the one-day close mark. So, let's look into how Cisco accomplished this milestone and the lessons learned. (The information is from credible sources: www.cfo.com and Wall Street Journal).

The company: Cisco

Cisco Systems, Inc. is an American multinational technology conglomerate headquartered in San Jose, California, in the center of Silicon Valley. Cisco develops, manufactures, and sells networking hardware, telecommunications equipment, and other high-technology services and products.

Cisco is one of the largest information technology companies in the world. It ranks 63 on the Fortune 100 with around $50 billion in revenue and nearly 80,000 employees. As of December 2021, Cisco had a market capitalization of around $267 billion.

One-day close

Cisco had achieved the one-day close mark for more than 20 years. Cisco’s finance organization (arguably the most efficient in the world) achieved its much-touted aim of a “virtual close.” On any given workday, the company can now produce consolidated financial statements by about 2 pm.

The idea of a virtual close was not fully formed when Larry Carter, a 19-year veteran of Motorola Inc., joined Cisco in 1995. Instead, he wanted to reduce Cisco’s 14-day close to 1 day. This is something Motorola had achieved - while cutting costs in half.

“The close process in a finance group is very akin to manufacturing.”

“Anyone in manufacturing will tell you if you can reduce the cycle time to manufacture a product, good things happen. Costs go down, inventory goes down, productivity improves, and quality goes up.” - Larry Carter, CFO, Cisco Systems, Inc., 2001

With that view in mind, Carter set to work reengineering many of the financial processes at Cisco and compressing their cycle times. Wherever possible, he used the Web to automate transactions, pushing the finance organization toward that one-day close.

As with manufacturing, implementing the virtual close was not a matter of implementing new technology. Instead, it also was a matter of redesigning and reorganizing the accounting and finance function: changing the accounting and data gathering processes, using standard accounting artifacts, changing accounting policies, reorganizing accounting and finance, and choosing the right and relevant information to manage the business.

Those accomplishments earned Larry Carter the 2000 CFO Excellence Award for Implementing Best Practices in Finance. This made him the first two-time winner in the category.

“We can literally close our books within hours, producing consolidated financial statements on the first workday following the end of any monthly, quarterly, or annual reporting period."

"More importantly, the decision-makers who need to achieve sales targets, manage expenses, and make daily tactical operating decisions now have real-time access to detailed operating data.” - Larry Carter, CFO, Cisco Systems, Inc., 2001

Six-hour close

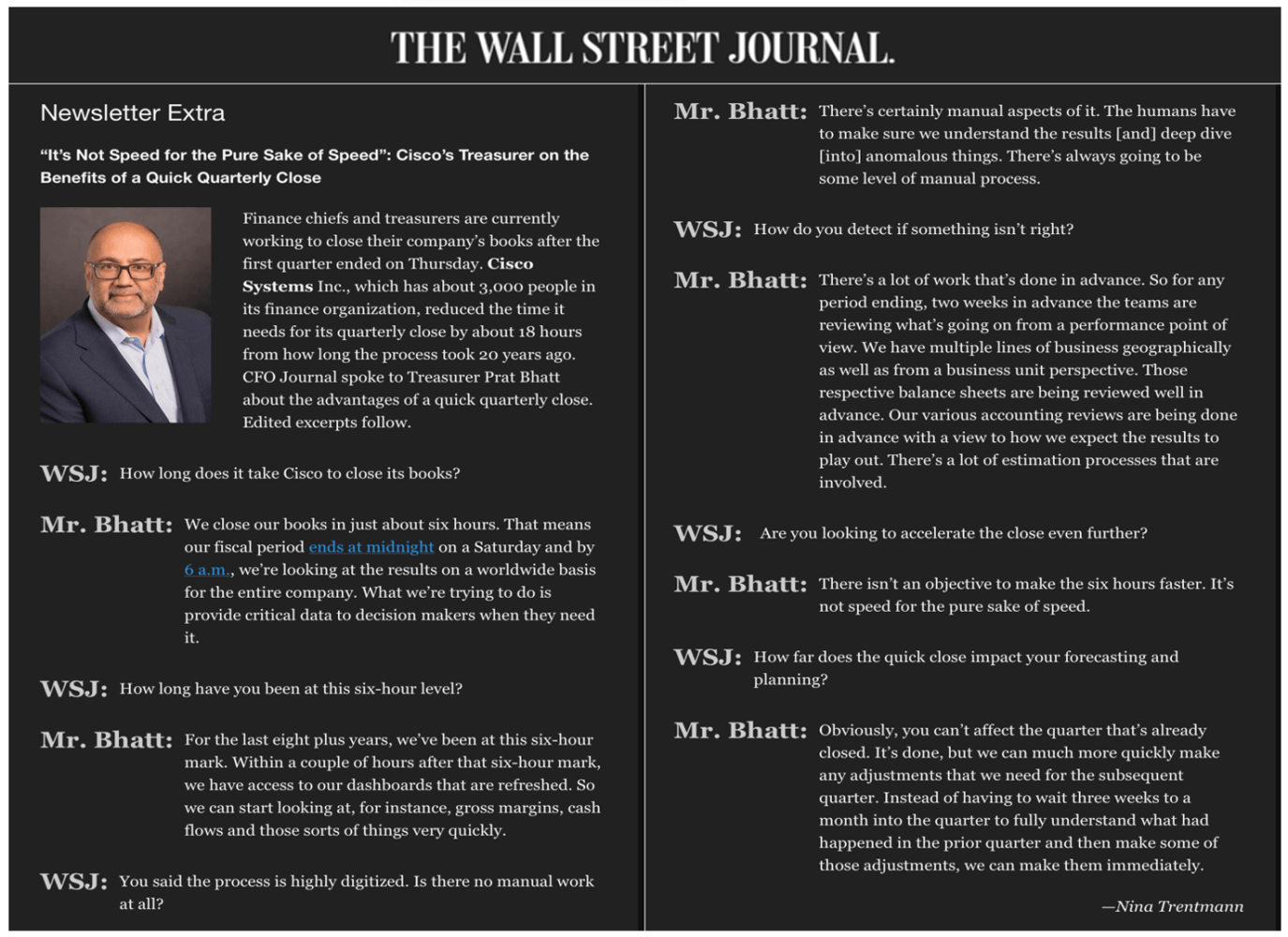

Fast forward to today, Cisco Systems Inc. continues to lead the pack. It's still faster than the rest and set the new benchmark with the accomplishment of a six-hour close.

For the last eight-plus years, Cisco reached the six-hour close mark, a reduction of 18 hours from 24 hours (one-day close) mark achieved twenty years ago. Cisco can close the books in about six hours. In other words, if the accounting period ends at midnight, then by 6 am the next day, the business results (on a worldwide basis) for the entire company will be available.

Within a couple of hours after that six-hour mark, the management can access the dashboards. They can start looking at things like sales, gross margins, cash flows, and those sorts of things very quickly.

"It's not speed for the pure sake of speed"

If you'd like to read further, here is the latest interview with Prat Bhatt, SVP and Chief Accounting Officer, carried out by The Wall Street Journal for their CFO Journal on 7th April 2022.

If Cisco can achieve less than one-day close for more than 20 years. Why can’t other corporations achieve the same? The same old song of defensive answers could be: our business is different, our business is a lot more complex, our legacy system’s limitations, etc. You can add a long list of answers to justify why your organization cannot accomplish the one-day close.

Wakeup call

The financial close is a critical process for any organization. The continuous close is a value-enhancing proposition. Improving the timeliness of information improves decision-making.

In today’s fast-moving and data-driven business environment, the performance benchmark for corporations to close their book are Excellent (six hours), Good (one day), Fair (three days), and Poor (six days).

One-day accounting close is a new normal.

So, if your finance and accounting department still needs six days instead of six hours to close the book and publish the financial results, it is a wakeup call for the CFO (Chief Financial Officer) or the CAO (Chief Accounting Officer) to roll up their sleeves and dive deep into the closing process. It's time to raise the bar!

There is an urgency to take swift and transformative actions to shorten the accounting closing cycle. The key to achieving faster closing is to work smarter, not harder, which will require an investment in people, process, and/or technology.

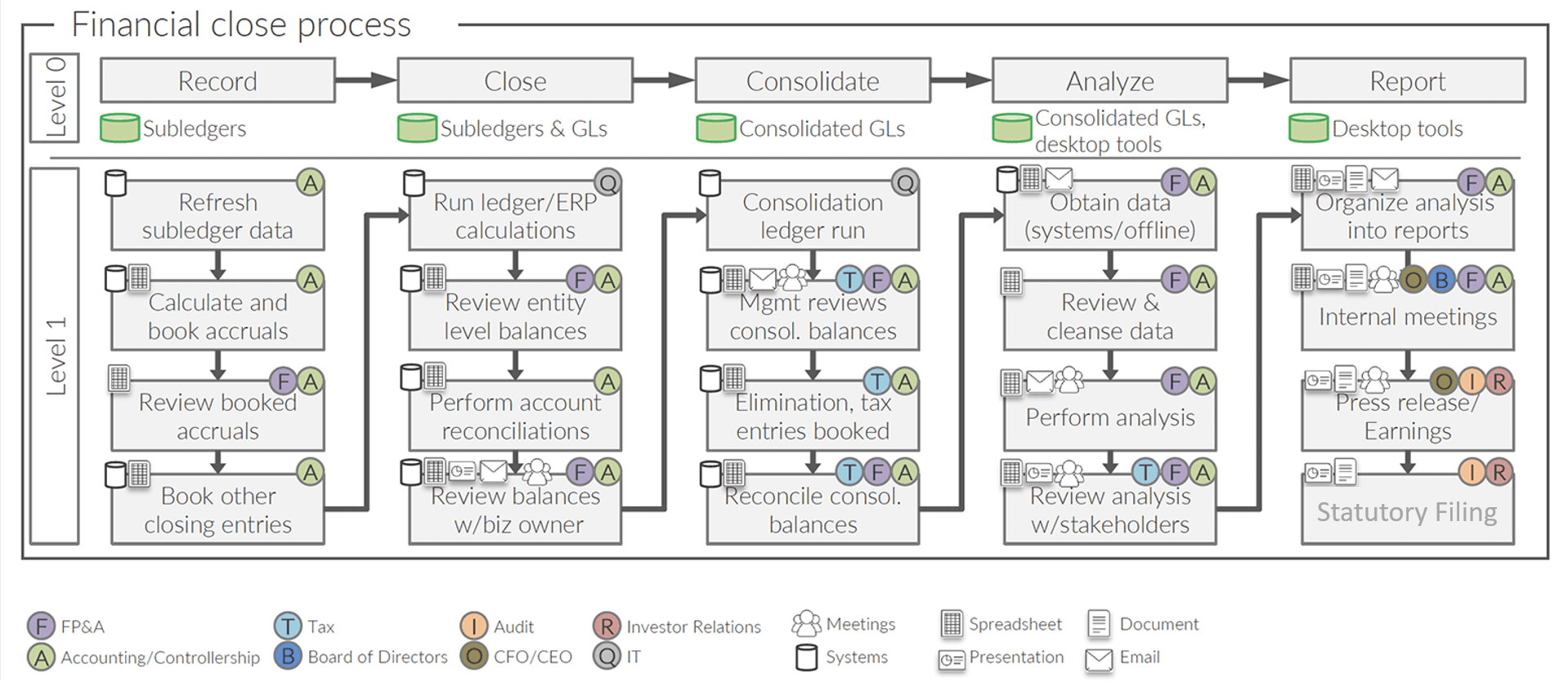

Traditional close

In the traditional close process with the traditional Record-to-Report (R2R) process, we wait until the end of the period to start addressing closing processes. It is a waterfall process that is reactive, sequential, and linear. Accounting teams operate like factory assembly lines.

Each team member is given specific tasks and responsibilities for the monthly close that ultimately produces the final product, the financial results, only at the end of the assembly line. Below is the typical traditional Waterflow finance close process.

The problem with this traditional approach is that closing the book becomes a time-consuming and resource-intensive monthly project or job order that requires a concerted effort, not only by the finance team but across all functions in the company. It is a dreadful process that repeats month after month and quarter after quarter.

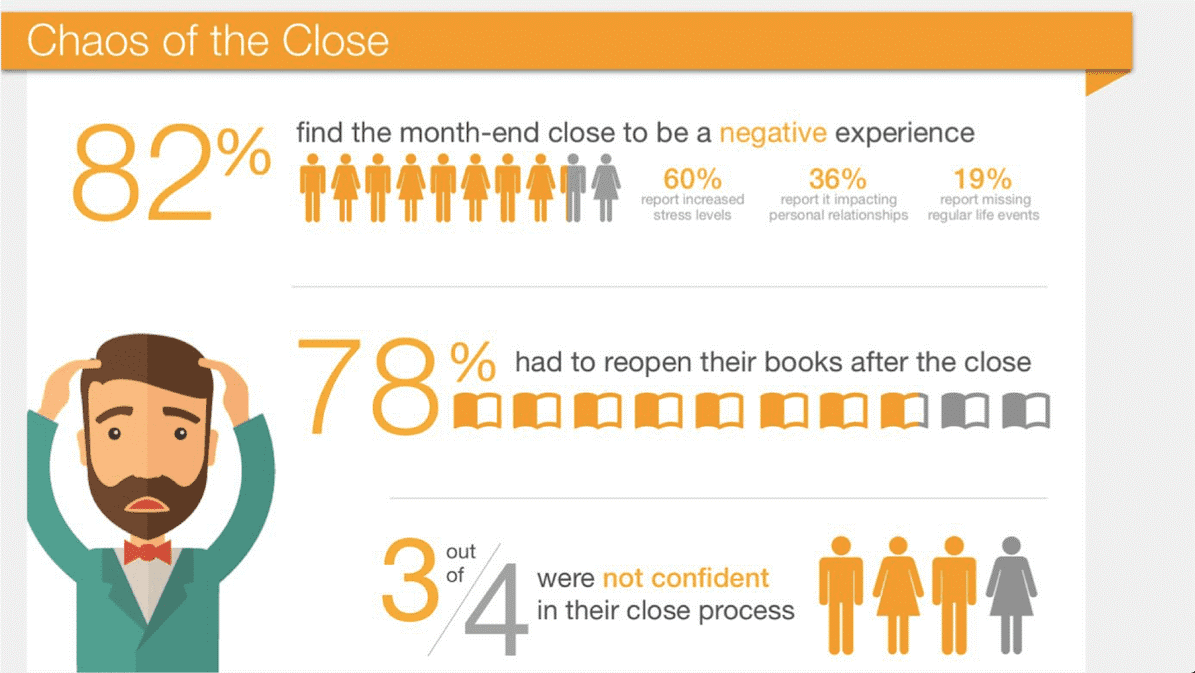

Closing the books at the end of each month is every accountant’s nightmare. It is a major source of stress and organizational burden. Those long hours spent in the office, sometimes during the weekend, with a pile of data are hectic and demotivating. Tensions run high and everything becomes so cramped up. The risk of error is elevated especially when using manual and complex processes that make it error-prone and labor-intensive.

A survey done by FloQast, Inc., revealed the chaotic month-end close processes that are labor-intensive, fraught with errors, and stress-provoking for accountants and their managers. See the summary in the infographic below.

Continuous close

Frustrated with the limitations of the traditional monthly close, some businesses are moving to a continuous close concept. Continuous close makes things much easier for both the company and the employees. This agile way of working can lead to less staff burnout and saves costs.

With continuous accounting, instead of closing the books at the end of each month, we spread many period-end processes throughout the period into day-to-day activities over an accounting period by closing a few items every day. The process of breaking down period-end closing activities makes the period-end close simpler and faster. It also provides better financial insight during the period.

If you are an accountant, you should understand that not all period-end activities can be executed during the period. However, many activities can be done or accurately estimated, thus providing insight earlier, hence improving management and control of operations for immediate corrections or decisions.

Different accounting closes

There are different concepts and terms used for financial close. The hard close, soft close, fast close, virtual close, continuous close, instant close, on-demand close, etc. Most of these are overlapped but do not replace each other. Here are short descriptions of a few:

Hard close

It is crucial to keep in mind that continuous close does not replace a hard close. Hard close is the process of closing the books in which all transactions for the period (month/ quarter/ year) have already been processed and there will be no more financial activity for that period. Once hard close is completed, financial data for the set period is locked and cannot be modified. A hard close is needed because there is a requirement to have official financial statements reported at the end of the period.

Soft close

Soft close or pre-closing allows the re-opening and update of the financial data of a period as and when it is required. Companies with continuous close practice should be able to perform soft close without any difficulties as they are continuously processing and updating the information.

Fast close

The main objective is to close the books as fast as possible. Speed and efficiency are the main drivers. The focus is on shortening the data-to-insight-to-action journey. Hence, faster close and reporting are the critical steps. Wherever possible, simplification, automation, standardization, or centralization of a closing process is a potential for operational improvement.

On-demand close

On-demand close or instant close is about having access to all real-time data with the ability to accurately close the books on-demand and to generate quality consolidated financial statements at any time.

Key takeaways

Accounting closing should be a non-event or a “business as usual.”

Continuous accounting is the future of accounting. It is happening now. The benefits of a continuous accounting close are evident as it will reveal crucial business information in real-time, hence empowering finance leaders to influence strategic decisions.

Now is the time to replace the traditional Record-to-Report (R2R) process with a continuous accounting approach. But the path to get there may seem intimidating for organizations that are amid a difficult, manual, or unstandardized close. Companies looking to adopt a continuous close need to embrace cultural as well as process and technology change. Technology is important, but people are usually the determining factor.

In today’s competitive business landscape, business leaders can no longer wait for the month-end numbers to be finalized to make key business decisions. With data and digital as the springboards, the finance function can aim to deliver real-time business reporting and analysis. Finance is happening in real-time. This enables the finance function to stay relevant and continue to add value to the organization.

Want to keep up with the latest releases on the Finance Alliance blog? Sign up to the Finance Alliance Fix newsletter and be the first to know about upcoming events, reports, and industry news!

Follow us on LinkedIn

Follow us on LinkedIn