[This article is based on a presentation given by Dani Martins, Strategic Business Partner & Founder of DM Brasil Soluções Estratégicas (and formerly VP Head of FP&A, Thoughtworks), at our FP&A Summit, London in 2024. Catch up on this presentation, and others, using our OnDemand service. And for more exclusive content, check out your membership dashboard.]

Everywhere you turn, AI is making headlines. It's in our emails, our meetings, our forecasts, and even our to-do lists. In finance, we’ve been promised that automation will streamline our work, reduce errors, and free us up for more strategic thinking. That’s exciting… until you realize no one’s exactly sure what “more strategic thinking” actually means in practice.

According to the World Economic Forum, 23% of jobs will change in just the next few years. That’s not a futuristic forecast, it’s already happening.

Some jobs will go. Some new ones will be created. And that leaves a big question for all of us:

If machines are doing more and more of the work...what do we do?

My answer?

We lean into what machines can’t do - our human skills.

Not just soft skills as a buzzword. I mean real, essential capabilities: empathy, adaptability, critical thinking, and leadership. These aren’t “nice-to-haves” anymore. They’re the core of what will set us apart in an AI-powered world.

In this blog, I’ll share what I’ve learned from my own journey, from traditional finance leadership to a more human-centered approach, and how we can all adapt, lead, and thrive in this next chapter of work.

What can’t machines do?

That’s the real question, isn’t it?

If AI can automate data entry, reconciliation, and even elements of forecasting, what’s left for us?

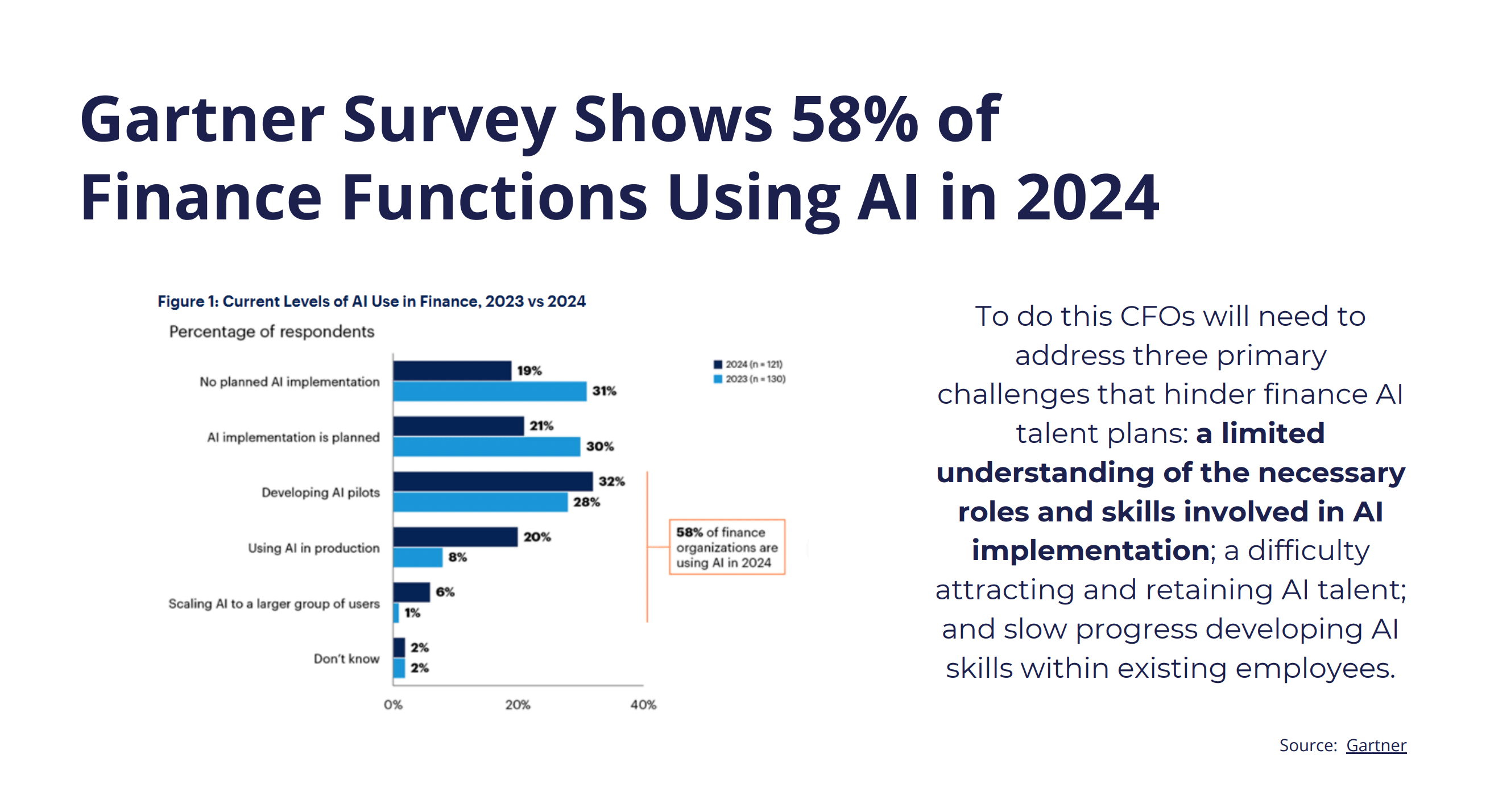

Well, I started looking deeper. I found a Gartner report that focused on AI adoption across Europe, and the data was eye-opening: AI usage in finance functions has jumped by 58% in just one year. That’s not a gradual shift. That’s a tidal wave.

And look, I get the skepticism. Many of us still rely on Excel as our daily tool. Most organizations don’t have a single source of truth. Collaboration tools are limited. It doesn’t always feel like we’re living in the AI age just yet.

But we are. It’s coming whether we’re ready or not.

To be fair, I was skeptical too…until I saw this data. Companies really are using AI. Not everywhere, and not always in flashy ways, but it’s happening. And where is it showing up the most?

In operational finance: accounts payable, accounts receivable, and invoice processing. The kind of work that’s rule-based and repetitive.

As leaders, that raises some important questions:

What happens to the people doing those jobs?

How do we help them evolve with the work?

It’s our responsibility to create new paths for our teams and to help them develop the skills they’ll need to stay relevant, valued, and engaged.

Challenges in integrating AI

Some of the biggest hurdles we’re facing with AI in finance aren’t technical, they’re human.

Let’s start with talent. We need people who understand AI and can actually implement it within a finance context. That often means hiring data scientists. But here’s the tricky part: these data scientists also need to understand accounting. They need to know how to connect the dots across the three financial statements.

That’s not easy to find.

So, we’re left with two options, and both are tough:

- Attracting that rare, hybrid talent from the outside.

- Upskilling the people already on our teams.

And honestly, I’m much more interested in the second one.

If we’re serious about transformation, we have to make it human. That means involving people early, building their confidence, and giving them a role in the future we’re creating, not just expecting them to keep up.

Navigating unknowns in finance

At the same time that automation is increasing, we’re also dealing with a lot of uncertainty. Even as we implement AI, there’s still very little clarity on which new skills will be needed long-term.

We don’t know, and that’s okay. What matters is creating some kind of path forward for ourselves, for our teams, and for the people who trust us to lead them.

That’s why I prefer the term human skills over “soft skills.” It helps us anchor into something real and practical. These are the capabilities we can lean on and develop while the rest of the world keeps shifting.

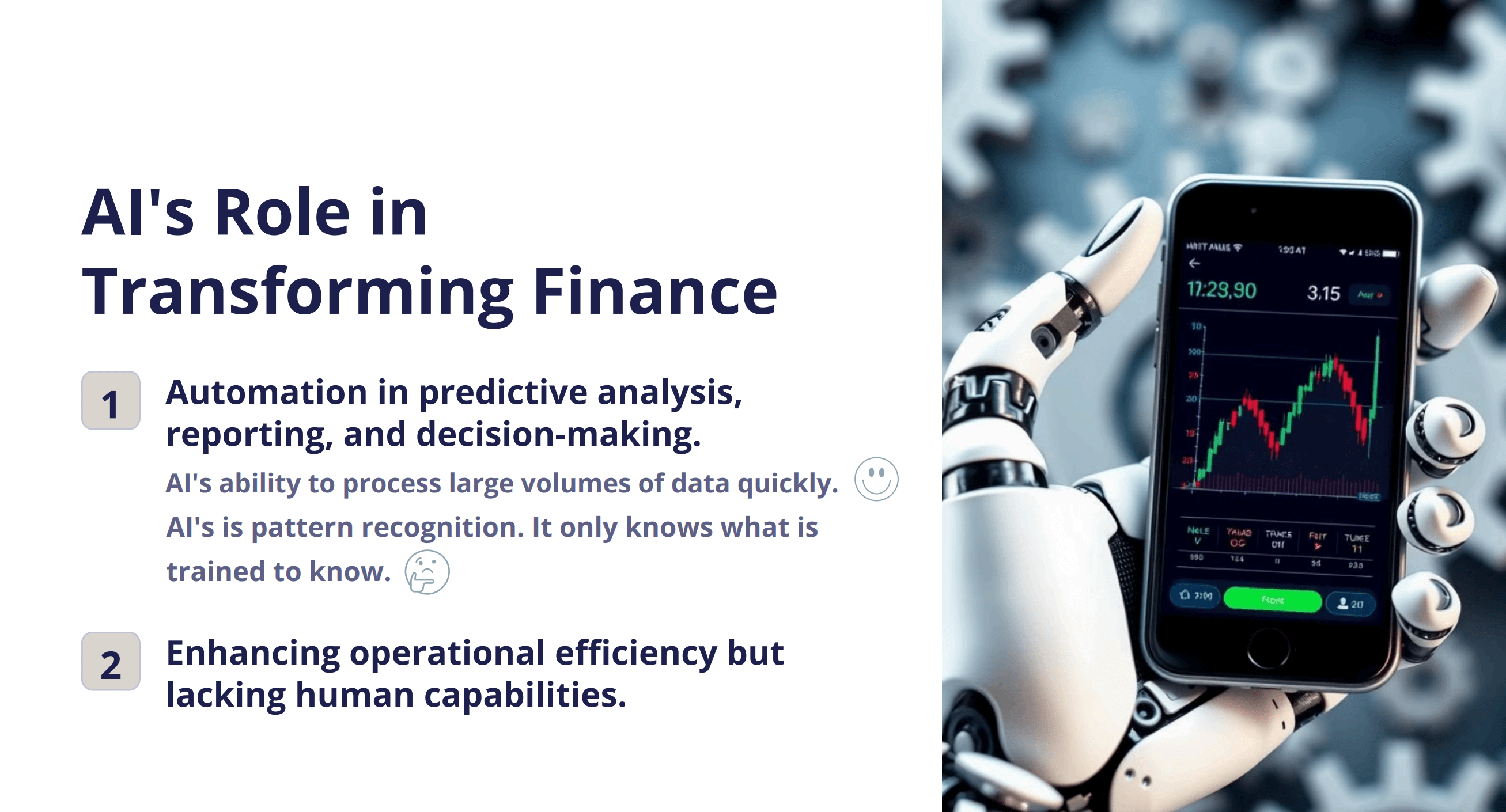

According to Gartner, AI is currently impacting three main areas in finance:

- Reporting (no surprise there)

- Predictive analysis

- Decision-making support

Now, while reporting is an obvious use case, predictive analysis is still rare. I’ve only heard of one finance team doing it successfully shared during an AFP conference in the U.S. But that company was already dabbling in blockchain and big data years ago. They were ahead of the curve.

Most companies? Still catching up. And let’s face it - finance is historically underfunded when it comes to tech investment.

So, the question is: how fast will this change really happen?

Honestly, I don’t know. And that’s a recurring theme in this conversation. I have more questions than answers. But that’s okay. The goal isn’t to have it all figured out, it’s to keep asking the right questions and moving forward with intention.

AI's role in decision making

Another big area where AI is making waves is decision-making. Now, I want to pause here and bring in two key reflections that came from a Gartner webinar I watched recently.

First, yes, AI absolutely processes large volumes of data far better than we can. Thank goodness for that. It can handle far more than Excel, Power Query, or whatever tool we’re using today. And let’s be honest, none of us are dreaming about spending more hours buried in spreadsheets. So, this is a good thing.

But here’s the catch: AI isn’t actually intelligent.

It’s artificial intelligence, but it’s not thinking or feeling. It’s trained by humans, and it can only spot patterns we’ve already taught it to recognize. So, everything AI gives us is based on the past. It’s great at repetition. But what about the unexpected?

What if another pandemic hits?

What if a new president shifts the global economy overnight?

These aren’t hypothetical questions. AI doesn’t know what to do in a brand-new scenario. It can’t anticipate what it hasn’t already seen.

So yes, AI will give us more operational efficiency, but it can’t replace the human ability to interpret, to question, to lead. That’s why we still matter and why the future is still human.

- The creativity to see beyond the data.

- The empathy to understand people and context.

- The leadership to act when there’s no playbook.

These are the things AI can’t do and these are the skills that will make you (and your business) stand out in an increasingly automated world.

Follow us on LinkedIn

Follow us on LinkedIn