Budgeting is an important business process that helps organizations allocate resources and track progress towards meeting their financial goals. However, the budgeting process can be hampered by several factors.

In this article, we'll discuss the three key pain points in budgeting and how they can be addressed.

1. Ineffective technology

More than 60% of companies still use Microsoft Excel as their primary budgeting tool.

Excel is very functional and user-friendly. However, it may not be the best tool for budgeting.

Issues arise when you must integrate and roll up the multiple business units at the total organization level. Many budgeting tools are now available that can be a better option than using Excel.

2. Long cycle times

The average cycle time for preparing an annual budget is around three to four months. This is way too long, slow to detect problems and doesn't add a lot of value.

The annual budgeting process is a key component of financial planning for many businesses. In order to be more effective, budgeting needs to be streamlined and accelerated.

There are a number of ways to improve the budgeting process and aim for shorter cycle times by data integration, real-time monitoring, and automated processes.

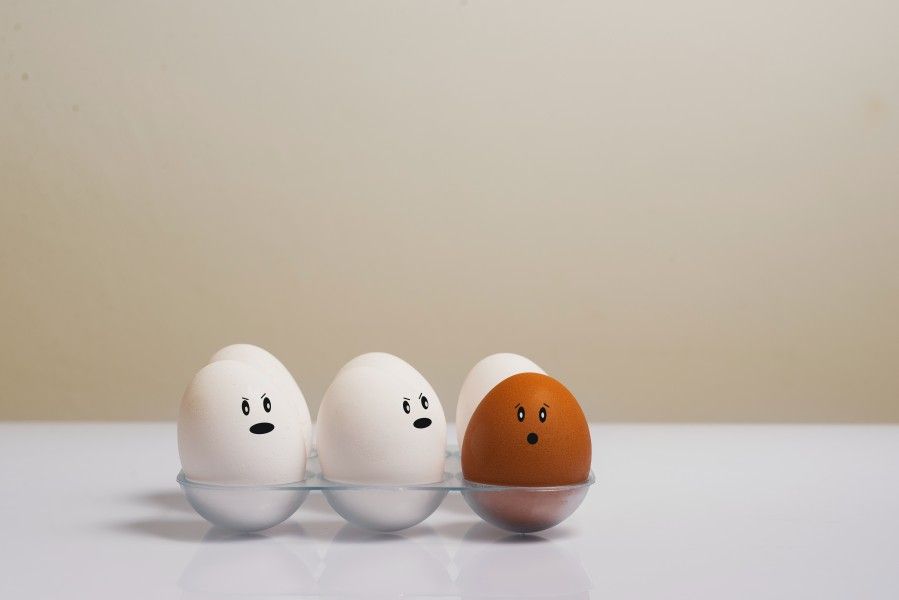

3. Gaming rather than stretch behavior

The traditional budgeting process incentivizes “gaming” instead of a “stretch” behavior.

What is “Gaming” behavior?

- Spending money at year end to avoid losing the budget next year.

- Accelerating sales near year-end/month-end to meet the budgeted quota.

- Negotiating easy targets

- Deferring necessary expenditure.

- Budgetary slack: i.e., deliberate under–estimation of budgeted revenue. or over-estimation of budgeted expenses.

What is a “Stretch” behavior?

A stretch means pushing the boundaries on what can be realistically achieved.

For example:

- For the sales division, this may mean setting higher sales targets than what would usually be expected.

- For the production department, this may mean producing more goods for less.

Better budgeting practices:

- Create budgets after goals/strategic direction has been set.

- Develop continuous/rolling forecasts.

- Employ and Automated driver-based metrics.

- Be honest and realistic.

Conclusion

Budgeting is a critical part of any organization, yet it is often ineffective. The three key pain points in budgeting are ineffective technology, long cycle times and gaming rather than stretch behavior.

Ineffective technology results in a lack of transparency and control over budgeting processes. Long cycle times make it difficult to respond to changes in the business environment. Gaming rather than stretch behavior leads to unrealistic budgets that do not take into account the true costs of doing business.

Follow us on LinkedIn

Follow us on LinkedIn