At one point in time, a big part of the SaaS finance function focused on how the month ended and how the past year looked. Now, it’s very much about living in the present and where that leads the organization tomorrow.

Providing the C-Suite with the information and insight they need to make the right decisions is a top priority for today’s CFOs, and it’s imperative they have integrity in their numbers.

Finance teams need to pull data fast, and they need it to be accurate, to achieve both they have to have complete confidence in their tech stack.

With this in mind, we searched high and low for the tools you need in your arsenal to build the ultimate finance tech stack.

Here's an overview of what I cover in this article:

- The best tools for payroll management

- Top accounting platforms to manage your books from anywhere in the world

- Great spend management tools for SaaS finance functions

- Three amazing enterprise resource planning systems

- Tools for streamlined and simplified payment processing

Payroll management and human resources

Payroll management isn’t just an HR function, everything from employee salaries to sick leave impacts the company’s revenue.

So here are three of the best tools to streamline payroll and pull out the figures that matter most to finance.

Captivate IQ

Captivate IQ is an automated and flexible solution that adds transparency to the commission process.

It allows the user to design an incentive plan and provides the data intelligence to show you which plans are moving the business forward and which ones need to be adjusted.

Share insights with sales leaders and minimize human error.

Website: captivateiq.com

Cost: Not available online

Gusto

Perfect for small businesses, Gusto offers HR tools and services to help with managing employee onboarding, payroll, and administrating health benefits.

Famed amongst its clients for its exceptional user experience, this tool now offers new functionality in areas like hiring and onboarding and payroll run flexibility.

Website: gusto.com

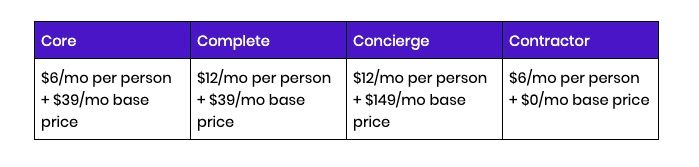

Cost:

monday.com

Visual, intuitive, and easy to use, monday.com helps teams to create their ideal workflow in just a few minutes. Choose from over 200 ready-made templates based on how real teams use the platform and dive in!

Run your entire sales pipeline and CRM in one place, as well streamlining and scaling business operations and structuring your HR processes.

Website: monday.com

Cost:

Accounting platforms

Manage your books from anywhere in the world and help eradicate the antiquated spreadsheet with our selection of accounting platforms.

Sage Intacct

Sage Intacct is a flexible and configurable solution built on a true cloud foundation.

Customize purchasing workflows to suit your needs, share data with ease and integrate with best-of-breed solutions (like Salesforce) without the sky-high IT costs.

Website: Sageintacct.com

Cost: Request quote on the website

FloQast

Created by accountants for accountants, FloQast automates common accounting workflows and helps to streamline and make them more efficient.

Intuitive and user-friendly, FloQast integrates with Slack so you can stay up-to-date with any changes that might affect month-end close.

Website: FloQast

Cost: Request a custom quote on the website

Versapay

Versapay aims to transform the efficiency of accounts receivable and accelerate your company’s cash flow by connecting your AR team with their customers over the cloud.

Customers particularly enjoy the autopay options, while Versapay users appreciate how simple the search function is for customer account history.

Website: Versapay.com

Cost: Request a quote on the website

Spend Management

Integrate and automate all of your company spending to drive organizational value through efficiency, lower supply costs, and improved productivity. How? You ask, by adding one of the following to your tech stack.

Spendesk

Spendesk offers smart, trackable spend management for teams of all sizes.

Your employees have access to their own cards with customizable limits, so they never need to pay with their own money. Meanwhile, CFOs have full visibility over company spend, with detailed records of every purchase.

The outcome is more autonomy for your team members and better control for leadership.

Website: spendesk.com

Cost: Request a quote on the website

Airbase

Aimed at small to midsize businesses, Airbase offers accounting automation tools for scheduling, accruing, and categorizing transactions.

Save time and provide a choice of payment types, including virtual cards, physical cards, checks, ACH, and vendor credits, all from one control center.

Website: airbase.com

Cost: Request a quote on the website

Coupa

Finance teams waste so much time editing business expense reports to ensure accuracy, reduce spend leakage, and pay employees correctly and on time.

Coupa’s software solves these expense management issues by providing a viable solution with the capabilities needed to provide spend visibility, ensure global compliance, and keep employees happy.

Website: coupa.com

Cost: Request a quote on the website

Enterprise resource planning systems

Recommending a single ERP solution is tricky, mainly because what you need depends wholly on your business structure and your goals as a company.

However, after a good deal of research, we’ve arrived at three solid choices for you to investigate.

FinancialForce

FinancialForce is a user-friendly, customizable tool to fit your team’s needs.

An integrated system with CRM and project tracking, reports are detailed and simple to understand.

Users appreciate the ease of access to a goldmine of readily available information, as well as the overall customer support.

Website: financialforce.com

Cost: Request a quote on the website

Netsuite

NetSuite offers a suite of cloud-based applications, including financials, Enterprise Resource Planning (ERP), HR, professional services automation, and omnichannel commerce. Highly customizable and versatile with a wide range of functionality, Netsuite offers everything a new business needs all in one place.

Website: netsuite.com

Cost: Request a quote on the website

Unit 4

Unit 4 offers users enormous freedom to build the ERP system of their dreams.

The system is set up to give you notifications for errors and actions required, ensuring accuracy at every step.

A clean and simple interface plus robust reporting capabilities make Unit 4 a solid choice for any mid-market or enterprise-level organization.

Website: unit4.com

Cost: Request a quote on the website

Payment processing tools

To run a successful business you need paying customers, in order for your customers to pay you need a payment processing tool, here’s three of the best.

Paypal

Paypal is a favorite amongst both huge online businesses and small boutiques for a reason. It’s secure, convenient, and integrated into almost every site you can think of.

With a fool-proof interface, users and customers can make and receive payments seamlessly from all over the world.

Website: Paypal.com

Cost:

GoCardless

GoCardless is one of the largest bank to bank direct debit platforms out there.

Simple to set up and easy for customers to use, this platform integrates seamlessly, automating regular payments and reducing the time it takes to manually chase invoices.

Website: gocardless.com

Cost: Custom pricing available on the website

Ayden

Ayden provides a modern end-to-end infrastructure that connects directly to Visa, Mastercard, and your customer’s preferred payment methods globally.

It offers a detailed overview of transactions, clean codes, and simple integrations and handles collections for household names like Netflix, Spotify, and Uber.

Website: adyen.com

Cost: Check out the full list of prices for supported payment methods on the website.

Searching for more resources and advice?

Sign up to our free Finance Alliance Slack community and start networking with other CFOs and finance leaders today! Share ideas, ask questions, discover new talent, and grow your network within one of the world's most engaged communities of finance professionals.

Follow us on LinkedIn

Follow us on LinkedIn