Considering how the world operates now, uncovering fraud is more difficult than ever. In the Association of Certified Fraud Examiners (ACFE) 2022 report, it states that global businesses lose around 5% in revenue annually of operational fraud and spend a projected guesstimate of 4.7 trillion dollars over fraud worldwide.

The report, which entails data from 2110 fraud cases from 133 countries, has an alarming median loss of 1.78 million dollars for each incident. Asia-Pacific countries were reported to have even greater losses, further proving the existence of financial crime as a global problem.

Fraud these days goes beyond the frontiers of falsifying financial statements and simple skimming. Advanced fraud operations are known to use everything from synthetic identity and deepfake technology to elaborate cross-border laundering. In one case I came across, a European financial institution was defrauded of approximately $35 million by a single employee over the course of a year. Systems did exist that were supposed to catch the fraud, but they relied on “advanced” rules, so the monitoring left a lot to be desired.

In the criminal and financial services sectors, it is no longer just a war of balance sheets; it's a full-blown strategic technology war. A criminal adopting AI identity tools, biopic evasion methods, and other adaptive deceitful methods has rendered traditional rule-based systems (which used to be the cornerstone of risk management) far too rigid, slow, and narrow in scope.

Most of these legacy systems based on static rules suffer greatly when it comes to login device/change times or IP address mismatching leading to an avalanche of false positives and exhaustive hitting firms’ compliance teams- all while degrading the customer experience.

This is where AI and ML come in, not as replacements but as changes for the better. AI/ML models featuring pattern recognition, anomaly detection, unsupervised clustering, and behavioral profiling provide risk evaluation that is real-time monitored, updated dynamically, and scalable to the increasing intricacies of modern financial criminal activities.

These technologies don’t just react, they learn, adapt, and together with predictive AI, foresee fraudulent attempts even before their execution, allowing banks to achieve the critical balance of agility, security, and compliance with laws and regulations.

Limitations of traditional rule-based systems

Historically, banks have relied on rule-based systems to identify fraudulent transactions. These systems operate on predefined rules, such as flagging transactions that exceed a certain amount or originate from high-risk regions.

While effective to an extent, these systems have significant limitations:

Static nature

Rule-based systems are inherently rigid. They require manual updates to adapt to new fraud patterns, making them slow to respond to evolving threats. This rigidity can result in outdated detection mechanisms that fail to catch novel fraud tactics.

High false positives

These systems often flag legitimate transactions as suspicious, leading to unnecessary investigations and customer dissatisfaction. For instance, a legitimate high-value purchase might be declined simply because it exceeds a preset threshold, frustrating customers and potentially leading to loss of business.

Inefficiency

The manual review process associated with rule-based systems is time-consuming and resource-intensive. Analysts must sift through numerous alerts, many of which are false positives, diverting attention from genuine threats. This inefficiency not only increases operational costs but also delays the response to actual fraudulent activities.

Lack of contextual understanding

Rule-based systems lack the ability to understand the context of transactions. They cannot analyze user behavior patterns or adapt to individual customer profiles, making it challenging to distinguish between legitimate and fraudulent activities effectively.

As fraudsters employ more sophisticated techniques, these traditional systems struggle to keep pace, necessitating a more dynamic and intelligent approach.

AI and ML offer adaptive, real-time analysis capabilities that can learn from new data, identify complex patterns, and significantly reduce false positives, thereby enhancing the overall effectiveness of fraud detection in the banking sector.

The AI advantage in fraud detection

AI and ML bring a paradigm shift in fraud detection by learning from data patterns and adapting to new threats in real-time. Unlike rule-based systems, AI models can analyze vast amounts of data to identify anomalies indicative of fraudulent activities.

Behavioral analysis and anomaly detection

AI systems can establish a baseline of normal customer behavior by analyzing historical transaction data. Any deviation from this baseline, such as an unusual transaction time or amount, can trigger an alert. For instance, if a customer typically makes small transactions during the day but suddenly initiates a large transfer at night, the system can flag this as suspicious.

Clustering and pattern recognition

Unsupervised learning techniques, such as clustering algorithms, group similar transactions together. Transactions that don't fit into any cluster are considered anomalies and warrant further investigation. Techniques like the Elbow Method, Silhouette Score, and Gap Statistics help determine the optimal number of clusters, enhancing the model's accuracy.

Dimensionality reduction for visualization

High-dimensional data can be challenging to interpret. Techniques like t-Distributed Stochastic Neighbor Embedding (t-SNE) reduce data dimensions, allowing for visual representation of complex datasets. This aids analysts in understanding the data structure and identifying outliers.

Autoencoders for feature extraction

Autoencoders, a type of neural network, are effective in detecting anomalies by learning compressed representations of data. They can reconstruct input data and highlight discrepancies, making them valuable for identifying fraudulent transactions that deviate from learned patterns.

Importance of model evaluation

While developing these models, evaluation metrics play a crucial role in performance tuning and risk assessment.

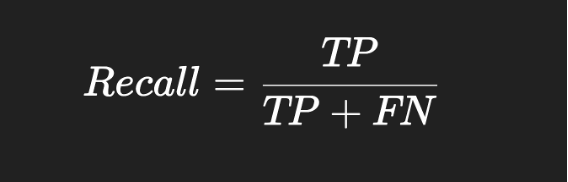

Recall (sensitivity): Measures how many actual fraud cases were correctly identified.

Where:

- TP (True positives): Fraud transactions correctly predicted as fraud.

- FN (False negatives): Fraud transactions incorrectly predicted as legitimate.

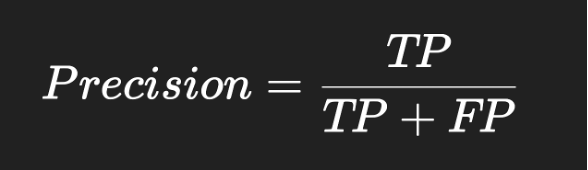

Precision: Measures the proportion of flagged transactions that were actually fraud.

- F1 score: Harmonic mean of Precision and Recall.

In fraud detection, recall is often more critical than precision, because failing to catch fraudulent activity can result in massive financial and reputational damage. However, a balance is essential to avoid overwhelming fraud teams with too many false alarms.

Real-world applications and case studies

HSBC: Enhancing detection with AI

HSBC has significantly improved its fraud detection capabilities by integrating AI into its risk management systems. In partnership with Google, HSBC developed the Dynamic Risk Assessment system, which analyzes over 1.35 billion transactions monthly across 40 million customer accounts. This AI-driven approach has led to:

- Increased detection: Identifying two to four times more financial crimes than previous methods.

- Reduced false positives: Achieving a 60% reduction in false positive cases, thereby minimizing unnecessary customer interactions and investigations.

- Efficiency gains: Reducing the processing time for analyzing transactions from several weeks to a few.

These improvements have not only enhanced HSBC's ability to detect and prevent financial crimes but also streamlined operations and improved customer experience.

JPMorgan chase: Real-time fraud prevention

JPMorgan Chase has implemented AI systems capable of real-time fraud detection, analysing customer behaviors such as transaction history, location, and device usage.

This proactive approach has resulted in:

The AI technology used in fraud prevention at JP Morgan has had a notable impact. The bank has seen a significant decline in fraudulent activities such as account takeovers and card-not-present fraud ever since they equipped themselves with AI powered systems.

As a case in point, the bank claimed to have achieved a 20% reduction in false positive cases - instances when genuine transactions are marked as fraud. A smoother journey for customers and faster resolution of genuine fraud cases has become possible as fast-paced customer interaction technology is put into place.

DBS Bank: Augmenting surveillance with AI

DBS Bank has integrated AI and machine learning into its transaction surveillance processes, addressing the high false positive rates associated with traditional systems. The AI model:

AI-driven compliance and fraud detection

DBS Bank has emerged as a leader in integrating AI into its risk management and compliance frameworks. By deploying AI-powered systems, DBS has achieved significant improvements in detecting and preventing financial crimes.

Key achievements:

Real-time transaction monitoring: DBS's AI system processes over 1.8 million transactions per hour, utilising advanced algorithms and behavioral analysis to detect suspicious patterns. This includes automatic flagging of unusual activities, analysis of cross-border transaction patterns, and real-time risk scoring of transactions.

Reduction in false positives: The bank's AI-powered compliance systems have achieved a 90% reduction in false positives, significantly decreasing the number of alerts that require manual review.

Improved detection accuracy: There has been a 60% improvement in detection accuracy, enhancing the bank's ability to identify genuine threats.

Faster investigation times: Investigation times for suspicious activities have been reduced by 75%, allowing for more efficient responses to potential threats.

Enhanced regulatory reporting: The AI systems have improved the accuracy of regulatory reporting, ensuring compliance with financial regulations.

These advancements underscore DBS Bank's commitment to leveraging AI for robust risk management and compliance, setting a benchmark in the banking industry.

Best practices for AI use in banking risk management

Successfully integrating AI into risk management requires a delicate balance between fostering creativity while strictly adhering to regulations.

- Hybrid model deployment

It is suggested that all banks institute AI models concurrently with traditional rule-based systems. Using this approach allows comparative assessment which gives institutions evidence concerning the efficacy of AI models as they transition. - Continuous model training

Fighting evolving techniques of fraud requires AI models to be regularly updated with new data. New patterns and anomalies will continuously learn and will enable the models to adjust. - Robust evaluation metrics

Recall, precision, and average F1 score are among the adequate measures for evaluating model performance. They assist in refining the models so that the hospitals can achieve the set target of maximum detection and minimum false positives. - Explainability and transparency

The implementations of Explanatory Artificial intelligence (XAI) enable all stakeholders to track the processes employed in arriving at specific decisions made. This is critical for the compliance with regulations and trust from stakeholders. - Responsible governance of artificial intelligence

It is necessary to set policies and frameworks around ethics. This encompasses protecting data privacy, mitigating prejudice, and ensuring the values and regulations of the AI-implementing entity are respected.

Final thoughts

Adoption and use of AI technology in banking risk management is a remarkable step in fighting fraud and financial crimes. The impact of AI on detection accuracy, operational effectiveness, and compliance is astonishing at HSBC, JPMorgan Chase, and even DBS Bank.

Discovering still more innovative ways to finance all kinds of crimes warrants employing artificial intelligence solutions, which is no longer merely beneficial. Banks can manage risks better, defend their clients, and maintain the integrity of the financial system when they start using AI.

Join our free Insider Membership for exclusive content

Access expert insights, community, courses, templates and more to boost your finance skills and career. No catches, no monthly bills – 100% free, forever.

What's included in an Insider membership?

📑 Templates & frameworks. Save time with battle-tested and ready-to-use templates.

✍️ Exclusive content. In-depth thought leadership articles from world-leading companies.

📺 Real-world case studies. Hours of insights from leaders at Adobe, Salesforce, Burberry, Virgin Galactic, and more.

📚 Ungated reports. One-click access to industry-leading insights to shape your strategies.

Follow us on LinkedIn

Follow us on LinkedIn